[ad_1]

aprott/iStock via Getty Images

With the S&P 500 on the verge of a bear market and the NASDAQ already in a bear market, I believe investors with a low to moderate risk tolerance also have an opportunity to take advantage of the selloff by investing in a low-risk index focused ETFs. iShares S&P 100 ETF (NYSEARCA:OEF) is one of those index-focused funds that can offer long-term growth to portfolios. OEF’s portfolio consists of large-cap growth and value stocks, which helps it mitigate downside risks during volatile market conditions and perform better than the broader market during bullish trends. Additionally, its low expense ratio and dividend factor make it a solid long-term holding in moderate portfolios.

How Does Buying the Dip Make For A Good Strategy?

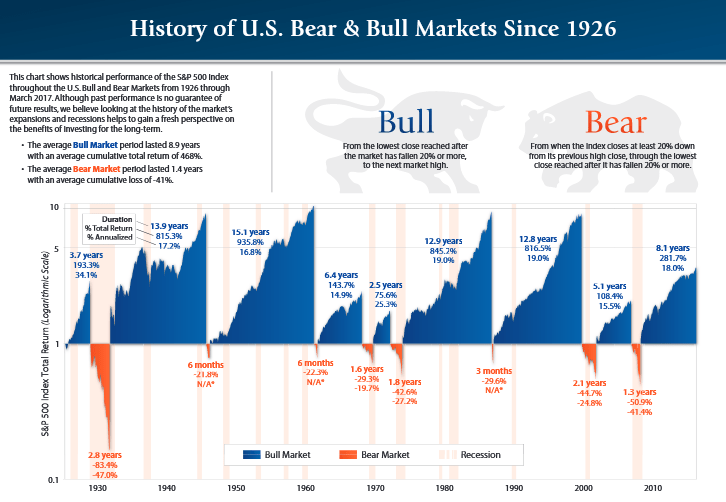

History of US Bull and Bear Market (raymondjames.com)

The S&P 500 selloff in 2022 is not the first in history. The index fell into a bear market around 20 times since 1930. After each bear market, the index bounced back strongly and the bull run lasted for an average of 9 years with an annual average return of 466%.

Though markets always bounce back strongly after a bear market, it can still be difficult to pick the right entry point and decide whether shares have already hit the bottom or how long the downward trend will last. In my view, the markets have already priced in a lot of impact of interest rate policies and they moved back to pre-COVID levels after the recent price collapse. Large caps are down around 15% to 25% while mid to small-cap tech stocks lost nearly 50% to 70% of their value from the previous high. Consequently, valuations eased back to five and ten-year averages.

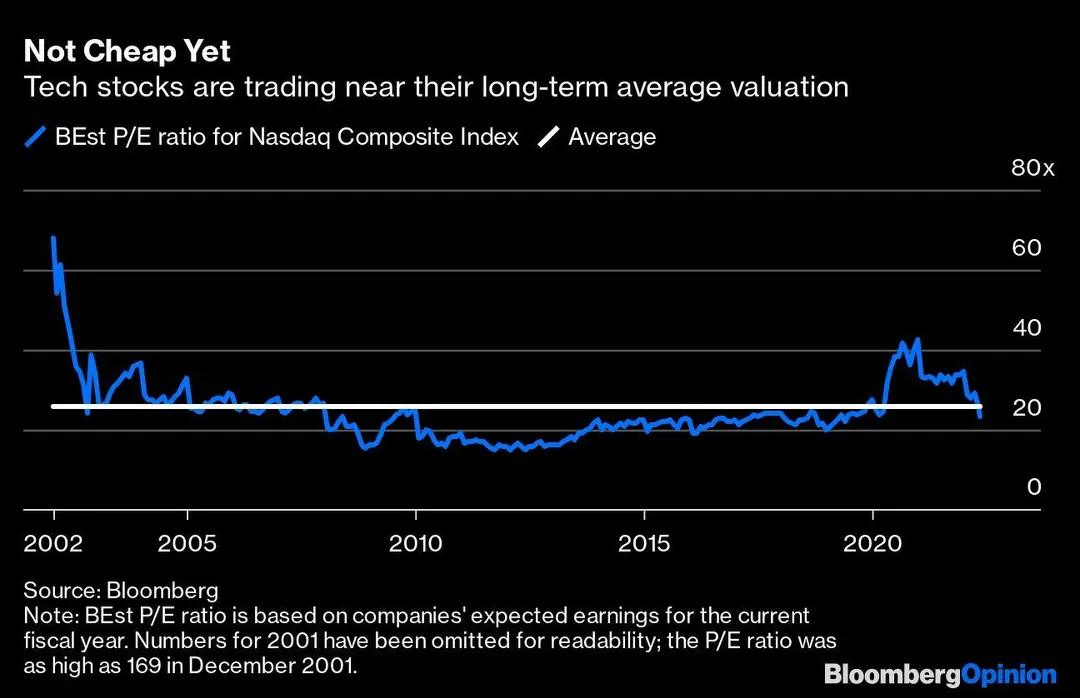

NASDAQ Forward Price to Earnings Ratio (Bloomberg)

According to Bloomberg data, NASDAQ’s forward P/E ratio fell below the 20 levels from its 2020 peak of 42. After the staggering price drop, the most popular large-cap growth stocks such as Meta Platforms (FB) look more like value stocks with a forward price to earnings of 16 times. The largest stock market component Apple’s (AAPL) price-to-earnings ratio is also in line with its five-year average of 22. The S&P 500 currently trades at 18 times earnings estimates compared to 33 times at the end of the March quarter of 2021. As stock market indices are now trading around the historical averages, it’s a good time to take advantage of the dip and hunt for buying opportunities. Investors can further lower the risk related to single stock investment by buying ETFs like iShares S&P 100 ETF for long-term gains.

