[ad_1]

sanjeri/E+ via Getty Images

Thesis

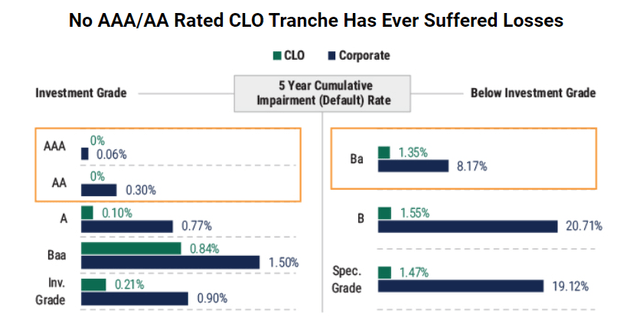

Janus Henderson AAA CLO ETF (NYSEARCA:JAAA) is an ETF focused on AAA CLO tranches. Collateralized Loan Obligations (CLOs) are a type of securitization that pool together leveraged loans and tranche out the risk. JAAA only contains the most senior risk tranche with the highest rating. AAA CLOs have never experienced a default; hence, they represent true AAA risk:

Historic Default Rates (Pinebridge)

We can see from the above table, courtesy of Pinebridge, the historic loss occurrence for the asset class. It just never happened. This is mainly due to the deep subordination at the AAA level (usually around 30%), the low default rate for leveraged loans, and high recovery rate for the asset class. The takeaway here is that AAA CLOs are true tried and tested AAA bonds. The credit risk is minute to non-existent here.

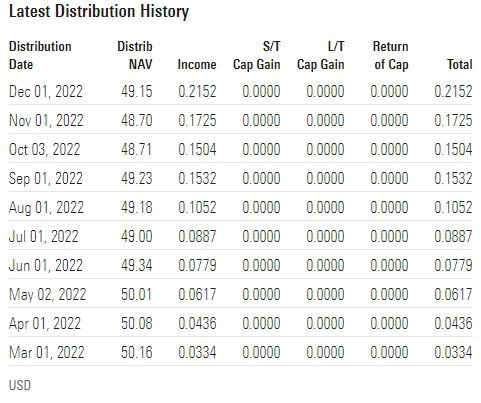

The asset class is also floating rate, meaning the actual cash-flows received by the fund’s assets have increased as rates have gone up. This has resulted in an ever increasing dividend distribution for the ETF:

Distribution History (Morningstar)

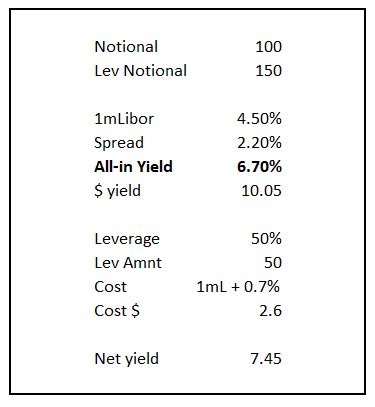

The distribution is going to go up as rates go up. On a 30-day SEC yield basis the ETF now offers a retail investor a yield in excess of 5%:

SEC Yield (Fund Fact Sheet)

The math is fairly basic for the 30-day SEC yield. Just take the latest distribution of 0.2152, multiply it by 12 and then divide it by the fund’s market price. In a rising rate environment all floating rate instruments should be evaluated on a 30-day SEC yield basis since it provides for a holder with a true quantification of the actual forward yield to be received.

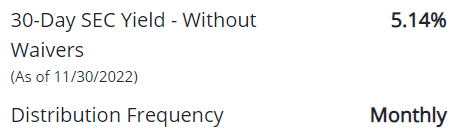

How would a CEF structure look like?

We like AAA CLO risk. It has proven to be a very, very stable asset class with virtually no historic losses. So if we have such a robust asset class with a low standard deviations for pricing, why not think about putting it in a CEF structure and adding up some leverage on top of it? With current credit spreads in the asset class at 220 bps, we tentatively took a stab at a 50% leveraged structure:

Potential AAA CLO CEF Structure (Author)

In the above table we take a tentative $100 million notional asset pool and layer in a 50% leverage construction on top. That gives us a $150 million asset pool to generate cash-flows. We can see that given where AAA spreads and 1-month Libor currently reside, the asset pool can generate an all-in yield of around 6.7% (unleveraged). Assuming a cost of leverage of 1mL+70bps (this will be dependent on each bank’s funding costs, capital requirements, structure, etc.) gives us a net leveraged yield of 7.45% on the theoretical CEF structure. A fairly attractive all-in yield ! Indeed this level is before any management fees, but the all-in yield could be enhanced by adding AA tranches.

In my mind, a AAA/AA CLO closed end structure makes sense, and I am surprised there is not one in the market already.

