[ad_1]

metamorworks/iStock via Getty Images

This monthly article series shows a dashboard with aggregate industry metrics in technology and communication services. Companies used to calculate these metrics are the largest holdings of the iShares U.S. Technology ETF (NYSEARCA:IYW). Therefore, this is also a review of IYW.

Shortcut

The next two paragraphs in italic describe the dashboard methodology. They are necessary for new readers to understand the metrics. If you are used to this series or if you are short of time, you can skip them and go to the charts.

Base Metrics

I calculate the median value of five fundamental ratios for each industry: Earnings Yield (“EY”), Sales Yield (“SY”), Free Cash Flow Yield (“FY”), Return on Equity (“ROE”), Gross Margin (“GM”). The reference universe includes large companies in the U.S. stock market. The five base metrics are calculated on trailing 12 months. For all of them, higher is better. EY, SY and FY are medians of the inverse of Price/Earnings, Price/Sales and Price/Free Cash Flow. They are better for statistical studies than price-to-something ratios, which are unusable or non-available when the “something” is close to zero or negative (for example, companies with negative earnings). I also look at two momentum metrics for each group: the median monthly return (RetM) and the median annual return (RetY).

I prefer medians to averages because a median splits a set in a good half and a bad half. A capital-weighted average is skewed by extreme values and the largest companies. My metrics are designed for stock-picking rather than index investing.

Value and Quality Scores

I calculate historical baselines for all metrics. They are noted respectively EYh, SYh, FYh, ROEh, GMh, and they are calculated as the averages on a look-back period of 11 years. For example, the value of EYh for hardware in the table below is the 11-year average of the median Earnings Yield in hardware companies.

The Value Score (“VS”) is defined as the average difference in % between the three valuation ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). The same way, the Quality Score (“QS”) is the average difference between the two quality ratios (ROE, GM) and their baselines (ROEh, GMh).

The scores are in percentage points. VS may be interpreted as the percentage of undervaluation or overvaluation relative to the baseline (positive is good, negative is bad). This interpretation must be taken with caution: the baseline is an arbitrary reference, not a supposed fair value. The formula assumes that the three valuation metrics are of equal importance.

Current Data

The next table shows the metrics and scores as of last week’s closing. Columns stand for all the data named and defined above.

