[ad_1]

rancho_runner/iStock via Getty Images

Investment Thesis

In my last article on the Invesco Aerospace & Defense ETF (NYSEARCA:PPA), I concluded that the fund was fairly valued and that the sector was benefiting from solid tailwinds. Since then, PPA gained ~5% vs. a loss of ~5% for the S&P 500 Index and provided better returns than the market. The war in Ukraine and the geopolitical tensions between China and Taiwan have greatly increased the prospects of the defense sector. We are now seeing a willingness from policymakers to increase defense budgets both in Europe and the US. As a result, I expect US defense stocks to grow earnings at a double-digit rate over the next five years thanks to a higher revenue growth rate and larger buyback programs. In terms of valuations, I believe the sector is fairly valued at the moment and investors should use market volatility to accumulate shares whenever PPA’s price dips below $70 per share.

What Has Happened Since My Last Article

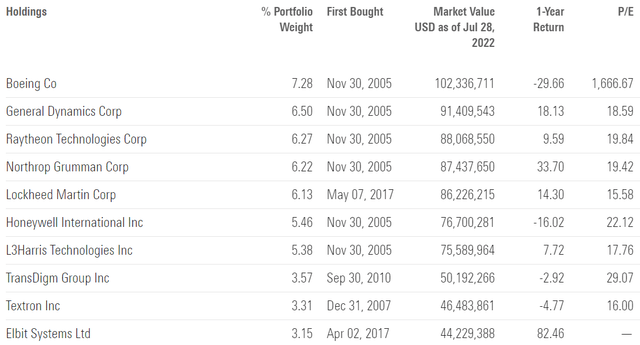

As a reminder, PPA tracks the Invesco Aerospace & Defense ETF, which invests in companies involved in the development, manufacturing, operations, and support of US defense, homeland security, and aerospace operations. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

Morningstar

I concluded my previous article with the following statement:

Given the solid tailwinds, I expect this sector to grow faster than the US economy over the next decade, which creates a compelling bullish investment case at the moment. PPA is in my opinion a great way to get exposure to this sector as it is well-diversified across constituents.

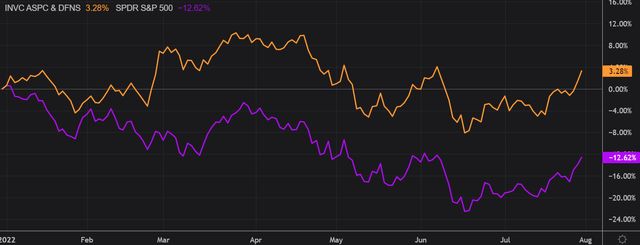

The defense sector held up very well against the backdrop of US equities so far this year. I have compared below PPA’s price performance against the SPDR S&P 500 Trust ETF (SPY) over the last 7 months to assess which one was a better investment. Since the beginning of the year, PPA is up by more than 3% compared to a loss of ~13% for the S&P 500. Not only has a strategy outperformed the market over the past seven months but it also provided lower volatility and drawdowns.

Refinitiv Eikon

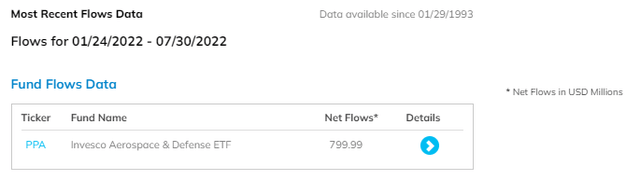

Investors have rewarded PPA by putting more money to work into this strategy. As a result, PPA registered ~$800 million worth of inflows since late January 2022, which represents over 50% of the fund’s latest assets under management.

FactSet

Geopolitical Risks Are A Tailwind For PPA

I believe the world is now sitting on a powder keg. Several hotspots such as Ukraine and Taiwan serve as a proxy for what a confrontation between the West and its adversaries could look like one day. In my previous article, I estimated that the US defense sector was growing at approximately 5% annually. However, the war in Ukraine has increased the pace of government spending on defense capabilities. In a great article from earlier this month, Foreign Affairs argues that the world is now entering the phase of the Great Rearmament. After the fall of the Soviet Union, defense spending wasn’t a priority for a large number of governments around the world. That said, we are now seeing a shift in policy with over 29 European countries pledging more than $200 billion in new defense funding. According to the European Commission, “investments will be needed to replenish the depleted stocks of military equipment”. It goes without saying that the main beneficiaries of this policy shift are defense contractors.

