[ad_1]

frantic00/iStock via Getty Images

Investment thesis and background

Since you are reading this, I assume you are concerned about inflation and cash preservation. So I let me first run an ad for the US treasury’s iBond. It is the safest and simple way to fight inflation and preserve cash now. You can have 7.1% interest locked in for the next 6 months for up to $15k per calendar year. After that, its interest changes with inflation. If you share our outlook, we believe the inflation will persist and the rate would continue at a relatively high level after. More details are on the U.S. Treasury’s TreasuryDirect website.

Now back to the iShares TIPS Bond ETF (NYSEARCA:TIP). It offers diversified exposure to Treasury Inflation-Protected Securities (“TIPS”) and therefore helps to protect against intermediate-term inflation. It offers relatively low volatility, substantially lower than other asset classes as you will see. Combined with its inflation protection feature, it can serve as a good fund for cash management. And indeed, this article describes my methods of using the TIPS fund as a cash fund in our survival/withdrawal portfolio (“SWP”).

Especially now, it is a challenging time for investors. Stock valuation is at a record high, bond yields are at a record low, a war is undergoing, and several crucial macroeconomic uncertainties are unfolding. As mentioned in our newly launched market service, we feel urged to remind investors that at times like this, it is especially important to stay disciplined and stay with simple and proven methods that you truly understand.

And a key to staying disciplined is to ALWAYS delineate short-term survival/withdrawal from long-term growth. For the SWP, we ourselves have been seeing and publishing warning signs since last November to urge readers to conserve cash and hunker down. For example:

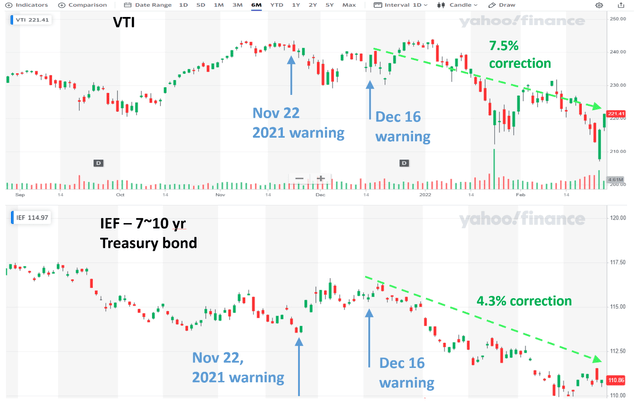

- In our Nov 22, 2021 article, we cautioned readers that our model showed a record low exposure index (“EI”), a key signal our proprietary algorithm monitors – a key parameter we use to allocate our cash reserve in all our accounts. We mentioned that now was a good time to increase cash reserve and be in a hunker-down mode with the summation equity yield and Treasury rate at a historical low.

- In our Dec 16, 2021 article, we cautioned again it was a good time to move toward maximum cash reserve and be in a hunker-down mode because of the warning signal from our exposure index again.

Those were clear signals for us. And we sold some equity and bond to increase our cash allocation. Shortly after this allocation change, both the stock and bond market went through a sizable correction as you can see next. As of this writing, VTI fell by about 7.5% (and the NASDAQ index fell more if you hold those funds). At the same time, the 10-year Treasury bond fell by more than 4%.

In this article, we will first provide a description of our method used in SWP, and then we will describe how TIP can play a role in the SWP to help navigate turbulent times like this.

Source: author and Yahoo finance

Our Survival/Withdrawal Portfolio (“SWP”)

The goal of the SWP is to provide capital preservation capability and at the same time, SOME growth – and growth is only a secondary goal here. As aforementioned, delineating survival from growth is the first step in successful investing and achieving financial security. Sadly, we’ve seen too many people around us make the tragic mistake of pursuing growth before ensuring survival. The SWP has been a proven tool for ourselves and many people around us to avoid such mistakes. And we hope you find it helpful too.

Especially for investors who need to withdraw either regularly or have a given financial obligation in the near future, capital preservation should be the absolute priority in this account under the current market conditions – a challenging combination of historical high stock valuation, low-interest rates, and a war!

