[ad_1]

Selman Keles/E+ via Getty Images

Investment Thesis

Tech stocks have handsomely rewarded shareholders over the last decade. However, I believe tech stocks are now a clear example of the divergence that can occur between past returns and expected returns. In other words, I think future returns are likely to look very different for investors buying tech stocks today than was the case 10 years ago. The recent economic data in the United States points to a strong labor market coupled with above-average inflation, which should push the Fed to raise interest rates and begin quantitative tightening. The reason why economic data is important is that it has a direct impact on the stock market. Equities, which are considered long-duration assets, will soon be discounted at a higher rate. As a result, there is a clear risk that valuations will take a hit. Particularly, I expect high P/E stocks to suffer the most going forward. In my opinion, Tech stocks are richly valued at the moment, which puts investors owning these stocks at the risk of a higher drawdown when compared to the overall market. In this article, I will review the iShares Expanded Tech-Software Sector ETF (NYSEARCA:IGV) which provides exposure to a basket of North American Tech stocks.

Strategy Details

The iShares Expanded Tech-Software Sector ETF tracks the S&P North American Expanded Technology Index. The index is composed of North American equities and provides exposure to companies engaged in software and interactive media-related businesses. This strategy can be used as part of a broad portfolio strategy to reach targeted exposure to software companies.

If you want to learn more about the strategy, please click here.

Portfolio Composition

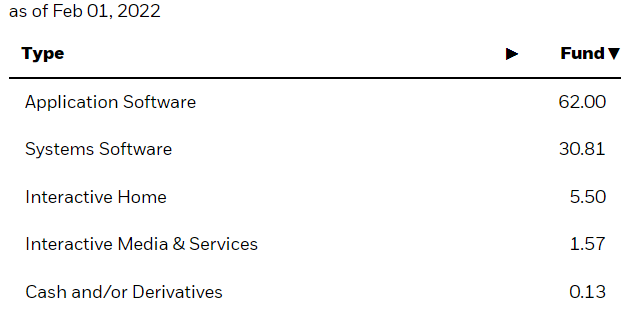

From the sector allocation chart below, we can see the index places a high weight on the Application Software sector (representing around 62% of the index) followed by Systems Software (accounting for 31% of the index) and Interactive Home (representing around 5.5% of the fund). The largest three sectors have a combined allocation of approximately 98.3%.

iShares

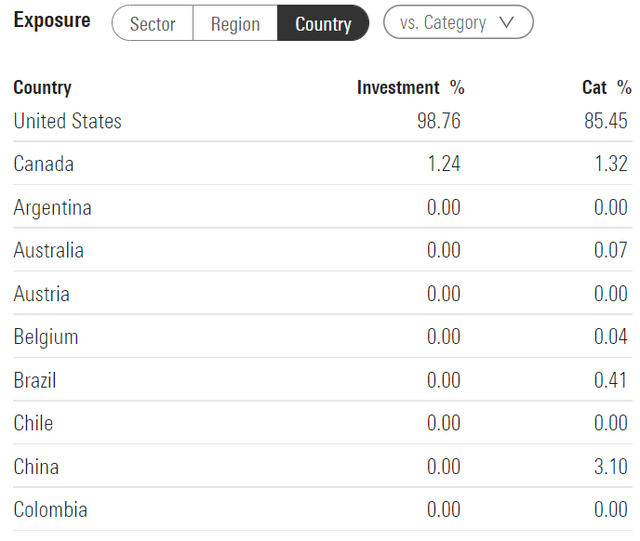

In terms of geographical allocation, the United States accounts for 98.8% whereas other countries such as Canada seem to be underrepresented given the low weight (only a 1.2% allocation to Canada).

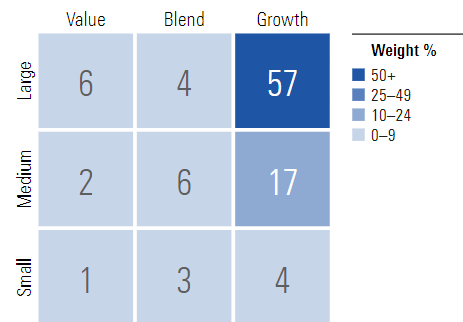

Morningstar

IGV invests over 57% of the funds into large-cap growth issuers, characterized as large-sized companies where growth characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is mid-cap growth equities. It is interesting to see that this ETF invests over 78% of the funds into growth stocks. Moreover, this strategy is mostly focused on large-cap stocks which account for 67% of total constituents. If you are looking to get more exposure to mid and small caps, I would suggest you look into the Invesco S&P SmallCap Information Technology ETF (NYSEARCA:PSCT), which has an average constituent market cap of $3.2 billion.

