[ad_1]

Feverpitched

Introduction

In the past few days, we have discussed two important transportation-focused articles:

- CSX Corporation’s (CSX) earnings showed ongoing supply chain issues and high inflation.

- Union Pacific (UNP) earnings were dominated by the same supply issues and lower volume growth guidance.

In this article, we’re going to zoom out a bit as we discuss the bigger picture. Global freight is not in a good spot as trade volumes are weakening quite significantly.

This is impacting shipping rates in the sector’s most important period while input costs remain high. That’s not a great combination, to put it mildly.

In this article, I will walk you through these developments and share my thoughts on the matter – especially because I have significant transportation exposure and my eyes on a few stocks in the industry.

So, let’s get to it!

Growth Is Gone, Now We’re In Contraction

Where to start?

I know I have started a lot of articles this way, but the question is always justified as we’re truly living in complex times. Since the start of the pandemic, we’re dealing with interconnected issues tied to supply troubles, energy and agriculture inflation, labor shortages, trade problems, lockdowns, and geopolitical challenges.

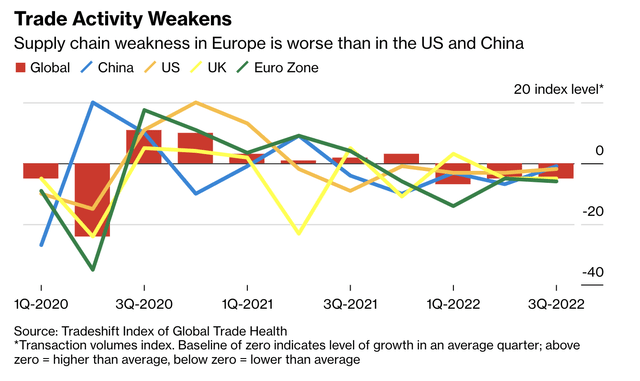

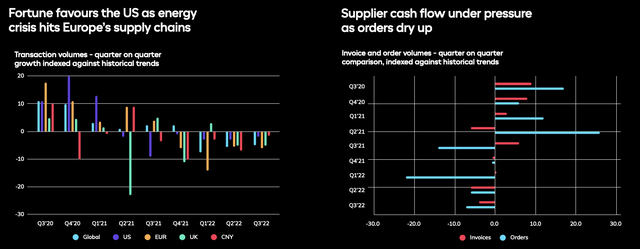

Now, tailwinds are turning into headwinds. Growth is turning into contraction. While global trade volumes picked up rapidly after the 2020 lockdowns, growth is negative as of 1Q22.

Bloomberg

The chart above is based on Tradeshift data (as reported by Bloomberg), which found a number of important trends:

- Manufacturing supply chains dropped 11 points below the expected range in the third quarter.

- Retail activity was 9 points under the baseline, the worst reading in 18 months.

- Transport and logistics were in negative territory for a second straight quarter.

According to the Tradeshift report:

Global buying activity fell by another 7 points against the expected range in Q3 as the decline in ordering volumes cranked up another notch. Earlier falls can be attributed to settling demand after previous spikes. But the latest data points to a more general slowdown across global supply chains.

Tradeshift

These developments make sense as economic growth indicators are slowing. The odds are rising that the ISM manufacturing index will fall below 50 in October, which would indicate a contraction. Regional surveys already indicate a decline toward 46, which would make a manufacturing recession a “done deal”.

