[ad_1]

Javier_Art_Photography/iStock via Getty Images

ARK Innovation ETF (ARKK) experienced its most significant one day of capital outflows in 10-months dating back to March of 2021. ARKK saw $352M exit the door on Wednesday, and over $500M leave the fund over the last two days according to Bloomberg data.

There is a comment in the movie “Wolf of Wall Street,” that epitomizes the mystery surrounding Cathie Wood’s thesis on ARKK and the way the ETF is performing:

“Nobody knows if a stock’s going up, down or f***ing sideways, least of all stockbrokers. But we have to pretend we know.”

In the movie scene, Mark tries to explain to Jordan that stockbrokers have to sell the confidence that they do know what will happen to their clients. Substitute the word stockbroker with Cathie Wood and, after two previous articles on ARKK I can’t find the current logic of this ETF. Yet her name floods the financial news. Why, because it keeps changing, and Cathie Woods, in telling us what she knows to provide confidence, makes me think she only pretends she knows.

A timeline of logic and logistics

According to the ARK invest website, the Fund’s investment theme of “disruptive innovation” is defined as the introduction of a technologically enabled new product or service that potentially changes the way the world works. Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements.

ARKK was created in 2014 as one of the first EFT’s of ARK Investment Management LLC; founded by Cathie Wood in October 2014 after 12 years as an investment officer at AllianceBernstein

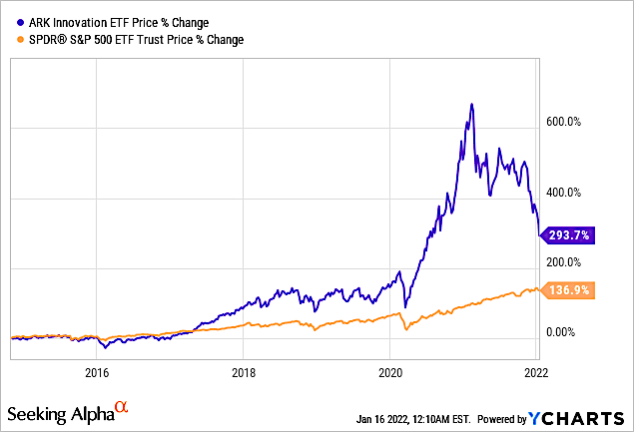

According to Chart 1, for the first several years, ARKK stock performance was comparable to the S&P 500, then started a slow increase in price change in 2017, and then retracked the S&P until the Covid-19 pandemic in early 2021. Since reaching a high of $156.58 on February 12, 2021, ARK Innovation ETF dropped 39.6%, closing at $94.59 on December 31, 2021. For all of 2021, the ETF was down 24.02%.

Year to date, ARKK is down another 15%, closing at $80.21 on January 14, 2022. From its high of $156.58, the stock is down nearly 50%.

YCharts

Chart 1

Progression of ARKK’s Top 10 Holdings

The investment theme of ARKK is stock holdings in companies that offer “disruptive innovation.” This raises an important question in Wood’s thesis – how long does disruptive innovation last until competitors come up with technology that matches or bests the innovative company? In other words, ARKK was started in 2014, so in the past six years, why is it that Wood’s top 10 holdings show only minor changes over time?

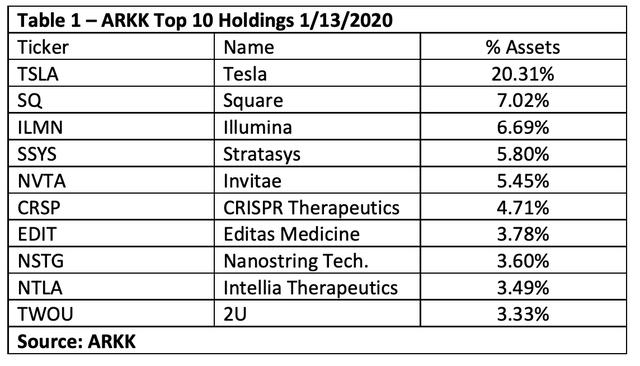

Table 1 shows ARKK Top 10 Holdings for 1/13/20. This was just prior to the Covid-19 pandemic, as shown above in Chart 1. With the announcement of the pandemic, markets around the world, including the ARKK stock price, dropped.

The global shutdown, when work/study/stay at home decrees dictated a change in the lifestyle of workers and students, gave rise to a demand for products such as PCs, video conferencing, and even exercise equipment when gyms shut down. ARKK stocks benefited.