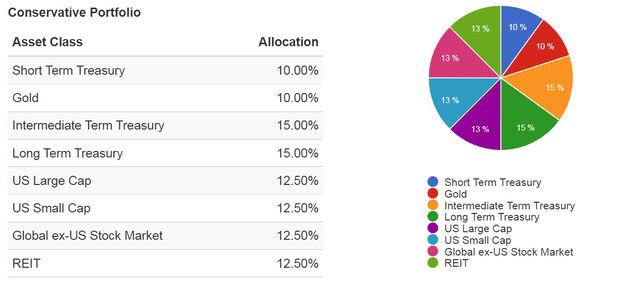

Our SWP is a variation of Ray Dalio’s All-Weather Portfolio (“AWP”) – a variation that made it more conservative to suit our goals and needs. It is a variation that we have been applying for more than 15 years to manage our short-term portfolio – a portfolio that we use to provide liquidity and meet our short-term needs. The portfolio consists of:

- About 10% cash or cash equivalent. The level of cash is dynamically adjusted based on the valuation of the stock market and bond rates as detailed in our earlier articles.

- About 10% of gold.

- About 15% of intermediate-term bonds

- About 20% long term bonds

- And the remaining are invested in stocks funds or stocks as detailed in our SWP model portfolio below.

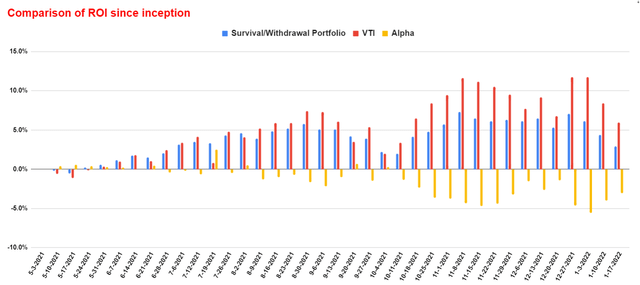

The performance of our SWP on a weekly basis since May 2021 (the first time we wrote about it on Seeking Alpha) is summarized in the following chart. Its performance is benchmarked against the Vanguard S&P total market ETF (NYSEARCA:VTI). Though it has been a really short time compared to my horizon and there is no need to read too much into the specific numbers, you can already see its conservative nature. It lags the overall market in general (for one thing – due to the cash holding), especially during one-way rallies like what we have been experiencing from May to the end of 2021. But it fluctuates a lot less. Particularly, it has NOT lost money since May 2021 even though VTI showed some negative returns.

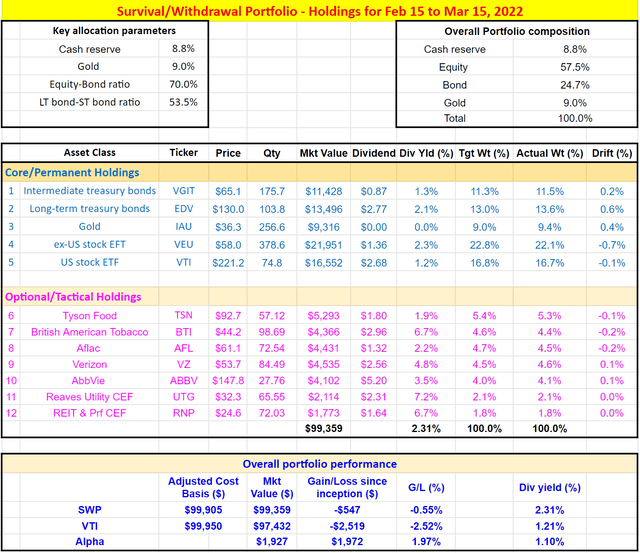

Furthermore, during market turbulent times like the past few weeks, the SWP quickly caught up with the overall market. The second chart below shows our current allocations in the SWP. We are allocating 8.8% into cash reservations and TIP can be part of it. And as you can also see, the SWP’s return has not only caught up with the overall market but is leading it by almost 2% as of now.

The long-term performance will be reported later in this article.

Source: author.

Source: author

TIP: basic info and closer look at its holdings

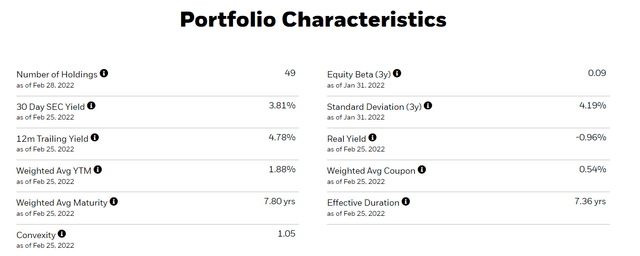

With the above background and thesis, now let’s take a closer at the TIP ETF itself. It is one of the popular iShares ETF families with a relatively large AUM of $35B. It charges an expense ratio of 0.19%. It trades with a decent daily volume and a tight spread. The other key info is shown below in the next chart. The fund exclusively holds United States Treasury bonds with a 12-month trailing yield of 4.78%. Its average maturity and duration are both between 7 to 8 years.

