[ad_1]

Paul Campbell/iStock via Getty Images

Thesis

We discussed in our previous article (Hold rating) on the SPDR S&P 500 ETF (NYSEARCA:SPY) that we were awaiting a significant bottoming signal to play out accordingly.

We believe the signal formed two weeks ago, as the market forced another sell-off toward the support level ($370), which we anticipated. As a result, we believe the market has likely staged a sustainable bottom, even though we seem to be learning that macro headwinds are worsening.

Snap’s (SNAP) Q2 card demonstrated that the headwinds in the ad industry might be worse than expected, as it delivered another quarter of poor performance and pulled its forward guidance. However, the market has continued to hold its July lows resiliently.

Some strategists and the media appear to focus on the so-called “earnings compression” after the significant multiples compression seen over the past seven to eight months. The SPY traded at a forward PEG (based on 5Y EPS CAGR) close to 1.18x. But, these commentators believe that the earnings compression effect could unfold in the upcoming slew of Q2 earnings releases that could see EPS estimates being revised downwards.

However, we also believe that the market is forward-looking. Therefore, we are confident that the worst sell-offs should be over moving forward as it formed a significant bottoming process.

We still anticipate some level of near-term volatility, given the worsening macro headwinds coupled with short-term overbought levels. However, long-term investors can consider using July’s significant bottoming signal to add exposure at the next retracement.

As such, we revise our rating on the SPY from Hold to Buy.

Is SPY A Good Buy During A Recession?

We believe that is the critical question that many investors could be seeking an answer to. We think it really depends on whether investors consider the current valuation as reflecting the worst headwinds that could impact the market.

Consider that the market is navigating some of the most challenging headwinds in recent times: surging inflation and energy costs, a hawkish Fed, geopolitical conflict, US-China semiconductor spat, global food shortages, ongoing supply chain disruption, capacity constraints hobbling the travel industry, and more.

So, the critical question is whether investors expect the so-called earnings compression to cause a multi-year reduction in the analysts’ EPS expectations moving ahead?

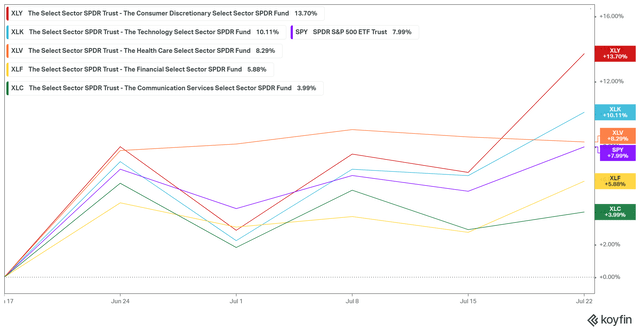

SPY 1M performance % (koyfin)

Despite the negative media headlines, the SPY has gained nearly 8% over the past month, led by consumer discretionary (XLY) and technology (XLK), as seen above. In addition, all five leading sectors (by weighting) in the SPY also gained, with communications (XLC) underperforming. Therefore, we believe pockets of strength can be seen in the SPY, despite the threat of a looming recession. Why? Because we think the market is forward-looking.

Unless the market expects macro headwinds to get much worse from here, leading to significant multi-year EPS estimates reduction, July’s bottom could likely hold.

Is Now A Good Time To Consider SPY?

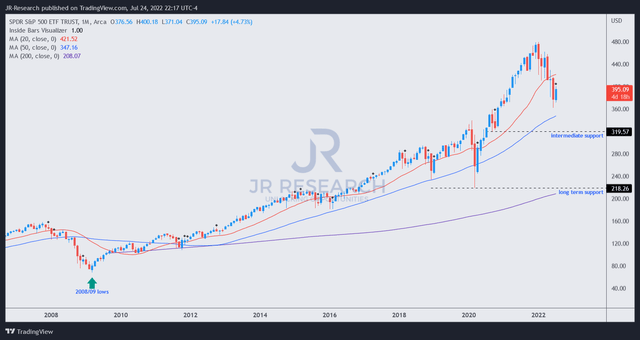

SPY price chart (monthly) (TradingView)

Some investors could point out that the SPY remains quite a distance from its critical 50-week moving average (blue line) that has supported the market’s advance from its 2008/09 bottom.

