[ad_1]

adrian825/iStock via Getty Images

Investment Thesis

Ensuring the growth of the U.S. semiconductor industry is a matter of national security. At least, that’s how Congress sees it with the passage of the CHIPS Act and the consideration of the FABS Act. These two pieces of legislation, supported by members on both sides of the aisle, are crucial in light of a semiconductor shortage that will persist until next year. However, in 2022, shares of the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ) have slumped 21.38% YTD, bearing the brunt of a much more broad tech selloff this year.

I find this dynamic fascinating because, unlike SOXQ’s high-growth tech peers, it trades at an attractive valuation of just 19.19x forward earnings. That’s more in line with the valuations for large-cap value ETFs and a key reason I think U.S. semiconductor stocks are an incredible deal at today’s prices. Therefore, I rate SOXQ as a strong buy, and I will also provide details on five other semiconductor ETFs worth considering.

ETF Overview

Strategy

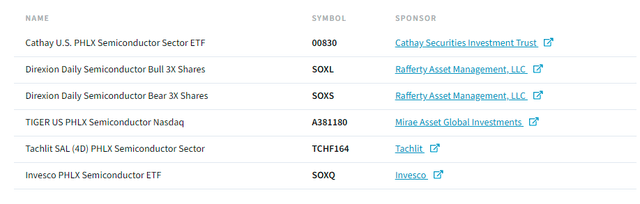

SOXQ tracks the PHLX Semiconductor Sector Index, selecting the 30 largest companies involved in producing and selling microchips, computers, and network equipment. The Index is modified-market-cap-weighted and requires constituents’ trading volumes to be at least 1.5 million in each of the six months preceding the reference date. Nasdaq lists the following products linked to the SOX Index.

Nasdaq

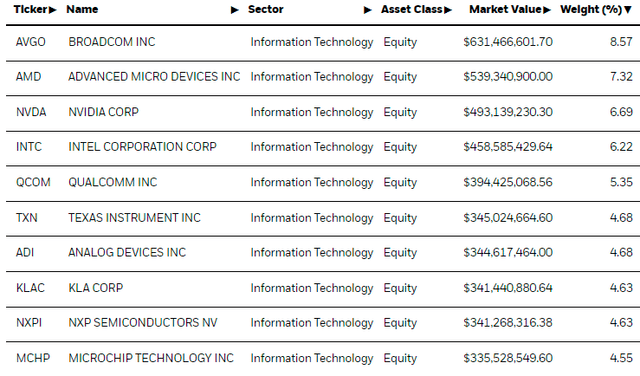

The SOX Index selects constituents annually in September and rebalances quarterly in March, June, September, and December. SOX’s two-stage weighting process ensures that no security has an allocation above 8%, and only five have an allocation above 4%. As you’ll see, 12 companies exceed this 4% constraint, so investors can expect this to correct when the Index rebalances next month.

Performance

The Index has a split-adjusted base value of 100 commencing on December 1, 1993, and a current value of 2,994.61. Therefore, annualized returns are approximately 12.67% compared to 10% for the S&P 500 Index. However, it comes with higher volatility, so it’s not for everyone.

SOXQ launched on June 9, 2021, so it doesn’t have much history. However, that shouldn’t dissuade you since there are four other U.S. semiconductor ETFs you can reference, plus another one that takes a global approach. I’ve listed them below and will provide a fundamental summary for them all shortly.

- First Trust Nasdaq Semiconductor ETF (FTXL): Multi-Factor, Factor-Weighted

- iShares Semiconductor ETF (SOXX): Vanilla, Market-Cap-Weighted

- Invesco Dynamic Semiconductors ETF (PSI): Multi-Factor, Tiered Weighting

- SPDR S&P Semiconductor ETF (XSD): Equal-Weighted

- VanEck Vectors Semiconductor ETF (SMH): Vanilla, Market-Cap-Weighted

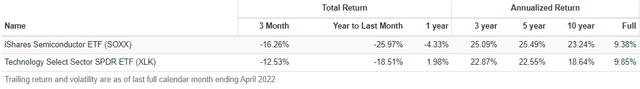

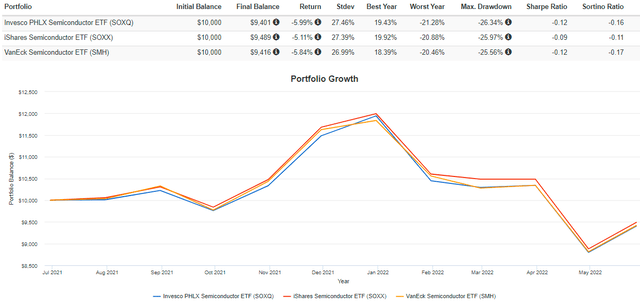

SMH is the globally-focused choice, with Taiwan Semiconductor Manufacturing Company (TSM) as the top holding. However, to gauge SOXQ’s risk and return profile, we can reference the returns of SOXX. Before SOXQ launched, SOXX tracked the same Index, and returns of the two ETFs have been near-identical since. One key difference is that SOXQ’s expense ratio is 24 basis points less.