Wells Fargo

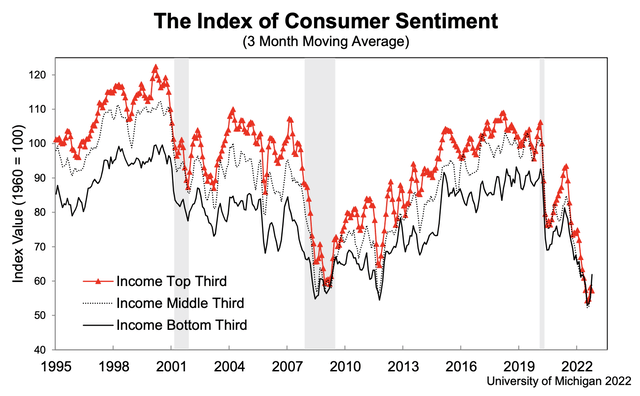

While manufacturing is connected to pretty much every other industry, problems are now everywhere. For example, this is what consumer sentiment looks like:

University of Michigan

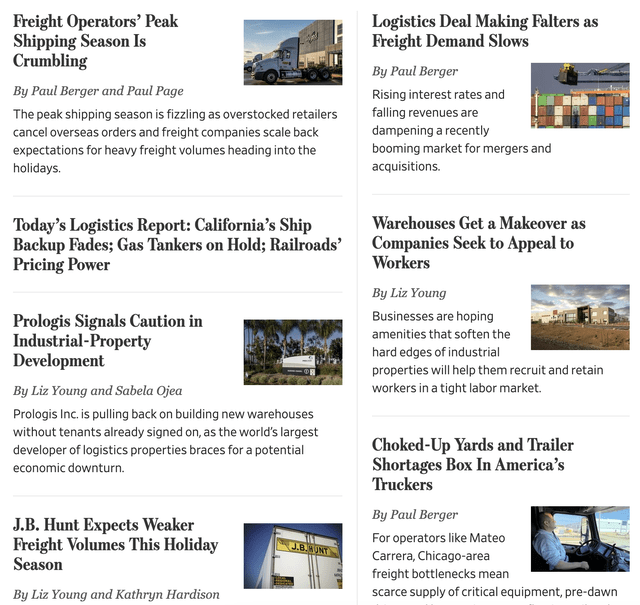

As these developments continue to unfold, we are being hit by a wave of negative headlines. The screenshot below shows some Wall Street headlines that summarize sentiment quite well.

