[ad_1]

arcady_31/iStock via Getty Images

Here we are, trapped in the amber of the moment. – Kurt Vonnegut

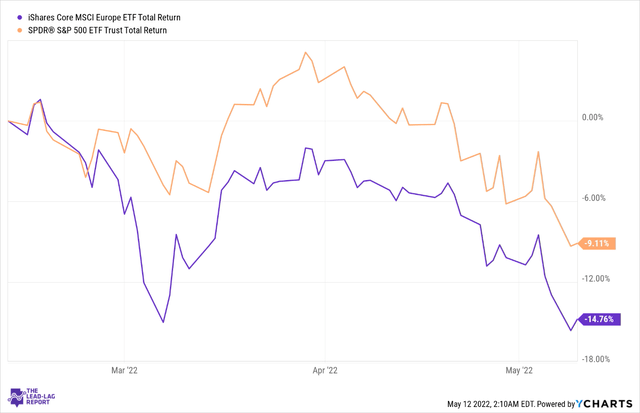

The iShares Core MSCI Europe ETF (NYSEARCA:IEUR), with an expense ratio of only 0.09%, provides one of the cheapest routes for investors seeking exposure to companies based in Europe. Unfortunately, that region has been experiencing some rather challenging circumstances over the past three months, and this is reflected in the relative performance of IEUR as it has underperformed the S&P 500 by over 500bps.

YCharts

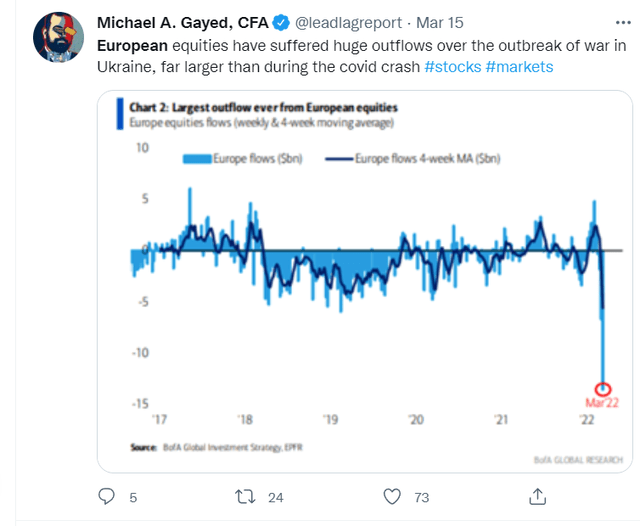

As noted in The Lead-Lag Report, the Russian-Ukraine conflict has been particularly damaging for the fund flow progress towards European equities, but that is not all.

In this article, I will highlight some of the key contours that are weighing on Europe and examine what it means for IEUR.

European conditions

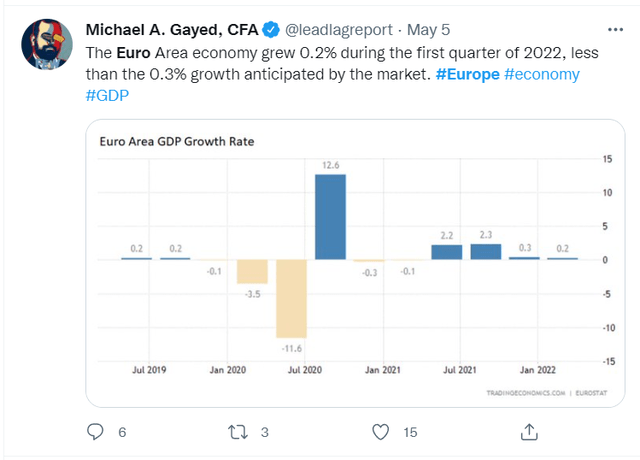

Europe appears to be caught between a rock and a hard place; firstly, the growth landscape looks rather unappealing. As flagged in The Lead-Lag Report, the recent Q1 GDP growth reading was quite abysmal, only coming in at 0.2% and lower even than Street estimates. I’m not sure one can expect a great deal of cheer in the quarters ahead, and there’s no discounting the fact that the US, with all its challenges, still appears to have a better growth trajectory than Europe. Consider the IMF’s recent economic outlook which came out last month; the GDP growth differential between the two regions in 2021 was rather close (5.7% for the US and 5.3% for Europe), but this year, you will see this expand even further with the US poised to grow by 3.7% whilst Europe will only see growth of 2.8%.