Holdings

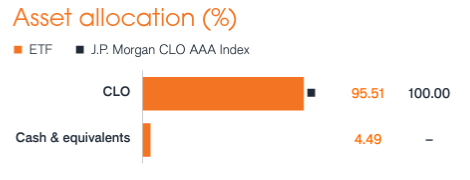

The fund contains only CLO debt:

Asset Allocation (Fund Fact Sheet)

The fund has a fairly small amount of debt tranches:

Characteristics (Fund Fact Sheet)

We can see from the above table that there are only 109 bonds in the fund. The average maturity of the AAA tranche is 3.05 years, and due to the floating rate nature of the asset class the duration figure is close to zero.

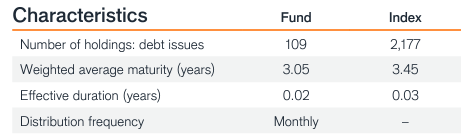

The vast majority of the underlying assets are AAA:

Ratings (Fund Fact Sheet)

There is a 0.74% figure for assets that are not AAA, but in this case A. We are presuming this represents a ‘fallen angel’, or better said a tranche of debt that was rated AAA upon issuance, but subsequently got downgraded.

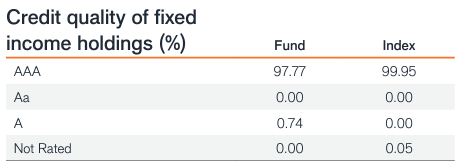

The fund does take some chunky positions in certain CLO names:

Top Holdings (Fund Fact Sheet)

However, do keep in mind that CLOs, by definition, are pools of assets. That means that by construction they are very granular and well diversified. We see de-minimis credit risk in this structure.

Performance

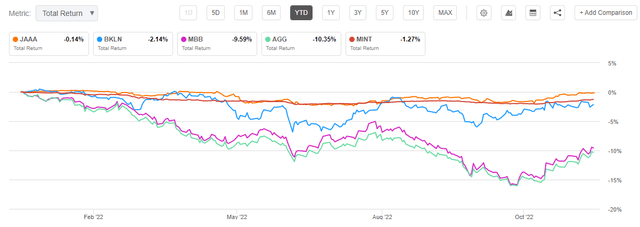

The fund is pretty much flat year to date, despite the violent rise in rates and credit spread widening:

YTD Total Return (Seeking Alpha)

We are comparing the fund with the Invesco Senior Loan ETF (BKLN), which is a leveraged loan ETF (i.e. this fund actually runs credit risk), the AAA mortgage fund iShares MBS ETF (MBB), the short dated corporate bond fund PIMCO Enhanced Short Maturity Active ETF (MINT), and the aggregate bond market ETF (AGG). Because of its very short duration, JAAA outperforms. It is surprising to see JAAA beating even the vaunted MINT fund this year.

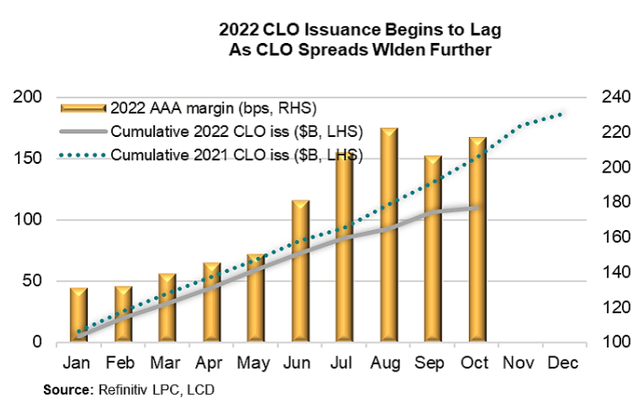

This speaks very well to the structure and the asset class in general – AAA CLOs are now a very established, tried and tested asset class, that somehow get a bad reputation by being bulked in with other securitizations. In our mind a 220 bps spread over risk free rates is unwarranted here:

AAA CLO Spreads (LCD)

Why is this? Because for many funds / structures / vehicles, securitized products, even if they are AAA, are not considered risk-free. There is actually a differentiation for bank capital requirements where securitizations are segregated with different capital requirements if put on the balance sheet.

Conclusion

JAAA is a AAA CLO fund. The vehicle is structured as an ETF, hence there is no leverage. Due to the floating rate nature of the collateral the fund has been increasing its dividends, now sporting a 30-day SEC yield in excess of 5%. The collateral pool is entirely AAA CLO slices, with almost non-existent credit risk (no AAA CLO has ever defaulted). The fund has a very short duration, which has helped it record a flat performance in 2022, on a total return basis. Expect a healthy return going forward, with the fund’s large dividend yield to be accompanied by small capital gains next year. This fund compares very favorably with more traditional short term cash parking vehicles. In our article, we also did a mock-up of a AAA CLO CEF structure, which could offer a more generous yield for a low standard deviation asset class.

[ad_2]

Source links Google News