On top of that, the war in Ukraine is turning out to be a protracted conflict where the frontline has been stabilized. Ukrainians are showing no intention to make any concession to the Russian side in terms of territory and there are likely to fight as long as the West will supply them with military gear. As per NATO’s declaration, the mission of Western countries in the context of the war in Ukraine is not only to provide modern military equipment but also to assist with training and to help implement a long-term modernization strategy of the Armed Forces of Ukraine:

Special funding assistance will be required for long-term training and the modernisation of Ukrainian forces, de facto bringing them to NATO standards. This is necessary, as Ukrainian weapon stocks composed of Soviet-standards equipment are depleted, and availability of such arms outside Ukraine is limited too. Crowdfunding military equipment for Ukraine – already successful in Lithuania – shows that the general international public is sympathetic and wants to play its part in this process. To help Kyiv to counterbalance Russia’s size advantages and scorched earth tactics, Allies should consider more military exercises to show NATO’s readiness and strength.

While defense contractors are already benefiting from this conflict by providing weapons, the main tail risk in my opinion at the moment is an escalation of the conflict to the rest of the European continent. In that case, military spending will pick up rapidly, making defense companies the “big winners” of the geopolitical chaos.

Another hotspot worth paying attention to is Taiwan, where the Chinese government has made unification a top priority of the sitting CCP leader. While there is no military conflict as of today in that region, the Taiwanese government has made it clear that they are against reunification with China. This could ultimately lead to an armed conflict in the region. 2022/2023 seems like an interesting timeframe for the CCP to realize its political agenda given the midterm election in the US and the economic slowdown taking place around the world. Moreover, China has been engaging in grain hoarding in recent months, prompting many analysts to question the rationale behind this decision. In this context, Chinese defense spending rose at the fastest pace in three years, reaching nearly 7% YoY. Therefore, I expect the US defense spending to pick up proportionally in 2022 and subsequent years in order to put pressure on China’s ambitions in the Pacific.

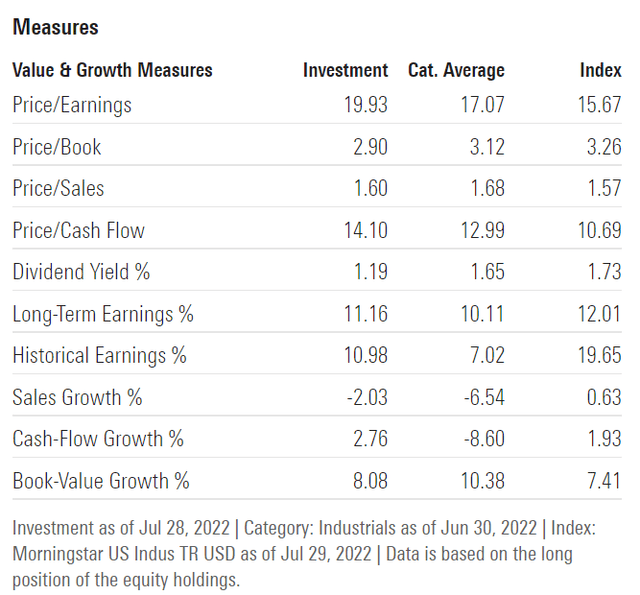

In my previous article, I argued that I feel comfortable buying this fund at close to 15x forward earnings. However, that was pre-war and I now believe that PPA deserves a premium given higher government spending and the tail risk of a world war. PPA now trades at ~20x earnings and has a price-to-book ratio of ~3. I believe the fund is fairly valued based on an estimated long-term earnings growth rate of 11% annually. If my investment thesis turns out to be true and defense spending picks up, it’s likely to see EPS growing at 12-16% over the next five years thanks to higher revenue growth rates and larger buyback programs.

Morningstar

Key Takeaways

PPA did relatively well compared to the market since my previous article. The fund outperformed the S&P 500 Index by more than 10 percentage points in one of the most volatile markets of the last 5 years. The war in Ukraine, as well as geopolitical issues in Taiwan, have considerably improved the defense sector’s potential. Policymakers in both Europe and the United States are now willing to spend more on their military. As a result of faster revenue growth and larger buyback plans, I anticipate US defense firms will grow earnings at a double-digit rate over the next five years. In terms of valuation, PPA remains fairly valued, and investors should take advantage of market volatility to purchase shares anytime PPA’s price falls below $70 per share.

[ad_2]

Source links Google News