How Does OEF Carry Less Risk And High Growth Potential?

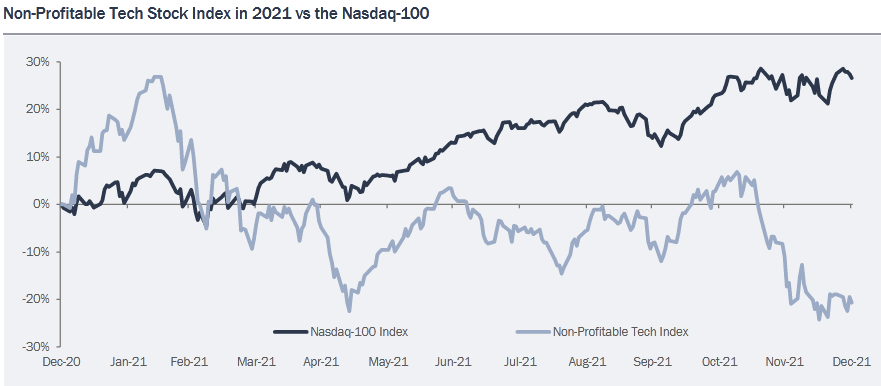

As the fund seeks to track 100 large-cap U.S. equities, its portfolio includes stocks from both large-cap growth and value categories. Recent market trends have validated the notion that large-cap stocks are less volatile than mid-cap and small-cap stocks, particularly when it comes to tech stocks. Small and mid-cap tech companies that borrow externally to fund their operations have been hit harder by the prospect of a rate hike. The chart below illustrates the difference in returns between large- and small-cap non-profitable tech stocks in the past year.

Returns dispersion between large and non-profitable tech stocks ((VGI Partners))

OEF’s top 7 out of 10 stock holding belongs to the large-cap growth category. Despite short-term uncertainty due to broader market trends and slowing growth numbers, fundamentals for large-cap companies look strong. They are less sensitive to high-interest rate policies due to their healthy balance sheets. For instance, Apple has cash and investments of $202.6 billion as of the end of 2021, while Alphabet ((GOOG)(GOOGL)) is sitting on $169.2 billion in cash and investments. Significant cash would enable these tech companies to invest in growth opportunities without relying on high-interest rate debt. Therefore, as soon as uncertainty subsides and investors regain confidence in markets, these tech stocks are likely to recover faster.

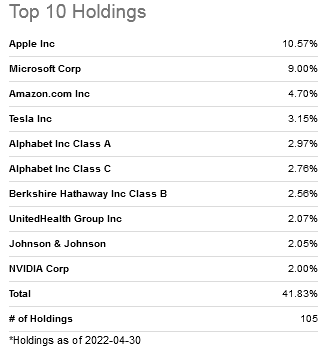

Top 10 stock holdings of OEF (ishares.com)

Along with large-cap growth stocks, OEF has almost 45% exposure to large-cap value stocks. Since the beginning of 2022, the fund’s exposure to health care, consumer staples, energy, and utility sectors helped boost its performance and offset the negative impact of tech stocks. For example, its top value stocks like Berkshire Hathaway Inc. Class B (BRK.B), UnitedHealth Group Inc. (UNH), Johnson & Johnson (JNJ), and many others have outperformed the broader market index so far in 2022. Besides share price performance, most of its value stock holdings also offer healthy dividends.

OEF Vs. SPY And QQQ

The data shows that OEF has done better than SPY both in terms of price return and total return over the years. OEF has returned 68% in price and 83% in total In the past five years, compared to SPDR S&P 500 ETF Trust’s (SPY) 64% in price return and 79% in total return. As SPY is tracking 500 companies listed on the New York Stock Exchange and includes a long list of small and mid-caps, it looks vulnerable to a high-interest rate environment. Therefore, I believe the large-cap-focused OEF may perform better than the SPY in the quarters and years ahead.

Total Return OEF vs SPY (Seeking Alpha)

On the other hand, Invesco QQQ Trust Series 1 (QQQ) is not worth considering unless you have a high-risk tolerance because the fund aims to track the NASDAQ 100 index, which is already in bear territory. The QQQ index plunged 27% year to date, and a high-interest rate environment will likely increase volatility for portfolios heavily concentrated in technology, consumer discretionary, and telecommunications companies. In the case of QQQ, 80% of its holdings are in these high-risk sectors. Additionally, the fund offers a low dividend yield.

Final Thoughts

Since valuations of the S&P 500 and NASDAQ have returned to the historical average, it’s a good time to look for buying opportunities. Rate hike policies and inflation worries have already been priced in up to some extent, and the markets may bounce back in the months ahead. Thus, OEF looks like a good choice for investors with moderate risk appetites. Due to its focus on both large-cap growth and value stocks, the fund has higher upside potential and lower downside risk. Moreover, the low expense ratio of .20% and the yield of over 1.30% make it a good long-term investment.

[ad_2]

Source links Google News