Also, they contend that the global financial crisis (GFC) led to a worse decline that broke down most of its critical support zones.

Indeed, the SPY could still fall further (in theory) to its intermediate support ($320) or long-term support ($220) before finding an eventual bottom. But, we believe it’s increasingly likely that we have seen the worst of the market sell-offs (despite the potential for short-term volatility).

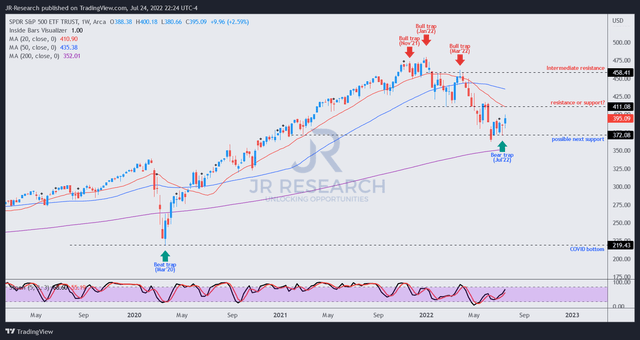

SPY price chart (weekly) (TradingView)

Importantly, we noted a bear trap (formed two weeks ago), which suggests that the market rejected further selling downside resolutely, as it ensnared bearish/pessimistic investors into the July lows. Therefore, we are confident that the support level we posited in our previous update will likely hold over the medium term.

What Could Impact Our Thesis?

Nothing is guaranteed. Furthermore, the SPY remains far above its long-term support. Hence, we can never rule out the potential for a much steeper sell-off. Moreover, the price structures seen are emblematic of astute traps set up by the market to tire investors/traders. Therefore, we believe the market would likely remain volatile, presenting opportunities for investors to buy on retracements, as it shakes out weak holders who added but couldn’t stomach the near-term volatility.

The media would focus on Apple’s (AAPL) earnings on July 28, as it believes it could determine the market’s recovery momentum. AAPL has also recovered markedly from its June lows as it navigates a weakening PC/mobile market while dealing with ongoing supply chain disruptions. As a result, we believe the Street has already set a relatively low bar for AAPL to cross in its upcoming earnings card.

However, we think its forward guidance will be critical to help assure the market that its impending iPhone 14 launch could overcome these challenges. As long as Apple doesn’t disappoint massively (note that Apple is usually more conservative with its forward guidance), we believe the green shoots of recovery seen in the SPY are likely to gain further cadence.

We believe the market will also be parsing Microsoft’s (MSFT) FQ4 card on July 26 and pour over its guidance. The market is likely anticipating a slowdown in consumer exposure and is assessing whether Azure’s growth is sustainable. Therefore, if Microsoft’s guidance doesn’t massively disappoint, we believe the software group could also have staged its bottom.

Note that we believe the market doesn’t need the behemoths to demonstrate robust growth currently. Moreover, the near-term set-up has likely anticipated disappointment and weakness in their upcoming earnings. Therefore, as long as these companies don’t issue guidance far worse than what the Street is anticipating, the risk/reward profile looks increasingly skewed toward upside potential.

Is SPY ETF A Buy?

We revise our rating on the SPY from Hold to a medium-term Buy.

We believe that a robust medium-term bottom on the SPY has formed. As long as the leading companies in the SPY don’t issue guidance much worse than the Street had estimated, we believe the bottom is likely to hold.

Notwithstanding, we anticipate short-term volatility, as the SPY seems overbought. Therefore, investors can consider a retracement first before adding exposure.

[ad_2]

Source links Google News