Portfolio Visualizer

The graph above shows that SOXX tracked the Technology Select Sector SPDR ETF (XLK) over the long run pretty well, albeit with higher volatility. However, in the last ten years, SOXX outperformed by an annualized 4.60% (23.24% vs. 18.64%). I think these recent results are more relevant given how the semiconductor chip shortage has persisted since around 2019, and SOXX continued to perform well despite the uncertainty.

Portfolio Visualizer

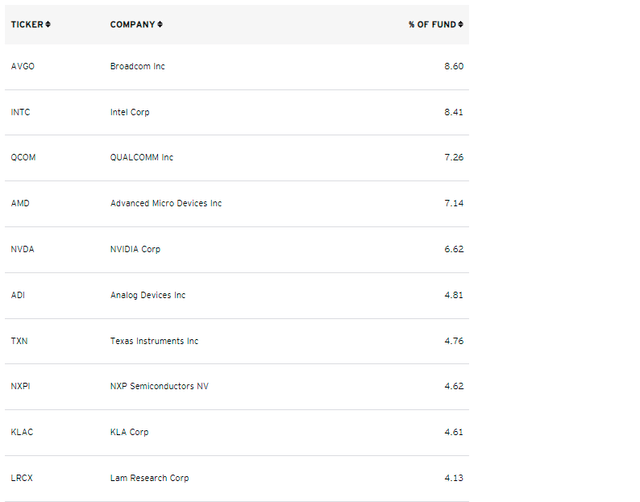

Top Holdings

SOXQ’s top ten holdings are listed below, which include Broadcom (AVGO), Intel (INTC), and QUALCOMM (QCOM).

Invesco

For reference, SOXX has a similar top ten holdings list, though with different weights. One change is that SOXQ includes Lam Research (LRCX) instead of Microchip Technology (MCHP) in the top ten, but otherwise, it’s very similar.

iShares

Fundamental Analysis

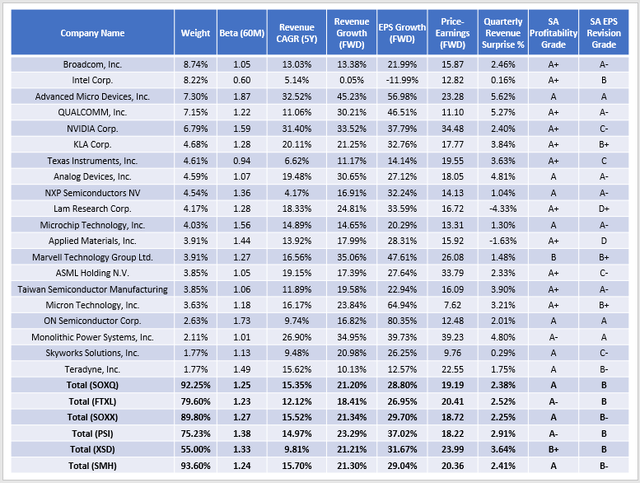

The table below highlights selected fundamental metrics for SOXQ’s top 20 holdings. At the bottom, you’ll find the summary metrics for the entire fund and summaries for the five other semiconductor ETFs mentioned previously.

The Sunday Investor

There are a few points I’d like to discuss:

1. Profitability is a priority for me regarding risky assets. Using Seeking Alpha’s Profitability Grade as a guide, SOXQ, SOXX, and SMH all have “A” Grades with about the same concentration level in the top 20 holdings. The three ETFs also have nearly identical betas, revenue growth, earnings growth, and forward price-earnings ratios. From this perspective, there isn’t much difference between the three. These findings validate why their historical results are almost indistinguishable.

Portfolio Visualizer

2. 90% of SOXQ’s top 20 holdings had a positive revenue and earnings surprise last quarter. SOXQ’s weighted-average revenue surprise of 2.38% slightly surpassed what Yardeni Research reported for large-cap S&P 500 technology stocks. More importantly, earnings surprises improved on Q4 2021’s figures, breaking a three-quarter downtrend. As I wrote recently in my analysis of the Invesco QQQ ETF (QQQ), this earnings season wasn’t nearly as bad as you might have thought, and there are reasons for optimism.

3. Wall Street has taken a more optimistic view of semiconductor stocks. SOXQ, FTXL, PSI, and XSD all have a Seeking Alpha EPS Revisions Grade of “B” compared to “B-” for SOXX and SMH.

