[ad_1]

Tero Vesalainen/iStock via Getty Images

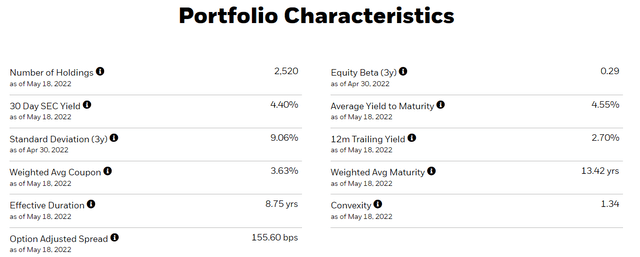

U.S. investment-grade corporate bonds have performed even more poorly than Treasuries during the latest bond market selloff, with rising credit spreads compounding losses. The iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSEARCA:LQD) now has an average yield to maturity of over 4.5%, which is significantly higher than the returns investors are likely to see on U.S. stocks. The ETF is likely to perform well during periods of weak economic growth, but a lengthy period of inflation and/or a credit crunch would result in further losses, particularly given the high weighting of banking sector bonds in the portfolio.

LQD ETF Price (Bloomberg)

The LQD ETF

LQD is one of the largest corporate bond funds on the market with USD32bn under management and a high degree of liquidity. For a corporate bond fund, the weighted average maturity is high at 13.4 years, with the fund only selecting bonds with at least 3 years to maturity. As a result, interest rate risk is high, which largely explains the recent selloff. The weighted average yield to maturity now sits at 4.5%, which is close to its highest level in a decade. This compares with a relatively small expense fee of just 0.14%.

ishares.com

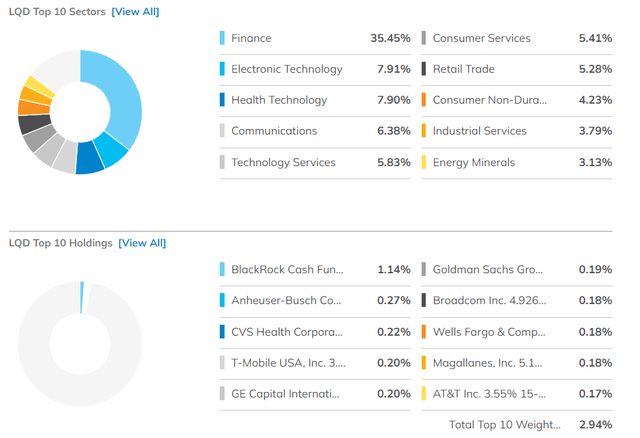

The fund is primarily focused on the U.S., which represents 86% of its holdings, with the rest spread across other developed markets. In terms of industry exposure, the financial sector dominates, with an outsized weighting of 35%.

LQD Sector Weightings (etf.com)

Positive Real Yield With Upside In The Event Of A Slowdown

The positive case for the LQD has become much easier to make over the past few months as its yield has risen sharply due to rising Treasury yields. The yield of 4.5% is now significantly higher than long-term inflation expectations as measured by the bond market. 10-year breakeven inflation expectations – calculated from the spread between inflation-linked and regular Treasury bonds – are currently 2.7%. Historically, investment-grade bonds witness a low default rate compared to non-investment-grade bonds, with S&P Global reporting in 2018 that the highest one-year default rate for AAA, AA, A, and BBB-rated bonds were 0%, 0.38%, 0.39%, and 1.02%, respectively. This suggests investors should expect to see positive real returns over the long term, even if defaults are historically high, which is not something that U.S. stocks are likely to achieve (see ‘SPX: Dip Buyers Beware’).

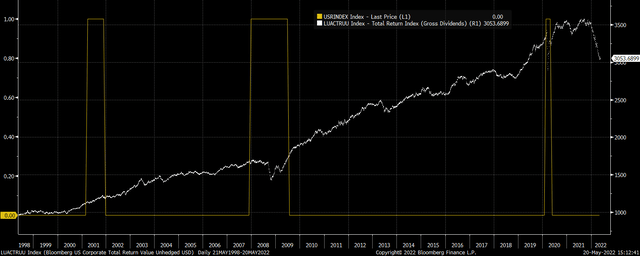

Bloomberg US Corporate Bond Total Return Index Vs Recessions (Bloomberg, NBER)

Another positive feature of the LQD is that investment-grade bonds tend to perform well during periods of economic weakness. If we look at the historical total return of the Bloomberg U.S. corporate bond index, we can see that returns were positive in both the 2001 and 2008/9 recessions, and only mildly negative during the 2020 recession. While credit spreads rose over these periods amid rising default risk and tightening liquidity, interest rate cuts provided significant support to bond prices across the board.

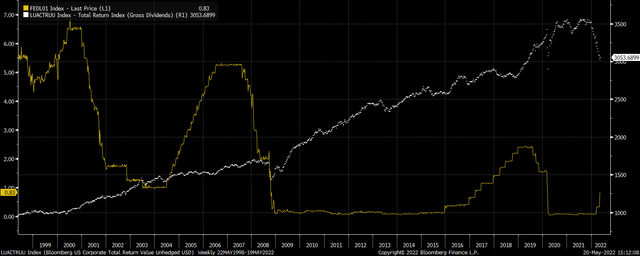

Bloomberg US Corporate Bond Total Return Index Vs Fed Funds Rate (Bloomberg)

The best-case scenario for the LQD would most likely be a mild recession causing the Fed reverses its hiking cycle allowing bond yields to fall sharply, offsetting any rise in credit spreads and losses from defaults. From the peak of the Fed hiking cycle in 2000 to the end of its easing cycle in 2003, the Bloomberg U.S. corporate bond index more than doubled in total return terms. While yields are currently much lower than they were back then, we should still expect to see strong returns under such a scenario.

High Inflation And/Or A Credit Crunch Are The Major Risks

While the LQD offers a reasonable long-term real return based on current inflation expectations, a key risk is that inflation remains elevated over the long term. Not only would this likely raise defaults, but it would pressure the Fed to continue hiking which would drive down bond prices across the board. Under a scenario in which inflation was to average 4% over the next 13-year (the weighted average maturity of the LQD), this would likely see the LQD generate around zero real returns after factoring in defaults and expense fees.

The biggest risk in the near term however comes from another credit crunch. As we saw during the height of the global financial crisis and again in the 2020 COVID crash, even the highest quality bonds tend to suffer greatly under such circumstances, with rising credit risk more than offsetting the benefits of Fed rate cuts. The LQD lost 20% during the 2008 credit crunch and 22% in the 2020 credit crunch. While this performance was significantly better than that of U.S. stocks, and new highs were seen in the ETF within the next 12 months, such a scenario remains the major risk. The high weighting of financial sector bonds in the LQD mean that any disruptions in the global financial system would be felt particularly hard.

Summary

The LQD offers investors a relatively high yield compared to long-term inflation expectations and U.S. stocks, with a spread over Treasuries that is likely to more than compensate for future defaults. In the event of a run-of-the-mill recession and a reversal in the Fed’s hiking cycle, the LQD could potentially post exceptional returns, as was the case in the early 2000s. On the downside, persistent inflation poses a risk that the LQD will underperform, while another credit crunch could result in significant short-term losses. On balance, I believe the ETF is a buy here, particularly for U.S. focused investors.

[ad_2]

Source links Google News