[ad_1]

I am not a fan of ETF investing. I think market-cap weighted fund readjustment that buys shares high and sells low is not a good recipe for investment. ETFs and CEFs do have their benefits, such as diversification and ease, but they are by definition not going to beat the underlying indices. We have spent the effort and energy to come to this site to read and write in order to achieve Alpha, the investment returns above what we could expect from the market at large (Wins Above Replacement for a baseball approach). My preferred way of doing this is by researching and buying shares of undervalued singular companies/stocks, reinvesting the dividends, and either trimming when it appears overvalued or holding for the long term.

Depending on your specific account, your investing style may change. For example, in my work-sponsored retirement account we can only choose from mutual funds or ETFs, and are limited to a small number of adjustments per year. In that fund, I simply contribute to, hold, and DRIP shares of the Vanguard Institutional Index Fund (VIIIX). It is the only choice available to me that is not a low return, high expense ratio, proprietary piece of garbage. My Roth IRA consists of a handful of stocks that I feel confident enough to hold for the long term. This includes stocks like Digital Realty Trust (DLR), Dominion Energy (D), and Bristol-Myers Squibb (BMY). My taxable brokerage account is more for regular additions and swing trading good deals. Sometimes this involves frequently buying and selling Preferred Apartment Communities (APTS) or long-term holding New Residential Investment (NRZ). These are faster, nimbler trades that are based on clear information about the underlying business that is impossible to do with an ETF that has many holdings.

It would be foolish to dismiss all ETFs and closed-end funds without checking in from time to time to see if one suddenly becomes an attractive investment despite its inherent shortcomings. This week I looked at the Invesco KBW Premium Yield Equity REIT Portfolio ETF (KBWY) due to the amount of attention that it receives, the decent yield and the fact that, on paper, the name of the fund closely aligns with some of my usual investment targets.

Image from finviz.com

This fund targets smaller, “undervalued,” higher dividend yielding stocks. A recent article by Jussi Askola titled Why You Probably Shouldn’t Buy VNQ shows that small-cap stocks usually trade at about a 12x price to funds from operations multiple and large-cap stocks trade around 20x FFO. This then would suggest that the best places to target risk-adjusted investment returns lie within the underdogs and not the established winners. KBWY, therefore, looks promising in its investment goals.

On April 4, 2018, popular contributor Rida Morwa wrote an article about KBWY and recommended this fund. I summarized his bullish stance into the following bullets:

-

Exposure to real estate

-

Monthly high yield and growth

-

Small-cap value approach

-

Diversification

-

Upside of top holdings

We’ve already covered point #3, and agree with Rida that small-cap value is usually a great way to go. Listing diversification and exposure to real estate holdings as reasons to invest is not necessarily valid in my opinion. Virtually every ETF by definition provides diversification and since there are many funds that target real estate, such as the Vanguard Real Estate ETF (VNQ), I don’t think that separates KBWY from the pack.

Monthly High Yield and Growth? Upside? Nope.

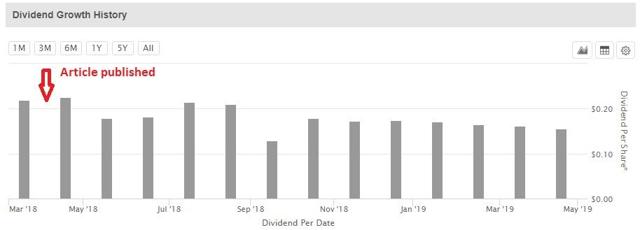

At the time of his article, KBWY was yielding 8.8% versus 4.8% for VNQ. This is a significant difference, and coupled with the fact that the dividend looked promising and had not yet begun its horrific march downward, I would have been interested as well.

Image from Seeking Alpha

Rida was right when he said that the irrational sell-off taking place in response to rising interest rates was creating a good opportunity for investing in real estate. KBWY also is not market-weighted like VNQ, which would be selling these undervalued assets, but is yield-weighted, and would be scooping up these good deals. The problem is that the high-yield, small-cap stocks were riddled with “sucker yields” and not “fallen angels”:

Image from Rida’s article, itself sourced from KBWY’s website

Those top-5 holdings are all ugly ducklings and I recently wrote on why I dislike Gladstone Commercial Corp. (GOOD). Some of these names were paying out above 100% AFFO, some still are, and some have since reduced their dividend.

Image from Yahoo Finance

Given the above performance of the top holdings since that time, it’s no wonder KBWY wasn’t able to appreciate in price and has been reducing the payout.

Let’s look at the price and dividend performance of KBWY and VNQ since April 9, 2018:

Image from Yahoo Finance

On April 9, VNQ closed at $74.66

KBWY closed at $31.31

Since then,

$3.44 in dividends for VNQ

$2.32 in dividends for KBWY

VNQ: $11.82 price appreciation + $3.44 in dividends = $15.26 gain, or 20.4% total return

KBWY: -$0.14 price appreciation + $2.32 in dividends = $2.18 gain, or 6.96% total return

For comparison, SPY total return during that period was 14.37%

KBWY is currently yielding 6.19% with a fairly steadily declining dividend

VNQ is currently yielding 3.94%

So, while the yield is higher than the average REIT investor’s de facto benchmark, it is by no means a source of growth, and declining dividends is the opposite of a tried and true DGI strategy popular with retirees or income seekers. Also, I don’t think I’m being hypocritical as a holder of the Exchange Traded Note MRRL, because its slight price and payout depreciation over the years are immensely compensated by the 21+% dividend yield. In that case, I am fine with depreciation because I’m being amply rewarded with an insane cash flow and doubling my holdings every 3.5 years. A 6.2% yield, on the other hand (8.8% when Rida’s article was published) is about the same as you’d get by buying EPR Properties (EPR) on a dip, which is both monthly-paying and an actual source of growth. But why would you want to di-worse-ify into these names along with it:

Image from KBWY website

So, things look just as ugly now as they did a year before. Uniti Group (UNIT) had a high-profile court-assisted implosion resulting in a dividend cut from $0.60 a quarter to $0.05. New Senior Investment Group (SNR) is still on the list and struggling, recently cutting its dividend from $0.26 per quarter to $0.13. Global Net Lease (GNL) still can’t cover its dividend, City Office REIT (CIO) is horrendously leveraged and uses bizarre accounting metrics like debt/EV, and Whitestone REIT (WSR) has accounting problems with the SEC.

Some holdings are okay or are improving such as Pennsylvania Real Estate (PEI) and Kite Realty Group (KRG), but why go through the trouble of owning some of the riskiest stocks you can find just to achieve a 6.2% (and falling) yield?

Summary

The interesting concept of targeting abnormally high historic yield for your fund’s holdings could work with more established blue chips, and was exactly how I was able to scoop up shares of established winners DLR at $101 and D at $64. However, when you do the same approach with small-cap stocks you have a higher chance of getting sucker yields and bankruptcy risks. KBWY should be avoided at all costs. Its past and current holdings should be a red flag to investors everywhere.

While I will continue to avoid ETFs in general, I realize that this specific ETF is not representative of the majority of the products out there. I just want to point out that with a little more effort and research, you can do your own diversification and bargain-shopping without taking on the unnecessary risks.

Disclosure: I am/we are long APTS, BMY, D, DLR, MRRL, NRZ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News