[ad_1]

utah778/iStock via Getty Images

Investment Thesis

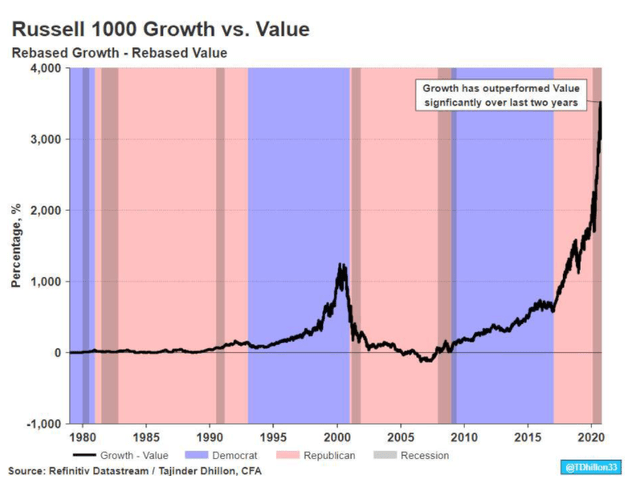

For a long time, the theory was that small stocks outperform large-cap stocks, and value stocks, defined as those with a low price/book ratio, outperform expensive stocks – the category typically referred to as growth. A common explanation is that the market should reward investors with higher returns in exchange for the additional risk they take in holding volatile, small-cap, and out-of-favor securities. The difference in returns between growth and value is now, as seen in the chart below, even higher than at the peak of the dot-com bubble.

Refinitiv Datastream

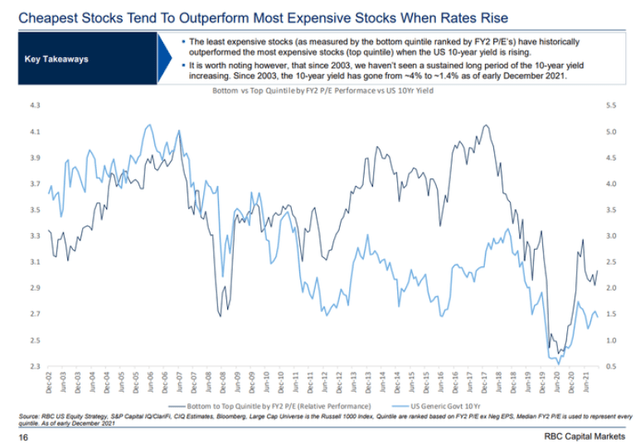

However, I believe we are at a turning point where value investing should do slightly better than growth because of higher inflation and higher interest rates. If we assume the Fed will go ahead and tighten its monetary policy, price-to-earnings multiples of the most expensive stocks become inversely correlated with 10-year yields during hiking cycles, as illustrated in the chart below. In other words, value historically outperforms growth as yields rise. In this article, I will review the iShares Russell 1000 Value ETF (NYSEARCA:IWD) which provides exposure to a basket of US mid and large-cap value stocks.

RBC Capital Markets

Strategy Details

The iShares Russell 1000 Value ETF seeks to track the investment results of an index composed of large and mid-capitalization U.S. equities that exhibit value characteristics. This ETF provides exposure to U.S. companies that are thought to be undervalued by the market relative to comparable companies. Therefore, this strategy can be used to access a specific category of domestic stocks or to tilt your portfolio towards value stocks.

If you want to learn more about the strategy, please click here.

Portfolio Composition

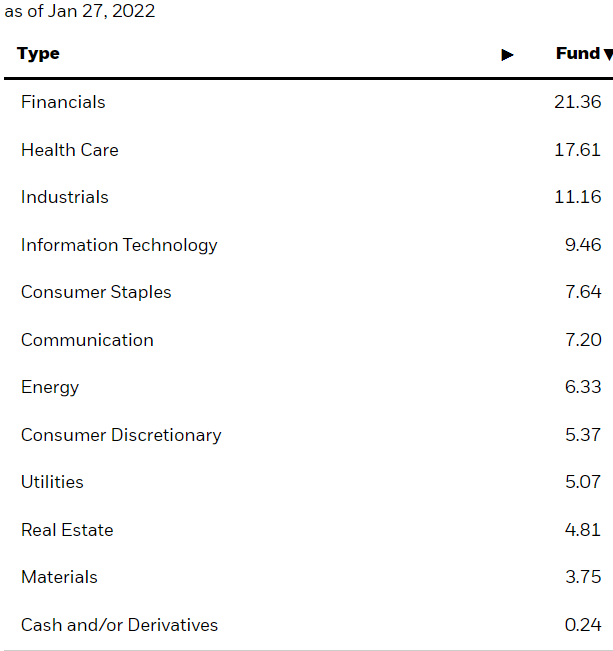

From the sector allocation chart below, we can see the index places a high weight on Financials (representing around 21% of the index), followed by Health Care (accounting for ~18% of the index) and Industrials (representing around 11% of the fund). The largest three sectors have a combined allocation of approximately 50%. All in all, IWD is well diversified across sectors in my opinion. In terms of geographical allocation, IWD invests only in the US.

