[ad_1]

(Source – Pexels)

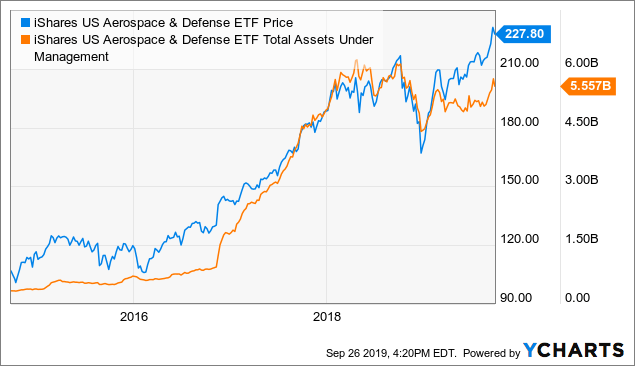

The Aerospace and Defense industry has been a very strong and unique industry group over the past decade. The iShares fund for the industry (ITA) has had an incredible 660%+ performance streak since 2009 and the firms in the industry have held their weight in dividends and revenue growth.

That said, it seems that investors may want to look to take their money off the table. Valuations are very high for a capital intensive sector, balance sheet quality has deteriorated severely, global jet sales look to be slowing, and the growing U.S.-EU commercial jet trade spat could cause supply-chain disruptions.

Even more, the fund is over-concentrated in Boeing (BA) which looks like an increasingly risky company from a regulatory perspective. Finally, the narrative of “increased government military spending” may hold to be untrue. The fact of the matter is that the U.S. government is running out of money and will need to eventually drastically reduce discretionary spending. Even if a military conflict breaks out, the era of “spend more win war” is seemingly over due to newer more cost-effective technologies (like drone swarms and cyber-attacks).

I also believe that many countries are interested in boosting their aerospace industry in order to reduce dependence on the United States. This could threaten to remove the U.S. near-monopoly on Aerospace which would be very negative over the long run.

Let’s take a deep dive into the fund to see whether or not its risks outweigh potential rewards.

The iShares Aerospace and Defense ETF

ITA is an older and very well known (perhaps the most well-known) single-industry ETF. It holds primarily companies that manufacture commercial and military aircrafts as well as other defense equipment. It has been trading since 2006, and currently has $5.5B in total AUM. Let’s see how that AUM level has changed over time to see if there are any interesting trends among fellow investors:

Data by YCharts

Data by YChartsThis is a very interesting fund flows chart that gives us insight into the narrative that drove the fund’s constituents higher. The huge increase in AUM occurred during the period following Donald Trump’s election. This is a sign that investors in the ETF see him as a primary catalyst to military spending. Military spending has increased over the past two years, but now that the government deficit is reaching all-time lows, I believe this spending will eventually slow.

The fund has 34 holdings but is a bit too concentrated with Boeing having a 22.5% weighting and United Technologies (UTX) having a 15.5% weighting. Of course, if United Technologies manages to acquire Raytheon (RTN) (which I slightly doubt), UTX will also have a 20% concentration. These 34 companies have a pretty high weighted average “P/E” ratio at 21.3X, particularly given the industry’s high cyclicality and price volatility.

Valuations and Revenue Growth Potential

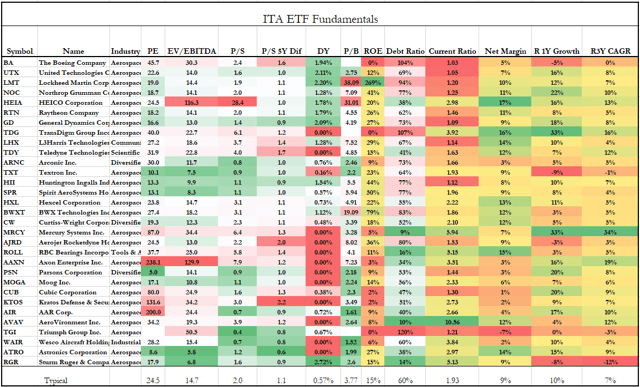

Overall, many of these companies have pretty sky-high valuations when their debt situation is taken into account. I will say that I’ve seen worse valuations and debt situations in sectors like consumer staples (XLP), and utilities (XLU), but these stocks are much more volatile and dependent upon economic growth than those two.

