[ad_1]

pawel.gaul/E+ via Getty Images

Main Thesis/Background

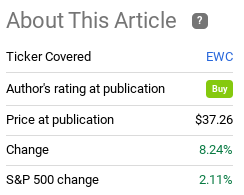

The purpose of this article is to evaluate the iShares MSCI Canada ETF (NYSEARCA:EWC) as an investment option at its current market price. This is a fund that is exclusively focused on Canadian equities, with a bias towards large and medium sized companies. I have held EWC for a while, and actually recommended it to readers earlier this year. In hindsight, this has been the correct call, as EWC has seen a gain over the last few months that has clearly outpaced the S&P 500:

Fund Performance (Seeking Alpha)

Given this strong performance, I wanted to do an updated review of EWC to see if I should continue to recommend buying it, or if a more cautious view is now warranted. In fairness, I would manage expectations to say I do not expect another 8% pop over the next few months. But, with that said, I still see a buy case for this fund and a reasonable forward outlook, which I will discuss in detail below.

This Is Both A Momentum & Value Play

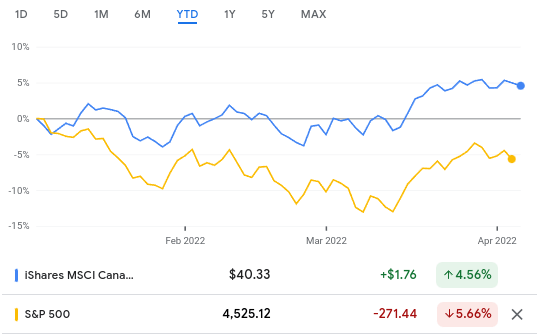

To begin, I think it is important to take stock of how 2022 has been to Canadian equities so far. As we just wrapped up a turbulent Q1, investors may be somewhat surprised to know that EWC exhibited quite a bit of strength this year. This compares to U.S. markets (as measured by the S&P 500) that are still down for the year, despite the recent rally. And, of course, we know developed markets in Europe have been hamstrung by Russia’s invasion of Ukraine. Yet, Canada has seen quite a bit of positive momentum, especially on a relative basis:

YTD Relative Performance (Google Finance)

I bring this up because momentum plays can often last a while. Investors see what is working – whether in a sector, stock, or country index – and want to jump in. This is why momentum plays often last for quite a while, the fear of missing out effect keeps bringing in new buyers. Whenever I am long an investment idea, such as EWC, and I see such strong relative performance, I tend to want to let that wave ride for as long as I can.

Of course, this does not mean to buy at any price. But an important point of note here is that despite EWC’s out-performance, Canadian stocks are still cheap when compared to the S&P 500. In truth, both indices have seen their P/Es come down on a year-over-year basis, but while the S&P 500 is at an elevated level on a longer term historical basis, Canadian equities are not:

Relative Value For Canada (Bloomberg)

My takeaway here is that Canadian equities, and EWC by extension, have quite a bit going for them. They are seeing a surge of investor interest, yet they still have a valuation advantage compared to stocks in America. For me, this suggests the buy case that I made in January still has merit today.

Why Consider Value Anyway?

Expanding on the point above, I want to now consider why value is important. While this may seem obvious, “value” doesn’t always win during bull market cycles. One may think that value, especially when compared to peers, is an important component of investing. Yet, when times are good, investors can often throw valuations out the window. This is why speculative stocks and growth stocks can out-perform for so long, despite their weak earnings, high valuations, or combination of the two.

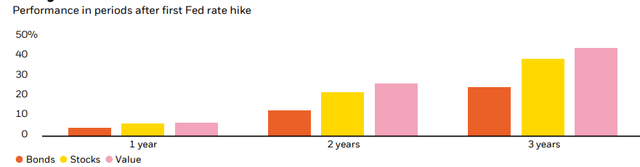

Yet, we have begun to see a turning of the tide when it comes to growth-dominance. Stock market volatility and market corrections tend to bring investors down to earth when it comes to what they want to pay for equity exposure. Furthermore, the rate hike cycle has finally started in the U.S., and has already been underway in Canada as well. What does this mean for stocks? Historically speaking, this means Value stocks/funds should be in for strong returns comparatively:

Value Out-Performs (BlackRock)

This is interesting to me, and reinforces why investors should be looking at adding value-oriented themes to their portfolios. To be fair, this historical performance is in no way guaranteed going forward. But it does help provide support that building on value positions – in my case EWC – is a reasonable move.

