[ad_1]

Ekaterina Belova

iShares MSCI Brazil Small-Cap ETF (NASDAQ:EWZS) is an exchange-traded fund that invests in Brazilian small-cap stocks. Somewhat surprisingly, the fund had as many as 105 holdings as of November 1, 2022, with the top 10 holdings representing between 2-5% of the fund each, making the fund reasonably diversified. Less surprisingly, the fund’s expense ratio is quite expensive at 0.57%. ETFs that invest in single countries, especially less developed countries with niche investment mandates, tend to be more expensive to hold.

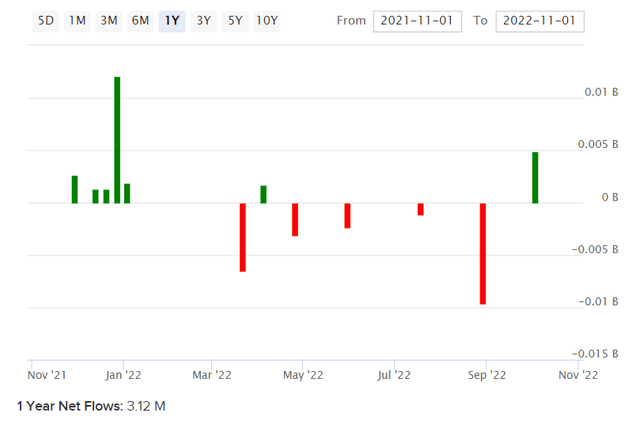

EWZS is indeed niche, with net assets under management of only $94 million as of November 1, 2022. That follows net inflows over the past twelve months of about $3 million, however on balance this is close to zero.

ETFDB.com

Lula da Silva recently won the 2022 presidential election, now as president-elect for Brazil. He is more left-wing than the incumbent president, Jair Bolsonaro, but regardless it is likely that political stability in Brazil will be the most important thing for investors (and thus lower equity risk premiums). The USD/BRL exchange rate has fallen in recent days, including on the election day, and hence the stronger Brazilian real shows evidence of market support.

TradingView.com

EWZS, the small-cap fund, has performed well this year, even adjusting for the stronger real. The year-to-date return in USD is just under 7% at the time of writing, or down circa -1% on an FX-adjusted basis. That beats the S&P 500’s fall of about -21%.

The five-year historical beta of the fund is 1.86x, which is very high. Professor Damodaran assessed Brazil as carrying a country risk premium of just under 3% as of January 2022. If we assume a base equity risk premium in mature markets of 4.2-5.5%, and scale that by the five-year historical beta, we get an implied country risk premium awardable to Brazilian equities of 3.6-4.7%, which is higher than Damodaran’s recommendation of 3%. However, EWZS invests not only in a riskier country, but also a characteristically riskier segment of that market. So, a country risk premium in that higher region is probably fair.

The current Brazilian 10-year yield is about 12%. Adding that local risk-free rate, which is very high, to our base equity risk premium of 4.2-5.5%, and adding our country risk premium (our own higher proxy on a beta-derived basis) of 3.6-4.7%, takes us to a cost of equity between 19.8-22.2%. We will use this shortly to estimate a fair earnings multiple for EWZS.

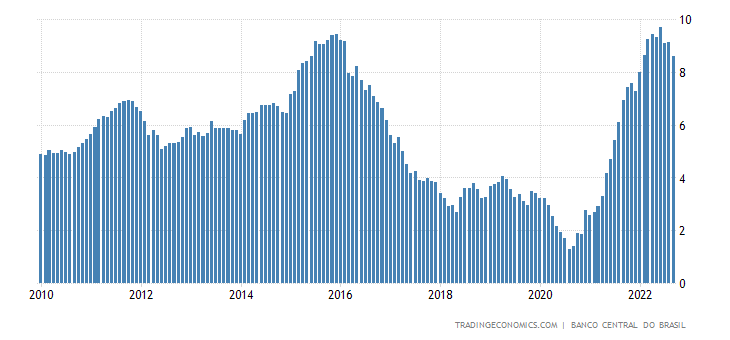

You would expect high levels of inflation given the high local 10-year, and you would be right: the local core inflation rate was 8.59% in September 2022.

TradingEconomics.com

However, the local 10-year yield is even higher, as are shorter-term yields (the one- and two-year yields are 13.23% and 11.70% respectively at the time of writing). So, local monetary policy is arguably tight, and so there is some future room for both inflation to settle and yields to settle even more. This could hurt the local currency potentially, but would also support local equity valuations and the real economy. Directionally speaking, this would likely be positive for Brazilian equities even on an FX-adjusted basis.