Source: iShares Fund Description

Specifically, the average maturity for the TIP fund is 7.8 years as shown above. The price of a bond goes up when its yield goes down and vice versa. And a primary driving force for bond yield is the interest rate. The effective duration is a quick (but reasonably accurate) way of estimating the price change of a bond fund as a function of yield. When the yield rises by 1% (e.g., caused by a 1% interest rate hike), the price of a bond decreases approximately by its effective duration in percentages. So in the example of TIP, its price will drop by about 7% if everything else is held constant. Such relatively small price volatility is one key reason to consider it as a cash management fund.

However, part (or all) of this drop will be compensated by the coupon payment (current at 4.8% a year and the coupon payments increase as yield increases). So in the end, the total loss, if any, would be quite small and manageable – another key reason to consider it as a cash management fund.

And we see other good reasons for a fund like TIP in the SWP.

TIP: a terrific diversifier for a conservative portfolio

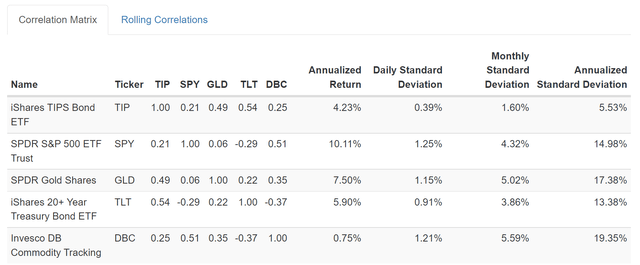

As can be seen from the following chart, the TIP fund has no or low correlation relative to other asset classes. It features a low correlation to equity (represented by SPY), gold (represented by GLD), long-term Treasury bond (represented by TLT), and also commodities (represented by DBC).

At the same time, for reasons discussed above, TIP also features a very low annualized standard deviation as you can see. Its annualized standard deviation is only about 5.5%, only about 1/3 or 1/4 of the other asset classes.

Source: simulation from Portfolio Visualizer, Silicon Cloud Technologies LLC

TIP: hedge against inflation

Here is a bit of TIPS 101. The central idea of TIPS is to provide protection against inflation. The way the protection works is that the principal of a TIPS is adjusted based on the inflation, and you are paid the adjusted amount at maturity. In contrast, the principal of a “normal” bond is fixed and does not change. The principal of a TIPS increases with inflation and decreases with deflation.

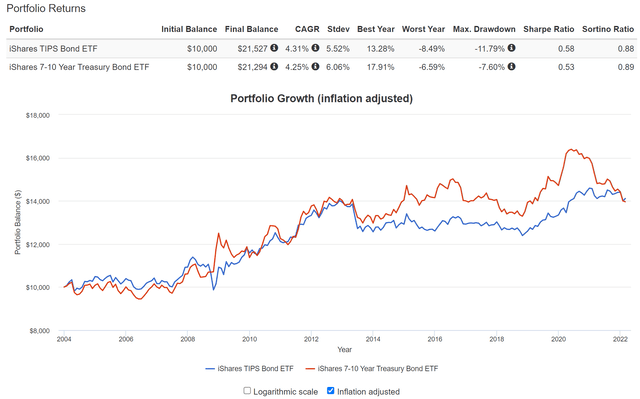

So besides the low correlation, low volatility, and healthy yield mentioned above, another good reason to include TIP is its inflation protection, as better illustrated in the next chart. As seen, TIP delivered a total return of about 4.3% CAGR since 2004, and so did a normal intermediate-term bond fund such as IEF (with comparable duration). You can see them tracking each other very closely between 2004 and 2016, because the inflation has been quite low during that period. It began to lag IEF after that due to the sharp Treasury drop (which benefited IEF) and the low inflation (which did not benefit TIP).

However, as inflation began to pick up around 2018, TIP’s role to fight against inflation began to demonstrate. And TIP’s total return caught up with IEFT quickly. Furthermore, if inflation persists at a relatively high level like what we are experiencing now, a normal bond like IEF will begin to depreciate in real dollars because of inflation, but TIP can keep up.

