[ad_1]

In the context of generalized stock market weakness and growing concerns about the health of the real estate market, the Vanguard Real Estate ETF (VNQ) suffered serious losses in the fourth quarter of 2018.

But the recovery has been equally impressive in the past several months, and the ETF is in fact trading close to historical highs as of the time of this writing.

Data by YCharts

Data by YChartsLet’s take look at Vanguard Real Estate ETF going forward, considering both the fundamental picture and the quantitative trend indicators.

An Improving Fundamental Picture

Back in the fourth quarter of 2018, things looked quite dismal for the real estate sector. The Federal Reserve was being more aggressive with its plans to reduce liquidity, while the US economy in general and the real estate sector in particular were showing some worrying signs of deceleration.

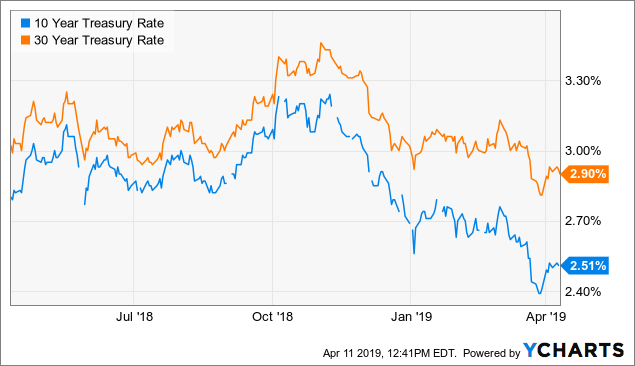

But the environment has significantly improved now. The Fed is being far more flexible and data-dependent, and long-term interest rates are down substantially in the past few months.

Data by YCharts

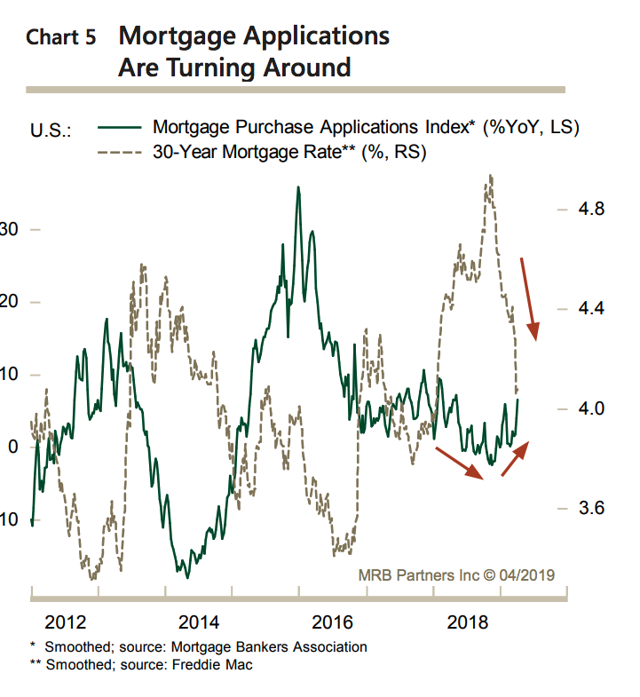

Data by YChartsThis is making mortgage rates much more affordable, which is a crucial driver for housing and for real estate activity in general. Mortgage applications are clearly turning around with the decline in mortgage rates in the first months of 2019.

Source: MRB partners

Source: MRB partners

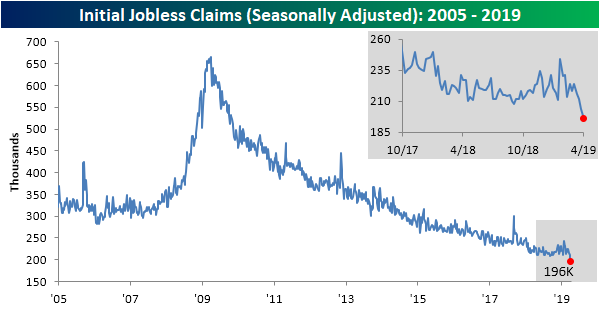

The jobs market remains remarkably strong. The most recent jobless claim data came in at 196K, which was the lowest seasonally adjusted number since October 4, 1969.

