[ad_1]

Diego Thomazini/iStock via Getty Images

I periodically hear from investors asking if they should invest in the Invesco QQQ ETF (NASDAQ:QQQ) because they want to tilt their portfolios towards tech growth. In the past, there was no question that QQQ was a very good way to invest in aggressive tech growth. QQQ’s value has always been dominated by a handful of very successful tech stocks each of which has a market cap so high that just 10 of those stocks have often made up over half of the total value of the entire QQQ ETF. The details of this overweighting is discussed in more depth in this recent article.

These top stocks, which include Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG) (GOOGL) have a long history of being the very best Tech growth stocks and of rewarding investors extremely well. But they are now mature companies, as are many of the other companies held by QQQ.

So before we can answer the question of whether QQQ is still the easiest way to invest in tech growth now we have to take a good look at the stocks that it currently holds, looking to see whether the ETF is still dominated by tech stocks, and whether the earnings per share of the stocks in QQQ are still expected to grow at the kind of annual rate that has historically made investors willing to invest even when the QQQ’s P/E ratio has been well north of 30.

History Teaches Us Why QQQ Is Thought of as a Tech Growth ETF

QQQ tracks the Nasdaq 100 index (NDX). It is a very simply designed index that picks stocks using no criterion save that they be the stocks of one of the 100 largest non-financial companies, ranked by market capitalization, that are listed on the Nasdaq stock exchange. There is no other requirement for inclusion in the Nasdaq 100 and thus in QQQ.

The Nasdaq first started listing stocks on Feb. 8, 1971. Unlike traditional stock exchanges like the NYSE and AMEX, the Nasdaq exchange was completely electronic and lacked the trading floor full of shouting brokers that was the defining characteristic of the earlier exchanges.

Listing on the Nasdaq exchange was cheaper than listing on the established exchanges. That is one reason why in the following years so many small startups listed on the Nasdaq exchange. Those startups included Apple, which made its IPO in 1980, Microsoft, which made its IPO in 1986, and Cisco (CSCO), which made its IPO in 1990. As the Dot.com boom of the 1990s gathered momentum, the success of those stocks led to the Nasdaq exchange becoming the trendy place for tech startups to list.

By now a few of those 1980s and 1990s startups have grown into trillion dollar Ultra Mega Caps. Many more have become respectable Large Cap companies. Hot young startups of all kinds still IPO on the Nasdaq. Some of them are the so-called “Unicorn” stocks, which are very much like some of the ephemeral darlings of the Dot.com era.

QQQ Has Always Held Popular “Unicorns” and Stocks with No Earnings

Over the past few years, at the peak of the most recent tech boom, investors have bid up these unicorn’s share prices so high around the time of their IPOs that they have achieved the multi-billion dollar market caps large enough to place them in the Nasdaq 100 despite never having reported a penny in earnings. Last November, for example, when I last ran a valuation scan on QQQ, CrowdStrike Holdings (CRWD) which went public in June of 2019 was the 28th largest stock in the Nasdaq 100 with a market cap larger than Cisco and a P/E ratio of 679.53.

Back in November, at the end of the recent boom, QQQ held the following stocks that had no earnings.

| % of QQQ | Ticker | Name |

| 0.217 | (OKTA) | Okta Inc. |

| 0.268 | (PDD) | Pinduoduo Inc. |

| 0.21 | (PTON) | Peloton Interactive Inc. |

| 0.188 | (SGEN) | Seagen Inc. |

| 0.172 | (SPLK) | Splunk Inc. |

This past November QQQ also held 20 stocks that did not have a 5-year-long history of reporting earnings.

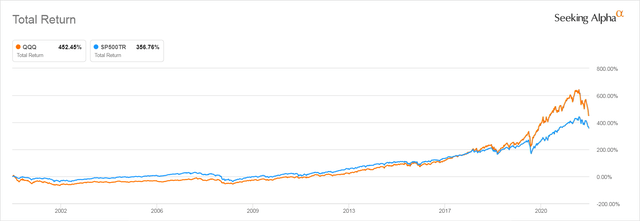

The Dot.com boom punished investors who invested in QQQ which started trading as that boom reached its extremely overvalued top. But investors who bought QQQ 20 years ago, in the last months of the Dot.com crash have reaped rich rewards. QQQ has far outperformed the S&P 500 on a price return basis.

