[ad_1]

ewg3D/E+ via Getty Images

Recent events have naturally piqued investor interest in the defense sector. Whatever the outcome of the Ukrainian conflict, it seems that the democracies, in general, have recognized the fact that the world has become less peaceful and that significantly higher levels of defense spending will be needed in the future. Even perennial laggards Japan & Germany have accepted that reality – with the ruling party targeting an increase in defense spending from the post-war cap of 1% to 2% in the case of Japan and Germany also raising to 2% but with the addition of a one-off rearmament program of E100 billion (approx. $110 billion). While the US has so far lagged behind, it seems likely that the next Congress and the next administration will be less recreant.

Many investors have therefore become more interested in the defense sector. However, this is a particularly difficult sector in which to choose individual stocks. Not only are the technologies arcane and difficult to analyze, but the equally difficult issues of government budgeting, pork barrel contracts, and national procurement policies must be considered. Many investors (including this one) are therefore inclined to use index funds to get broad sectoral exposure to the US defense sector. Today I compare two such funds – the iShares U.S. Aerospace & Defense (BATS:ITA) and the SPDR S&P Aerospace & Defense (NYSEARCA:XAR).

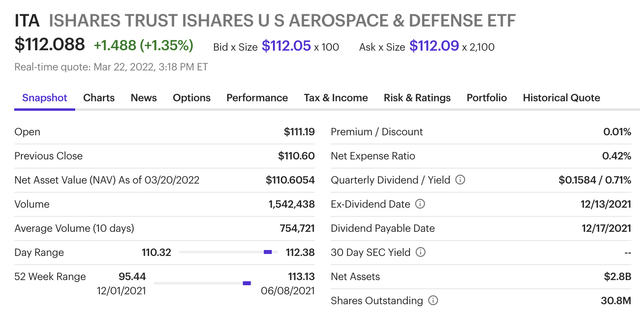

ITA (E*Trade)

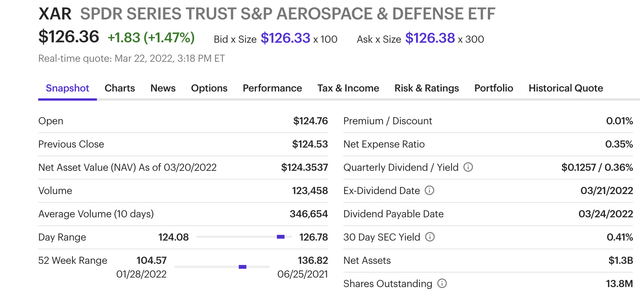

XAR (E*Trade)

These funds are superficially similar – since they both track, to a large degree, the S&P Aerospace & Defense Select Industry Index. However, investors may wish to consider three areas of difference.

Yield

ITA’s yield of 0.71% is significantly higher than XAR’s ).41%, even though ITA has materially higher fees (0.41% vs. 0.35%). Since a significant number of defense companies are relatively young and/or in emerging–technologies, the sector as a whole does not generally pay out a high yield, but in comparing two substantially similar funds, the difference is important – Advantage ITA.

Liquidity

Both funds are relatively large and liquid, and both have listed options. However, ITA’s net assets (both funds are unleveraged) of $2.8 billion are more than twice XAR’s $1.3 billion, and ITA’s liquidity is proportionately higher, with a current ten-day average volume of 755,000 vs. XAR’s 347,000 (the unit prices are similar. Again, advantage ITA.

Portfolio Selection

While both funds track the same index, there is an apparently minor but actually very consequential difference in their stock selection methodology.

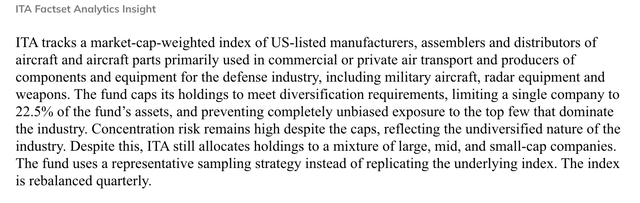

ITA describes their policy as follows:

ITA Stock Selection (etc.com)

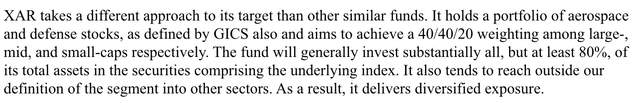

While XAR says

XAR Stock Selection (etc.com)

The consequence of this is quite different portfolios (both funds provide daily updates).