Source: Bespoke

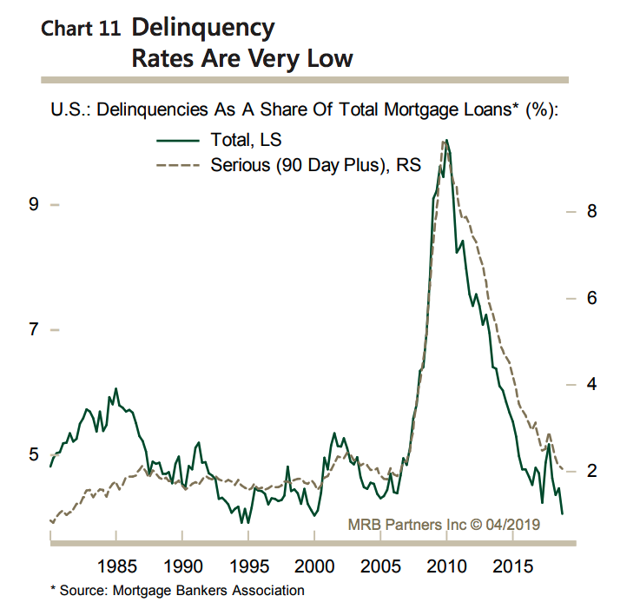

Low interest rates in combination with a strong jobs market are major tailwinds for the real estate sector. Looking at delinquency rates, the numbers are more than healthy based on the most recent data.

Source: MRB partners

In the fourth quarter of 2018, interest rates were much higher and activity indicators in the real estate sector were clearly decelerating. In such a context, VNQ TF was under heavy selling pressure.

But the scenario is quite different now, interest rates have declined substantially, the labor market is showing record strength, and variables such as mortgage applications and delinquency rates look clearly encouraging.

As long as these fundamentals remain in place, the macroeconomic picture is bullish for the Vanguard Real Estate ETF.

The Trend Is Your Friend

Real estate is a very cyclical sector, and trend-following indicators can be remarkably effective when it comes to controlling for downside risk in these kinds of investments.

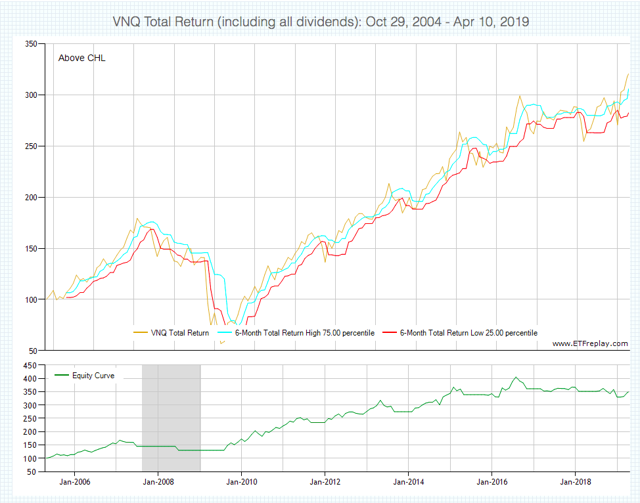

Source: ETFreplay

The chart above shows the six-month price channel for the Vanguard Real Estate ETF. The equity curve below is for a quantitative strategy that buys the ETF when the price crosses above the 75% level in the channel and goes to cash when it falls below the 25% level.