Wall Street Journal

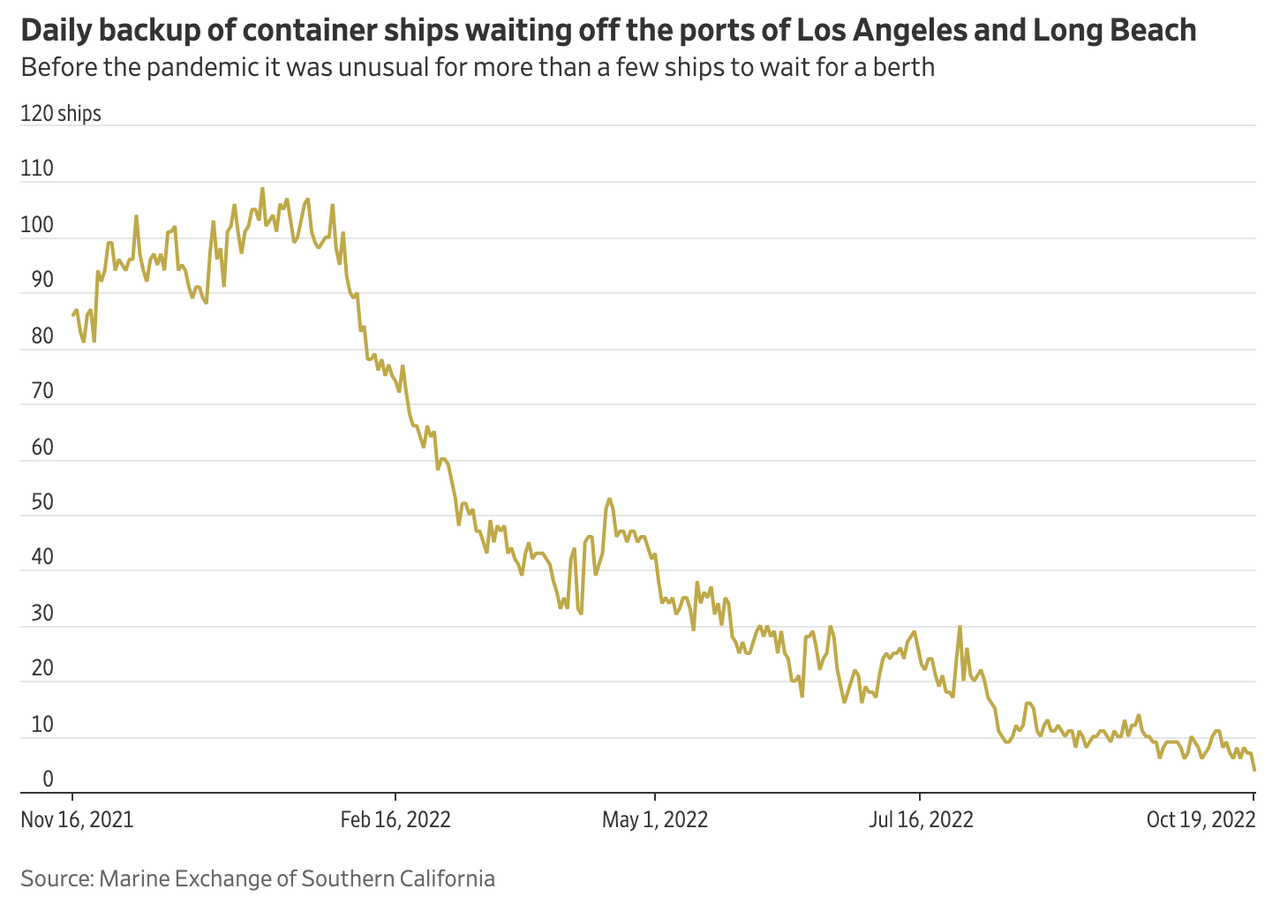

Speaking of the Wall Street Journal, the paper recently published a chart showing that the backup of container ships waiting off the ports of Los Angeles and Long Beach (the big ones in the US) has faded entirely.

Wall Street Journal

With that said, let’s dive into the transportation industry, as there’s a lot to unpack.

How Bad Is It?

