[ad_1]

Welcome to another chapter in my series of dividend stock ETF investing. After analyzing primarily U.S.-based funds of the kind, I now turn my attention to an investment vehicle focused on international shares: the iShares International Select Dividend ETF (IDV).

According to the issuer, this ETF “tracks the investment results of an index composed of relatively high dividend paying equities in non-U.S. developed markets.” Among the top three holdings in the fund are British American Tobacco (BATS), Commonwealth Bank of Australia (OTCPK:CMWAY) and Royal Dutch Shell (RDS.A)(RDS.B), together accounting for about one-tenth of the ETF’s total assets under management. In what pertains to geographic representation, the U.K. accounts for nearly one-fourth of the fund. Meanwhile, Australia, Italy and France combined add up to another one third of the total allocation.

Credit: Kiplinger

I have repeatedly argued that “dividend payers have clearly outperformed non-dividend payers over a very long period time, having achieved the feat with even lower volatility” – at least in the United States. This is particularly relevant for growth investors, as income seekers probably need little extra incentive to be interested in dividend stocks.

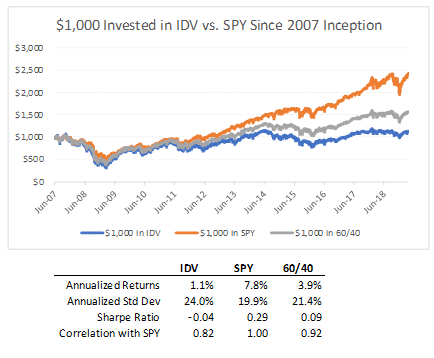

One of the potential benefits of investing in international shares is that they might be able to help a U.S.-heavy portfolio better diversify its equities position. To assess this feature using historical data, I compared the performance of IDV with that of the S&P 500 (SPY) and of a portfolio made up of 60% domestic stocks, 40% international shares since mid-2007. The results are depicted below.

Source: DM Martins Research, using data from Yahoo Finance

Source: DM Martins Research, using data from Yahoo Finance

Evident from the graph and table above, international stocks have historically produced significantly lower returns than domestic stocks in the past 12 years. The under performance did not come to the benefit of lower risk, as IDV’s average annual volatility of 24.0% has topped the S&P 500’s less erratic 19.9% since 2007. In addition, the international ETF experienced a gut-wrenching peak-to-trough drop of 65% in market value during the Great Recession, compared to a horrible but much less concerning 51% pullback in the S&P 500.

But past performance is not always indicative of future results. There’s a material chance that foreign equities could do better than U.S.-based ones going forward. In fact, currency helps to explain the unimpressive returns of international stocks in the past several years, while the same FX dynamic might not necessarily repeat in the future. See graph below depicting the 2%-per-year drop in the value of the Euro relative to the U.S. dollar since the start of 2008.

Source: macrotrends

What I find most discouraging instead is that the correlation between international and domestic stocks has been pretty high, at 0.82. This is probably the result of a more globalized business environment, in which companies have become much more exposed to some of the same macroeconomic factors, regardless of where they happen to be domiciled. Therefore, international dividend stocks have not been as effective of a portfolio diversification tool as I would have hoped them to be.

Is there any compelling benefit?

With diversification abilities and past performance not looking so good for IDV, I ask myself in what way an investment in this or a similar ETF might make sense. For example, high-yield investors may appreciate that IDV is a robust dividend distributor, boasting a 30-day SEC yield of 5.1% that makes most U.S.-based ETFs look wimpy.

But a few caveats are worth mentioning here. First, IDV’s management fee of 0.50% is a bit too high compared, for example, to its U.S. high-yield stock counterpart SPDR Portfolio S&P 500 High Dividend ETF (SPYD) — by 43 bps, to be precise. So IDV’s 80-bp yield advantage over SPYD falls by about half once fund expenses are taken into account.

Second, and particularly worrisome for income seekers domiciled in the United States, IDV’s dividend distribution is relatively unpredictable, probably a consequence of currency fluctuations. Since 2Q17, the ETF has made quarterly payments to shareholders ranging from $0.26/share to $0.61/share, suggesting a 30-day dividend yield that has dropped to as low 3.1% in the past couple of years (but also risen to as much as 7% around the end of the second quarters of each year).

Those who rely a bit more heavily on steady income payments, therefore, may understandably become frustrated by this ETF’s distribution volatility.

Last few words

It has become clearer to me that the drawbacks of investing in a dividend-paying international stock ETF probably outweigh the benefits of doing so, especially for U.S.-based investors. The key desirable feature of IDV, namely its high yield, is partially offset by higher management fees. For similar distribution volume, I believe an investment in a domestic fund like SPYD might make more sense.

International stocks could conceivably perform better than domestic issues in the future, unlike what has happened in the past 12 years at least. But with those superior results far from being a guarantee and correlations between U.S. and foreign stocks approaching a peak, it becomes harder to make a compelling argument in favor of investing in IDV.

I do not own IDV because I believe I can create superior risk-adjusted returns in the long run using a different strategy. To dig deeper into how I have built a risk-diversified portfolio designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News