[ad_1]

Bet_Noire/iStock via Getty Images

Article Thesis

With inflation running at a multi-decade high, bonds are not a great place to hide. Equities or real assets, such as real estate, seem like more appropriate investments in times like these. Individual stocks can still suffer from inflation, e.g. if consumers spend less on certain goods or if higher input costs can’t be passed on to consumers. In this article, we’ll take a look at the connection between inflation and equity returns and what it means for investing in the S&P 500 (SPY).

How Does Inflation Impact The Stock Market Overall?

Inflation measures the change in the prices for consumer goods, services, etc., and thus maps the loss of value of money. Inflation has generally been relatively benign for the last couple of decades, as the Fed has been able to keep price changes more or less in line with its 2% target. In 2021, however, inflation has accelerated massively, hitting as much as 7% in December — the highest level in more than 30 years. This was caused by several contributing factors, among them rising energy prices, rising transportation costs, and increasing wage pressure.

With inflation running at way higher levels than 2%, buying bonds that offer yields of 1%-2% seems like a pretty bad idea, as net losses in real terms are more or less guaranteed.

Stocks have a better chance at withstanding inflation, however. Since equities represent ownership in companies and their respective assets (brand value, factories, inventory, equipment, machinery, real estate, etc.), they are oftentimes seen as a hedge against inflation. And they do, in fact, tend to outperform bonds and other fixed-rate assets during times when inflation is high. Not only do the assets that the companies own rise in value, but companies can ideally also expand their profits.

Let’s look at an example: Let’s say a company manufactures a phone for $250 and sells it for $400, making for a $150 profit. If inflation of 10% causes the company to incur an in-line 10% rise in expenses (material, labor, …), expenses climb to $275. If the company pushes hikes the price of its phone by 10% as well, in line with general inflation, the sales price climbs to $440. The profit, in this simple scenario, climbs to $165 — 10% more than before inflation played a role. In real terms, the company’s profit has thus remained stable — the company did neither benefit nor suffer from inflation.

Not every company is able to push through higher input costs, of course, thus this example does not hold true for every company in the market. On the other hand, some companies that have locked in input costs might be able to push through price increases nevertheless, thereby expanding profit margins.

Equities thus offer some inflation protection, but some studies indicate that equities do, overall, not generate perfect inflation protection. Of course, there are many other contributing factors that play a role in equity returns, such as real GDP growth (which is high right now), Fed policy, and so on.

Are Stocks Good During Inflation?

Stocks tend to offer some inflation protection, and they are thus a better pick compared to bonds, cash, etc. during times of inflation. With bonds, there’s a solid chance of positive real returns, whereas holding cash that loses 3%, 5%, or 7% of its value every year is not offering a chance for positive returns at all.

Not all stocks perform equally well during times of inflation, however. Some industries offer well-above-average inflation protection, such as energy (XLE), mining (XME), real estate (VNQ), which makes them especially suitable for an investment environment where inflation is at a high level. Commodity producers benefit from increasing commodity prices, leading to higher profits. The real estate owned by REITs rises in value while their debt gets inflated away, making them winners in an inflationary environment. Likewise, other owners of already-paid-for real assets, such as infrastructure companies (pipelines, terminals, power plants, and so on) also benefit from the same principle — their assets grow in value, while their usually sizeable debt gets inflated away.

Being in stocks from these industries thus offers above-average inflation protection, compared to other stocks that can’t pass on higher costs as easily (retail, food services, etc.).

What Does Inflation Do To The S&P 500?

The S&P 500 index does represent ownership in a wide range of US equities. In general, the principles that make equities a better pick during inflationary times hold true for this index as well, although it should be noted that the inflation impact is not equal for all S&P 500 constituents.

There’s a notable distinction between how value stocks (VTV) and growth stocks (VUG) tend to perform during times of high inflation. Value stocks, with low growth and high current cash flows, generate the majority of their future earnings in the foreseeable future. Growth stocks, with high growth but low or no current profits, will generate the majority of their future profits many years in the future. Higher inflation forces central banks to act, usually by raising interest rates or withdrawing monetary stimulus. This results in higher discount rates, which naturally have a larger impact on growth stocks due to the fact that their profits are further in the future. This leads to value stocks usually outperforming during times of higher inflation and rising interest rates, while growth stocks perform better during times of lower inflation when interest rates are low or declining.

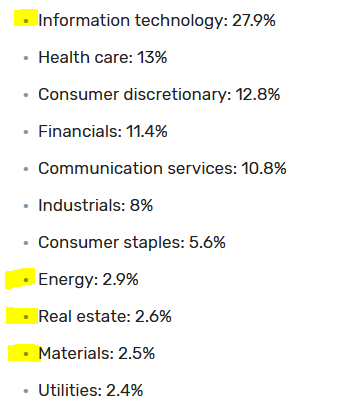

The S&P 500 contains both value and growth stocks, of course, although it has a relatively high allocation to industries such as tech (XLK) or communication services (FCOM), which are generally growth-heavy. Current S&P 500 weights look like this:

S&P 500 sector weight

thebalance.com

We see that industries with above-average inflation protection, such as energy, materials, and real estate, make up small portions of the index, at less than 3% each, respectively. On the other hand, the growth-heavy tech industry makes up more than one-fourth of the overall index.

One could thus argue that the S&P 500, due to its large growth allocation, provides somewhat weaker inflation protection compared to a more equal-weighted equity portfolio. Still, the S&P 500 will offer superior inflation protection and long-term performance compared to most non-equity assets, including bonds/fixed income and cash.

Is SPY A Good Choice During Inflation?

If one wants to invest purely for inflation protection or seeks to maximize returns in a scenario where inflation remains high or rises further, SPY is not the best choice. In that scenario, a higher allocation to inflation beneficiaries such as energy or real estate would make sense. One could also argue that a higher weighting of finance names could be a viable choice, as the Fed’s interest rate increases will lead to expanding net interest margins for most banks.

Most investors do not want to position their portfolios for a pure inflation play, however. Since the SPY still provides reasonable inflation protection compared to non-equity alternatives, while also providing a lot of diversification that helps with different types of macro crises, the SPY does not seem like a bad investment choice.

For those that seek especially strong inflation protection, SPY is not ideal, but it still seems like a very reasonable investment choice for someone seeking broad-based exposure to US equities. It can be expected that SPY will perform well in the long run, and investors should consider that the ETF’s very low fees are an advantage versus most smaller, more specialized ETFs that usually have higher fees.

Is SPY ETF A Buy, Sell, Or Hold?

The SP 500 index is trading for around 19.5x this year’s expected net profit, based on forecasted EPS of $225, per Yardeni. This isn’t a low valuation, but it also is not ultra-expensive. The US economy is recovering well from the pandemic, and with economic growth coming in at a surprisingly high level in Q4 2021, it seems possible that we will see further upward revisions to current EPS estimates for the S&P 500. The SPY also offers a dividend yield of 1.3% right now — arguably at the low end of the historic range.

The outlook for the economy is solid, and valuations aren’t extremely high, but on the other hand, there’s a lot of uncertainty about the market’s direction over the coming weeks and months. Interest rate worries have led to significant volatility in the S&P 500 index and individual equities, and it might be a good idea to wait and see how things shake out before entering the SPY.

I do believe that investors who hold SPY will do reasonably well in the long run, but the broad index is not cheap enough to make SPY an outright screaming buy.

[ad_2]

Source links Google News