QQQ and S&P 500 Total Return Since 2001 Dot.Com Bust

Seeking Alpha

To What Extent Now is QQQ a Tech ETF?

To answer this question, I downloaded the list of the 102 stocks currently held by QQQ and sorted them by their GICS sectors and Industry Groups. Here is how their sector assignments break out sorted by the total number of QQQ stocks in each sector.

Stocks in QQQ Broken Out by Business Type

| Sector | Type of Company | Total # of Stocks | % of QQQ by Weight |

| Information Technology | Hardware, Software, Semiconductors, related services | 42 | 50.16 |

| Consumer Discretionary | Retail, Clothing, Hotels, EVs | 15 | 14.84 |

| Health Care | Biotech, Pharma, Supplies | 13 | 6.12 |

| Communications Services | Social media, Cable, Advertising, Streaming, Gaming | 12 | 17.36 |

| Industrials | Manufacturers, Hard Goods Distributors, Trucks, Railroads | 8 | 3.43 |

| Consumer Staples | Food, Beverages, Drug Stores | 7 | 6.58 |

| Utilities | Electric Utilities | 4 | 1.36 |

Data as of 5/16, compiled by the author

As my readers know, I find the arbitrary way that the GICS sectors are defined annoying. There are plenty of stocks not classified as technology stocks by the GICS standard that a reasonable person would consider a technology stock. For instance, the Communications Services category includes the likes of Alphabet and Facebook (FB) which were classified as technology stocks by GICS until 2018. Amazon, arguably one of the greatest Tech companies in the world, is classified by the GICS system as being a Consumer Discretionary stock. So is Tesla (TSLA). Surgical robot company Intuitive Surgical (ISRG) is classified as being a Health Care stock.

So while companies that are officially classified as technology companies only make up a hair over half of the total value of QQQ, when I went in and manually added up the weights of the stocks of all the companies a reasonable person would consider to be technology intensive, I found they made up a full 74.97% of the total weight of QQQ.

So yes, though QQQ’s index does not explicitly select technology-related stocks, it is still very much a technology-dominated ETF.

QQQ May Indeed Be A Better Way to Invest In Technology Than Pure Technology ETFs

I recently wrote about the changes that are going to be made to which stocks the GICS classification system classify as Information Technology stocks. To summarize my findings, the index providers who own the GICS classification system keep deleting successful tech stocks out of the Information Technology sector and placing them into more stagnant sectors, probably to increase the appeal of indexes that track those other sectors.

I also explained how this makes Technology Sector ETFs that use the GICS sector classification system less appealing to investors who want to invest in the whole spectrum of technologically-focused companies. The largest of these Tech Sector ETFs is the Vanguard Information Technology ETF (VGT).

When I published those articles many readers asked me what ETFs they should invest in if they wanted to maintain a Tech focus in their portfolios. The table above suggests that QQQ is a decent way to invest in what the average person would consider to be technology, if they don’t mind getting a bit of random this and that in their portfolio like ketchup-maker Kraft Heinz (KHC), nuts and bolts distributor Fastenal (FAST), and coal hauler CSX (CSX), a railway.

There Is No Guarantee That QQQ Remains a Tech ETF

Though QQQ is currently very much a technology-heavy ETF, investors do need to be aware that nothing in the way that QQQ is constructed ensures it will remain one. Should popular startups in other industries start listing their IPOs on the Nasdaq and become dominant in the market, the current weighting of technology in QQQ could change. Investors who buy and hold for the long-term should periodically review the complete list of QQQ’s holdings, by weight, to review how they have changed. That list can be downloaded from the Invesco product page for QQQ.

Is QQQ Still An Aggressive Growth ETF?

Investors are attracted to what they perceive as technology stocks because those stocks have been the most aggressively growing stocks in the entire US stock market for the past 30 years.

But I was very surprised to find when I did the analysis for my most recent article, Are FAANG Stocks Worth Investing In Now? that the earnings growth of the most heavily weighted stocks in QQQ has slowed down dramatically.

