[ad_1]

marchmeena29/iStock via Getty Images

IVE strategy and portfolio

The iShares S&P 500 Value ETF (NYSEARCA:IVE) has been tracking the S&P 500 Value Index since May 2000. IVE has 453 holdings, a distribution yield of 1.83% and a total expense ratio of 0.18%.

As described by S&P Global, the underlying index selects companies in the S&P 500 index exhibiting the strongest value score based on three ratios: book value to price, earnings to price, and sales to price. It is weighted by market capitalization and rebalanced annually. According to the prospectus, the underlying index represented about half of the market capitalization of the S&P 500 index (SPY).

IVE invests almost exclusively in U.S. companies (98.7% of asset value), mostly in the large cap segment (77.6%). As expected, IVE is cheaper than its parent index regarding usual valuation ratios (reported in the next table).

|

IVE |

SPY |

|

|

Price/Earnings TTM |

18.31 |

21.92 |

|

Price/Book |

2.82 |

4.23 |

|

Price/Sales |

2 |

2.94 |

|

Price/Cash Flow |

13.27 |

17.15 |

The top 10 holdings, listed below with valuation ratios, represent 17.9% of asset value. The heaviest position weights 3.34%, so the risk related to individual stocks is low.

| Ticker | Name | Weight (%) | P/E TTM | P/E fwd | P/Sales TTM | P/Book | P/Net Free Cash Flow | Yield% |

| BRK.B | Berkshire Hathaway Inc. | 3.34 | 8.87 | 27.51 | 2.85 | 1.55 | 30.09 | 0 |

| JNJ | Johnson & Johnson | 2.52 | 23.31 | 17.24 | 5.19 | 6.57 | 55.73 | 2.33 |

| PG | Procter & Gamble Co. | 2 | 28.3 | 27.26 | 5.2 | 9.31 | 64.41 | 2.17 |

| XOM | Exxon Mobil Corp. | 1.89 | 16.11 | 9.47 | 1.32 | 2.2 | 17.57 | 4.05 |

| CVX | Chevron Corp. | 1.69 | 20.89 | 11.27 | 2.09 | 2.35 | 28.63 | 3.34 |

| UNH | UnitedHealth Group Inc. | 1.54 | 30.19 | 25.25 | 1.81 | 7.27 | 35.69 | 1.06 |

| KO | Coca-Cola Co. | 1.3 | 28.35 | 26 | 7.16 | 12.06 | 69.26 | 2.76 |

| DIS | Walt Disney Co. | 1.26 | 78.26 | 29.6 | 3.3 | 2.68 | 162.55 | 0 |

| VZ | Verizon Communications Inc. | 1.16 | 10.06 | 9.84 | 1.67 | 2.73 | N/A | 4.78 |

| WMT | Walmart Inc. | 1.16 | 32.28 | 23.36 | 0.76 | 5.26 | 88.95 |

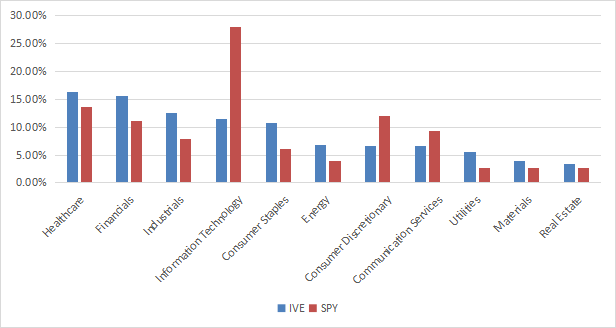

The top two sectors are healthcare (16.4%) and financials (15.6%). Compared to the S&P 500, the fund underweights technology, consumer discretionary, communication and overweights all other sectors. It results in a much better balance across sectors.

IVE sectors (chart: author; data: Fidelity)

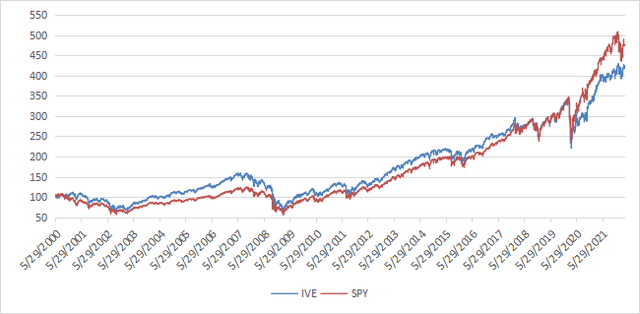

Since inception in May 2000, IVE has slightly underperformed SPY (the difference in annualized return is 56 bps). The risk measured in maximum drawdown and volatility (standard deviation of monthly returns) is a bit higher.