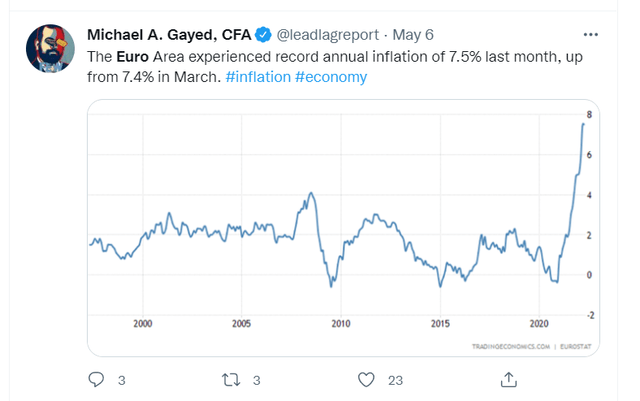

At the other end of the spectrum, you have growing inflation risks; it’s become rather tiresome to use the term “record highs” as this seems to be a regular occurrence over the last six months; currently, we’re now looking at steep levels of 7.5%.

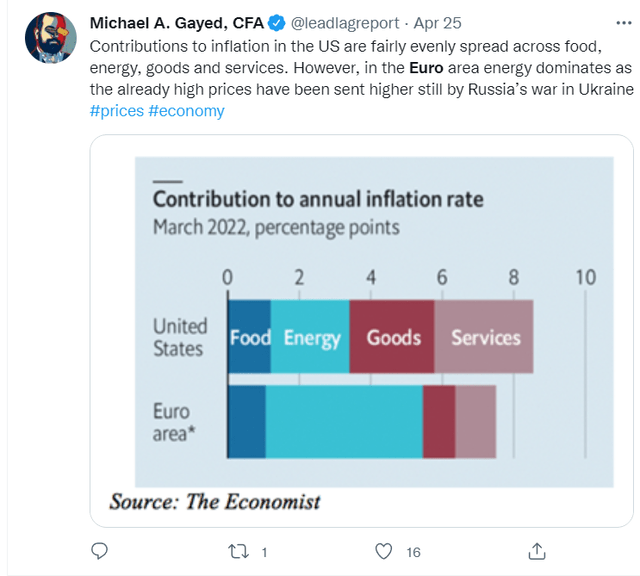

However, as noted in The Lead-Lag Report, what’s rather interesting is that quite unlike the US – where the inflation appears to be more broad-based across various categories – things in Europe are predominantly driven by steep energy prices. In light of this, the latest EU embargo on Russian crude oil feels like the region is trying to shoot itself in the foot.

Hitherto, the ECB had reluctant to lift rates or taper its QE measures (until recently), but it appears that these recent inflation numbers have upset the applecart. The ECB’s next rate hike meetings are on June 8-9 and July 20-21, and the expectation now is that interest rates will likely be lifted from all-time lows in the second meeting. The market is basically pricing in 2-3 rate hikes for the rest of the year but this could well change either way. I say this because you can’t dismiss the risks of aggressive tightening too quickly and this is something that has also been flagged by notable ECB member – Fabio Panetta who has recently been quoted as saying that “monetary tightening aimed at containing inflation would end up hampering growth that is already weakening,” Panetta believes the Euro area may well already be in the throes of stagnation.

Speaking of rate hikes, one also ought to highlight that these recent talks haven’t necessarily done a great deal to halt the progress of the EUR/USD’s trajectory which certainly doesn’t bode well for holders of IEUR. I mentioned in this week’s Lead-Lag Report that the dollar may actually be taking a bit of a pause in May but I only believe this will be temporary as not only is the Fed tightening at a more aggressive pace but you also ought to consider the dollar’s growing safe-haven status.

