[ad_1]

Galeanu Mihai/iStock via Getty Images

For the second consecutive week, investors were net sellers of fund assets (including conventional funds and ETFs) redeeming $17.5 billion for the Refinitiv Lipper fund-flows week ended September 7, 2022.

Equity funds (-$12.9 billion) suffered the lion’s share of the net outflows this week as investors assessed the impact of the Federal Reserve Board’s strong commitment to fight inflation by aggressively hiking its lending rate—which has been a headwind for equities—the ongoing energy crisis in Europe, and a new COVID-19 related citywide lockdown in Chengdu, China.

The 10-year Treasury yield rose 12 basis points (bps) during the fund-flows week, settling at 3.27%, while the two-year yield closed unchanged at 3.45%. The 10- and two-year Treasury yield spread remained inverted, although narrowing to a negative 18 bps, but still providing recessionary signals.

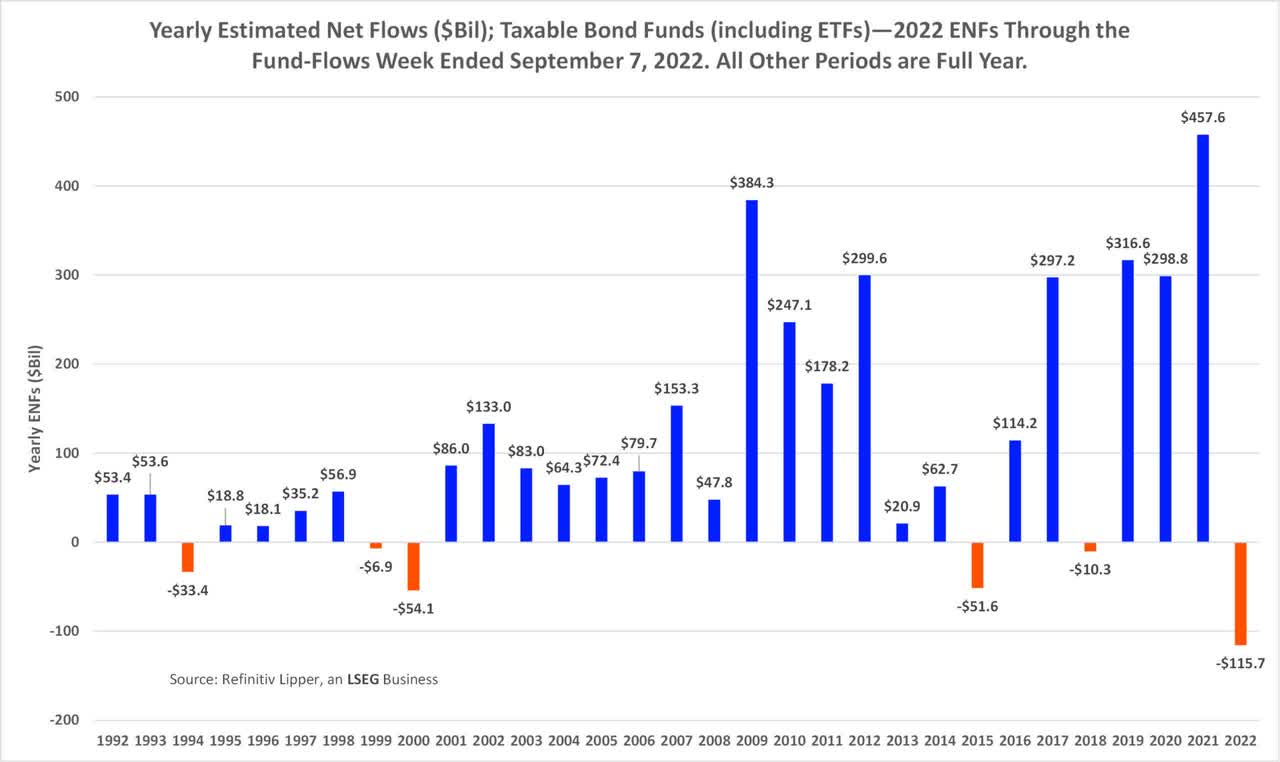

Keeping in mind that there is an inverse relationship between interest rates and bond prices, it’s not too surprising to see that the average taxable fixed income fund is down 9.41% year to date, with the 10-year yield rising 175 bps so far this year. As a result, investors have redeemed a record $115.7 billion from taxable fixed income funds through September 7, exceeding any full-year net outflows dating back to 1992 when Lipper began tracking weekly net flows.