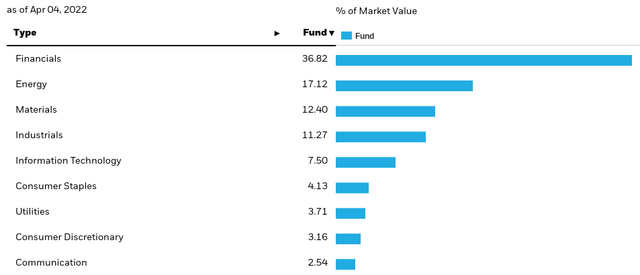

Reminder: EWC Is Overweight Financials

I will now dive into the underlying holdings of EWC. As I have noted in prior reviews, this is a play on Canadian stocks, but it heavily skewed towards the Financials/Banking sector. Half of the fund’s top holdings are Financial companies, and the sector accounts for almost 37% of total fund assets:

Sector Weightings (iShares)

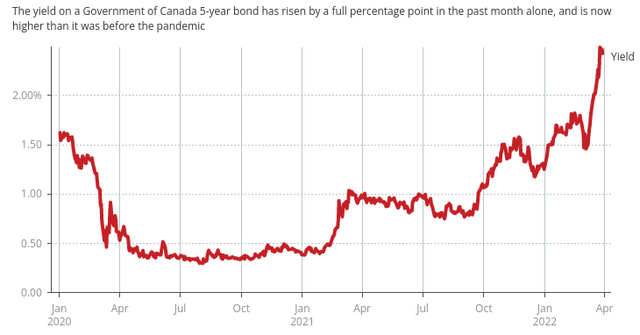

In our current environment, I view this exposure positively. The geo-political risks in Europe and declining consumer sentiment are taking their toll on the sector in the short-term, but I expect those headwinds to smooth out over time. For me personally, the bigger story is the continuous rise in yields, which should help pad the bottom-line of lenders as they raise interest rates on loans and mortgages in response:

5-Year Yield ( Canadian Broadcasting Corporation)

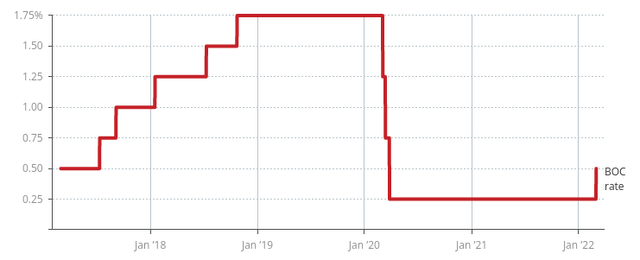

Importantly, it is not just yields that are pushing higher. Last month, the Bank of Canada finally hiked rates, and there are signs more hikes are on the way:

Bank of Canada Benchmark Rate (Canadian Broadcasting Corporation)

My take is this is an environment that will bode well for banking and financial stocks, all other things being equal. Therefore, I view EWC’s make-up in this regard as a tailwind.

Is This Idea A “Sure Thing”? Not A Chance

So far I have painted a positive picture for Canadian equities, and EWC as a trading option. But I want to revert back to a point I made at the beginning that I am not quite as bullish as I was when the year started. Seeing such a strong gain in a short time-frame always makes me a little cautious. I took this into consideration when I was determining my current rating, and while I ultimately ended up landing with a “buy” case still in-tact, I think readers would probably be wise to be a bit more selective with when they buy, and by how much. The reason is there are some serious headwinds facing Canadian equities, and these risks can be overblown after equities have a big run. What I mean is, markets tend to look for reasons to sell off after strong gains, and can exaggerate small issues into big ones if they are looking for an excuse to.