4. SOXQ’s weighted-average forward price-earnings ratio of 19.19 is the third-lowest, and it’s much cheaper than 25.61 for the Technology Select Sector SPDR ETF (XLK). That’s a nice valuation buffer and a reason why I think it’s one of the better tech plays. SOXQ’s 0.19% expense ratio is also the cheapest. XSD and SMH cost 0.35%, SOXX costs 0.43%, PSI costs 0.56%, and FTXL costs 0.60%.

Incentivizing Chipmakers: Aid Is On Its Way

CHIPS For America Act

Financial assistance is coming to the U.S. semiconductor industry soon. The Creating Helpful Incentives to Produce Semiconductors, or CHIPS Act, was passed in January 2021, but no funding was authorized at the time. The Act (Section 9902) requires an entity to apply to receive Federal financial assistance for investments in semiconductor equipment and manufacturing facilities if the entity:

- has a documented interest in constructing, expanding, or modernizing a semiconductor manufacturing facility

- has made commitments to worker and community investment through training, education benefits, and programs meant to expand employment opportunities for economically disadvantaged individuals; and

- has an executable plan to sustain the facility after Federal financial assistance ends

Here is a brief timeline of events since:

1. On June 8, 2021, the U.S. Senate passed the US Innovation and Competition Act, or USICA, 68-32, which would provide a $52 billion boost to the semiconductor industry.

2. On January 13, 2022, a group of business leaders and academics wrote a letter to members of the New York Congressional Delegation, reading, in part:

We urge you to pass the U.S. Innovation and Competition Act (USICA), which, among other things, would fully fund the Creating Helpful Incentives to Produce Semiconductors for America Act (CHIPS Act).

3. On February 4, 2022, the U.S. House of Representatives passed the United States Innovation and Competition Act of 2021, or USICA (H.R. 4521), by a vote of 220-210, with only one member from each party jumping the aisle. This competing piece of legislation appropriates approximately $50 billion in financial assistance through 2026, as follows:

- $24 billion in fiscal 2022

- $7 billion in fiscal 2023

- $6.3 billion in fiscal 2024

- $6.1 billion in fiscal 2025

- $6.8 billion in fiscal 2026

4. On March 28, 2022, the Senate passed the House version with amendments, and Congress is currently working on creating a final version to send to President Biden.

5. On May 4, a motion to reinstate a Research & Development tax credit was overwhelmingly approved in the Senate by a roll call vote of 90-5. The credit was eliminated in 2017 to help offset a drop in the corporate tax rate but didn’t go into effect until this year. During the legislative session that day, China was mentioned 64 times, suggesting lawmakers’ intention to frame this as a national security issue. China responded by criticizing the Act for its “cold war mentality.” Nevertheless, it’s likely to pass sometime soon, and you can expect China to ramp up the pressure on U.S. chipmakers in the meantime. That should create extra volatility in the market, but I think it will mostly be short-term noise best ignored.

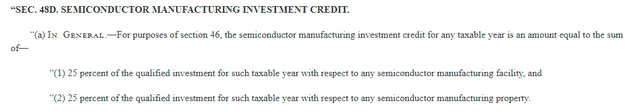

FABS Act

Congress is also considering the Facilitating American-Built Semiconductors (“FABS”) Act. Though introduced on June 17, 2021, no legislative actions have been taken since. However, it seems that while the CHIPS Act would provide direct subsidies, the FABS Act provides tax credits as described below:

Congress.gov

Also worth noting is the existence of an R&D Coalition with Intel’s chief serving as Chair. Initially, the group’s mission was to change the tax code to incentivize more R&D domestically. Now that the R&D tax credit restoration is virtually a sure thing, the group has expanded its objectives to include changing how R&D expenses are amortized. As it stands today, firms will be required to amortize R&D expenses over five years beginning in 2022 rather than deducting them all in the same year they were incurred, thus significantly diminishing the benefit.

Investment Recommendation

The U.S. semiconductor industry is the most attractive tech industry to me. It trades at a six-point discount on forward earnings compared to XLK, has a 21% estimated revenue growth rate, and a nearly 30% estimated earnings per share growth rate. Most companies are highly profitable, analysts are revising estimates upwards, and the industry is poised to receive financial assistance through subsidies and tax credits. Congress has decided that securing domestic chip production is a national security issue, and that should be bullish for the industry going forward.

Investors have six semiconductor ETFs to choose from, but SOXQ is the cheapest and has the best profitability, valuation, growth, and volatility. Owners of other ETFs like SOXX may want to consider switching, but only if it’s done in a tax-efficient manner. The differences are only slight, and there’s no guarantee SOXQ will outperform despite the lower fees.

Thank you for reading, and I look forward to discussing this further in the comments section below.

[ad_2]

Source links Google News