[ad_1]

Vladimir Agapov/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on January 27th, 2022.

Two months ago I wrote about the iShares 0-5 Year High Yield Corporate Bond ETF (SHYG), a high-yield short-term corporate bond index ETF, with a 4.9% dividend yield. Economic conditions have materially changed since, so I thought an update was in order.

SHYG focuses on high-yield corporate bonds, which perform particularly well when economic fundamentals are strong, as they currently are.

SHYG further focuses on short-term bonds, which perform comparatively well when interest rates are rising, as they currently are.

SHYG’s holdings are tailor-made for current economic conditions. This has allowed the fund to outperform most asset classes, including treasuries, bonds, and equities, for the past few months. Outperformance is set to continue, in my opinion at least, as current economic conditions seem likely to hold. As such, the fund is a buy, and one which is particularly appropriate for income investors and retirees concerned about rising interest rates.

SHYG – Basics

SHYG – Overview and Investment Thesis

SHYG is a high yield short-term corporate bond index ETF. It is administered by BlackRock, the largest investment manager in the world. The fund tracks the Markit iBoxx USD Liquid High Yield 0-5 Index. It is a relatively simple index, including all USD denominated high yield corporate bonds with a maturity of at least five years. Securities must also meet a basic set of size, liquidity, etc., criteria. There are issuer and security caps, meant to ensure a modicum of diversification. The fund’s underlying index seems adequate enough, with no significant issues or negatives.

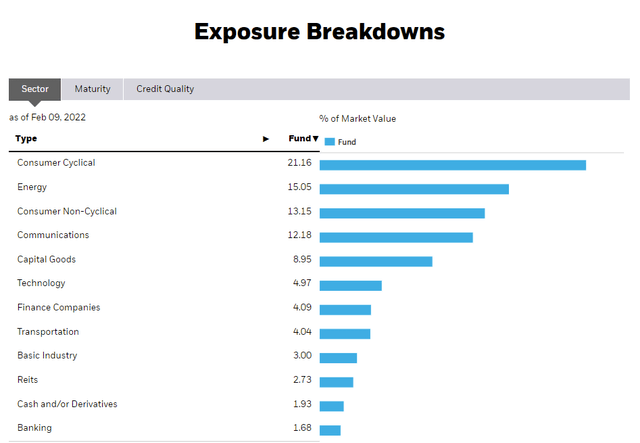

SHYG’s underlying index is reasonably broad, which results in a well-diversified fund. SHYG currently invests in 700 different bonds, with exposure to most relevant industries. The fund is somewhat overweight consumer cyclicals and energy, as these two industries have comparatively weak companies, financials, and credit ratings. SHYG’s diversified holdings reduce portfolio risk and volatility, prevent the possibility of significant losses from any one corporate bankruptcy or default, and are a benefit for the fund and its shareholders.

SHYG Corporate Website

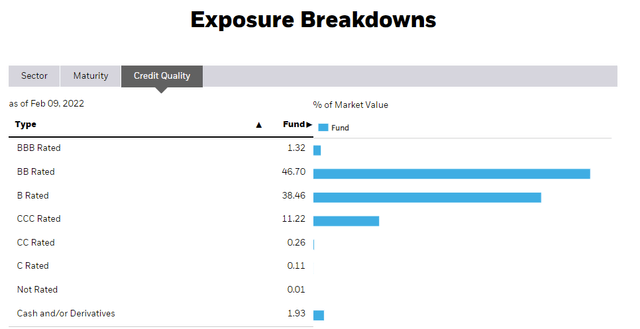

SHYG’s credit ratings are quite low, as expected.

