[ad_1]

jimfeng

Published on the Value Lab 8/9/22

The iShares U.S. Transportation ETF (BATS:IYT) is a pretty skewed portfolio that ends up having some idiosyncratic risks. We think logistics is going to be a valuable part of the supply chain for a while, but from a profit perspective, there are headwinds coming in from labour unions. With demand side being somewhat uncertain since logistics is the center of inflation and a target for monetary authorities right now, we don’t like the operating leverage coming in from tough labour unions. The multiple is a bit too high considering all this.

IYT Breakdown

The story of IYT boils down to the prospects of a couple of businesses. 20% at the head of the holdings is in UPS (UPS), and the next 20% is Union Pacific (UNP) with another railroad just under.

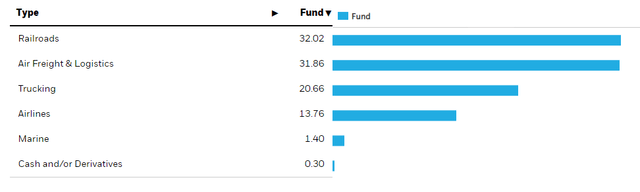

Sector (iShares.com)

Railroads together account for 32% of the portfolio, with logistics generally being another 32% as well.

What are the problems with this? Logistics businesses are still commanding value and interest, but there are concerns on the demand side as macro becomes uncertain. Ultimately, logistics is the culprit for a lot of the current inflation we are seeing. Sawmills are aplenty, so is steel capacity, but across these industries, we are seeing bottlenecks at logistics rather than the upstream capacity. Therefore, logistics are at the center of the crosshairs for monetary authorities. That is to say that monetary authorities are looking to cool demand so demand isn’t pushing up against the limits of logistics capacity. Therefore, the scarcity of logistics will have to come to an end from reducing aggregate demand, which all goes through logistics. The demand side is therefore in some threat. There is excess demand, and therefore margin for demand declines, but the conditions will have to worsen for logistics at least a little.

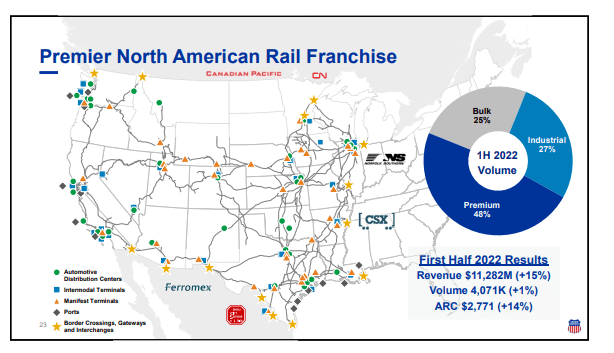

With railroads specifically, there is concern on the supply side too. Railroads may be actually more resistant than logistics because they are responsible for moving industrial products to a sputtering manufacturing industry. 10% of the revenue of UNP comes from the energy industry. There’s a lot of coal demand too as well as for essential bulks like fertilizers, grain and renewable products, and all sorts of basic materials and essential chemicals like petrochem and plastics.

Exposures (UNP Q2 2022 Pres)

UNP looks more resilient than standard logistics exposures like UPS on the demand side, less exposed to direct consumer declines. But the issue is on the supply side with labor unions. Wage increases are going to be 24% into 2024. Compensation is around 20% of revenue, so this is going to be a pretty meaningful 400 bps decline in operating margin from this fixed cost inflation. This can be extrapolated across the railroad industry.

Conclusions

The PE is not that low on this portfolio at around 16.52x. It’s not low, especially considering that earnings are going to compress from pressure on the cost side. Moreover, 10% of OPEX is in Fuel. Fuel prices are up at least 30% as well as the pressure from labor inflation. The total compression of the bottom line could be 10% before considering potential pressure on the demand side. Yields aren’t relevant either. The PE therefore inches towards 19x on an adjusted basis. That’s getting a little high, implying an earnings yield just above 5% where reference rates reaching above 3% now, offering very little risk premium. We’d pass on IYT on these directional effects and limited value.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News