[ad_1]

piranka/E+ via Getty Images

It seems the market is finally removing the benign monetary and fiscal tailwinds premium from stock valuations, and tech players, especially those deemed long-duration equities, are bearing the brunt.

However, some investors might argue that after the choppy start to 2022 and tech stocks foray into the correction territory, the long-term market darlings are now offering compelling discounts to their previously elevated valuations. Thus, after a consolidation, they might resume their years-long rally.

My point here is that it is too early to crank up bets on tech shares. But for those investors who have a contrarian opinion, I would like to present the analysis of the iShares Expanded Tech Sector ETF (NYSEARCA:IGM), a passively managed fund overseeing a portfolio of ~$3.4 billion disproportionately spread between 351 equity holdings. I would like to describe its risk profile, paying attention to the asymmetry of factors that makes IGM prone to sluggish performance in the short term.

In essence, IGM offers an undoubtedly compelling growth profile, with around 45% of the net assets deployed to the stocks with 20% or higher consensus forward revenue growth rates, as my analysis of the data downloaded from the screener illustrated. Quality is simply impeccable, with 97% of the holdings boasting robust margins and sector-leading returns on capital.

But sales growth goes hand-in-hand with premium multiples. The principal risk is a minuscule share of stocks exhibiting value characteristics in its portfolio, just 6%. Another way of saying, IGM is a top-heavy cohort of shares that are expensive even by standards of the traditionally richly valued tech sector (defined broadly), and it does not have a margin of safety, at all.

So the combination of the key factors here is rather precarious, with risks of a prolonged weakness remaining high. I will provide a more detailed commentary on that below in the article.

Investment strategy. Holdings. Factor exposure

The first thing worth touching upon is that around three and a half years ago, IGM was deeply recalibrated, renamed, with the underlying index replaced.

Now, its investment mandate is to track the S&P North American Expanded Technology Sector Index. On the index webpage, one can notice that its history traces back only to September 2018, while the fund has been around since 2001.

The Global Industry Classification Standard (also known as GICS) developed by S&P Dow Jones Indices and MSCI was updated in September 2018, with the communication services sector replacing outdated telecommunication. So the freshly-created CS sector and its members like Meta Platforms (NASDAQ:FB) and Alphabet (NASDAQ:GOOG) that were ousted from the reshuffled tech benchmarks and other “technology sector and select technology-related companies from the communication services and consumer discretionary sectors in the U.S. and Canada” became eligible for the index IGM tracks.

As you might notice looking through the holdings data on the iShares U.S. Technology ETF (NYSEARCA:IYW) website, neither Amazon (NASDAQ:AMZN) nor Netflix (NASDAQ:NFLX) is present in its portfolio. Before joining the movies & entertainment sub-industry of the CS sector, NFLX was a consumer discretionary stock. AMZN has always been in the CD sector.

IYW’s peer VGT that mimics the performance of the MSCI US Investable Market Index/Information Technology 25/50 has cut even more $1 trillion club members (or aspiring candidates) from its basket, with FB and GOOG also missing. And though that is completely explainable since they technically operate in the relatively novel communication services sector, I would not say that an ETF ignoring mega-cap titans that are supposed to define the future metaverse landscape, a primary theme for the coming decades, is a Buy.

Now let us delve deeper into the fund’s portfolio.

As of January 19, IGM was long 351 stocks. The fund has injected a substantial slug of money into the tech mammoths (defined in the broadest sense possible), with the main ten positions accounting for ~51% of the net assets, and the top trio that encompasses Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and AMZN having over a quarter. For better context, in the Nasdaq 100 (NASDAQ:QQQ), these three have a close to 29% of the net assets. No, risk dispersion is not adequate here.

Though IGM is supposed to be a mix of U.S. and Canadian stocks, its pronounced tilt towards the former market does not come as a surprise. IGM has invested just ~$43 million in Canadian players including Shopify (SHOP), or only ~1.2% of the net assets. So I would not say that the loonie question poses a significant risk.

Speaking about the holdings overlap with the bellwether exchange-traded funds, stocks present in IGM have only ~39% weight in the S&P 500 ETF (NYSEARCA:IVV). It has exposure to numerous companies that have not qualified for the S&P 500, with SHOP, SNOW, and MRVL being notable examples. Overlap with QQQ is close to 71%, with a caveat that the Invesco fund has not invested in such remarkable tech players as Accenture (NYSE:ACN), Visa (NYSE:V), and Twitter (NYSE:TWTR), though IGM has.

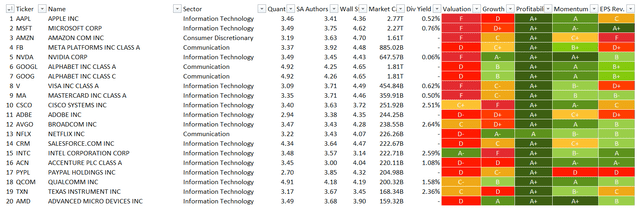

Now, as promised, a more detailed look at factors. The dashboard below summarizes the Quant data for the 20 key holdings.