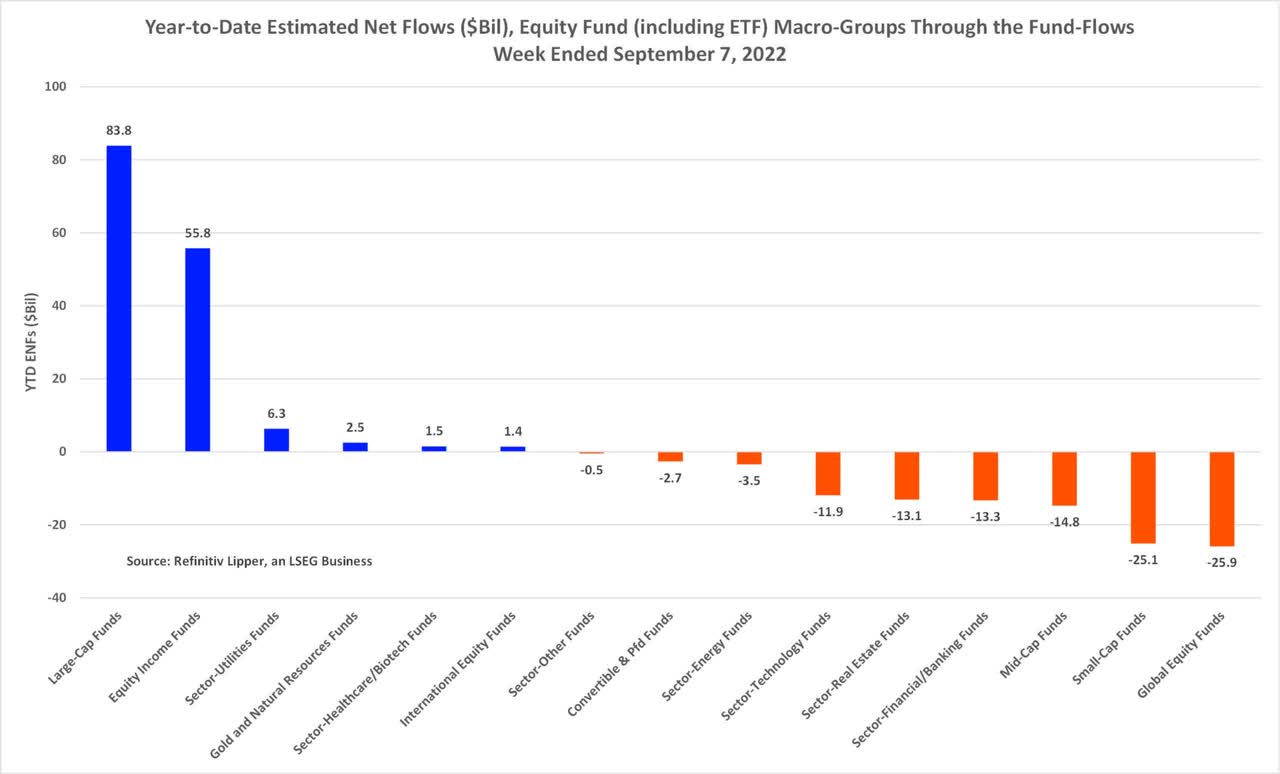

While inflationary fears, rising interest rates, the ongoing war in Ukraine, and lingering impacts from COVID-19 have kept investors at bay since the beginning of the year, investors remained in search of high-quality large-cap issues and dividend-paying securities to offset losses seen in both their fixed income and equity portfolios.

While the average U.S. Diversified Equity (USDE) Fund (including ETFs) is down 16.48% year to date, there is quite a dichotomy between the YTD losses seen by growth- and value-oriented funds. For example, the average Large-Cap Growth Fund is down a whopping 25.27% so far this year, while its Large-Cap Value Funds counterpart only suffered an 8.78% decline for the same period.

This makes sense as investors have punished the 2021 high-flying tech-oriented funds over the last eight-plus months, with the average Science & Technology Fund (-30.57% YTD) and Global Science & Technology Fund (-35.27% YTD) witnessing the largest losses in the equity funds universe. Investors have been searching for safety in large-cap dividend-payers that have solid balance sheets, low debt, and stable sources of earnings. While Mid-Cap Value Funds (-7.27% YTD) and Multi-Cap Value Funds (-8.18% YTD) have done the best job mitigating losses of the classifications in Lipper’s USDE macro-classification, U.S.-focused Equity Income Funds (-8.41%) came in a close third.

Equity Income Funds are defined as funds that, by prospectus language and portfolio practice, seek relatively high current income and growth of income by investing at least 65% of their portfolio in dividend-paying equity securities.

While the other three main assets classes—Money Market Funds (-$167.2 billion), Taxable Bond Funds (-$115.7 billion), and Municipal Bond Funds (-$83.9 billion)—have suffered net redemptions year to date, equity funds (including ETFs) have attracted a net $40.6 billion, with only select macro-groups being the recipients of investors’ assets.

The primary attractor of investors’ assets year to date was the large-cap funds macro-group, taking in a net $83.8 billion, followed closely by equity income funds (+$55.8 billion) and at a distance by sector-utility funds (+$6.3 billion). Global equity funds (-$25.9 billion) and small-cap funds (-$25.1 billion) were the equity universe macro-group pariahs.

In the large- and multi-cap classification space, the Vanguard Total Stock Market Index Fund, Institutional+ Share Class (VSMPX, warehoused in Lipper’s Multi-Cap Core Funds classification) attracted the largest YTD draw of net new money, taking in $276.7 billion, followed by Vanguard 500 Index ETF (VOO, +$33.3 billion), Fidelity 500 Index Fund (FXAIX, +$26.0 billion), and iShares Core S&P 500 ETF (IVV, +$18.2 billion), each housed in Lipper’s S&P 500 Index Funds classification.

On the equity income funds side of the ledger, Schwab US Dividend Equity ETF (SCHD, +$9.6 billion) took in the largest net inflows year to date, followed by Vanguard High Dividend Yield Index ETF (VYM, +$6.9 billion), iShares Core High Dividend ETF (HDV, +$5.0 billion), and T Rowe Price Equity Income Fund, I Share Class (REIPX, +$4.4 billion).

Despite the average equity fund recording just a 0.07% decline during the most recent fund-flows week, investors continued to duck for cover. They padded the coffers of the quasi-safe-haven macro-groups, with equity income funds attracting the only net inflows in the equity funds (including ETFs) universe, while government-Treasury funds (+$4.4 billion) and government-Treasury & mortgage funds (+$32 million) took in the only sums of net new money on the taxable bond funds side.

For the week, the outcasts of the equity asset class were large-cap and international equity funds (including ETFs), handing back some $5.8 billion and $2.3 billion, respectively. Meanwhile on the taxable fixed income side of the equation, corporate high-yield funds (-$2.3 billion) and flexible portfolio funds (-$1.1 billion) witnessed the largest net redemptions.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source links Google News