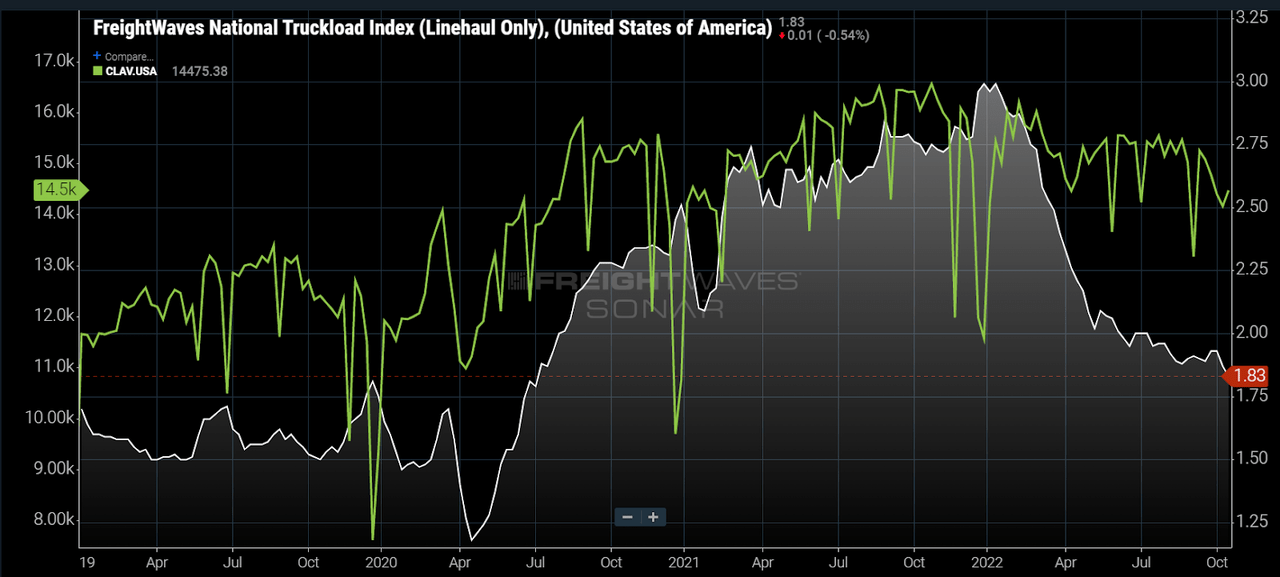

Trucking rates are falling. Truckload spot rates, excluding fuel costs, are down 37% from their January 2022 highs.

FreightWaves

Knight-Swift Transportation (KNX) is confirming these developments as it cut its annual profit forecast to $5.17, well below analyst expectations of $5.40.

Businesses are slowing their orders on concern consumer demand won’t hold up, and that means less freight to carry, especially for smaller truckers, the company said late Wednesday as it reported quarterly earnings. That’s leading to a decline in the prices transportation companies can charge, and their operating costs are still soaring, Knight-Swift said.

[…] “These muted trends have continued into October as supply chains appear to be catching up and adjusting for uncertainty in consumer demand,” Chief Executive Officer David Jackson said in a statement. “If these trends continue, we expect truckload supply to rapidly exit the market.”

In light of these developments, the question is how much more downside (risk) we are facing.