Here is a table of the fundamentals statistics for the stocks in the ETF:

(Source – Unclestock)

Overall, I’ve seen worse financial data, but this is certainly not signaling any undervaluation. “P/E” valuations are a bit high, companies are trading at historical “P/S” premium of about 10%, and revenue growth is not high enough to justify such valuations.

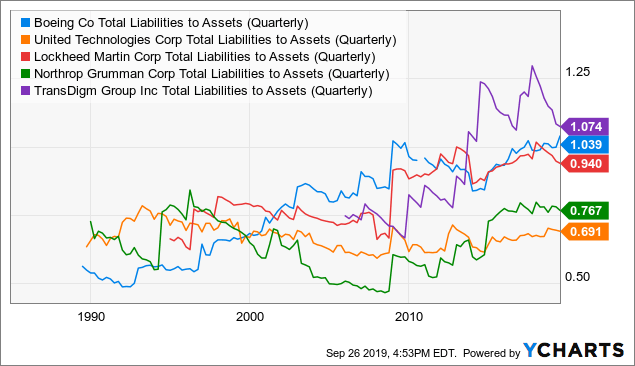

For many of the larger companies (the top 10 make up about 70% of the fund), their debt situation is also not great. These very high debt ratios are largely due to share buybacks and excessive dividend payments which will likely slow given their poor cash balances. Boeing and United Technologies both have relatively low-profit margins and barely have enough current assets to meet short-term obligations.

As shown below, we can see that the top five holdings in the fund have all been increasing leverage over the past three decades:

Data by YCharts

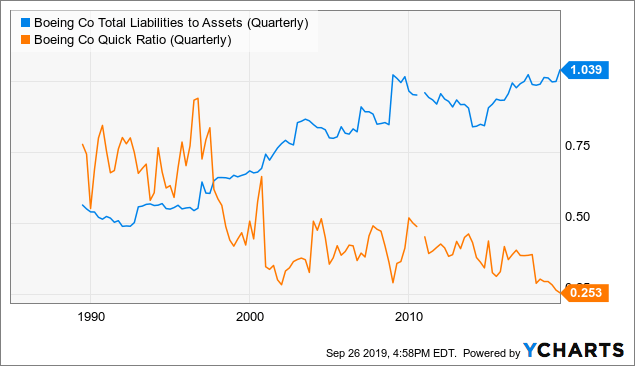

Data by YChartsBoeing, in particular, looks very risky. Global confidence in the company is fading and interest in competition is rapidly rising. I imagine that the EU will most definitely retaliate against Boeing following their victory against Airbus. This is all coming as Boeing’s financial stability is teetering (despite its sky-high valuation and near-monopoly status). Just look at the company’s complete lack of cash on hand and rising leverage over time:

Data by YCharts

Data by YChartsFrankly, I see no outcome where Boeing investors today make a profit. The stock is way overvalued and pressures both financially and geopolitically are mounting against the company. We are living in a world that is increasingly hostile toward monopolies. Boeing is a red-hot “sell”.

Slowing Revenue Growth Drivers

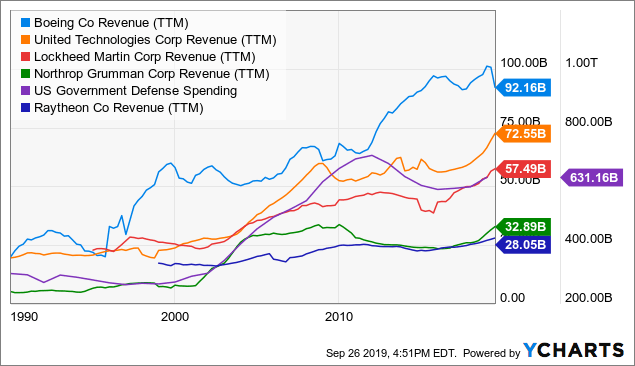

Speaking of monopolies, the companies in ITA also have very high monopsony risk. This is the case when companies are too dependent on a single buyer which is, in this case, the U.S. government. Many of the top companies generate more revenue from commercial airline buyers, but revenue growth is still highly dependent on U.S. defense spending. Take a look at the revenues of these companies vs. U.S. defense spending:

Data by YCharts

Data by YChartsAs you can see, a major reason for the “second wind” in the Aerospace industry as a whole is the recent increase in military spending on equipment upgrades and new technologies.