SHYG Corporate Website

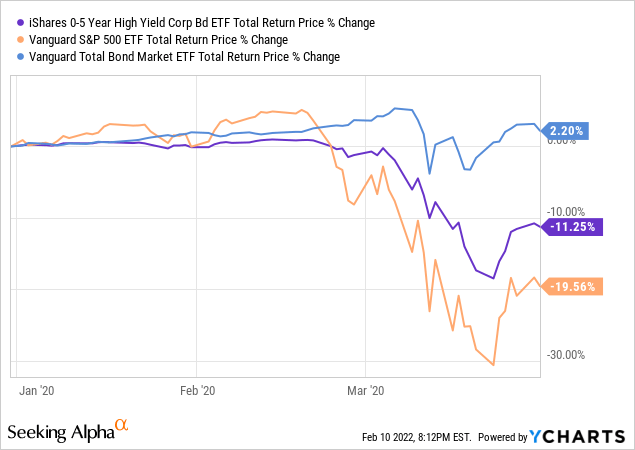

As can be seen above, the fund’s median bond has a credit rating of BB, a relatively low rating. Bonds rated BB are issued by companies with relatively weak financials and balance sheets, but not excessively so. As such, SHYG is a moderately risky fund. Expect moderate losses during downturns and recessions, somewhere between those of equities and investment-grade bonds. This was last the case during 1Q2020, the onset of the coronavirus pandemic.

SHYG is a moderately risky fund, appropriate for most investors and retirees. Still, it is not a particularly safe fund, and so might be inappropriate for more conservative, risk-averse investors and retirees.

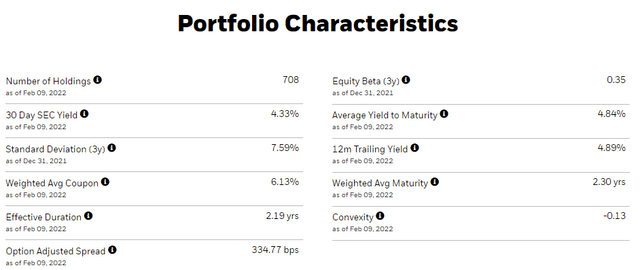

Finally, the fund focuses on securities with relatively low maturities and duration, as expected.

SHYG Corporate Website

SHYG is a short-term high yield corporate bond index ETF, and its holdings reflect that. With this in mind, let’s have a look at the fund’s investment thesis.

SHYG – Investment Thesis

SHYG’s investment thesis rests on the fund’s comparatively strong expected returns, especially considering current market conditions.

For most asset classes and funds, including SHYG, returns consist of dividends plus capital gains (losses). Both look reasonably strong for SHYG relative to its peers.

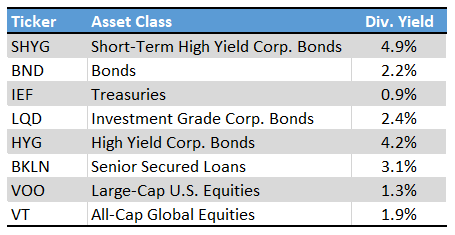

SHYG currently sports a 4.9% dividend yield. It is a relatively strong yield, and quite a bit higher than that of most bonds and equities. Strong yields are almost always a benefit for investors, and that is the case for SHYG.

SeekingAlpha – Chart by author

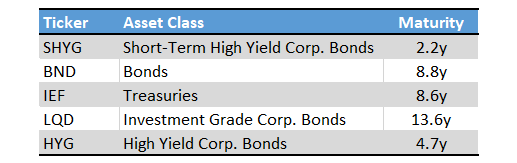

SHYG’s dividends should also see some growth in the coming years. Some context first. Most bond funds, including SHYG, focus on fixed-rate bonds, with fixed coupon payments until maturity. These bonds currently carry relatively low interest rates, as Federal Reserve policy has driven rates low as a simulative measure to combat the coronavirus pandemic. Rates are likely to increase in the coming months, as policy shifts to combat above-average inflation. Rising rates does not immediately lead to higher coupon payments or dividends for most bond funds because, as mentioned previously, most of these focus on fixed-rate bonds. Funds need to wait until their bonds mature and are replaced for newer, higher-yielding securities to see higher coupon payments and dividends. SHYG focuses on short-term bonds, with short maturity dates, and so should benefit from rising interest rates relatively quickly: the fund simply has to wait less time to replace its bonds. SHYG’s holdings sport an average maturity of 2.2 years, significantly lower than average.

