[ad_1]

ETF Overview

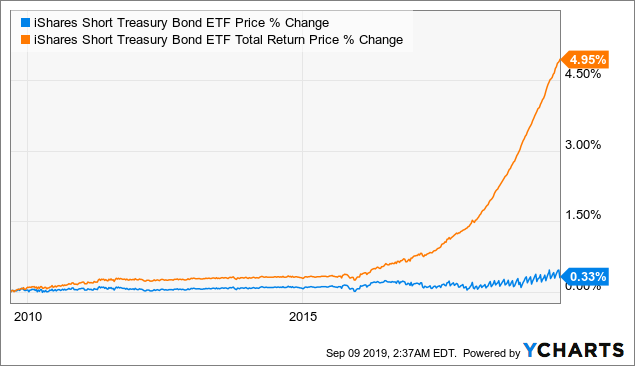

iShares Short Treasury ETF (SHV) focuses on U.S. treasuries that will expire within 1 year. The ETF tracks the ICE U.S. Short Treasury Bond Index. SHV has very low credit risk as all of the bonds in its portfolio are U.S. Treasury bonds. It also has very low interest rate risks as all of its treasuries will expire within 1 year. The ETF’s dividend yield closely follows the change of the Fed’s key interest rate. It is a good vehicle for income investors to preserve capital while earning some interest income.

Data by YCharts

Fund Analysis

When evaluating bonds, there are several things we check. First, we look at whether the bond is safe or not (credit risk). Second, we look at how well these bonds are impacted by the interest rate (interest rate risk). So we will go through this checklist one by one.

Low credit risk

SHV’s portfolio consists of only U.S. treasuries. These are bonds that are basically backed by the credit of the U.S. government. This is probably one of the safest bonds we can find in the world right now. At the moment, U.S. government bonds have credit ratings of AA+ stable (S&P) and AAA stable (Fitch, and DBRS). Therefore, we do not foresee any credit risk at all even in an economic downturn.

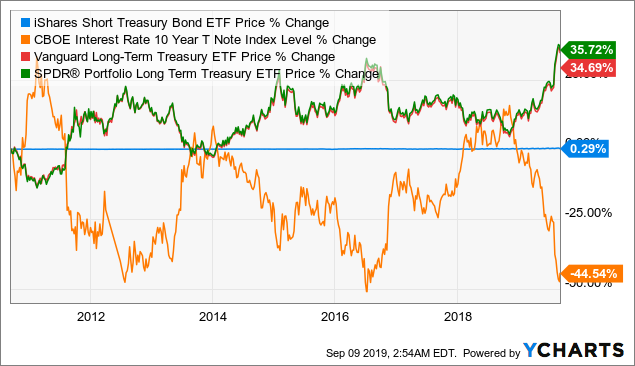

Low interest rate risk

Now we will see whether these bonds will be impacted by the change of the interest rate. In general, short-term bonds are less impacted by the changes in interest rate as these bonds are almost reaching maturity. On the other hand, long-term bonds’ market value can be impacted by the change of interest rates. Since all of SHV’s bonds are short-term treasuries that will mature within 1 year, SHV’s fund price is not sensitive to interest rate changes. As can be seen from the chart below, unlike other long-term treasury ETF that are quite sensitive to the rise and fall of the interest rate, SHV’s fund performance is much less sensitive to the interest rate. In fact, the changes in fund price in the past 10 years is only 0.29%. On the other hand, Vanguard Long-Term Treasury ETF (VGLT) or SPDR Portfolio Long Term Treasury ETF (SPTL) have much higher volatility (34.69% and 35.72%) as they are much more sensitive to the change of interest rate. Therefore, we think SHV’s fund price will not be impacted much in a rate change environment. Hence, it is a good fund for investors whose goal is to earn some income while preserving their capital.

Data by YCharts

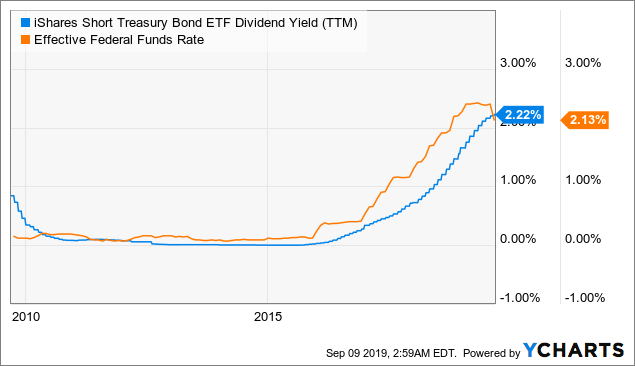

A “predictable” dividend

Investors of SHV will receive dividends with an annualized yield of about 2.2% on a trailing 12-month basis. This yield is the highest we have seen since the Great Recession. Since short-term treasuries closely tracks the effective federal funds rate, we believe this yield has likely reached the near-term peak already and is expected to decline. This is because the Fed will likely cut its key interest rate at least once and maybe twice in the coming few months. This should result in lower yield for short-term treasuries.

Data by YCharts

Investor Takeaway

We think SHV is a good treasury ETF to own as both interest and credit risks are low. However, this income is closely tied to the Fed’s policy to cut or increase its key interest rate. Given the fact that the Fed may need to cut its key interest rate once or twice in the coming months, we expect interest income from SHV will decline in the near-term. Nevertheless, it is still a good vehicle for income investors to preserve capital while earning some interest income.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News