[ad_1]

billnoll/E+ via Getty Images

Ongoing volatility across financial markets has led to many deep selloffs in numerous assets. To some, the correction may seem to be a significant discount buying opportunity; to others, a final warning of an even larger crash. To me, the latest sell-off is an opportune time to reposition assets as some may be bottoming while others may have ways to go. In my view, there is solid evidence to suggest that the U.S. economy is rapidly headed toward a “hard landing” situation. An economic slowdown is needed to slow inflation, but I do not believe inflation can fall too dramatically due to ongoing global production issues, particularly in the energy sector. Overall, I believe this points to a “stagflationary” environment with a potentially sharp economic contraction combined with an elevated but flat inflation rate.

In my view, precious metals have the best overall outlook today compared to other commodities and asset classes. Excluding a few, stocks and bonds appear weak due to the growing strain on earnings (demand destruction) from high inflation. Many commodities, such as crude oil, may remain elevated and rise higher; however, as we’ve seen over the past two weeks, energy commodities are susceptible to changes in the demand outlook. Silver (NYSEARCA:SLV) crashed dramatically in May as the U.S. dollar soared with real interest rates.

Silver often sells at a sharp discount during corrections and crashes as investors race out of all assets into cash. As the economy slows, the Federal Reserve often re-enacts dovish interest rate hikes and QE, causing silver and gold to rise back to new highs. Of course, despite record inflation, silver is still well-below its all-time-high of over $40/oz. Physical silver bullion is near that high, but the future’s market spot price is far lower. This factor represents both a risk and reward for investors in silver ETFs like SLV, as many distrust the efficacy of its physical backing. However, the widening spread between the spot silver market and the retail silver market may imply the spot market is due for a surge. More than anything, despite its short-term price fluctuations, silver is historically one of the best assets to own during economic, political, and social uncertainty periods.

Silver Crashes With Stocks, But Rallies Faster

The situation we’re seeing in silver today is in-line with standard patterns. Historically, silver often crashes rapidly at the onset of an economic storm as the U.S. dollar strengthens against other currencies. As investors and traders rush out of financial assets, real interest rates (interest rates after inflation) rise rapidly. As real interest rates rise, the value of the U.S. dollar against other currencies usually follows suit. Together, this creates a liquidity shortage in financial markets, which is bearish for essentially everything. That said, liquidity panics typically make the best fire-sale opportunities.

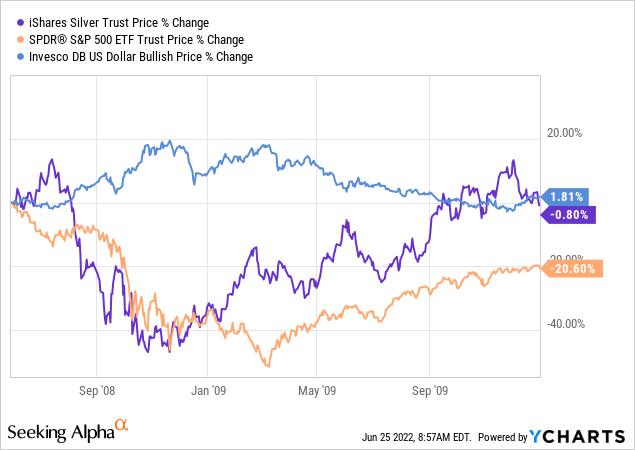

See the 2008 crash below:

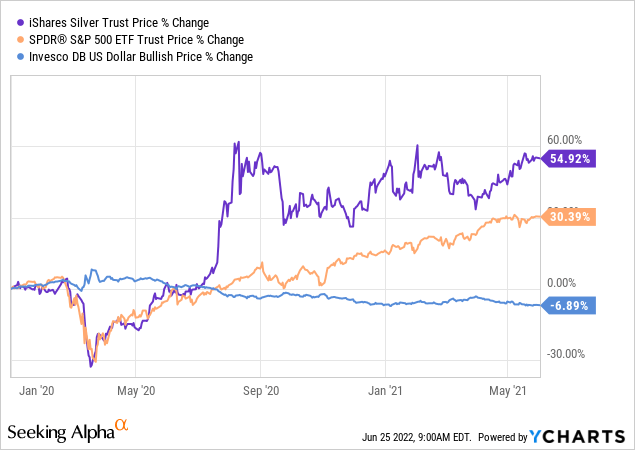

In 2008, silver led stocks lower, bottoming around six months before the stock market. The 10-year Treasury inflation-indexed rate (the real interest rate) rose from 1.6% to over 3% from June to November of 2008 – the same period silver crashed. Quickly, the crash led to the Federal Reserve and U.S. Treasury testing new ideas about mitigating the liquidity crises. Back then, “QE” was a new idea and near-zero interest rates were largely untested. It was unclear what inflationary impacts those policies would have, so the price of silver rose relatively slowly from 2009 to 2011, reaching nearly $50. In 2020, we saw the same general pattern as in 2008, but events played out at a far more rapid pace. See below:

Markets learn from history and adapt. In 2020, the silver market saw three years of events (late 2008 to 2011) play out in only six months. Though real interest rates initially declined in 2020, they spiked from ~-0.57% to 0.55% during the first two weeks of March of 2020 as silver plummeted. In 2009, the shock quickly led the Federal Reserve to pursue stimulative money-creating policies. The silver market seemed to understand the inflationary impact of QE and re-priced much more rapidly, rising by around 50%. Of course, 2020’s situation was also unique due to the rapid onset of negative economic catalysts.

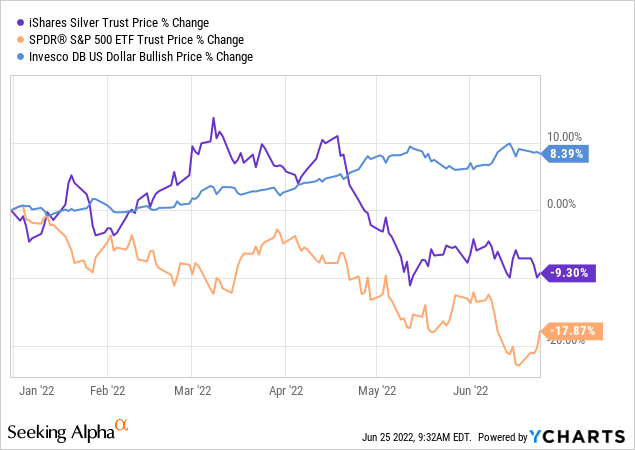

Today, we’re seeing the same sharp rise in real interest rates – more pronounced but not as rapid as in 2020. The 10-year real rate has risen from -1% in March to around 0.6% today. This has occurred as most assets have declined in value. Per usual, silver has tracked stocks lower:

Silver is now at a critical juncture, being at a firm support level it has held since 2020. SLV has bounced back up above $20 on many occasions over the past two years but is now slightly lower at $19.5. Following historical recession patterns, we may expect the price of silver to decline. After that, as the inflation outlook declines and the Federal Reserve is struck by a “surprise recession,” they may re-enact QE, potentially sending silver and inflation much higher.

Japan Signals Fiat Currency Breakdown?

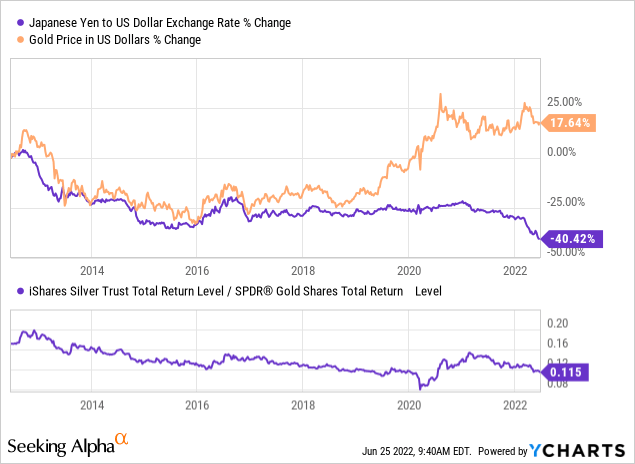

Of course, if inflation fails to decline, then the Federal Reserve will not have a safe capacity to re-enact dovish policies. Markets are genuinely marching into uncharted territory today as high debt levels (normally deflationary) mixed with supply-driven inflation make it unclear where the trend is headed. In general, I have been of the opinion that, in a recession, silver would not see as large a crash as it did in 2008 and 2020 due to inflation-driven demand. However, it should be noted that many historical patterns are breaking down. For example, the Japanese Yen (FXY) and gold (and to a lesser extent silver) are usually tightly correlated, but today, the Yen is imploding while gold is flat:

The Japanese Yen is often seen as a “haven asset” due to the country’s historically low inflation rate. However, the country’s monetary authorities seemingly lost control as its yield curve control program broke despite increased bond buying. Silver has declined with the Yen, but that may be due to its greater exposure to changes in financial conditions. On that note, the silver-to-gold ratio is back to pre-COVID levels, so I suspect silver’s underperformance to gold may not last much longer.

Many investors look to silver not as a way to make money but as a means of protecting themselves from fiat money. In my view, we may be seeing that pattern begin to play out in Japan, the country with the most considerable public debt to GDP and worse “Zombie banks” than the U.S. Japan’s currency has been falling at the fastest pace since 2012, but unlike then, it is not matched with a decline in gold. Unlike the Federal Reserve, The Bank of Japan has made essentially no efforts to stop inflation and has continued QE despite it to try to aid its stagnant economy.

If you’re in Japan, gold and silver are surging in value compared to the local Yen. Central banks in the U.S. and Europe have taken a more defensive approach, which has aided currency strength (particularly in the U.S.) at the expense of the economy. Of course, Japan’s fate may be inevitable as it would seem that, once the economy slows enough, the Federal Reserve will rapidly return to a dovish stance to boost economic demand. Of course, since production is improbable to grow during a recession, such a scenario may only worsen inflation.

The Bottom Line

The situation in the silver market is undoubtedly complex. Historically, silver is a weak asset during recessions but is a vital asset coming out of them, primarily due to associated monetary stimulus. Events in Japan may foretell the breakdown of fiat currency’s value in the U.S., potentially warning the Federal Reserve not to renew QE or interest rate hikes even if the economy slows dramatically. I believe the Federal Reserve will return to a dovish stance if inflation slows, likely causing inflation to rise much higher. If inflation does not slow despite a recession, then it will likely increase even higher coming out of the recession. In other words, no matter what, inflation and fiat currency instability are likely here to stay.

In the future, the price of silver may continue to decline in the short run due to potential continued declines in stocks and bonds. However, silver appears to be in a strong discount position, with silver at its support level and the silver-to-gold ratio at its 2019 range. It must be noted that increased demand for physical bullion, and a growing lack of supply from mines, have led to a widespread shortage across vendors, leading to considerable increases in retail silver premiums. Bulk physical silver bullion ranges from around $28/oz to $35/oz, a staggering 50% premium to today’s spot price. Physical silver premiums have been rising since 2020 but have jumped even higher in recent months.

To me, the situation in physical retail bullion signals that the true supply-demand gap in the silver market is much more significant than is currently suggested in the spot market. The spot silver market may be weighed down due to short-term changes in financial liquidity. Indeed, waves of litigation regarding silver price manipulation have publicized the spot silver market’s sensitivity to financial flows. The retail bullion market is comparatively more robust, making it a potential indicator of the spot market’s long-term trend.

Technically, the silver ETF SLV legally owns physical silver, not futures. With millions of dollars, one can hypothetically take delivery of physical silver in exchange for the ETF through the Bank of New York Mellon. Of course, one physical silver bar may back more than one paper silver product such as SLV under the view that very few investors will take delivery. Undoubtedly, this factor creates some counterparty risk for SLV during a dramatic fiat currency breakdown as demand for physical delivery would likely rise dramatically. Still, while it may be wise to have a healthy supply of physical silver, SLV’s superior liquidity and far lower premium make it a strong portfolio asset, particularly compared to most stocks and bonds today.

[ad_2]

Source links Google News