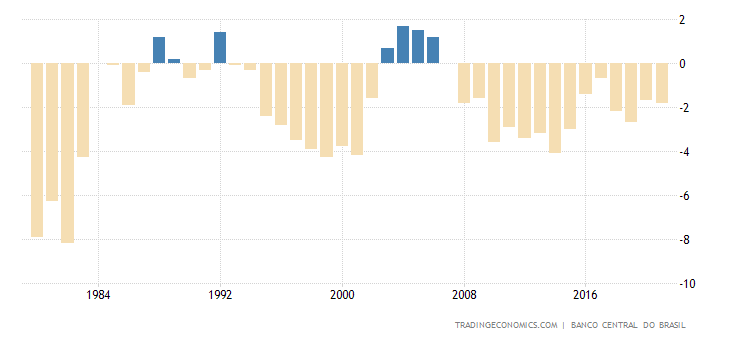

One caveat is that certain PPP models indicate potential over-valuation: the Economist’s Big Mac Index suggests the real is 7% overvalued against the U.S. dollar as of July 2022 (their GDP-adjusted model). Also, the Brazilian current account is negative vs. GDP, illustrated below, which is usually a sign of over-valuation.

TradingEconomics.com

All considered, I would be tempted to suggest that the real is not well-positioned to appreciate further, especially with current yield differentials likely already generous. We should take this into consideration before returning to the fair earnings multiple estimation.

With a cost of equity of 19.8-22.2% (outlined earlier), we finally need to consider long-term earnings growth potential. Over the long term, while eventually long-term nominal earnings growth is unlikely to sink to a lower level toward zero (as has historically occurred in the most developed and mature markets), for the sake of discounting we could assume anywhere from 2-5% for Brazil based on the past decade or so of core inflation (this is assuming zero earnings growth in real terms for the moment).

Our new “normative” forward earnings yield estimate therefore comes to 14.8% on the lowest side, and 20.2% on the high side. That equates to a forward earnings multiple of 4.95-6.76x. Morningstar data suggests that EWZS’ forward price/earnings multiple was 8.42x as of October 31, 2022, while EWZS’ benchmark index factsheet from MSCI (i.e., for the MSCI Brazil Small Cap Index) as of September 30, 2022, indicated a forward price/earnings multiple of 9.56x. The price/book ratio per the benchmark was 1.37x, implying a forward return on equity of 14.3%, which is fair.

Ultimately, this means that the current forward earnings yield is actually only about 10.5-12%, which is uncomfortably lower than local bond yields.

I would not be entirely surprised to see EWZS hold up into the next business cycle, and generate 10-15% returns (at most) on an annualized basis over the next few years. This could be supported by generally lower bond yields. However, given the potential for a valuation re-rating to the downside, and potential FX headwinds (should the Brazilian real start to ease off against the U.S. dollar, out of its current range), I would remain neutral on EWZS at present.

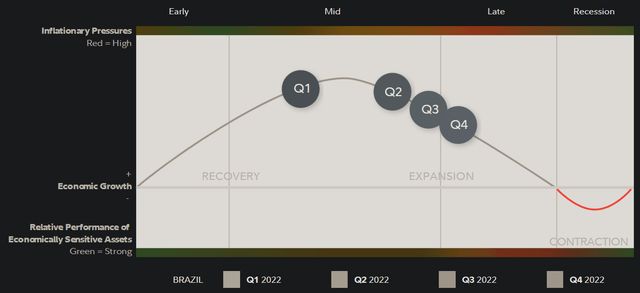

I like to periodically review Fidelity’s research on business cycle positioning, and for Brazil, it is estimated that the country is presently in the later stage of its current business cycle (Q4 2022).

Fidelity.com

This is possibly constructive, but with markets being forward-looking, there will be a 6-12 month lead into the next local recession. That is, EWZS will likely find itself under pressure once a local recession looms, which is another potential risk to EWZS’ performance potential in combination with FX risk and valuation risk.

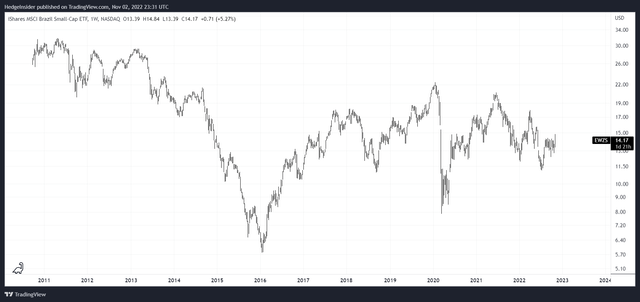

Another more simplistic point is that EWZS is still trading under its inception price in Q3 2010.

TradingView.com

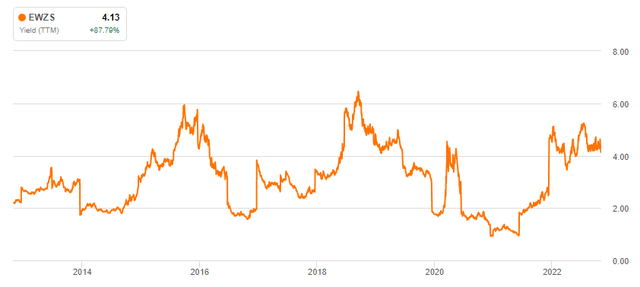

The current dividend yield (based on a 30-day SEC yield basis) is 4.25% as reported by iShares themselves, which is good but mostly in line with its long-term average per Seeking Alpha data (historical dividend yield chart below).

SeekingAlpha.com

In summary, I think the recent election is probably good news for Brazil, but I would not be interested in buying Brazilian equities (nor Brazilian small-caps) at this juncture.

[ad_2]

Source links Google News