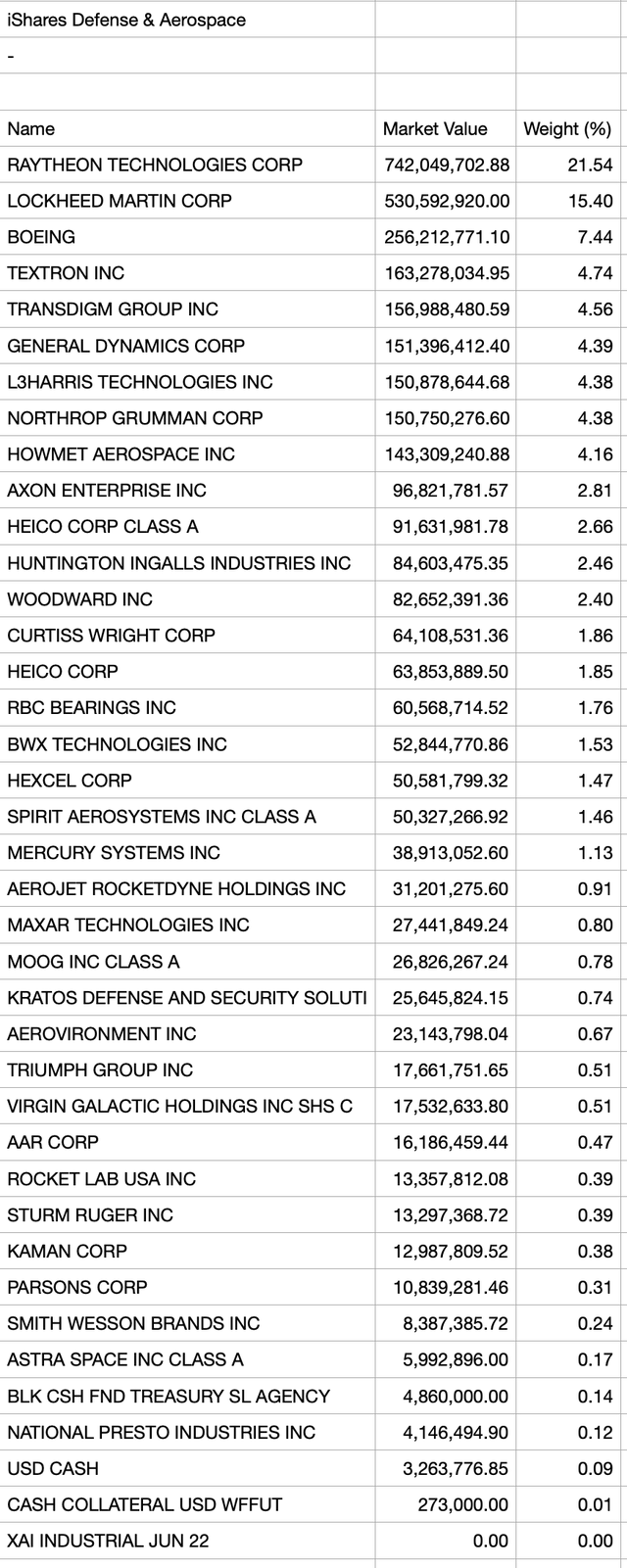

ITA has:

ITA Holdings (iShares)

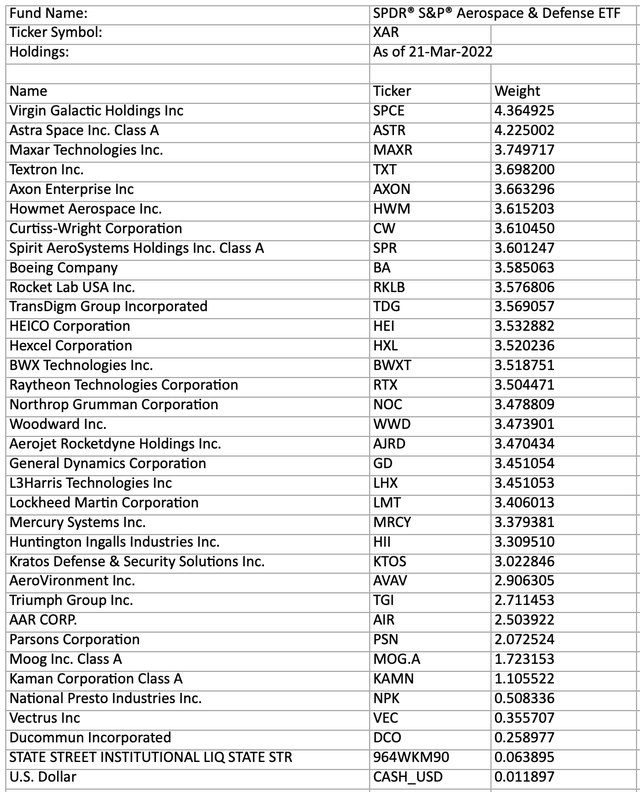

and XAR has:

XAR Holdings (State Street)

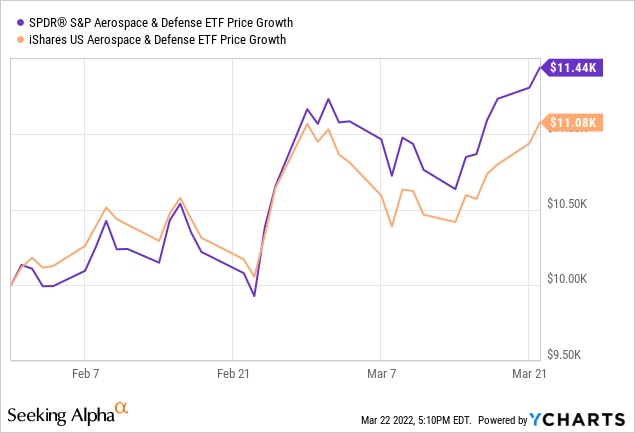

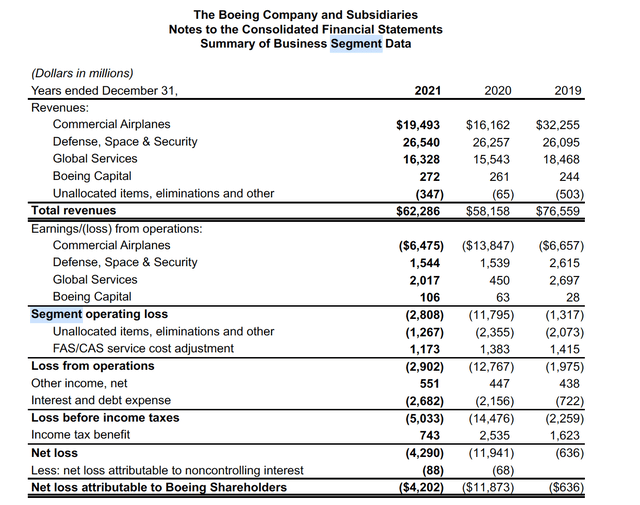

There are several differences, but the most significant one and, in my view, the one that explains the relative out-performance (shown above) of XAR since the Ukraine crisis flared up, is the relative weighting of Boeing (BA). XAR has 3.59% Boeing, while ITA has far more at 7.44%. Boeing is, of course, a defense company, but it is far more than that. Its troubled commercial aircraft division, while smaller in revenues than the defense segment, has been solely responsible for the company’s massive operating losses over the last several years.

Boeing segments (Boeing Annual Report 2021)

Furthermore, the commercial aircraft business as a whole is negatively correlated to the defense business, as Boeing Global Services segment is now demonstrating. While Boeing’s leasing arm (Boeing Capital) has relatively little exposure to Russia & Ukraine, the entire commercial aircraft business is very exposed to any conflict (military or diplomatic) with China.

Boeing & China (Boeing Q2 ’21 10-Q)

The problem with Boeing is not that it is a bad company (in my opinion) but that the split of its business makes it neither fish nor fowl. The commercial business will prosper if the world economy expands and becomes more peaceful, and in that circumstance, the defense business will decline and act as a dead-weight impeding the stock price. Conversely, in troubled times, the situation will reverse and the defense business will charge ahead, while the commercial aircraft business will hold the stock price back. This makes it undesirable as a fund holding for investors who are seeking to benefit from either circumstance.

Therefore, XAR’s lesser exposure to the commercial aircraft business makes it a purer defense play. For those investors seeking mainly defense exposure, advantage XAR.

Conclusion

It is difficult to avoid completely exposure to Boeing when investing in defense. However, I prefer to minimize that exposure, and therefore, I prefer XAR to ITA, despite the latter’s slight advantages in yield & liquidity.

[ad_2]

Source links Google News