[ad_1]

Over the last week, Invesco’s DB Energy ETF (DBE) has rallied by nearly 7% in a run which has largely erased the losses seen over the last month. In this article, I’m going to dig into the mechanics of the DBE ETF to explain what is driving returns as well as discuss the underlying fundamentals of the commodities which DBE holds. It is my belief that the bottom is in for DBE and that in the next few months shares should appreciate.

The Instrument

Let’s start with a discussion of exactly what DBE is. Investors can sometimes jump straight into an analysis of the underlying commodity/idea which an ETF is supposed to track and in the process potentially miss variables which will impact the instrument.

Invesco’s DB Energy ETF tracks the DBIQ Optimum Yield Energy Index which is an index constructed by Deutsche Bank (NYSE:DB) that largely gives exposure to three major energy commodities (crude, gasoline, distillate, with a small position in natural gas). What is interesting about the methodology is that it seeks to maximize roll yield through ongoing shifting of exposure across the forward curves of these major commodities. What is great about this specific methodology is that it potentially avoids the issues which most ETFs / ETNs which track commodities markets face: roll yield.

In this article, I will not do a deep dive into the mechanics of roll yield, but the basic concept is that futures markets tend to see prices in back months drift towards prices in the front of the curve as time approaches expiry. For positions held in a contango market, roll yield tends to be negative as prices in the back fall towards prices in the front. For markets in backwardation, roll yield tends to be positive as prices in the back rise towards prices in the front.

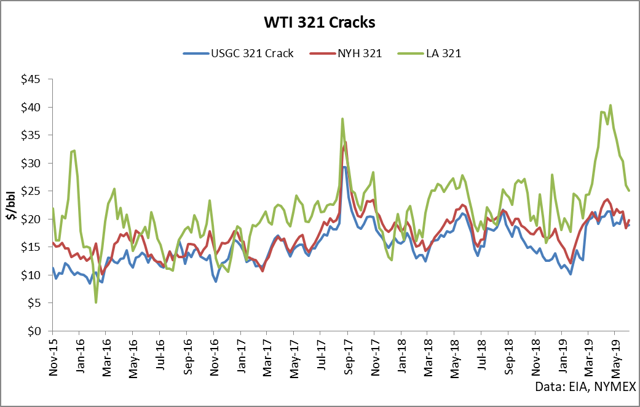

DBE is poised to reap substantial benefits through roll in that crude is in backwardation in the back months, RBOB is clearly in backwardation and distillate is in contango. With most of the ETF giving positive roll exposure, there will be a relatively constant stream of positive returns through roll and will give tailwinds to holders of the ETF. All this said, let’s get into the fundamentals of these commodities to generate an idea as per where DBE could be headed in the future.

Crude Fundamentals

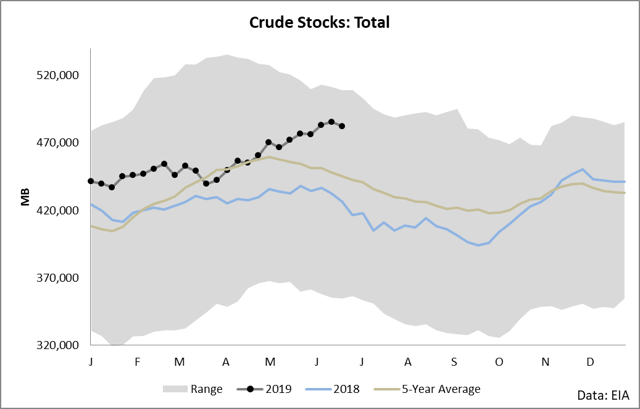

At the top of the barrel, DBE holds a sizable position in crude oil. The crude fundamentals have been bearish through about last week with a recent turning point seen in the latest EIA data. As seen from a 5-year range perspective, inventories have been solidly above the 5-year average and have continued to climb until last week.

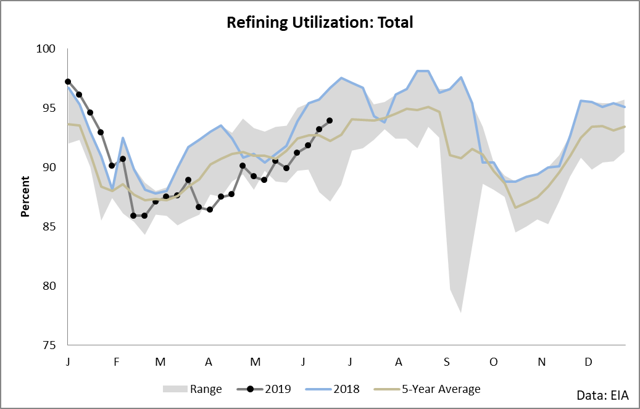

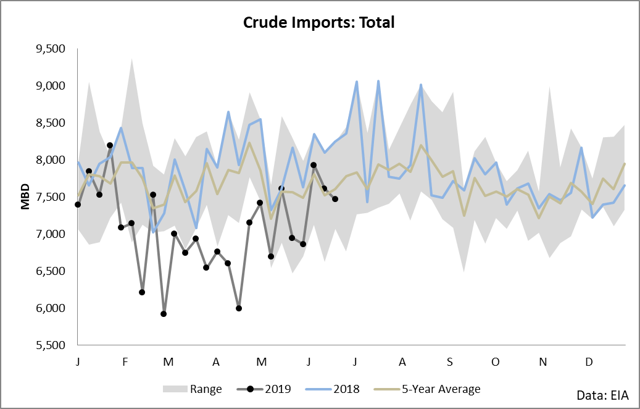

The turning point in earnings came as refining runs increased above the average for another week and imports fell off from recent highs.