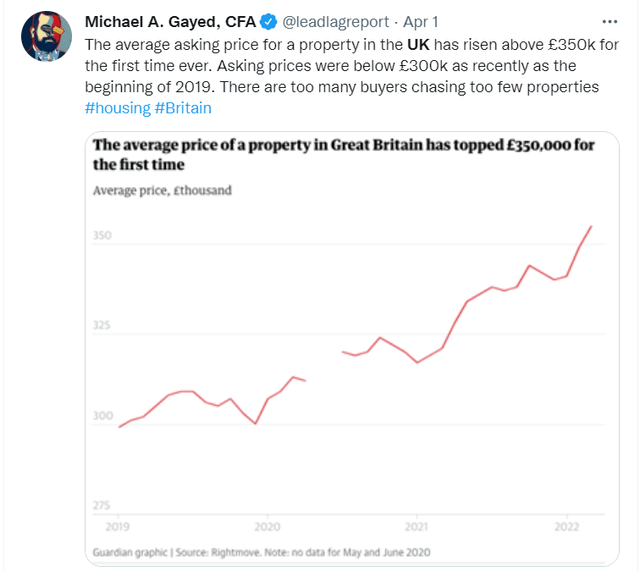

I’d also urge investors to keep an eye out for developments in the UK, as stocks based in this region actually account for a quarter of the total holdings. One component of the UK economy that currently troubles me is the housing market. As highlighted in The Lead-Lag Report, property prices there have hit levels never seen before.

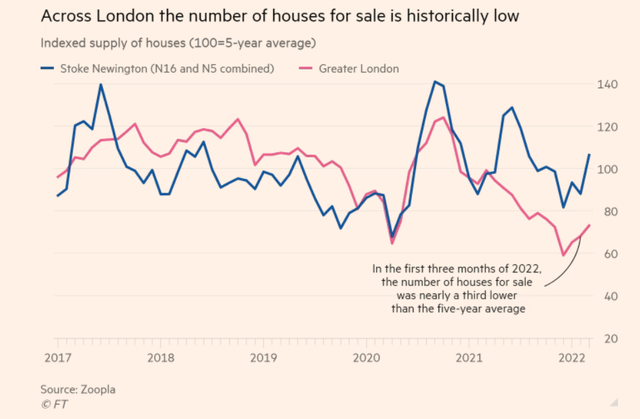

It certainly doesn’t help that the supply in large housing markets such as London is also at rather lowly levels.

FT

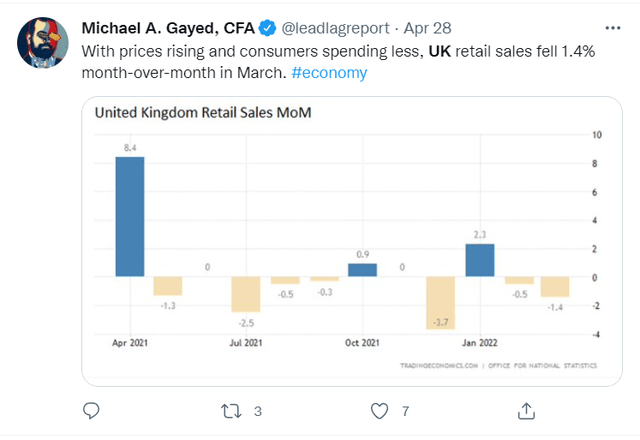

It is believed that the Bank of England may have to continue to aggressively hike rates to 4% ( it has already done so 4x since Dec last year), even as inflation is poised to cross the 10% mark by the end of this year! We’ve already seen the impact of high inflation on the dwindling appetite for retail products.

Weak purchasing power and significantly tighter monetary conditions set the UK housing market up for a nasty fall.

Conclusion

YCharts

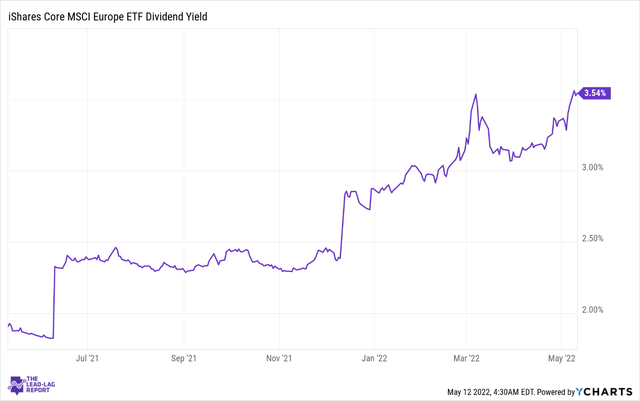

Economic conditions across Europe don’t appear to be in great shape, and policymakers are confronted with some pressing dilemmas on whether to focus on growth or manage inflation. If there’s a silver lining in all of this, I’d say that prices of IEUR have corrected to a point where forward valuations look very attractive. You can currently pick up IEUR at a forward P/E of only 12.8x, which represents a 28% discount to the corresponding multiple of the S&P 500. In addition to that, one shouldn’t also overlook the attractive dividend yield on offer, of 3.54%; it’s the highest it’s been in nearly two years.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

[ad_2]

Source links Google News