So, what are some of these concerns? One that comes to mind immediately is some of the political pressure facing governments around the world, including Canada. Rising oil and inflationary metrics have put a damper on an otherwise growing global economy, and that is having incumbent governments moving to take some populist measures to regain support. In truth, rising oil prices has so far been a positive for EWC, as the fund has a large amount of Energy exposure. Further, the Materials sector is another one that tends to out-perform when inflation is high, and EWC has a good bit of exposure here as well. So, for the time being, these sectors have been drivers of EWC’s positive performance.

But therein lies the concern. When people are struggling and governments need someone to shift the blame to, they may tend to attack those very same companies that are doing well. They make for targets, given the recent influx of good fortune, and that is what is happening. If we look domestically, we have seen calls for “windfall” taxes on oil companies. While this has been a U.S.-led measure so far, it could have implications for foreign firms that do business in America. Too few details are known about this plan to be certain, but the initiation of it is a concern to say the least.

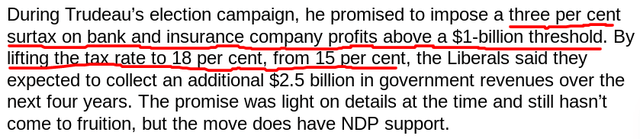

Looking into Canada, there are similar positions taken, with the banking sector a likely target. Specifically, Justin Trudeau’s government has formed a coalition with an opposition party, with the result being a move to increase taxes on large banks is becoming closer to a reality:

Tax Plan (Bloomberg)

Ultimately, neither of these positions has become law yet. But their consideration, coming at a time when equities are starting to rise again, is worrisome. It tells me that incumbent governments are going to keep on taking populist positions to generate enthusiasm among their bases – and that often puts corporate profits in the cross-hairs. For sure, the merits of this are debatable from a public policy perspective. But from an investor standpoint, higher taxes are almost never a positive – whether they are one-off taxes or higher statutory rates. Seeing these types of headlines in Canada’s media focus on the banking sector, the very same sector that has the biggest weighting in EWC, tells me investors need to monitor this risk very closely.

Canadian Consumers Are Worried

Another sore point for me is a trend in Canada that is also affecting us here in America as well. This is declining consumer sentiment. While not surprising, the root causes of these declines are primarily inflation, rise in fuel prices, and geo-political crisis in Europe. In my view, equities have been very resilient lately in the face of all these hurdles, but we should be aware that Canadians on a whole are not as optimistic as global investors have been recently:

Canadian Consumer Sentiment (Bloomberg)

There are a few ways to look at this. One is cautiously because this could be a sign consumers are about to cut back on their spending. The other view is this represents a contrarian buy signal. Sentiment is at a one-year low, so it is possible it has bottomed out and brighter days are soon ahead. If that is the case, buying in now to front-run that makes sense.

Beyond that contrarian potential, readers should take some comfort in the fact that EWC has little direct consumer exposure. Less than 8% of its holdings are in either the Consumer Discretionary or Consumer Staples sectors, so other macro-factors are more relevant to this fund than household sentiment anyway.

Bottom-line

Canadian economic growth was strong in 2021, coming in at 6.7%, which is a good part of the reason why EWC has had such momentum in early 2022. While inflation and war in Europe are headwinds, investors can take some comfort in knowing that EWC offers a bit of a hedge on these macro-risks. For one, EWC is long Financials, Energy, and Materials – all sectors that tend to out-perform during inflationary times accompanied by central bank rate hikes. Two, while war in Ukraine is never going to be a positive, investors looking to branch out of Europe and into developed markets are finding value in the U.S., Japan, and, notably, Canada. The location in North America offers investors some relative safety away from the troubles in Europe, which is why I continue to add to U.S. and Canadian stocks, rather than bottom-feed in European equities for the time being.

In sum, risks are there, but I see enough positives to balance out my fears. The Canadian economy has been resilient in the past, and Covid-related restrictions continue to be lifted that are helping support expected GDP growth for the year ahead. Therefore, I will keep on buying EWC on any weakness in the weeks and months ahead, and suggest readers give the fund some consideration at this time.

[ad_2]

Source links Google News