[ad_1]

PeopleImages

Thesis

The Krane Shares Trust – Quadratic Interest Rate Volatility and Inflation Hedge ETF (NYSEARCA:IVOL) is an exchange traded fund that tries to capture the rates market volatility. The vehicle is fairly opaque when an investor takes a first glance at the fund:

IVOL is a first-of-its-kind fixed income ETF that seeks to hedge relative interest rate movements, whether these movements arise from falling short-term interest rates or rising long-term interest rates, and to benefit from market stress when fixed income volatility increases, while providing the potential for enhanced, inflation-protected income

Source: Fact Sheet

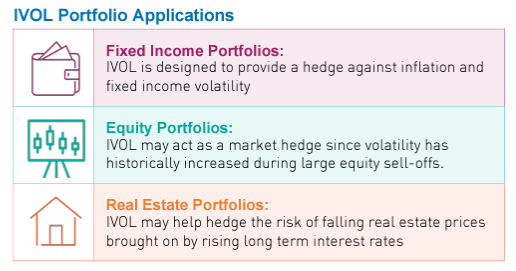

Furthermore the Fact Sheet states the following applications for the ETF:

Portfolio Applications (Fact Sheet)

So what does IVOL actually hold and what does it do? In the below “Holdings” section you can have a clear parsed out look at the holdings, but they essentially boil down to a 90% portfolio allocation to the Schwab U.S. TIPS ETF (SCHP) and the other roughly 10% in options on various rates components (as of Q1 2022 the options were looking to exploit the U.S. Treasuries 2Y/10Y spread). So in reality a very simple dual composition of a TIPS ETF and taking a view via options on the 2Y/10Y spread. The fund does this with a 0.99% annual fee versus only 0.04% for SCHP.

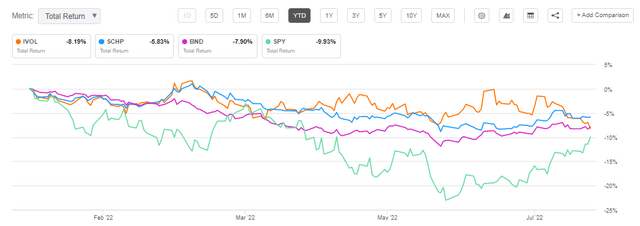

IVOL’s performance is underwhelming – it is down -8.19% year to date (versus -5.83% for SCHP) and up only 3.17% on a 3-year basis versus +10% for SCHP. This basically means that the rates volatility trading adds no value to IVOL, it basically constitutes a subtractor to performance. An investor is better off here just buying SCHP outright if TIPS exposure is sought.

If we look at the stated Portfolio Applications above we can see that they do not really jive either:

- “IVOL is designed to provide a hedge against inflation and fixed income volatility”

2022 has been a year of surprisingly high inflation and massive fixed income volatility as measured by the MOVE index. Has IVOL provided positive results? No. Has IVOL monetized via a positive gain the fixed income volatility? No.

2. “IVOL may act as a market hedge since volatility has historically increased during large equity sell-offs”

We have seen a significant down move in the equities market this year but IVOL has failed to provide a hedge. In effect the vehicle lost money on its volatility positioning.

3. “IVOL may help hedge the risk of falling real estate prices brought on by rising long term interest rates”

This factor has also happened in 2022 with rates higher, mortgage rates higher and house prices starting to cool off. Unfortunately IVOL has not been a hedge.

We do not mean to be a “Negative Nancy” here but outside of a very bombastic name we see very little usefulness in IVOL from its volatility trading or stated Portfolio Applications. Let us not mince our words – IVOL is an ETF that has roughly followed its main component (SCHP) and has on its own generated a negative trading result from its rates volatility trading. While positioning can change as the portfolio manager sees fit we would have expected some sort of long swaption straddle positioning in order to monetize a high vol in the rates space, not options on the 2Y/10Y relationship. From our perspective a retail investor is best served to stay away from an overly complex ETF which has not outperformed its largest holding SCHP and has failed to generate a positive result in a year of record fixed income volatility and inflation.

Holdings

If we look at the fund’s fact sheet we get the following description of the holdings:

Portfolio Composition (Fact Sheet)

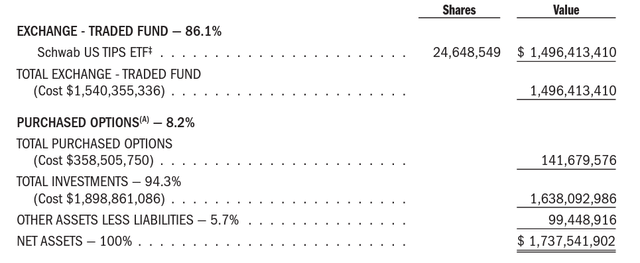

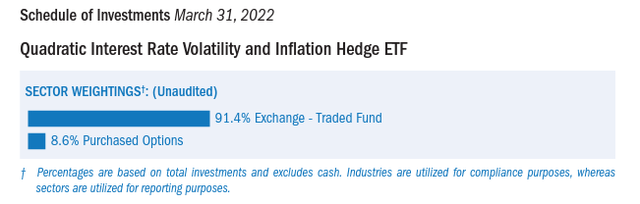

Since the above does not say much regarding what the ETF actually holds we went to the Annual Report for 2022. Effectively the fund contains two risk factors as per the annual report:

Balance Sheet Components (Annual Report)

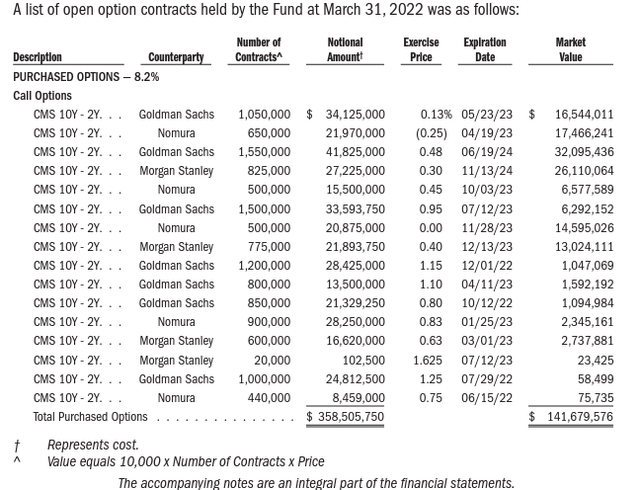

On one hand the vehicle has a large weighting in the Schwab U.S. TIPS ETF and a sub 10% allocation to “Purchased Options”. Drilling into the option holdings we get the following:

Option Contracts (Annual Report)

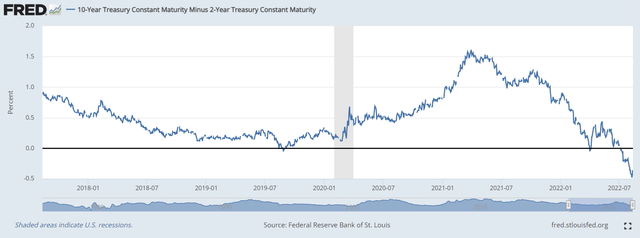

These are call options on the Treasury 10 Year yield minus the Treasury 2 Year yield. Basically the 10Y – 2Y relationship of the treasury curve is a relationship widely followed in the financial industry (10Y/2Y inversion is a well acknowledge recessionary sign for example) and there are options on the net spread between the 2 points in the curve. A visual representation of the spread gives us a flavor of the current inversion:

2Y/10Y Graph (The Fed)

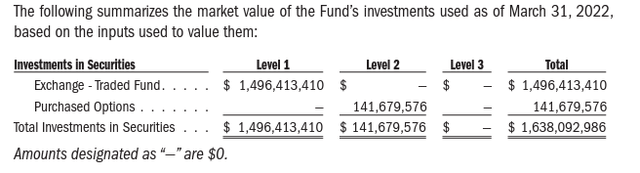

Please note that the above table from the Annual Report has some unrealized gains/losses embedded in the figures, so from a portfolio composition standpoint it is simpler to look at the below:

Fund Investments (Annual Report)

Schedule (Annual Report)

Think about IVOL as an ETF which holds 90% of its cash in SCHP and the other roughly 10% in options on various rates components (as of Q1 2022 the options were looking to exploit the U.S. Treasuries 2Y/10Y spread).

Performance

The fund is down more than -8% year to date:

YTD Performance (Seeking Alpha)

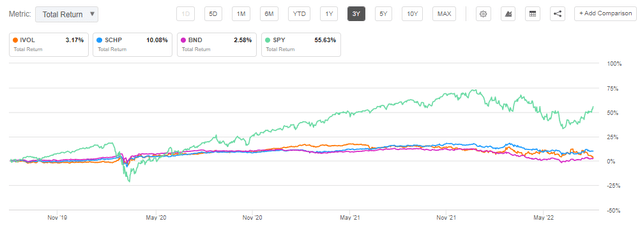

If we look at the ETF’s performance we can see that it underperformed SCHP, its largest holding, which translates into a negative performance for the options strategy that composes the 10% of the portfolio outside of SCHP. That means that the fund manager did a poor job of taking advantage of the high volatility environment in 2022, and an investor would have been better off just investing in SCHP outright. There is also no diversification effect when looking at the bond and equities markets and IVOL – they all expose similar negative total returns. A three year chart paints a similar picture where IVOL underperforms SCHP:

3Y Total Return (Seeking Alpha)

The takeaway here is that the fund does not generate long term alpha via its rates trading strategies but actually subtracts from the performance. An investor is much better off just investing in SCHP outright.

Conclusion

IVOL is an ETF which tries to provide a hedge against inflation and fixed income volatility. The ETF has a dual factor composition, holding 90% of its portfolio allocation in the Schwab U.S. TIPS ETF and the other roughly 10% in options on various rates components (as of Q1 2022 the options were looking to exploit the U.S. Treasuries 2Y/10Y spread). IVOL has a negative performance of -8.19% year to date, underperforming SCHP and signaling a negative profit & loss from its rates trading component. A 3-year total return profile paints a similar picture. With a high management fee and a failure to generate positive alpha from rates volatility trading we are hard pressed to see why a retail investor would allocate cash to this complex ETF that falls short of its stated goals.

[ad_2]

Source links Google News