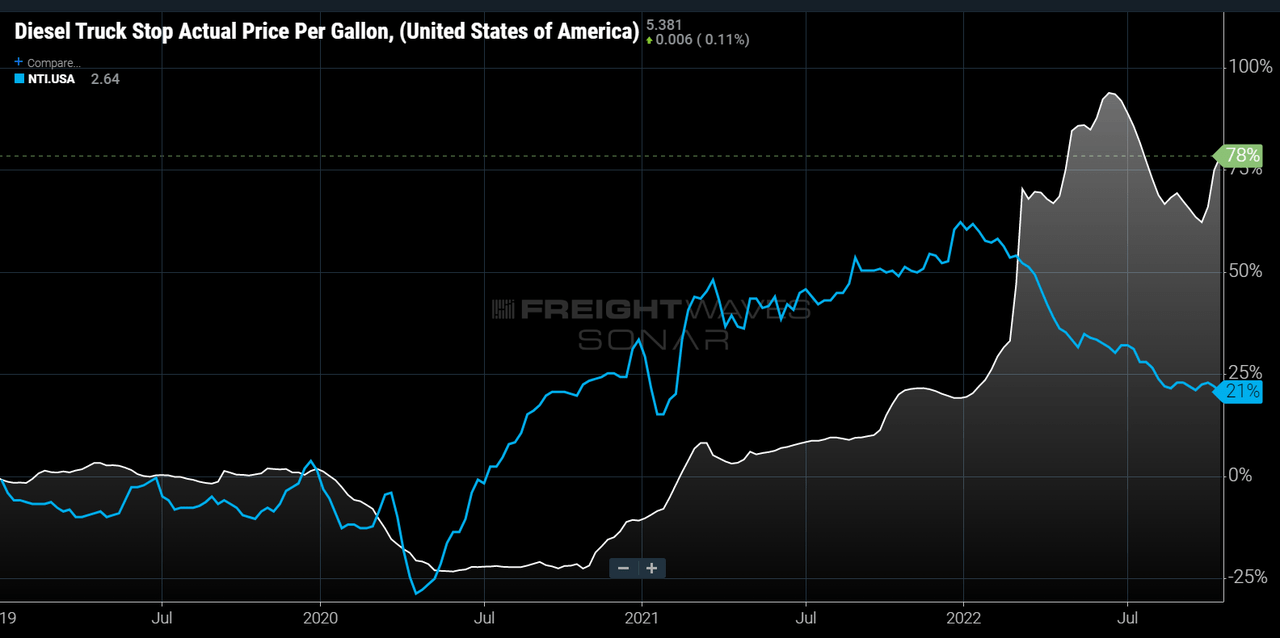

According to FreightWaves, we’re now seeing declining spot rates and rising fuel costs. These divergences are extremely rare as fuel is highly cyclical – in general.

FreightWaves

The divergence is likely based on two things.

- There was a lot of room on carrier operating margins.

- The balance between capacity supply and demand was shifting dramatically from an undersupplied market to an oversupplied one.

Since early May, the average fuel price has fluctuated but is currently about 2% higher than it was at that point. All-inclusive spot rates have fallen another 11%, but at a much slower pace. In October, the price of fuel appears to have a stronger impact on spot rates (including fuel).

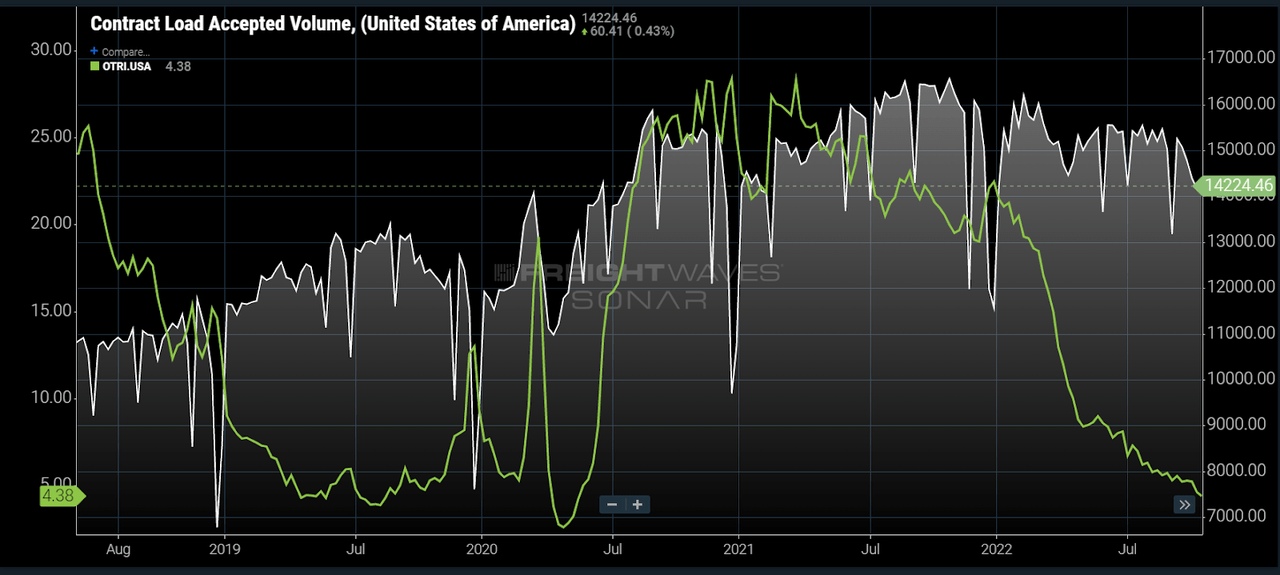

The problem is the demand side. Accepted tender volumes are now 11% lower on a year-on-year basis. Accepted tenders, as displayed in the chart below, are representative of load volumes being moved under contracted rates.

FreightWaves

According to FreightWaves:

In an easing environment, carriers accept more loads under contract rates because they have less optionality and network disruption. In 2019 CLAV increased as loads moved from the spot market back under contract and rejection rates fell, suggesting capacity increased to meet demand.