|

VS |

QS |

EY |

SY |

FY |

ROE |

GM |

EYh |

SYh |

FYh |

ROEh |

GMh |

RetM |

RetY |

|

|

Hardware |

64.40 |

58.87 |

0.0638 |

1.4709 |

0.0592 |

16.19 |

38.11 |

0.0348 |

0.9005 |

0.0404 |

7.14 |

41.85 |

-5.42% |

-4.81% |

|

Comm. Equip. |

-20.74 |

30.76 |

0.0347 |

0.1496 |

0.0309 |

24.53 |

63.01 |

0.0314 |

0.2832 |

0.0415 |

15.07 |

63.80 |

-11.32% |

-3.56% |

|

Entertainment |

-11.53 |

-14.38 |

0.0394 |

0.4946 |

0.0290 |

11.40 |

47.66 |

0.0503 |

0.4380 |

0.0391 |

17.32 |

45.21 |

-17.45% |

-27.93% |

|

Electronic Equip. |

-25.14 |

43.50 |

0.0404 |

0.3739 |

0.0351 |

20.07 |

45.25 |

0.0437 |

0.8385 |

0.0401 |

12.69 |

35.12 |

-4.54% |

-8.19% |

|

Software |

-21.10 |

10.61 |

0.0237 |

0.1299 |

0.0297 |

21.60 |

83.86 |

0.0275 |

0.1785 |

0.0382 |

17.45 |

86.12 |

-23.18% |

-27.41% |

|

Telecom |

8.50 |

2.85 |

0.0777 |

0.6621 |

0.0192 |

12.80 |

57.46 |

0.0491 |

0.6494 |

0.0294 |

11.87 |

58.73 |

-13.26% |

-15.74% |

|

Semiconductors |

-10.11 |

13.47 |

0.0522 |

0.1977 |

0.0292 |

29.37 |

62.75 |

0.0469 |

0.2530 |

0.0364 |

23.31 |

62.16 |

-6.36% |

-1.04% |

|

IT Services |

-28.32 |

8.42 |

0.0335 |

0.2029 |

0.0233 |

29.65 |

54.42 |

0.0392 |

0.3392 |

0.0334 |

24.88 |

55.73 |

-12.95% |

-7.51% |

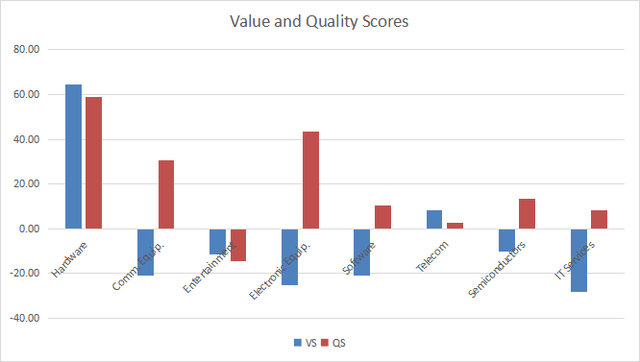

Value And Quality chart

The next chart plots the Value and Quality Scores by industry (higher is better).

Value and quality in technology (Chart: author; data: Portfolio123)

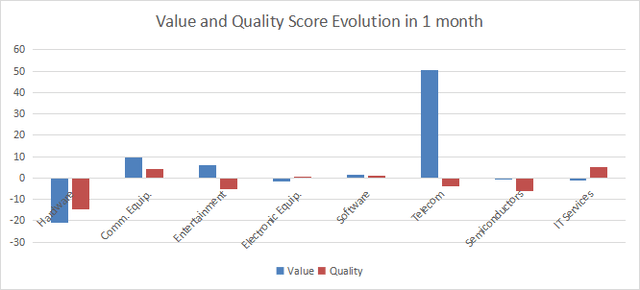

Evolution Since Last Month

The most notable change is a surge of value score in telecommunication. Hardware has deteriorated in value and quality but stays on the top in both scores.

Value and quality variation (Chart: author; data: Portfolio123)

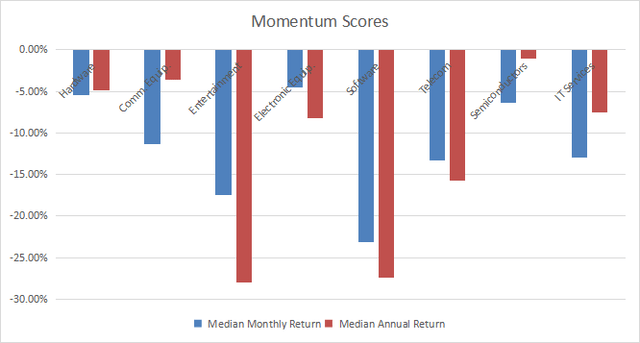

Momentum

The next chart plots momentum data.

Momentum in technology (Chart: author; data: Portfolio123)

Interpretation

Hardware is the most attractive tech industry regarding valuation and quality scores. Telecommunication is undervalued by about 8% relative to 11-year averages, and quality is close to the historical baseline. Other subsectors are overvalued by 10% to 28% relative to the baseline. It may be justified by very good quality scores for communication equipment and electronic equipment. All subsectors except entertainment are above their quality baseline. IT services is the most overvalued one and its quality score is not high enough to justify it.

Focus On IYW

The iShares U.S. Technology ETF has been following the Dow Jones U.S. Technology Capped Index since 5/15/2000. It has a total expense ratio of 0.43%, which is significantly higher than other passive index ETFs like Vanguard Information Technology ETF (VGT) (0.10%) and Technology Select Sector SPDR ETF (XLK) (0.12%). IYW holdings are capital-weighted with a capping methodology: the weight of any single issuer is limited to a maximum of 22.50%, and the aggregate weight of constituents exceeding 4.50% of the index is limited to a maximum of 45%. These conditions are assessed quarterly.