ARKK

Table 1 also shows that Wood increased her holding in Tesla (TSLA) to 20.3%. Block (SQ) was added and Twitter (TWTR) and Amazon (AMZN) were removed from the top 10.

CRISPR Therapeutics AG, a gene editing company and incidentally my favorite biotechnology stock, was added, and joined Editas Medicine (EDIT) and Intellia Therapeutics (NTLA).

Holding Stocks as They Plummet

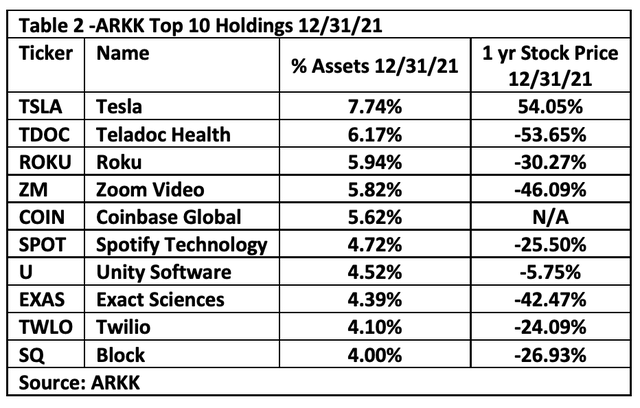

Table 2 shows ARKK Top 10 Holdings for 12/31/21. It shows the 1-year stock price performance of the ARKK Top 10 Holdings. This Table shows the holdings at the end of 2021 as ARKK retreated from 152% growth in 2020 to a drop of -24% in 2021.

In other words, comparing Table 1 before the pandemic and the 152% 2020 rise in ARKK with Table 2 after a 24% drop in 2021, the full spectrum of the rise and fall of ARKK, we see significant changes in the Top 10 Holdings. Tesla remained #1 and Block formerly Square, dropped from #2 to #10.

More importantly there are two takeaways:

- Tesla is the only stock in the Top 10 that increased in 2021 yet its % of Assets decreased from 20.31% before the rise (Table 1) to 7.74% after the rise.

- The seven stocks added during the two time periods decreased in stock price an average of 32%.

ARKK

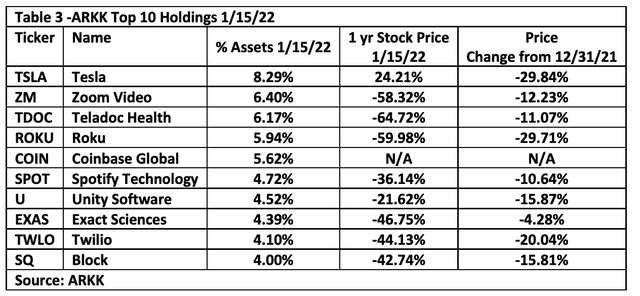

Table 3 shows the Top 10 Holdings as of 1/15/22, just two weeks after the listing in Table 2. Tesla remained at the top of the Holdings, and its stock price decreased the most of the 10 stocks on the list. Tesla’s percentage of assets increased to 8.29%. But this was significantly lower than the 10.31% on January 13, 2020 prior to the downturn (Table 1).

We see a significant takeaway in stock performance. Stock prices dropped an average of 16.6% in just two weeks. This drop follows the 32% drop for the 1-year.

ARKK

Investor Takeaway

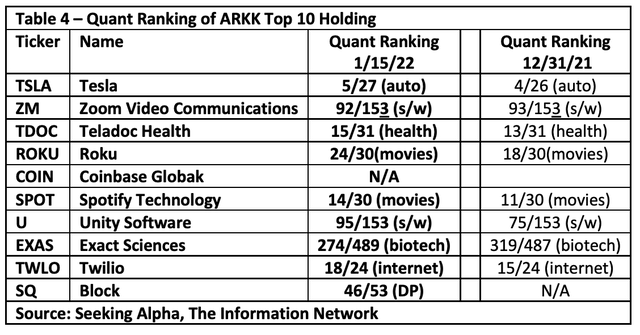

Table 4 shows the Seeking Alpha Quant rankings for the Top 10 Holdings on 1/15/22. This is the same period as in Tables 2 and 3. In all cases except Exact Sciences (EXAS), the Quant Ranking degraded in the two-week period.

ARKK

The drop in stock price, the degradation in Quant Ranking among its peers, and the buy/sell activity of stocks all are warning signals that the thesis of this ETF has shortcomings.

Need for another lockdown?