Morningstar

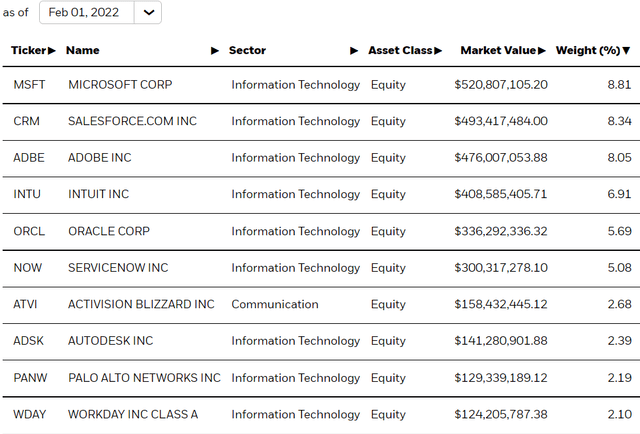

The fund is currently invested in 129 different stocks. The top ten holdings account for 52.24% of the portfolio, with no single stock weighting more than 9%. All in all, I would say that IGV is well-diversified.

iShares

Since we are dealing with equities, one important characteristic is the valuation of the portfolio. According to Invesco, the fund currently trades at an average price-to-book ratio of 10.9 and an average price-to-earnings ratio of 45. I generally consider a company trading at a forward price-to-earnings ratio above 20 to be richly valued. Moreover, I believe we are at an inflection point in the market where the Fed is ready to raise interest rates and start quantitative tightening, which will put further pressure on valuations.

Is This ETF Right for Me?

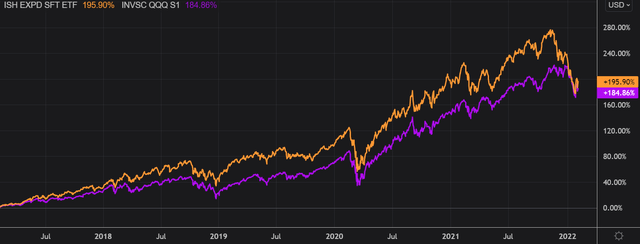

I have compared below the price performance of IGV against the performance of the Invesco QQQ ETF (NYSEARCA:QQQ) which tracks the Nasdaq 100 over 5 years to assess which one was a better investment. Over that period, the IGV outperformed the Nasdaq 100 by an 11 percentage points margin. To put it into perspective, a $100 investment in IGV five years ago would now be worth $295.9. This represents a compound annual growth rate of more than 24%, which is a very good absolute return. Another interesting characteristic of Tech stocks is the high volatility. Until recently the outperformance spread between IGV and the NASDAQ was relatively large. However, the gap narrowed considerably in December 2021 and January 2022 when market volatility started to pick up, suggesting that IGV has a higher drawdown.

Refinitiv Eikon

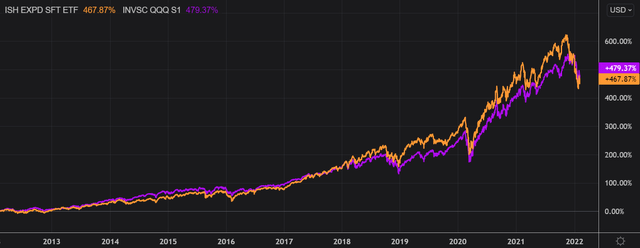

If we take a step back and look at the performance from a 10-year perspective, it is interesting to note that QQQ did in fact better than IGV. The Nasdaq finished on top and outperformed IGV by an ~11 percentage points margin. However, it is worth noting that IGV delivered strong results up until November 2021 and was outperforming QQQ for a long time. I think it is pretty clear by now that you are at risk of higher drawdowns if you own IGV. This has been the case on several occasions, especially during the 2018 pullback and the COVID-19 crash. Before you consider buying IGV, I think it is important you have a clear risk mitigation strategy. One effective way to hedge risk is through the use of put options, although that might be expensive at the moment given the current level of volatility.

Refinitiv Eikon

Key Takeaways

IGV provides exposure to a basket of North American Tech stocks. This ETF performed well over time, compounding at a double-digit rate over the last decade. However, it is important to highlight that the market did very well too over the same period of time, which shows how hard it is for any strategy to beat the market over a very long period of time. Given the fact that we are at a turning point in monetary policy in western economies, high multiple stocks, and especially tech stocks, are risky investments for now in my opinion. If I would be adding IGV to my portfolio today, I would definitely hedge this position using some puts.

[ad_2]

Source links Google News