As of writing, the fund holds 155 stocks. The three heaviest companies are Microsoft Corp. (MSFT), Apple Inc. (AAPL) and Alphabet Inc. (GOOG, GOOGL): they weigh between 11% and 19% of asset value, and 46% together. Other constituents are under 5%. The next table lists the top 10 companies with growth and valuation ratios (these are the top 11 holdings as I have grouped Alphabet’s two stock series). Their aggregate weight is 65.7%.

|

Ticker |

Name |

Weight% |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

AAPL |

Apple Inc. |

18.57 |

38.05 |

23.81 |

23.90 |

0.63 |

|

MSFT |

Microsoft Corp. |

16.28 |

30.44 |

27.18 |

27.96 |

0.95 |

|

GOOGL, GOOG |

Alphabet Inc. |

11.20 |

47.20 |

20.55 |

20.23 |

0 |

|

FB |

Meta Platforms, Inc. |

4.34 |

13.14 |

14.27 |

15.89 |

0 |

|

NVDA |

NVIDIA Corporation |

3.75 |

122.95 |

43.25 |

29.38 |

0.10 |

|

AVGO |

Broadcom Inc. |

2.97 |

103.86 |

32.32 |

15.95 |

2.89 |

|

ADBE |

Adobe Inc. |

2.33 |

-12.37 |

37.65 |

27.80 |

0 |

|

INTC |

Intel Corp. |

2.26 |

35.14 |

7.12 |

12.32 |

3.41 |

|

TXN |

Texas Instruments Inc. |

1.98 |

32.51 |

18.83 |

18.49 |

2.79 |

|

CRM |

Salesforce, Inc. |

1.97 |

-65.81 |

107.43 |

34.60 |

0 |

Data calculated with Portfolio123

IYW and XLK are almost on par in annualized return since May 2000. IYW is a bit more volatile.

|

Total Return |

Annual. Return |

Drawdown |

Sharpe |

Volatility |

|

|

IYW |

262.15% |

6.03% |

-81.82% |

0.31 |

25.06% |

|

XLK |

266.58% |

6.09% |

-79.65% |

0.32 |

22.82% |

Data calculated with Portfolio123

In summary, IYW is a good product for investors seeking exposure in tech companies with capped weights. It holds much more stocks than XLK (currently 155 vs. 79), but past performance is almost the same: tail holdings have a low aggregate weight relative to S&P 500 tech companies. Investors willing to keep a position in technology for the long-term may indifferently choose IYW or XLK. Liquidity makes XLK a slightly better choice for short-term trading and option strategies. For those who want to avoid limited exposure to top holdings, the Invesco S&P 500 Equal Weight Technology ETF (RYT) is a better choice.

Dashboard List

I use the first table to calculate value and quality scores. It may also be used in a stock-picking process to check how companies stand among their peers. For example, the EY column tells us that a hardware company with an earnings yield above 0.0627 (or price/earnings below 15.95) is in the better half of the industry regarding this metric. A Dashboard List is sent every month to Quantitative Risk & Value subscribers with the most profitable companies standing in the better half among their peers regarding the three valuation metrics at the same time. Below is an excerpt of the list sent to subscribers several weeks ago based on data available at this time.

|

KLIC |

Kulicke and Soffa Industries, Inc. |

|

THRY |

Thryv Holdings, Inc. |

|

TDC |

Teradata Corporation |

|

AMKR |

Amkor Technology, Inc. |

|

ZD |

Ziff Davis, Inc. |

|

SWKS |

Skyworks Solutions, Inc. |

It is a rotating list with a statistical bias toward excess returns in the long term, not the result of an analysis of each stock.

[ad_2]

Source links Google News