[ad_1]

Drew Angerer/Getty Images News

The iShares U.S. Infrastructure ETF (BATS:IFRA) is an exchange-traded fund that invests in companies that could benefit from increased domestic infrastructure activities. The fund had 157 holdings as of May 26, 2022, with assets under management of $1.807 billion. The expense ratio is 0.30%.

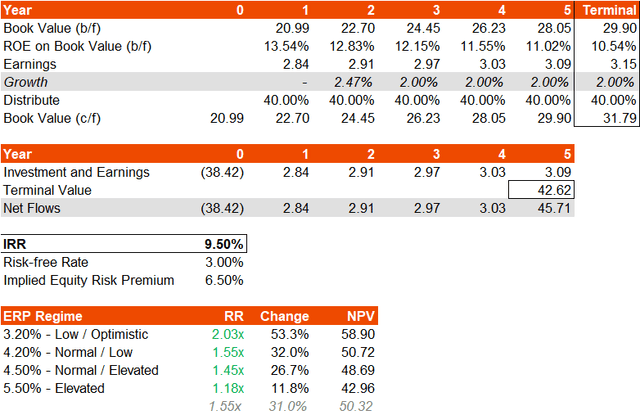

The fund’s benchmark index is NYSE FactSet U.S. Infrastructure Index, although the benchmark does not come with regular factsheet reporting. Nevertheless, we can use an external data provider Morningstar which tells us that the price/earnings ratio on a forward basis was circa 13.52x as of May 27, 2022, with a price/book ratio of 1.83x. That implies a forward return on equity of about 13.5%. Forward three- to five-year average earnings growth is estimated to be 15.44%. The trailing dividend yield at 2.28% probably implies a distribution rate (of earnings) on a trailing basis of perhaps around 40%.

It is possible Morningstar’s forward price/earnings implicitly overstates the earnings (denominator) in the equation. Nevertheless, to begin with, we can imagine IFRA’s return on equity petering out to about 10%, until earnings growth falls to about 2% per annum (which would happen quickly in this scenario of a gradually falling return on equity). With a 2% earnings growth floor (probably close to the rate of inflation, i.e., a conservative approach), and assuming we value IFRA at the same forward price/earnings ratio of about 13.52x in year five, our valuation implies a forward IRR of about 9.50% through to year five.

Author’s Calculations

If we suggest a fair equity risk premium of about 4.20-4.50%, and a risk-free rate of circa 3% (allowing for a slight movement upward on the U.S. 10-year yield, which is a reasonable proxy for U.S. equity investors’ risk-free rate and which is currently under 3%), upside of circa 26-32% is possible (on a total return basis). That’s a conservative case in which we assume nominal earnings growth that is close to the likely level of inflation (i.e., immaterial or even negative “real” earnings growth).

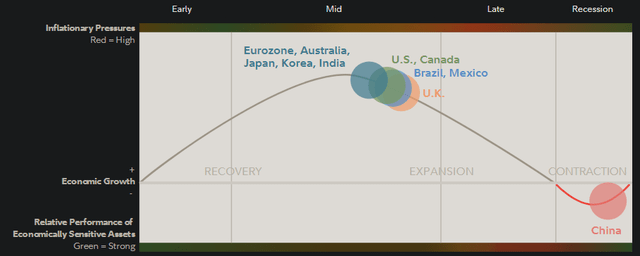

The U.S. economy could well avoid recession in the near term. Fidelity looks at various factors including economic growth, credit growth, earnings growth, government policy, and inventory and sales growth. The Q2 2022 assessment is that the United States is in the middle of its current business cycle.

Fidelity.com

IFRA’s portfolio is probably going to tick along regardless though. Its historical beta is about 1.06x at the time of writing. But our ERP range of around 4.20-4.50% is fair enough. Even if we took an elevated 5% ERP and scaled it up by 1.06x, and then added a risk-free rate of 3%, our implied cost of equity of 8.3% would still fall under our implied 9.50% IRR.

Having said that, there is not much of a margin of safety here, and the implied IRR is quite mediocre as compared to other opportunities available. If there was a “surprise recession” in the near term, a material drop in earnings coupled with risk aversion could easily see IFRA take a hit. And the dividend yield is not high, so there wouldn’t necessarily be a very strong price floor.

On balance then, while IFRA is probably modestly undervalued, and to be fair this is on most likely conservative earnings growth projections, I think it is best to probably maintain a neutral stance on the fund.

To take a more “optimistic” view though, imagine ROE is held constant at circa 13.5% for five years, and then we exit on a forward price/earnings multiple of, again, 13.52x (the current multiple), our IRR would increase to 15.45%. And on a cost of capital of even 8.5%, that would imply upside of over 80%. But the distance here is likely too great; more likely the market is discounting more modest longer-term returns on equity as well as greater uncertainty than the fund’s historical beta would suggest.

There is enough margin of safety to imagine a forward return of up to 10% per annum over the five years on a total return basis. However, I suppose there are near-term risks that could hit risk sentiment in these kinds of stocks specifically. The “bullwhip effect” discussed recently in the FT describes a phenomenon in which overstocked inventories lead to oversupply, price-cutting at retailers etc. (the initial overstocking being due to supply chain disruptions and reversals of “just-in-time” stocking arrangements). All of this could indirectly hit infrastructure companies that IFRA invests in (which iShares describes in two groups, as “[firstly] owners and operators, such as railroads and utilities, and [secondly] enablers, such as materials and construction companies”).

So, in summary, IFRA is probably undervalued and offers a decent medium- to long-term IRR. However, on the other hand the IRR does not include a large margin of safety that would protect an investor from deflationary forces and/or a recession, not to mention investor risk aversion on the back of one or both of these. I would maintain a neutral stance on IFRA at present prices, but would not be surprised the fund to continue to do modestly well over the short- to medium-term.

[ad_2]

Source links Google News