In that article I documented how analysts forecast that Apple, which makes up a full 12.62% of the total value of QQQ, will only grow at an annualized rate of 7.69% over the next three years. Facebook is expected to grow its earnings at 8.36%. Amazon’s earnings are expected to drop 75% by year end 2022 and it may only average 10% annual growth over the next three years if the company meets analysts’ consensus forecast expectations.

I have provided much more detail about the current state of the FAANG stocks in my most recent article.

Mind you, these forecasted growth rates aren’t terrible. The S&P 500 is currently forecast to only grow earnings at a rate of 5.25% over the next two years. But annual EPS growth rates in the single digits aren’t what investors have come to expect from these, the world’s most visible technology stocks. Apple’s EPS growth rate over the past 7 years has averaged 15.82%, almost twice the 7.69% projected going forward.

Investors who look beyond the tech sector can find dividend-paying stocks that are achieving similar or better growth rates in some of what are thought of as Old Economy dividend stocks. Lowe’s (LOW) for example, is forecast to see its EPS grow at an annual rate of 11.72% going forward. Caterpillar (CAT) at 14.77%.

QQQ’s Stocks’ Forecasted EPS Growth Rates Are Relatively Modest

To determine whether the slowdown I observed in the FAANGs extended to QQQ as a whole, I used FastGraphs to extract the forecasted Adjusted (Operating) Earnings Growth Rate for the next 2 or 3 years for each of the 102 stocks currently held by QQQ.

The unweighted average of the estimated forward-looking growth rates of all the stocks in QQQ is 12.02%.

I then attempted to calculate a weighted EPS growth rate for QQQ by multiplying each stock’s forecasted EPS growth rate by its weight in the ETF and summing them all up. So Apple, which makes up 12.62% of QQQ as of May 16 and is expected to grow by 7.69% would contribute .97% to the total growth rate of QQQ. This produced a figure not very different from the unweighted average: 11.97%.

QQQ’s Current EPS Growth Forecasts Are Almost Half Its 5 Year Historical Average

The unweighted average historical EPS growth rate of the stocks in QQQ over the past 5 years has been 21.49%, which is far higher than the average projected future EPS growth rate.

The weighted average 5-year historical EPS growth rate for the stocks in QQQ, calculated via the same methodology as I used for the forecasts was 23.03%.

This suggests that the growth rates of most of these stocks going forward are expected to be roughly half of what they have been over the past 5 years. This is undoubtedly because so many of the stocks that are weighted most heavily in QQQ have seen enormous growth during the COVID-19 lockdown, growth that is not likely to be duplicated any time soon.

Inflation Has Damaged QQQ’s Price And Slowing Growth Will Make the Damage Worse

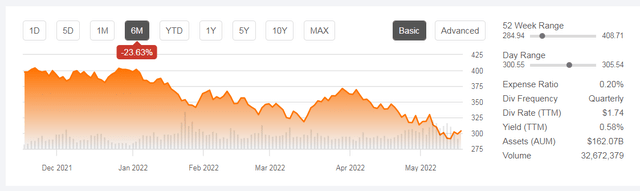

QQQ’s price has already dropped almost 24% since November.

QQQ’s Price Decline Over the Past 6 Months

Seeking Alpha

This decline is partially investors’ response to rising rates. Investing professionals tell retail investors that tech stocks do poorly when rates rise as you can see in this article provided by Fidelity Investments. But QQQ’s price decline is also is a reaction to some disappointing 4th quarter 2021 and 1st quarter 2022 earnings reports and future guidance. Most importantly, much of that disappointing guidance was not due to interest-rate-sensitive factors.

