[ad_1]

Dilok Klaisataporn

The iShares Core S&P MidCap ETF (NYSEARCA:IJH) captures the mid-market of the US. In doing so, it avoids a lot of high valued tech stocks and ends up focused on industrials and financial issues like insurance companies and regional banks. The IJH multiples are quite low implying a decent earnings yield, but the issue is taking broad industrial exposures in any economy right now that is dealing with inflation. Where it is unclear how cost structure might affect profits across the IJH portfolio, more conviction is needed. So while cheaper than US large cap, there isn’t a strong case for IJH.

IJH Breakdown

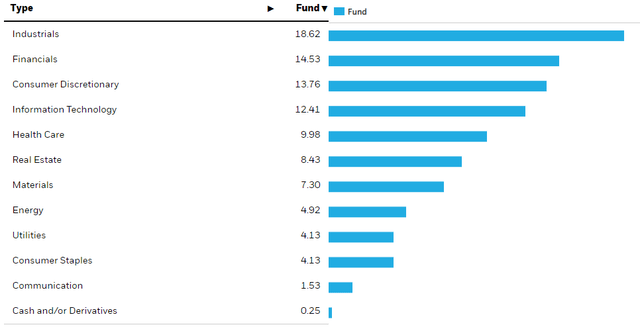

The ETF covers the US mid-cap. This ends up including the industrial segment of US enterprise, as well as financials.

Sector Breakdown (iShares.com)

Financials have quite a bit going for it. Savings rates remain very low while lending rates grow. Banks are profiting from the higher rate environment by being able to issue or adjust debt without liabilities being affected. Insurance companies are also benefiting in the current environment. The rollover in low maturity and risk fixed income instruments into higher yields is a positive for the majority of an insurer’s asset management allocation. Moreover, P&C in particular is coming off a great season of pricing, and have policies that can mature very economically.

The financial exposures at 15% look solid, but the 19% allocation to industrials is more of a concern. Industrial stocks are going to have a very heterogeneous exposure to inflation, which is transmitting through a subset of commodities more than others. With different exposures on the cost side to various commodities, more conviction is needed when making industrial allocations to consider the effect of heterogeneous OPEX and COGS exposures. We don’t love the ETF approach in the industrial sector.

Conclusions

Currently the S&P 500 has a P/E of above 30x. This really indicates that markets have not gotten the memo as far as the economy goes. With every other equity market in the world, and even every other asset class market in the US pricing in a downturn, US markets are belligerent and unwary investors will pay the price for that.

The IJH has a substantially lower P/E, indicating what we already know which is that valuations in large cap are driven not just by cash flows but substantially by multiples, therefore driving the high P/E of the S&P. A 15x P/E for US mid-cap shows that smaller US companies might still offer value. However, we still don’t like the industrial exposure, where inflation and uncertainty around it could seriously affect the prospects of this large allocation of companies. Moreover, the third largest allocation is to consumer discretionary at 14%. Those are exceptionally levered to economic cycles. Overall, the timing does not look right yet for IJH. We pass.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News