Importantly, I do not think that investors should expect military spending to increase drastically. As a macro-oriented analyst, it seems clear that the U.S. government’s current degree of deficit spending is completely unsustainable.

Now, there is a chance that yet another military conflict breaks out in the Middle East, but we are already spending nearly as much as we did during the peak of the last wars. Those involved in government contracting know that, if red-tape was streamlined (which it would if a true war begins), the government could reduce spending without harming capabilities. Frankly, there is reason to believe the government has increased bureaucratic red-tape across the military-industrial complex as a slightly Keynesian attempt to boost economic growth.

Finally, over the long run, I think it is safe to say that the era of very expensive jets and helicopters will be replaced by cyber and drone warfare. As humans are slowly (and steadily) removed from combat vehicles, costs will fall dramatically and many of these companies will find themselves creating outdated products. Perhaps AeroVironment (AVAV) or L3Harris (LHX) (in ITA) could be solid growth picks to fit this theme.

The Bottom Line

The U.S. aerospace industry will eventually have its global authority put into question. In my opinion, the rapid decline in demand for Boeing aircraft is only the beginning. Global trade and geopolitical tensions are rising, for many countries like Russia and China, it is a national security/autarkic economic concern to develop their own aerospace industry.

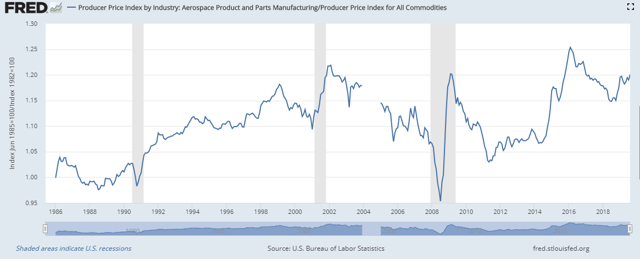

China’s Comac and France’s Airbus will continue to be propped up by governments (WTO legally or not). While competition is low today, it will increase. Real prices in the Aerospace industry are very high by historical standards, and when that is the case, prices usually fall dramatically. Take a look at Aerospace PPI divided by total PPI:

(Source – Federal Reserve Economic Database)

In the short-run, I agree that revenue and earnings will likely be strong for most of these companies. That said, I believe that long-run growth expectations are far too high. Investors in the industry may not be discounting the risk of a likely eventual decline in U.S. dominance and pricing power.

When new tariffs are inevitably placed on the industry, investors will likely quickly rethink their growth expectations and valuations for many of these companies will likely fall by at least 25%. Military spending in the budget is strong, but the budget does not take into account the fact that interest expense will likely rise for the U.S. government. Remember, the Aerospace industry is politically the easiest part of the U.S. discretionary budget to cut.

Regarding commercial airline demand in the short-run, I expect it to continue to be weaker than many expect. Growth in plane demand over the past two decades has largely been from Emerging Asia and the Middle East. Now that those high-growth economies are slowing, I expect growth expectations on behalf of airlines to decline and plane purchasing to eventually slow. This will not only harm Boeing, but also the companies in ITA that sell to Boeing.

Overall, ITA looks like a “sell”. I will say that the industry does not look as bad as a few others, but it seems like a clear underperformer over the coming months and years.

Interested In Closely Following Global Events?

“The Country Club” is a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We will certainly be providing subscribers further updates on this idea.

Subscribers receive exclusive ideas, model portfolios, and a wide range of tools including our exclusive “Country Club Dashboard” which allows them to visualize global financial and economic data. If you haven’t already, please consider our 2-week free trial and get your passport to global markets today!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in ITA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News