[ad_1]

Mlenny/E+ via Getty Images

France is like a maddening, moody lover who inspires emotional highs and lows. – Sarah Turnbull

Introduction

Last week, I had made the case for a broad basket of European stocks via the iShares Core MSCI Europe ETF (IEUR). In this article, I’d like to examine the investment case of stocks belonging to Europe’s third-largest economy- France. The investment product in question here is the iShares MSCI France ETF (EWQ) which offers exposure to roughly 68 large and mid-sized French-based stocks. EWQ comes across as a very stable fund with an inordinately low annual turnover ratio of 4% (to put things into perspective, the asset class median is 25%)

EWQ vs. FLFR

One may also consider the cheaper alternative- Franklin FTSE France ETF (FLFR) which has an expense ratio of only 0.09% vs 0.5% for EWQ but there are some drawbacks to consider; firstly, with only $10m in AUM (EWQ- $838m) there is the question of whether you’d face liquidity and volume issues. Just to put things into perspective, EWQ’s average daily share volume is 468x that of FLFR’s volume. One also has to consider that yield differential is quite a lot with EWQ offering yields of 3.86% as against FLFR’s figure of 2.85%.

The French macro-economic and political landscape

After a difficult 2020 when the French economy contracted by 8%, it’s fair to say it has done reasonably well in 2021, growing by 7% (the strongest growth in over 50 years) and also exceeding the pre-crisis level of activity by the end of last year. The quick turnaround in fortunes is one of the key reasons why Emmanuel Macron looks well-poised to gain a second 5-year term as President when the country goes to vote in early April this year.

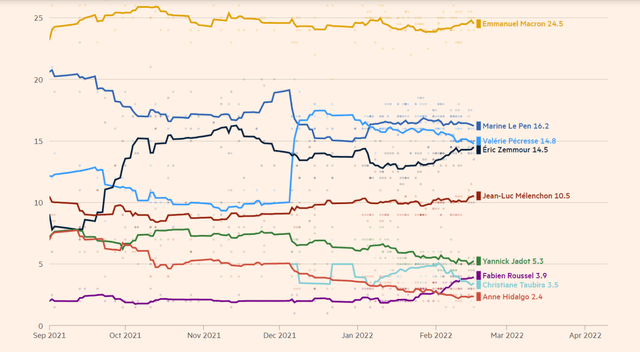

Financial Times

Recent polls show that the current incumbent has managed to accumulate a comfortable rating well ahead of his other left-wing, far-right, and right-wing peers. If Macron does retain his seat, I believe this should be taken well by the markets as the last thing it needs is another bout of volatility on account of a potential change of guard at the upper echelons of the country’s leadership hierarchy.

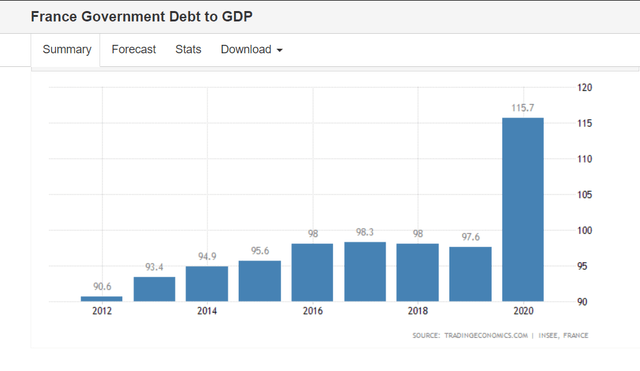

Regardless, whoever comes on board, they have their task cut out as the economy’s growth trajectory is poised to slow quite considerably; the IMF points to 3.5% growth in 2022, before the pace of growth almost halved to 1.8% in 2023. One of the reasons why the French economy has managed to bounce back pretty well is due to the various stimulus packages that were put in place; the flip side of something like this is that the fiscal position of the government has deteriorated quite drastically.

Government debt as a % of GDP which was previously quite consistent between the 90-98% mark over many years, hovers well above 100% currently. So far there’s no mention from any of the Presidential candidates (including Macron) as to whether they will be putting measures in place to bring down the level of debt via some fiscal prudence but France runs the risk of being looked down by rating agencies if it doesn’t get its house in order.