Simulation from Portfolio Visualizer, Silicon Cloud Technologies LLC

Long-term performance of the SWP

As aforementioned, our SWP is consisted of the following assets,

- About 10% cash or cash equivalent. The level of cash is dynamically adjusted based on the valuation of the stock and bond market. It can (and did) go to 0% when the market is undervalued like during the 2020 pandemic turmoil.

- 10% gold and silver using a gold-silver trade strategy as detailed in my earlier article

- 15% intermediate-term bonds such as TIP and other treasuries

- 15% long term bonds

- The remaining are invested in stocks. You could just pick a total market fund like VTI. Or you could tailor your exposure with sector funds. The example below shows an equal allocation among US large-cap, US small-cap, international stocks, and REITs.

Source: Portfolio Visualizer, Silicon Cloud Technologies LLC

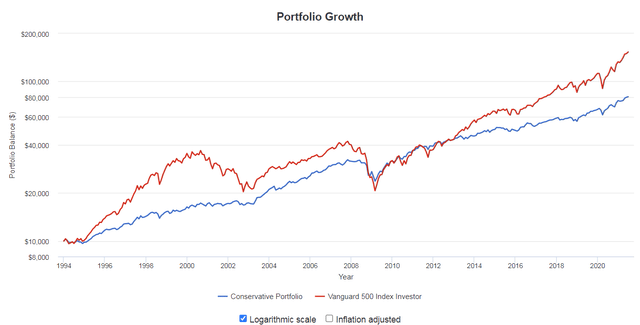

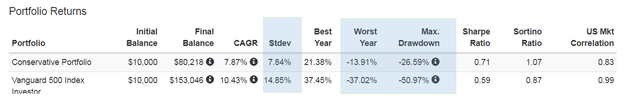

The next chart shows the backtest results based on the composition shown in the pie chart above (with all the data available to me since 1994). As seen, the performance of my conservative portfolio lags the overall market in general (for one thing – due to the cash holding). But it fluctuates a lot less and does a much better job preserving my capital, as seen in the next chart. As highlighted by the blue boxes, its standard deviation is about half of that of the overall market, its worst year performance is about 1/3 of the overall market, and finally, the maximum drawdown is about half of the overall market.

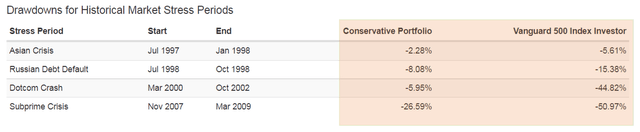

The preservation capabilities are even more impressive when we look at the historical drawdowns during all the market crises. In the past three decades or so since 1994, there have been 4 major market crises. As highlighted in the orange box, the overall US markets suffered drawdowns of 50%, 44%, 15%, and 5% respectively. In contrast, the conservative portfolio only suffered one double-digit drawdown of 26%. And all the other drawdowns are in the single-digit range, from ~2% to 8%.

Lastly, while doing an excellent job preserving capital, the conservative portfolio also kept handsome growth. The CAGR during this relatively long backtest period is almost 8%, not too far from the 10.4% offered by the overall market.

Source: simulation from Portfolio Visualizer, Silicon Cloud Technologies LLC

Source: Simulation from Portfolio Visualizer, Silicon Cloud Technologies LLC

Source: simulation from Portfolio Visualizer, Silicon Cloud Technologies LLC

Conclusions and final thoughts

This article discusses the details of the TIP fund and its application in a survival/withdrawal account. Particularly,

- We want to reiterate the importance of ensuring your short-term survival before pursuing growth. Providing protection may not feel as exciting as providing spectacular returns. But managing your survival portfolio is absolutely THE key to ensuring your financial security in the long term. You want to stay rich once you become rich.

- The above is even more important if you actively withdraw. The magic of compounding is such that a 10% loss hurts you more than a 10% gain can help you – it’s a simple mathematical fact. So a withdrawal when your portfolio is underwater hurts you much worse than taking/spending a profit (it feels like you are spending the house money even though it is not). As a result, if you actively withdraw, the REAL performance of this SWP is actually even better than what is on the surface.

- Lastly, the TIP fund can serve as a good vehicle for cash management in a withdrawal account because of its relatively low volatility, healthy dividends, low correlation to other asset classes, and inflation protection.

[ad_2]

Source links Google News