Going forward, the question for the market is this: will demand remain strong? To understand the demand for crude oil, we need to next examine the gasoline and distillate balances and markets.

Product Demand

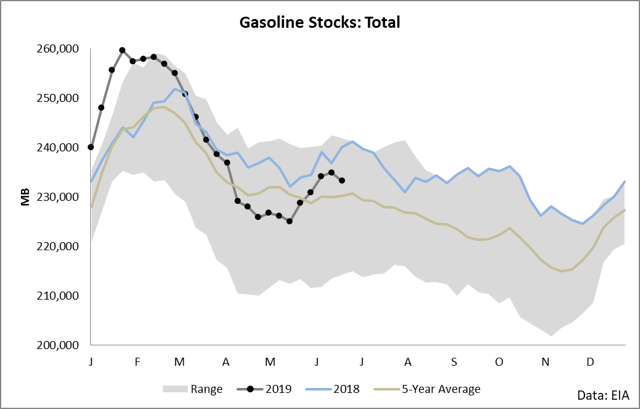

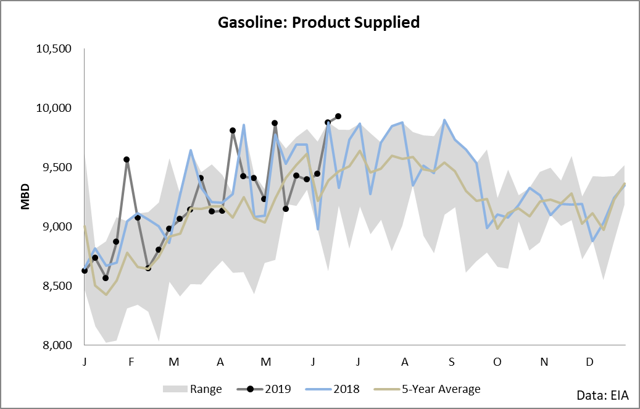

The largest share of refinery offtake comes in the form of gasoline. If we can understand the gasoline markets, we can get an idea as per where crude demand is headed as well as the price of gasoline itself. The supply and demand balance for gasoline is strongly indicating that the recent run-up in inventories has rolled over and we are likely to see draws into the future.

The leading driver of gasoline demand has been organic demand as seen through product supplied continuing to hit highs for this time of the year.

Assuming a normal driving season (which is a fair assumption barring a recession), we should see crude runs recover back towards the top of the 5-year range and product supplied remain elevated.