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

IVE |

324.42% |

6.83% |

-61.61% |

0.41 |

16.03% |

|

SPY |

376.52% |

7.39% |

-55.42% |

0.46 |

15.14% |

Data calculated with Portfolio123

The next chart plots the equity values of $100 invested in IVE and SPY since IVE inception. The two funds have alternatively outperformed each other. IVE has been lagging since the March 2020 market meltdown.

IVE vs. SPY (chart: author)

Comparing IVE with my value benchmark

The Dashboard List is a list of 80 stocks in the S&P 1500 index (occasionally less), updated every month based on a simple quantitative methodology. All stocks in the Dashboard List are cheaper than their respective industry median in Price/Earnings, Price/Sales and Price/Free Cash Flow. An exception in Utilities: the Price/Free Cash Flow is not taken into account to avoid some inconsistencies. After this filter, the 10 companies with the highest Return on Equity in every sector are kept in the list. Some sectors are grouped together: Energy with Materials, Telecom with Technology. Real Estate is excluded because these valuation metrics don’t work well in this sector. I have been updating the Dashboard List every month on Seeking Alpha since December 2015, first in free-access articles, then in Quantitative Risk & Value.

The next table compares IVE performance since inception with the Dashboard List model, with a tweak: here the list is reconstituted once a year to make it comparable with a passive index.

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

IVE |

324.42% |

6.83% |

-61.61% |

0.41 |

16.03% |

|

Dashboard List (annual) |

1097.99% |

12.03% |

-56.19% |

0.69 |

16.73% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

The Dashboard List beats IVE by a wide margin in return and risk-adjusted performance (Sharpe ratio). A note of caution: the ETF performance is real and the list is simulated.

IVE fundamental shortcomings

The underlying index has two shortcomings in my opinion. The first and largest one is to classify all stocks on the same criteria. It means the valuation ratios are considered comparable across sectors. Obviously they are not: you can read my monthly dashboard here for more details about this topic. A consequence is to privilege sectors where valuation ratios are naturally cheaper, especially financials. Some other sectors are disadvantaged: those with large intangible assets like technology. To make things simple, companies with large intangible assets are those with a business model based on massive R&D, or a strong branding, or large user databases, or operating in a field where competition is limited by an expensive entry ticket. All these elements are not correctly reflected by valuation ratios.

The second flaw is using the price/book ratio (P/B), which first amplifies the intangible asset issue, and second adds some risk in the strategy. Intuitively, we can guess a large group of companies with low P/B contains a higher percentage of value traps than a same-size group with low price/earnings, price/sales or price/free cash flow. Statistically, such a group will also have a higher volatility and deeper drawdowns in price. The next table shows the return and risk metrics of the cheapest quarter of the S&P 500 (i.e. 125 stocks) measured in price/book, price/earnings, price/sales and price/free cash flow. The sets are reconstituted annually between 1/1/1999 and 1/1/2022 with elements in equal weight.

|

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

Cheapest quarter in P/B |

9.95% |

-72.36% |

0.48 |

21.05% |

|

Cheapest quarter in P/E |

11.25% |

-65.09% |

0.57 |

18.91% |

|

Cheapest quarter in P/S |

12.62% |

-65.66% |

0.6 |

20.46% |

|

Cheapest quarter in P/FCF |

12.23% |

-63.55% |

0.61 |

19.05% |

Data calculated with Portfolio123

This explains my choice of using P/FCF and not P/B in the Dashboard List model.

Takeaway

IVE follows a systematic strategy based on a ranking system using three valuation metrics. Its portfolio is better balanced across sectors than its parent index S&P 500. The heaviest ones are healthcare and financials. It has slightly lagged SPY since its inception two decades ago. It is not a bad product: in fact it has alternatively beaten and lagged SPY, which means it may be a component of a tactical allocation strategy switching between different investing styles (value and growth for example). However, as a buy-and-hold investment, the S&P 500 Value Index doesn’t seem to add value to the broader index. I think there are two shortcomings in its rules: it ranks stocks regardless of their sectors, and one of the three metrics is a bad choice. An efficient value model should compare stocks in comparable sets (sector, industry), like I do in the Dashboard List since 2015. My model also uses three valuation metrics, but prefers price/free cash flow to price/book. Moreover, a simple ROE rule helps filter out some value traps and normalize the number of components.

[ad_2]

Source links Google News