[ad_1]

Marco VDM/E+ via Getty Images

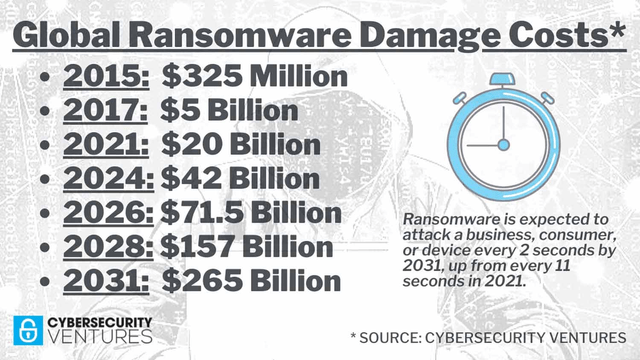

Among the most popular thematic investing plays is cybersecurity. Consider that Cybersecurity Ventures estimates that global ransomware damage costs will exceed $250 billion by 2031. Compare that to 2021’s total of just $20 billion. Clearly, this niche will play a critical role in future business security.

A Booming Industry

Cybersecurity Ventures

There are a few ETFs that track baskets of tech-related services firms in the industry. The iShares Cybersecurity and Tech ETF (NYSEARCA:IHAK) seeks to track the investment results of an index composed of developed and emerging market companies involved in cybersecurity and technology, including cybersecurity hardware, software, products, and services, according to iShares. It’s benched to the NYSE FactSet Global Cyber Security Index.

While “emerging market” is in the iShares description, you’ll find many now-household domestic I.T. companies in the fund. CrowdStrike (CRWD), Fortinet (FTNT), Zscaler (ZS), Palo Alto Networks (PANW), and Check Point Software (CHKP) are just a handful of the top holdings. The Information Technology sector comprises 87% of IHAK while Industrials represents 13%. This fund is certainly a play on tech and duration, so should interest rates rise further, you might see losses in this rate-sensitive area as it pays a scant 0.23% SEC yield.

On valuation, IHAK sports a P/E ratio of 24x, per iShares as of July 11. Volume and liquidity are trading characteristics to consider – IHAK’s 30-day average volume is just 70,000 shares and its 30-day median bid/ask spread is 0.11 percentage points.

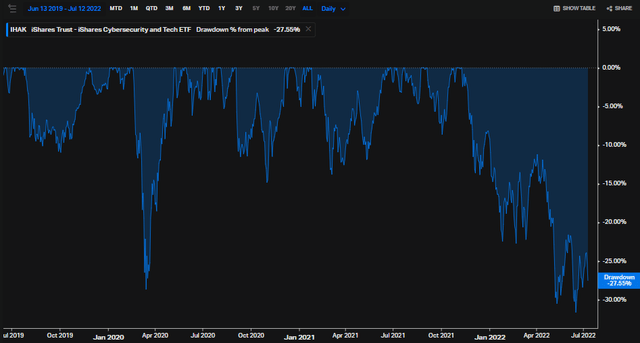

It has been a rough go of it for investors in IHAK and similar cybersecurity plays, such as the HACK ETF. IHAK is down almost 28% from its November 2021 peak amid a broad sell-off in everything that is tech and software.

IHAK’s 28% Plunge Off The November 2021 All-Time High

Koyfin Charts

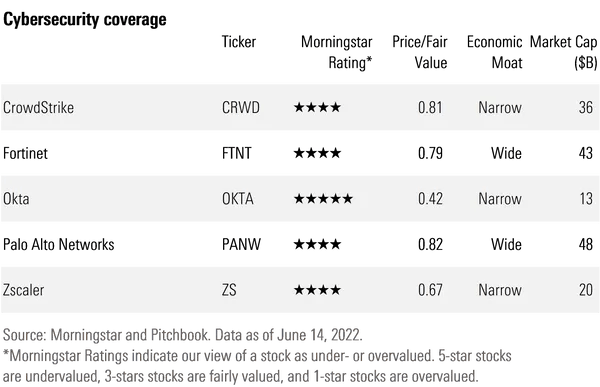

There might be hope, though. In a June 2022 review of cybersecurity stocks, research firm Morningstar concluded that four of IHAK’s highest-weighted holdings earned a four-star rating. Okta (OKTA), IHAK’s fifth-biggest position, even garnered a five-star rating.

Morningstar’s Take: Cybersecurity Stocks Undervalued

Morningstar

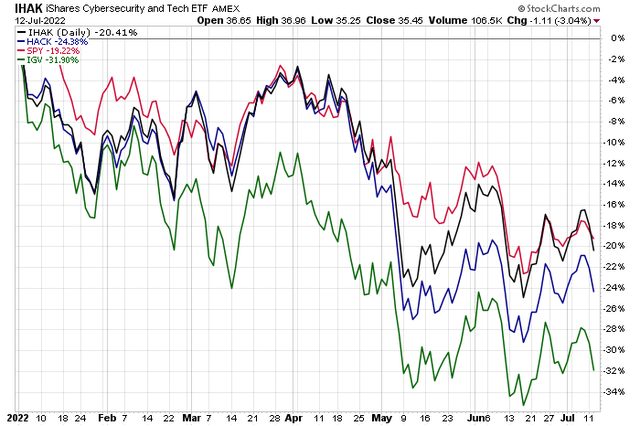

In terms of performance so far this year, IHAK is not doing all that bad. Consider that the fund’s 20% loss is about on par with the broader S&P 500, and it’s outperforming the more well-known HACK ETF by about 4 percentage points in 2022. Moreover, the cybersecurity space beats the Tech & Software ETF (IGV) by a whopping 11.5% YTD. So, IHAK is an area of relative strength despite being in a bear market of its own.

2022 Performances: IHAK Beats HACK and IGV

StockCharts.com

The Technical Take

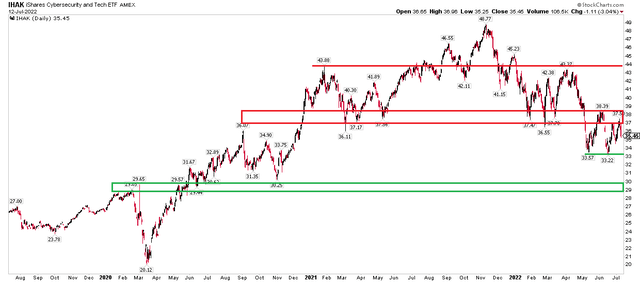

The narrative makes sense and valuations have come down, but the technical chart shows there’s work to do. A broad head and shoulders topping pattern played out since early 2021. The key neckline is in the $36 to $38 range – IHAK broke below that last quarter and failed to climb above it in June and July. It’s an obvious resistance range. Moreover, $43 to $44 is another trouble spot for the bulls.

Support is seen between $33 and $34 with another key area at the pre-pandemic high and 4Q20 pullback low ($29 to $30). Those are key spots to trade around with IHAK. I’d be a buyer on a dip into the low $30s with a stop below the $29 February 2020 peak. Profits should be taken on an approach of $36.

Key Resistance and Support Zones for IHAK

StockCharts.com

The Bottom Line

Long-term investors might look to buy the dip on cybersecurity stocks given their 25% to 30% drawdown and intriguing valuation. The industry should continue to see big demand in the years ahead. IHAK offers exposure to the biggest cybersecurity tech companies. Short-term traders have several price areas to reference on both and the long and short sides.

[ad_2]

Source links Google News