Trading Economics

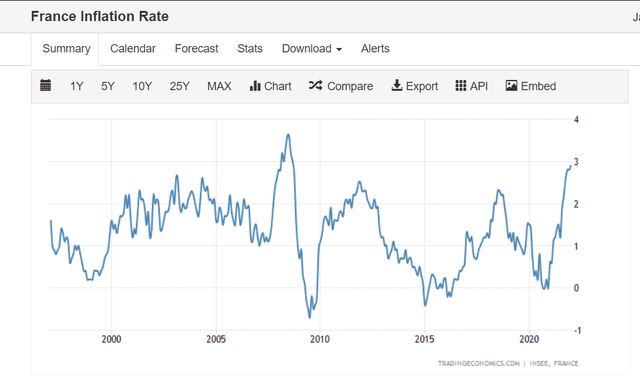

The other issue that the country is currently dealing with is of course inflation; whilst this is nothing of the scale of what the US is experiencing it is still at around its highest point since the GFC. As with most other regions, energy prices continue to be the main driver here.

Trading Economics

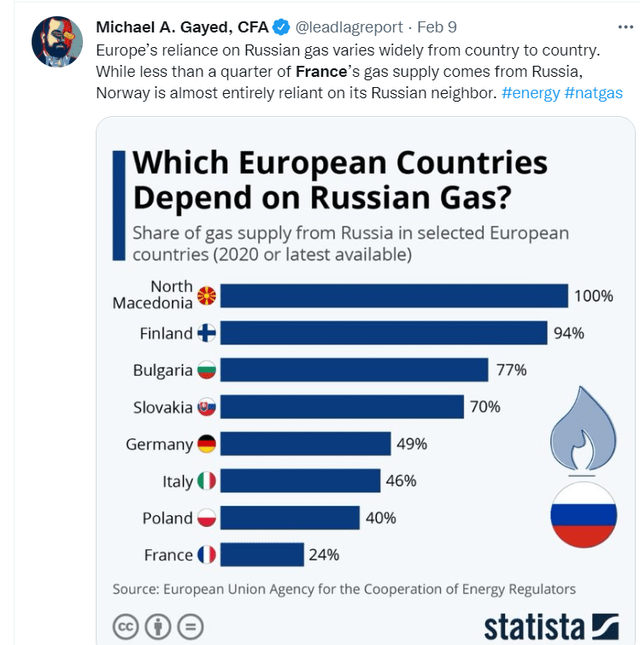

Much literature has been devoted to Russia’s impact on natural gas prices but interestingly, as pointed out in The Lead-Lag Report, France is one of those countries that were somewhat relatively better positioned than the rest of Europe with less than a quarter of gas supplies coming via Russia.

Twitter

All in all, inflation will likely come in at 2% by the end of FY22 before declining to 1.7% over the next two years.

EWQ’s portfolio is dominated by names from the industrial segment and I believe the prospects for this sector look relatively better this year after much of 2021 where global supply chain challenges weighed heavily on order books, particularly export order books. I believe order backlogs across the world are now being cleared with industries such as automobiles seeing a pickup this year. Do note that even though the French economy may have recovered to pre-crisis levels last year, French industrial production was still 6% below the pre-crisis level at the end of 2021 so there’s still ample runaway left for this segment before anyone brings up talks of overheating, etc. The latest French manufacturing PMI report showed production and export orders have picked up although there are some concerns regarding the cost base of these industrial companies given the spike in raw materials and wage costs.

Conclusion

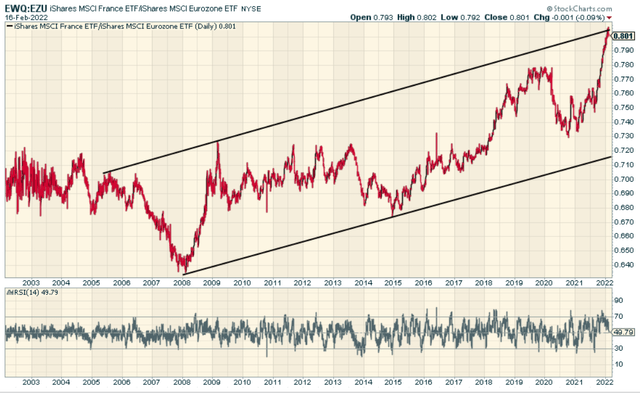

As far as valuations go, French equities are not overly attractive; as per YCharts, EWQ trades at a forecasted P/E of almost 15x, above the corresponding multiple of the iShares MSCI Eurozone ETF which trades at 13.4x. Also do consider that French equities look somewhat overbought relative to the rest of the Eurozone.

Stockcharts.com

Overall, I believe one is looking at a mixed picture when it comes to French equities.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

[ad_2]

Source links Google News