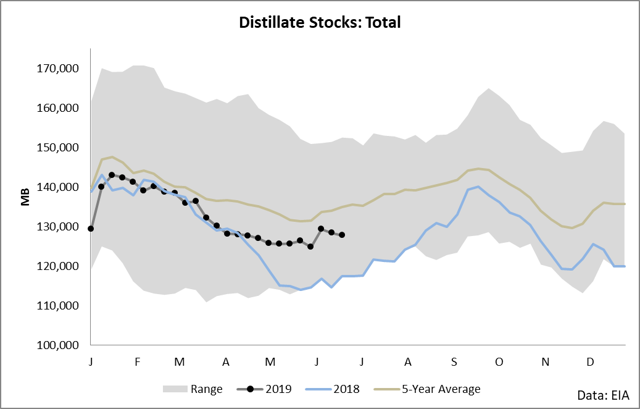

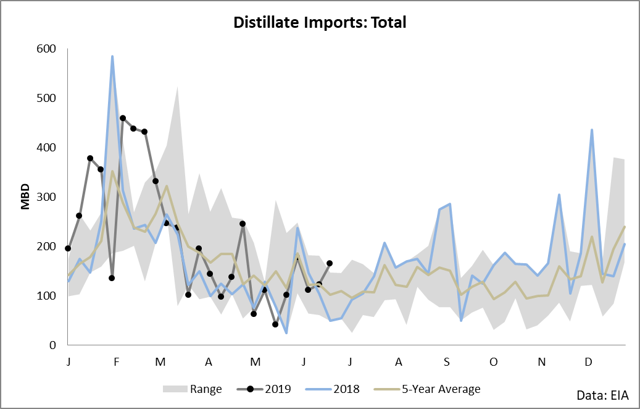

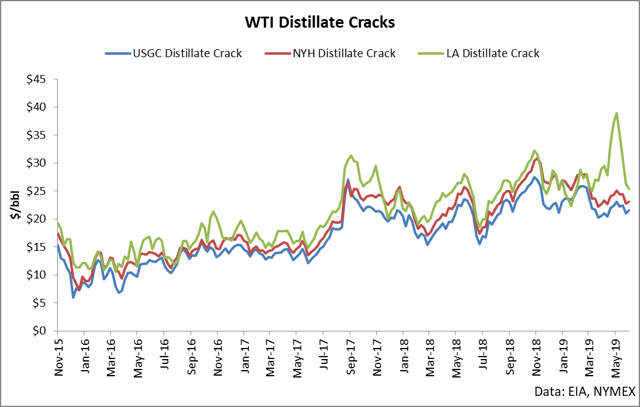

The distillate side of the equation shows a different story but with the same ending: bullish. Throughout this year, we have seen distillate stocks remain beneath the 5-year average as healthy demand has eroded stocks throughout the year.

What is noteworthy in the recent EIA release is that we’re starting to see an uptick in distillate imports which implies that there’s still room for U.S. refineries to produce and supply the market.

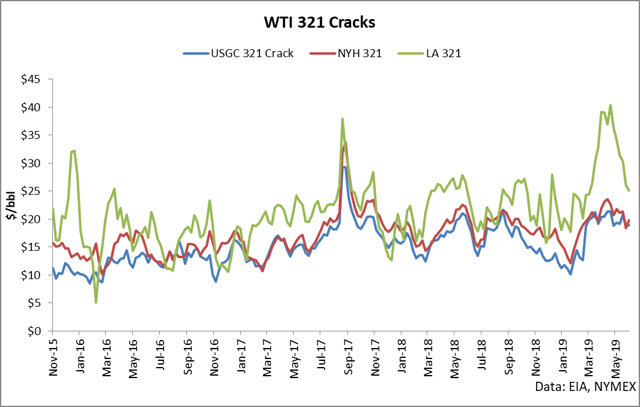

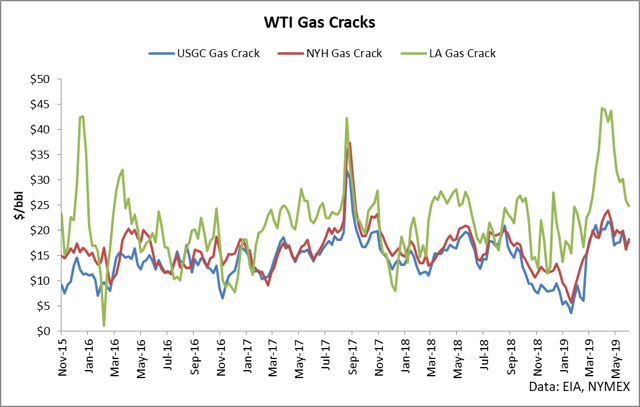

The overall cracks for gas and distillate show where the pricing signal lies and each of these cracks is indicating that further supply is needed to meet demand, despite having fallen off in recent months.

As long as cracks remain elevated (and given the recent PES refinery explosion, this is bound to help), RBOB and distillate will be bullish and so will demand for crude oil which will likely pull prices higher and benefit the holdings of DBE.

Natural Gas Fundamentals

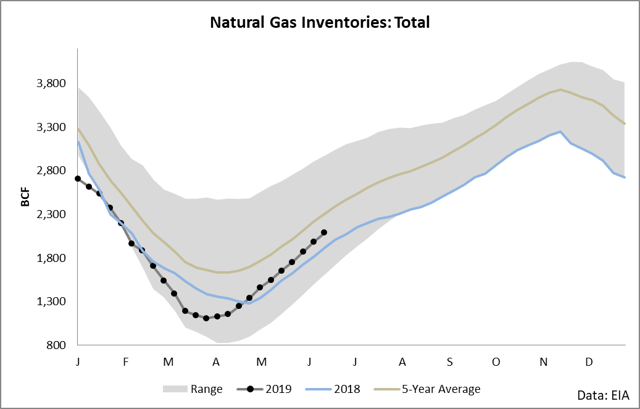

DBE is unique in that it also gives exposure to natural gas. Natural gas is unfortunately pretty bearish right now based on the fact that inventories continue to rise and CPC data isn’t very conclusive.

Inventories are going to continue growing at above-average rates as long as power burn remains low and power burn will remain low as long as the weather continues to come in at average or below average in the major demand centers.

On the bright side, natural gas makes up a minority share of DBE’s holdings (about 10%); however, it will be a drag on earnings.

Conclusion

We’ve just covered a lot of fundamentals for four different energy commodities. It was a lot of charts and discussion, but that’s what you have to do if you’re holding an ETF which gives exposure to four separate commodities. Crude, gasoline, and distillate are all bullish based on the fact that inventories are falling once again and cracks suggest further runs for refining. Natural gas is bearish due to poor seasonal cooling demand but it makes up a minor share of DBE’s holdings. Positive roll opportunities exist in most of the commodities held by the ETF, which means that we’re likely to continue to see returns attributed to roll in the future. DBE is a really good buy.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News