[ad_1]

A fund of funds is looking for its mojo.

“To everything there is a season.” Whoever thought that would apply to exchange-traded funds?

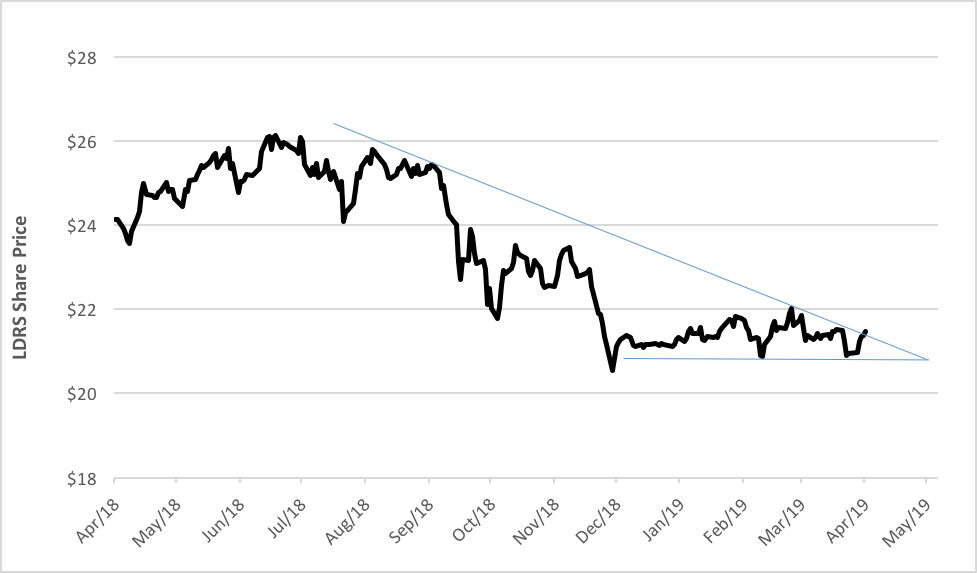

A look at the price trajectory of the Innovator IBD ETF Leaders ETF (LDRS), though, has some market technicians convinced that this may be the turnaround season for the year-old portfolio.

It’s the triple bottom in the LDRS chart that’s got them persuaded. A reversal pattern, a triple bottom is created from three nearly equal lows. Generally, the wider the gap between then lows, the more powerful the pattern. Take a look at the LDRS chart below. Technicians would argue that a bottom has been forming since late December.

Innovator IBD ETF Leaders ETF (LDRS)

LDRS debuted to great fanfare in late December 2017 as a fund of funds that tracks the IBD ETF Leaders Index. The index is a creation of the Investor’s Business Daily that selects top-performing ETFs on the basis of their relative strength against a basket of global equity. For LDRS’ underlying index, distinctions about geography, asset class or strategy are immaterial. All that matters is momentum. That’s both good and bad.

Momentum’s fine, ‘til it’s not. Remember the dot-com melt-up? Prices got way ahead of fundamentals back then. So, what safeguards LDRS against such headiness? Well, the index algorithm calls for a flip to ETFs holding cash and equivalents when the asset mix appreciates too quickly. On the other hand, the fund will hold only cash if fewer than three ETFs pass its liquidity and relative strength screens.

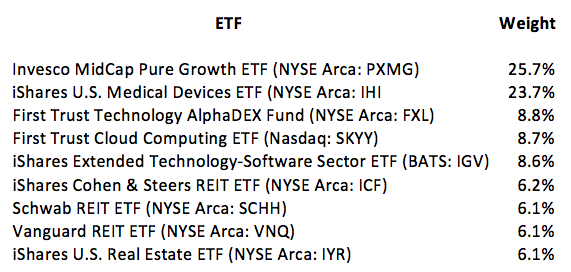

LDRS’ recent underperformance may be attributable to an ETF market that has plowed the middle ground between the index strictures. The portfolio never crossed either tripwire, so it churned away mightily looking for the next big thing. Or things. At present, there are just nine ETFs in the fund:

If real estate, technology, medical devices and pure growth are indeed the next big things, LDRS could add some spice to an otherwise well-diversified portfolio. The risk is formidable, though, and so far not well-rewarded.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link Google News