One clear indication is that ARKK and its holding stocks increased during the pandemic, and as the pandemic waned, stock prices dropped in tandem. The drop in Covid transmission was followed by relief by businesses and individuals that the lockdowns would soon end. Thus, purchases of tech products that benefited from Covid slowed significantly.

Stocks in the ARKK ETF can be considered Covid stocks, benefiting from the lockdowns, which may not be relevant post-lockdowns.

Buying stocks on the way down

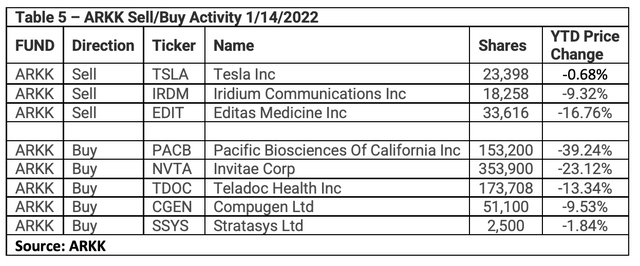

Cathie Wood’s active management in ARKK has been mystifying, as she doesn’t appear to know when the bottom will be reached, yet she continues to make stock purchases as they are still dropping.

Cathie Wood constantly makes multiple stock trades for ARKK and her other ETFs. Shown in Table 5 are the trades for ARKK on a single day, 1/14/2022. This chart shows that she sold 23,398 shares of TSLA, its sole company that had positive growth in the Top 10 Holdings in 2021.

Importantly, she bought significant numbers of shares of other companies, whose stock prices decreased an average of 20% in the past two weeks alone.

ARKK

What is disruptive innovation?

ARK defines ”disruptive innovation” as the introduction of a technologically enabled product or service that potentially changes the way the world works. But it doesn’t mean that these disruptive companies are and will be market leaders in the near or mid-term.

For example, Apple’s (AAPL) iPhone was a market disruptor when first introduced in 2007, yet its market share never reached more than 25%.

Cathie Wood’s inflation thesis

At the end of December 2021, Cathie Wood presented her analysis of the economy and philosophy on ARK Invest in a series of Tweets:

“In our view, fears of inflation will give way to confusion and fears of recession during the next three to six months. If so, the rapid growth rates of truly innovative companies, many of their equities maligned this year, should be rewarded handsomely.”

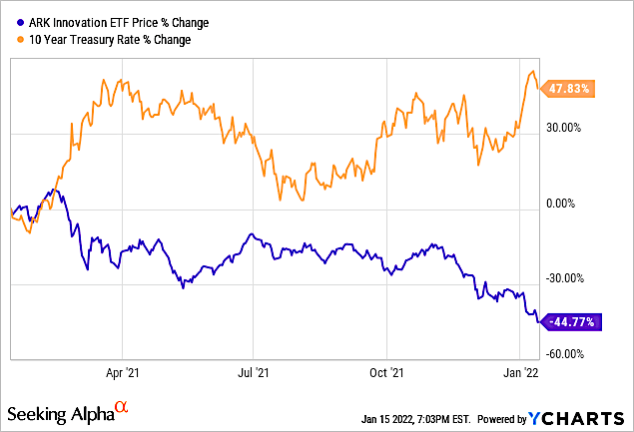

Meanwhile, yields for the 10-year Treasury note yielded 1.771% Friday afternoon, which means that yields have climbed by about 26 basis points in the first 10 trading days to start a calendar year, which would be the briskest such rise since 1992.

Chart 2 shows that ARKK Price % Change is inversely proportional to the 10-Year Treasury Rate.

YCharts

Chart 2

Final Thoughts

ARKK is 50% off its all-time trading peak, which took place on February 12, 2021. That means to get back to its peak the stock needs to increase 100%. Since it’s still falling, the time frame may be long for that to happen. The non-logical way Cathie Wood is managing this ETF is the exact reason capital outflows have been large.

I have shown the relationship of stock performance and the 10-year treasury yield. But that is strongly dependent on Fed action in 2022, and the uncertainty is great.

Now is not a time to buy ARKK, as there are absolutely no signs the bottom of these ARKK stocks has been reached. However, this ET,F as shown in Chart 1, has outperformed the S&P over the past five years by 2.6X. It may be worth holding but constant monitoring the performance and paying attention to the 10-year treasury is necessary.

Don’t rely on Cathie Wood. I go back to my opening sentence from The Wolf of Wall Street – “But we have to pretend we know.”

[ad_2]

Source link Google News