[ad_1]

Truth is ever to be found in simplicity, and not in the multiplicity and confusion of things.

– Isaac Newton

Where to turn when the strong dollar is hurting exporters and expanding trade tariffs are hurting importers? Maybe companies that don’t export or import much, like many of the small-cap companies in the Russell 2000, tracked by the IWM ETF.

The U.S. dollar is strong – and for good reason, namely, people want to buy stuff that is priced in USD. Many people want to buy U.S. Treasuries, since government bonds in most other developed countries pay negative interest. As the dollar strengthens, it gets harder for emerging market governments to service their USD-denominated debt, increasing risk there. Stock markets in most developed countries aren’t doing well compared to the U.S. (that’s related to the negative interest rate situation), so everyone want to buy U.S. stocks – and that takes dollars.

A strong dollar can be great if you’re traveling outside the U.S. – everything starts to look like it’s 10-15% off – but it hurts U.S. exporters, who are also being hurt by trade wars (it would be nice not to have to mention trade wars, but we must). What about importers? Isn’t a strong dollar good for them? Under “normal” conditions, yes. However, either the importers eat the cost of the tariffs (uh-huh, trade wars again), which hurts their profits, or raise prices to offset the cost of the tariffs, which upsets consumers.

Let’s recap: exporters are in a tough spot because of the dollar, and importers and consumers who want to buy imported goods are in a tough spot because of tariffs.

Who isn’t in a tough spot? How about businesses that don’t export and don’t import? Maybe real estate companies. It’s awfully difficult to import or export land (no Greenland jokes, please). But if you want to buy U.S. real estate, you need U.S. dollars, so to foreign buyers it looks like U.S. real estate prices are rising. That can make them think twice about buying (look what’s happening to the price of luxury apartments in Manhattan).

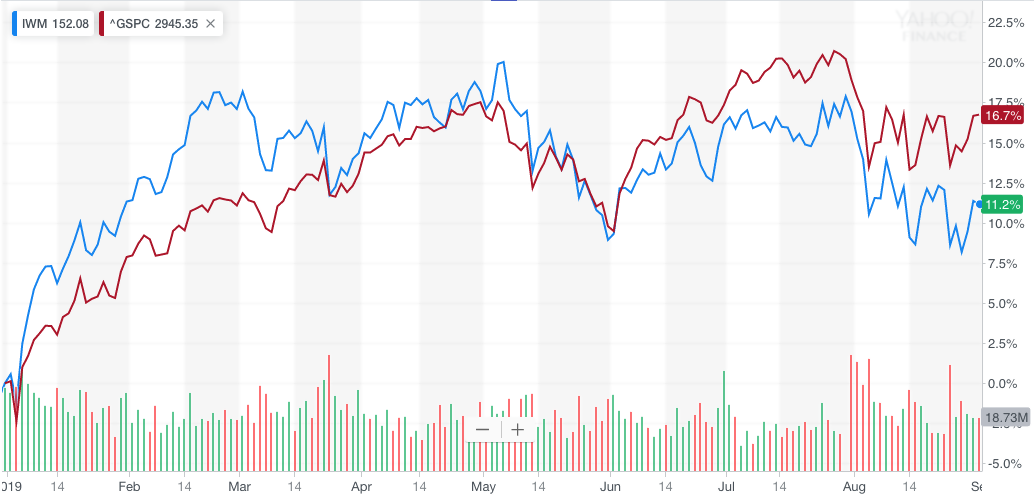

Who else doesn’t import or export? Many (but not all) small businesses fit that description. And what’s been happening to small-cap firms this year? The Russell 2000 index (tracked by iShares ticker IWM) did outperform the S&P 500 (SPY) for the first half of 2019, but then the situation reversed, quite significantly.

What’s going on? What makes the IWM wander away from the S&P 500? That’s a complicated issue, but in terms of sector exposures, here’s something interesting:

|

Sector Exposure |

IWM |

SPY |

Difference |

|

|

Basic Materials |

5.22% |

2.35% |

2.87% |

|

|

Communication Services |

1.04% |

3.74% |

-2.70% |

|

|

Consumer Cyclical |

11.21% |

11.99% |

-0.78% |

|

|

Consumer Defensive |

3.88% |

8.12% |

-4.24% |

|

|

Energy |

2.77% |

4.41% |

-1.64% |

|

|

Financial Services |

16.58% |

15.66% |

0.92% |

|

|

Healthcare |

15.46% |

13.79% |

1.67% |

|

|

Industrials |

15.19% |

10.14% |

5.05% |

|

|

Real Estate |

9.38% |

2.84% |

6.54% |

|

|

Technology |

15.16% |

23.49% |

-8.33% |

|

|

Utilities |

4.12% |

3.47% |

0.65% |

|

Yes, small caps are overweight Real Estate, but note that the S&P is much more tech-heavy than IWM. When tech outperforms, the IWM is likely to underperform. If you think small caps will do better than large caps due to the strong dollar and tariffs but you still want that tech exposure, maybe buying IWM, shorting SPY and adding a touch of QQQ is the way to go.

—————————————————————————————-

Your ability to stick to a strategy matters more than the strategy itself.

The Lead-Lag Report is designed to help you stick to your goals through deep intermarket analysis. My research produces a weekly report that will give you an edge in reading the market for your asset allocation decisions.

You’ll get short, intermediate, and long-term ideas built off of the four award winning white papers I co-authored on generating alpha and predicting stock market corrections.

Interested? Ignore fake news and get real market analysis.

Try a two week free trial here and get The Lead-Lag Report today.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services by Pension Partners, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Pension Partners, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

[ad_2]

Source link Google News