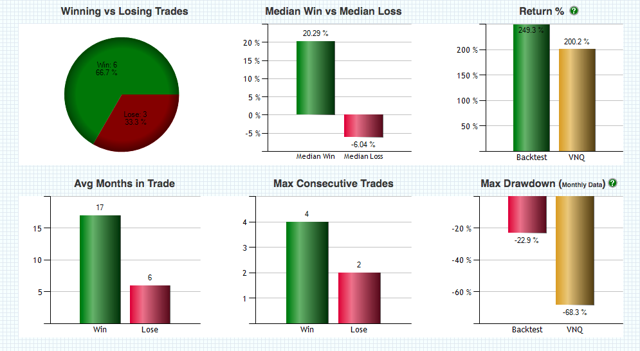

Source: ETFreplay

Source: ETFreplay

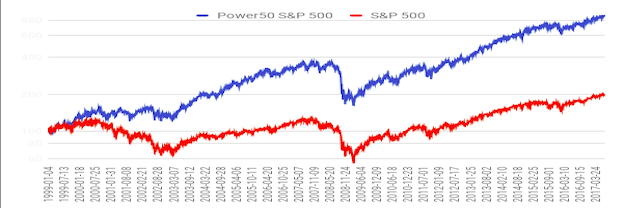

The backtested performance metrics for this strategy are quite strong. Since October 29, 2004, meaning since Vanguard Real Estate ETF is available for trading, the strategy has gained 249.3% versus 200.2% for a buy and hold position in the ETF.

More importantly, the strategy does a great job in terms of risk reduction. The maximum drawdown is 22.9% for the quantitative strategy versus a much larger drawdown of 68.3% for the ETF.

The main game changer in terms of risk reduction is that the trend-following strategy went to cash in June of 2008, so it protected the portfolio before the massive bear market during the financial crisis.

Offering more details, the table shows the different buy and sells for the trend-following strategy over time. As you can see, the quantitative system is currently long in the Vanguard Real Estate ETF since January 31, 2019.

When investing in such a cyclical sector, the trend is your friend if you are looking to optimize performance and control for downside risk. It’s worth noting that the trend indicators over the middle term are currently indicating a long position in VNQ.

When investing in such a cyclical sector, the trend is your friend if you are looking to optimize performance and control for downside risk. It’s worth noting that the trend indicators over the middle term are currently indicating a long position in VNQ.

Winners Keep On Winning

Trend following is about buying stocks and ETFs that are rising over time. But money has an opportunity cost, when you buy an investment with below-average returns, you are missing on the opportunity to put that capital to work in an investment with superior performance.

Besides, relative momentum is a pervasive force, meaning that outperforming assets tend to keep outperforming more often than not.

This means that you don’t just want to buy investments that are rising in price, you really want to buy the investments that are producing superior returns in comparison to other alternatives available in the market.

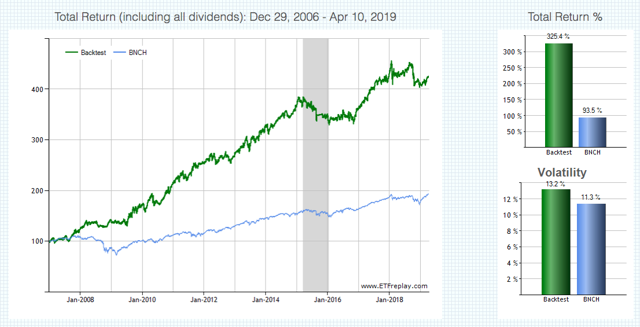

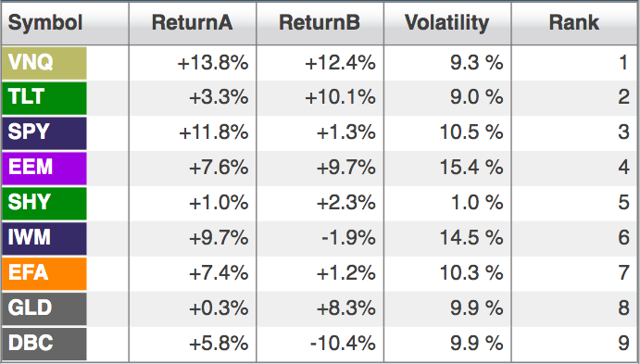

The Asset Class Rotation Strategy is a proprietary quantitative strategy available in The Data Driven Investor. This system rotates between 9 ETFs that represent some key asset classes.