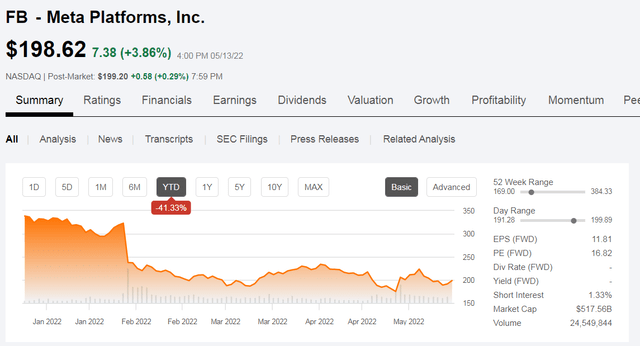

Meta Platforms (Facebook) dropped 14.2% in a single session when the company reported fourth-quarter earnings that missed consensus forecasts and issued disappointing forward guidance. This was attributed to a considerable extent to Apple giving users the ability to block Meta’s trackers in its latest release of iOS.

FB’s Steep One Day Price Decline After Disappointing Earnings

Seeking Alpha

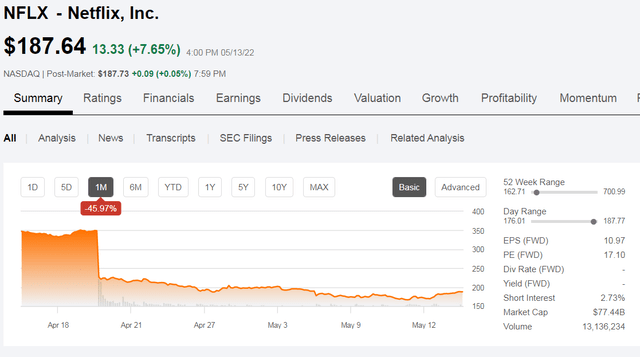

Netflix (NFLX) saw its price drop 35% in a single day after its 4th quarter 2022 earnings report revealed that its number of subscribers had declined and forward guidance suggesting that that number would decline further. This decline may have more to do with the strength of the competition in the streaming niche and the perceived quality of Netflix’s offerings than with inflation.

NFLX Disappointing Earnings After Poor Forward Guidance

Seeking Alpha

Some Unicorns and Profitless Stocks are Gone or On Their Way Out

The other reason that the price of QQQ has come down so dramatically over the past few months is that investors have fled the once popular Unicorn stocks and those that have a long history of negative or absent earnings.

Of the profitless stocks that were listed in QQQ back in November 2021, Peloton is no longer held by QQQ. Splunk and Okta have sunk to become the 101st and 102nd stock in what is supposed to be a 100 stock index, which means they are likely on their way out, too.

QQQ’s Valuation is Still Very High For Its Growth Rate

On the QQQ product page, Invesco only provides a Price/Earnings ratio for QQQ dating back to March 31, 2022. The P/E ratio back then was 28.0. QQQ’s price has dropped significantly since then. But when I calculated the Average and Weighted Average P/E ratio for QQQ using the P/E ratios supplied by FastGraphs, which come from Factset and are dated as of May 16, 2022, I found that the unweighted Average P/E ratio for all the stocks in QQQ came out to 34.08. The weighted average was 31.01.

Those are very high P/E ratios for a basket of stocks that overall are only growing earnings at about 12% a year.

Bottom Line: QQQ Is Still A Tech ETF But Not An Aggressive Growth ETF

QQQ is not a bad investment. The companies it holds are currently forecast to grow their earnings at an annual rate that is higher and faster than those in the S&P 500. But QQQ isn’t going to be providing new investors with the kinds of magnificent returns it achieved over the past decade unless the tech stocks that dominate it can boost their earnings growth back to the kinds of double-digit rates investors have become used to seeing. I have provided a detailed analysis of what it will take for the FAANG stocks to do this in my May 17, 2022 article dedicated to those stocks.

Momentum has not been QQQ’s friend these last 6 months. With the average EPS growth rate of the stocks in QQQ having been cut almost in half compared to their past 5-year average, and with so many longer-term investors in QQQ sitting on what are still huge profits, even after its recent price decline, QQQ looks very vulnerable to ongoing profit-taking if investors see more disappointing earnings and worrisome guidance as 2022 progresses.

That suggests that until there is reason to believe that QQQ’s largely tech stock holdings are going to be able to return to growing their earnings at rates closer to 20% than 10% a year, QQQ may be a disappointing investment for new investors.

[ad_2]

Source links Google News