A decline in the CLAV at this point suggests that aggregate demand is falling versus carriers choosing to divert capacity to the spot market. Considering spot rates are offering a significant discount to contract rates, this makes sense.

Given these developments, we can assume that a lot of carriers will be operating at a loss if input inflation remains sticky while freight rates continue their decline.

The fact that the surge in fuel is influencing spot rates is a sign that margins are razor thin.

Moreover, on Twitter, FreightWaves CEO Craig Fuller noted the impact a weakening consumer is having on transportation companies going into the last two months of this year.

Retail plays an outsized role in the trucking industry during the 4th quarter, especially from Oct 15 – Dec 15th. Even in a good year construction, ag, & beverage volumes slow down significantly and retail becomes king.

Retailers have nearly all of the products they need in their distribution networks for the holidays (and then some), which means that there won’t be a lot of freight demand as we head into the last two months of the year. It’s going to get worse from here.

What This Means For Transportation Stocks

As I wrote in my prior article, the iShares US Transportation ETF (BATS:IYT) is a great vehicle to invest in diversified transportation exposure, and as a tool to track the industry without having to build one’s own index.

Owned by BlackRock, the iShares ETF has an expense ratio of 0.39%, which I believe is rather high. In my prior article, I commented:

This means I prefer the ETF as a trading vehicle to “buy low and sell high” instead of a long-term investment alternative. I don’t want readers to (indirectly) pay their asset manager 0.39% per year. If investors want long-term exposure without too much risk, I suggest buying 1 railroad, 1 air freight and logistics company, and 1 trucking company.

Established in 2003, the ETF is the largest transportation ETF with a daily volume of roughly 160 thousand shares and close to $800 million in assets under management.

The ETF has a 30-day SEC (dividend) yield of 1.31%. Please ignore that, as I don’t recommend dividend investors buy IYT. The expense ratio is simply too high.

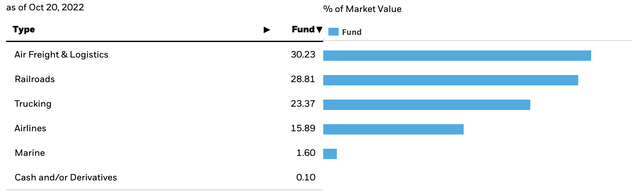

The good news is that IYT is extremely well-diversified. Investors get high exposure to railroads, air freight and logistics, and trucking. With smaller exposure to airlines and marine transportation.

iShares

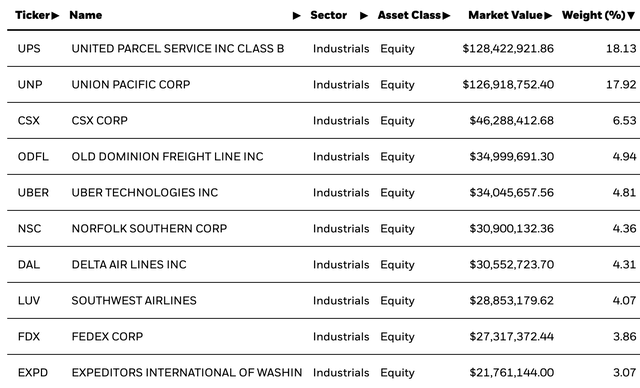

The ETF’s largest holdings are listed below. I own two companies on this list, Union Pacific and Norfolk Southern (NSC).