Quant dashboard for 20 key holdings

Created by the author using data from Seeking Alpha and the fund

As you can see, in this cohort, only Intel (NASDAQ:INTC) has clear value characteristics. Overall, it is an exceedingly complicated task to find an attractively priced company inside the portfolio, while finding an overappreciated one is simple as over 80% have Quant Valuation grades of D+ or worse.

As I said above, the fund has a tilt towards growth. Though just around 30% have Growth grades of at least B-, those with forecast forward revenue growth rates above 20% have an ~45% weight. At the same time, a staggering 63% of the holdings (109 stocks) are anticipated to improve forward EPS by no less than 20%.

Though IGM is a growth investor’s dream, with large exposure to high-quality stocks (109 names, ~93% weight), considering the current market sentiment, its mix of factors is clearly fragile.

Returns

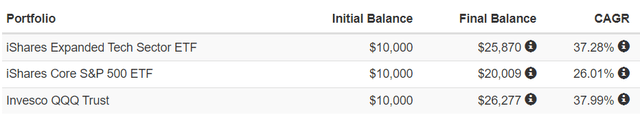

Its first three full trading years with the new index ended December 31, 2021, were grossly successful, with the compound annual growth rate flying well above IVV’s ~26%.

IGM, IVV, QQQ CAGRs

Portfolio Visualizer

A 37.3% CAGR is nothing short of impressive, but with the better context added, it does not look that bright. QQQ delivered close to 38%, and higher fees (43 bps vs. 20 bps) are more likely to blame.

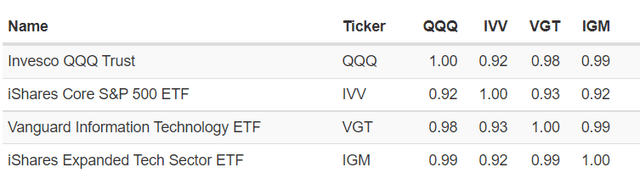

To bring more color, the table below shows that QQQ and IGM are almost ideally correlated, with the coefficient based on daily returns approaching 1, while for the IVV/QQQ pair, it is 0.92, still indicating that their returns move in tandem though to the lower extent.

IVV,QQQ,IGM,VGT correlation

Portfolio Visualizer

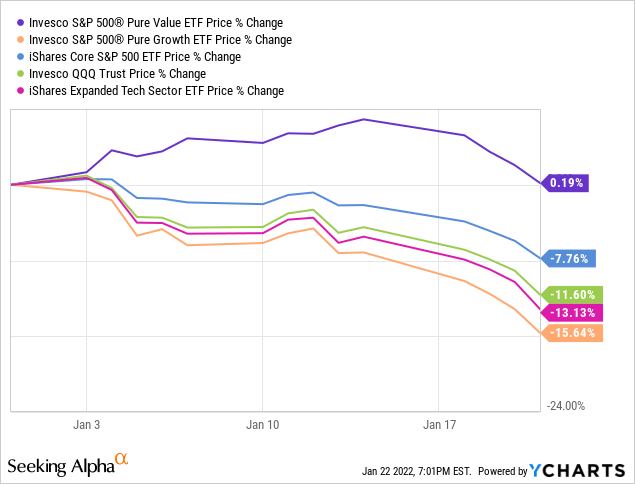

Speaking about 2022 returns, amid the persisting market softness, IGM has underperformed both IVV and QQQ as its price has declined by more than 13%, while IVV has been down by just ~7.8%, principally because its pure value component (RPV) that I have discussed recently has been propping its NAV up, even though it has also suffered.

Meanwhile, RPG has taken the brunt of evaporating growth premia, which I have touched upon shortly in the note.

Final thoughts

In sum, there are two questions worth addressing.

First, is it worth buying the tech dip right now? Truth be told, I am thinking about it, actively researching the market environment. But I would say not yet. The market has been bidding multiples up for too long, and now the looming increase in the risk-free rate (and the cost of capital overall) is becoming very real, pushing stock prices lower. NFLX has lost almost 22% in just one day amid concerns over user growth. It vividly illustrates how nervous investors have become.

Second, is IGM any better than QQQ? The answer should be the same. For me, it is rather obvious that tech growth investors would like to see Tesla inside the ETF’s portfolio they own. And they can get exposure to it by buying into QQQ, not IGM. Besides, the latter is more expensive, and expensiveness inevitably leads to, though rather insignificant if costs are not dramatically higher, underperformance. With this in mind, I give IGM a Hold rating and encourage my dear readers to do their own due diligence.

[ad_2]

Source links Google News