iShares

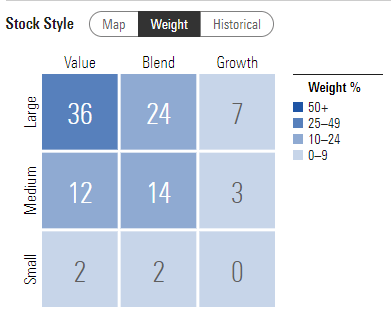

IWD invests ~36% of the funds into large caps value stocks, characterized as companies where value characteristics predominate. Large-cap issuers are usually defined as companies with a market capitalization above $8 billion. The second-largest allocation is in large-cap blend equities, which are companies with a market cap above $8 billion where neither value nor growth characteristics predominate. Unsurprisingly, IWD allocates only a fraction of the funds (~4%) to small-caps, which generally have a larger runway to compound than large-cap issuers.

Morningstar

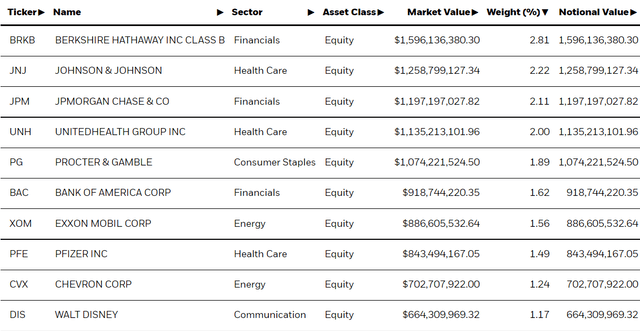

The fund is currently invested in 852 different stocks. The top ten holdings account for 18.11% of the portfolio, with no single stock weighting more than 3%. All in all, I would say that IWD is pretty well-diversified across constituents.

iShares

Since we are dealing with equities, one important characteristic is the valuation of the portfolio. According to iShares, the fund currently trades at an average price-to-book ratio of 2.56 and an average price-to-earnings ratio of 19.71. Even if the valuation doesn’t strike me as being extremely cheap, you still end up getting a better deal with IWD than with a plain vanilla S&P 500 fund. For instance, it is estimated that the S&P 500 is currently trading at a price-to-book ratio of 4.36 and a price-to-earnings ratio of ~21.

Is This ETF Right for Me?

IWD has a distribution rate of 1.62%. Given the low dividend yield, I don’t think this ETF is suitable for the dividend investor. I have compared below the price performance of IWD against the price performance of the SPDR S&P 500 Trust ETF (NYSEARCA:SPY) over 5 years to assess which one was a better investment. Over that period, IWD underperformed SPY. Compared to the S&P 500, IWD underperformed by a ~52 percentage points margin. To put IWD’s returns into perspective, a $100 investment in IWD five years ago would now be worth $146.79. This represents a compound annual growth rate of ~8%, which is an average return in my opinion.

Refinitiv Eikon

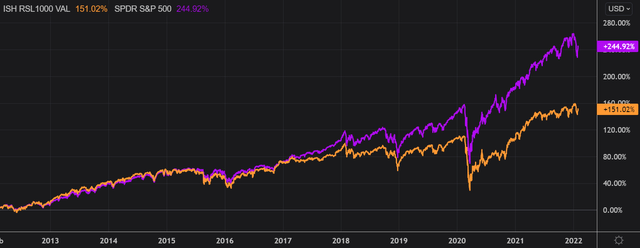

If we take a step back and look at the performance from a 10-year perspective in the below chart, it is worth noting that IWD was performing similarly to SPY until the March 2020 crash. After that pullback, the performance spread between the two ETFs widened considerably. Even if SPY benefited from one of the most remarkable US bull markets in history, I think it just shows how hard it is for any strategy to beat the market over a long period of time.

Refinitiv Eikon

Key Takeaways

IWD tracks the performance of a basket of US mid and large-cap value stocks. I like the fact that IWD is pretty well-diversified both across sectors and constituents. Moreover, I think that allocating a portion of your portfolio to a value strategy makes sense at the moment since we are at an inflection point in US monetary policy, which should favor value stocks going forward. In terms of valuation, IWD offers a better value for money than a plain vanilla S&P 500 ETF like SPY and can be successfully used to tilt your portfolio towards value stocks.

[ad_2]

Source links Google News