iShares

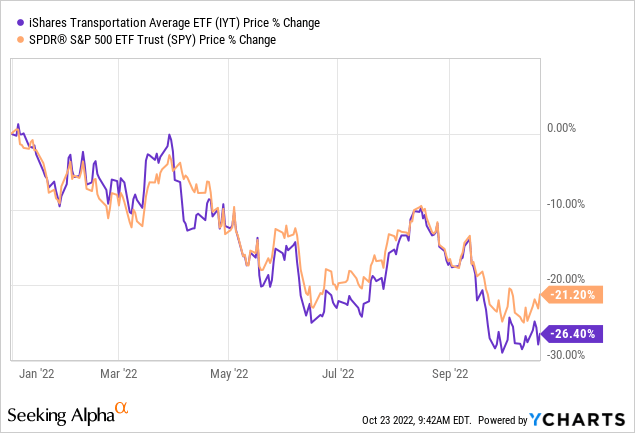

With that said, transportation stocks are having a tough time. The IYT ETF is down 26.4% since the start of the year, underperforming the market by 520 basis points.

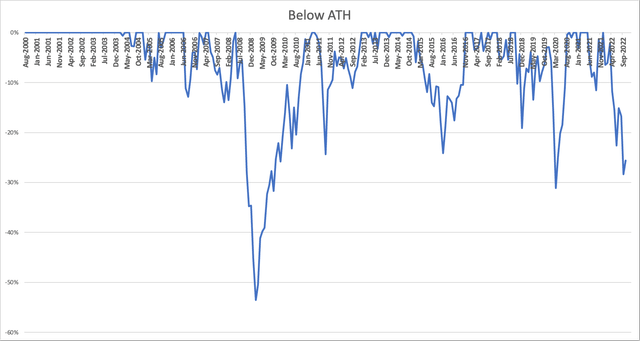

On a monthly closing price basis, the sell-off is now comparable to the one in 2020 and even worse than the 2015/2016 manufacturing recession.

Author (IYT Drawdowns)

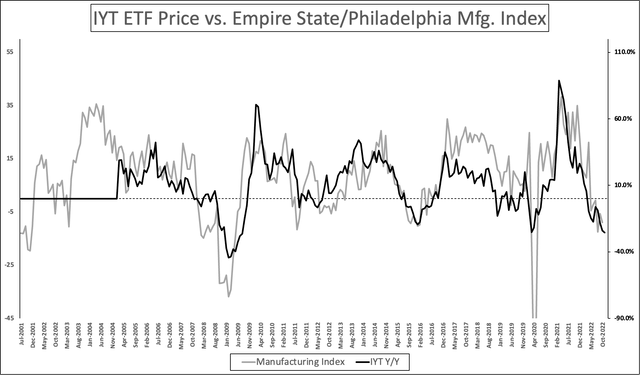

What this tells us is that a lot has been priced in. The chart below confirms this as well as I’m comparing the year-on-year performance of IYT to regional manufacturing surveys.

Author

Unfortunately, it is impossible to make the case that the bottom is in. After all, the Federal Reserve is still determined to remain “very” hawkish as inflation remains persistent. As I said in a recent Seeking Alpha podcast, the bottom may not come until something “breaks”.

However, and I explained this in the two articles I referred to in the introduction of this article, I am a buyer of what I believed are undervalued equities. My long-term investment strategy is to aggressively acquire companies that trade below fair value. While both bear and bull markets tend to bring valuations to either extreme undervaluations or overvaluations (meaning bottom buying is tricky), I believe this is the way to go.

Takeaway

Economic growth is in a tough place. A recession is now a certain thing as both manufacturing and consumer sentiment is in a bad spot. Even worse is that the Federal Reserve isn’t expected to support the economy anytime soon. Inflation remains high, as a lot of supply-side issues are unresolved.

The pain is now clearly visible in the transportation industry. Global trade is contracting, spot rates are rapidly declining, and margins are razor thin.

Even worse is that input inflation remains high as fuel costs are strong as a result of supply issues.

As a result, transportation stocks are underperforming the market in an already bad year.

While it’s hard to make the case for a bottom, I’m starting to buy quality stocks in the industry as I like the value a lot of these companies bring to the table for long-term investors like myself.

In the weeks ahead, I will discuss the stocks on my radar.

(Dis)agree? Let me know in the comments!

[ad_2]

Source links Google News