Company Filings – Chart by author

SHYG’s low maturity holdings should benefit from rising interest rates relatively quickly, a significant benefit for the fund and its shareholders.

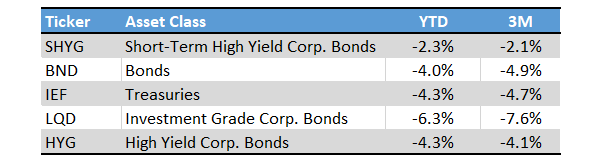

SHYG’s expected capital gains (losses) are also relatively strong, for the same reasons as above. When interest rates increase, investors tend to sell older, lower-yielding bonds to buy newer, higher-yielding issues. Selling pressure causes prices to drop for most older issues, leading to capital losses for bond investors, including most bond funds. Losses tend to be higher for bonds with longer maturities, as investors need to wait longer to replace these. As SHYG focuses on comparatively short-term bonds, losses should be relatively small, and short-lived. This has been the case YTD, and for the past three months as well.

SeekingAlpha – Chart by author

In my opinion, rates are likely to see further increases in the coming months, leading to continued outperformance for SHYG.

Finally, SHYG should also benefit from continued economic strength, inflation notwithstanding. High yield corporate bond prices are partly dependent on underlying economic conditions. When conditions are strong, investors are willing to fund risky companies at comparatively good prices, knowing they are likely to be repaid. When conditions worsen, investors are less willing to do so, leading to higher high yield bond prices, and losses for investors. Economic conditions are quite strong, with unemployment going down and growth going up, which should help keep the fund’s holdings at reasonably strong prices, minimizing losses.

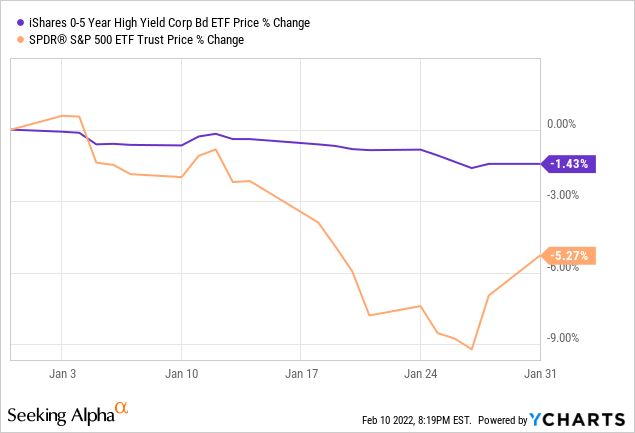

Importantly, bond prices are more tightly linked to economic fundamentals. Sentiment matters, but less so, as these securities have clearly-defined characteristics and cash-flows. Bond prices should remain relatively stable even if equities crash. This has been the case YTD, but was especially notable in January, before equities recovered.

SHYG should see relatively stable share prices as long as economic fundamentals remain relatively strong, regardless of any changes in inflation or Federal Reserve policy. Do expect losses if conditions were to significantly worsen, or if interest rates were to spike, but the fund is somewhat insulated from these minor market jitters.

Importantly, SHYG, and short-term high yield corporate bonds, are one of the only few asset classes which is performing relatively well under current economic conditions. Stocks are going down, due to valuation concerns and bearish market sentiment. Bonds in general are also going down, due to higher interest rates. Short-term high yield corporate bonds are performing relatively well, and should continue to do so as long as current economic conditions continue.

Conclusion

SHYG’s comparatively strong 4.9% dividend yield and low duration make the fund a buy. The fund is particularly appropriate for investors concerned about rising interest rates.

[ad_2]

Source links Google News