- Vanguard Real Estate.

- SPDR S&P 500 (SPY) for big stocks in the U.S.

- iShares Russell 2000 Index Fund (IWM) for small U.S. stocks.

- iShares MSCI EAFE (EFA) for international stocks in developed markets.

- iShares MSCI Emerging Markets (NYSEARCA:EEM) for international stocks in emerging markets.

- Invesco DB Commodity Index Tracking (DBC) for a basket of commodities.

- SPDR Gold Trust (GLD) for gold.

- iShares 20+ Year Treasury Bond (TLT) for long-term Treasury bonds.

- iShares 1-3 Year Treasury Bond (SHY) for short-term Treasury bonds.

In order to be eligible, an ETF has to be in an uptrend, meaning that the current market price is above the 10-month moving average. If no ETF is in an uptrend, the system goes for the safest asset in the group, which is the iShares 1-3 Year Treasury Bond.

Among the ETFs that are in an uptrend, the system buys the top 3 with the highest relative strength. Relative strength is measured by a ranking system that considers total returns over three months and six months, and it includes volatility as a negative factor. The benchmark is a globally diversified portfolio that is allocated 60% to stocks and 40% to fixed income.

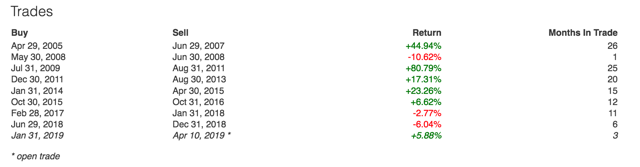

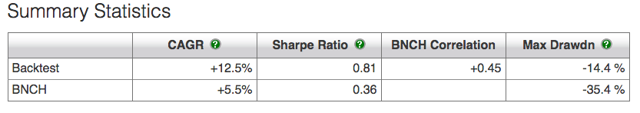

Backtested performance numbers are quite strong. Since January of 2007, the strategy gained a cumulative 325.4% versus 93.5% for the benchmark. Annual return is 12.5% for the strategy versus 5.5% for the benchmark over that period.

Source: ETF replay

Source: ETF replay

The strategy is also quite effective in terms of risk reduction, the maximum drawdown is 14.4% versus 35.4% for the benchmark.

Source: ETFreplay

Looking at the relative strength rankings, the Vanguard Real Estate ETF is currently the top ranked ETF in terms of risk-adjusted performance among the nine ETFs in the investable universe.

Source: ETFreplay

Source: ETFreplay

From a middle-term perspective, VNQ is not only in an uptrend but also delivering superior risk-adjusted returns in comparison to other widely representative ETFs. This bodes well for investors going forward.

The Bottom Line

There are many risk factors to consider. An unexpected increase in inflation could drive interest rates higher, producing a big tailwind for the real estate sector. Besides, the economic cycle in the US is quite mature, and the real estate sector will certainly feel the pain if we enter a recession over the coming years.

That being acknowledged, the interest rate environment remains favorable, and a strong jobs market is a big tailwind for the real estate sector. Adding to this, the quantitative metrics in terms of both trend-following and relative strength are clearly bullish in terms of the timing in the position.

All things considered, the Vanguard Real Estate ETF is in a position of strength to continue delivering solid returns in the coming months.

Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term. A subscription to The Data Driven Investor provides you access to profitable screeners and live portfolios based on these effective and time-proven return drivers. Forget about opinions and speculation, investing decisions based on cold hard quantitative data can provide you superior returns with lower risk. Click here to get your free trial now.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News