[ad_1]

One of this year’s positive surprises thus far has been the remarkable performance of the clean energy sector. As the catastrophic long-term consequences of climate change become increasingly clear, market expectations of a decisive market shift toward renewable energy have soared. A recent cost-benefit analysis by the Global Commission on Adaptation concluded that investing $1.8 trillion over the next decade is essential to stem the global warming threat, and could actually produce net benefits in excess of $7 trillion in the long run.

Meanwhile, several Democratic presidential candidates have expressed their intention to spearhead an initiative that involves spending trillions in the battle against climate change, in what is set to be a crucial element in next year’s political debate. Indeed, the drive to reshape the global energy landscape is as strong as ever and therein lies investment opportunity. In this context, it should come as no surprise that clean energy ETFs continue to enjoy impressive momentum.

One interesting fund in this promising sector is the iShares Global Clean Energy ETF (ICLN). It is one of the largest ETFs in the clean energy sphere, with assets under management of approximately $360 million. While it has delivered stellar gains over the past twelve months relative to the broad market, its returns are eclipsed by some of the more aggressive funds in the sector. Instead, the true value of ICLN, I believe, can be found in its defensive nature, which is ideal for the period we are going through.

First of all, it has to be understood that even through the iShares Global Clean Energy ETF ICLN seeks to track the investment results of an index composed of global equities in the clean energy sector, its approach is unlike that of most other ETFs in the sector. To wit, ICLN is designed to mirror the performance of a market-cap-weighted index of 30 global companies that produce energy from solar, wind, and other renewable sources such as biofuels, ethanol, as well as geothermal and hydroelectric source. And this includes not only energy producers but also firms engaged in the production of technologies and equipment necessary for the development and growth of these subsectors. This allows the inclusion of companies that are not purely clean energy businesses but do have strong interaction with the sector.

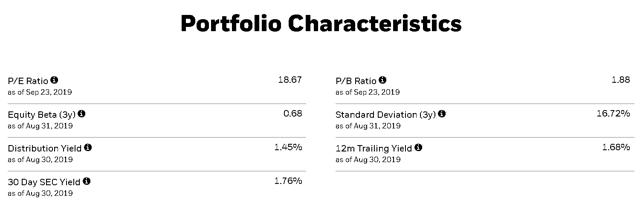

Source: iShares.com

What really sets this ETF apart from rival funds is the value it provides. With a P/E ratio of 18.67 and a P/B ratio of 1.88, it is among the best choices for value-seeking investors who seek exposure to the sector. Meanwhile, it boasts a relatively high distribution yield and one of the lowest expense ratios (0.46%) in the segment. On top of that, it has a notably low beta, which makes it perfect to safely navigate periods of heightened volatility. Admittedly this sector is vulnerable to volatility spikes, which makes ICLN better suited for the long term-investor.

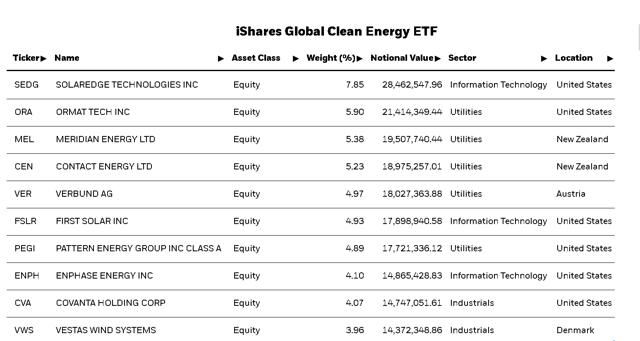

Source: iShares.com

In terms of the fund’s sustainability characteristics, it is noteworthy that ICLN has an MSCI ESG quality score – peer rank of 97.70%, which essentially means that it surpasses most of the other clean energy ETFs with one of the top scores in the sector. This is a valuable metric that allows investors to understand each company’s ability to manage existing environmental, social, and governance risks and opportunities, which should play a crucial factor in the decision making process and significantly affect future performance, especially in a constantly evolving field like this.

ICLN is well diversified with a portfolio of companies spanning numerous countries and sectors. This adds another layer of protection in the event of market turbulence without significantly impacting the fund’s performance as we have seen in recent years. The fund’s top ten holdings also reveal that United States represents the lion’s share of its geographic allocation, and this is to be expected. In fact, it is a wise strategic decision, as we can reasonably expect that ultimately the global effort to fight climate change -despite the lack of progress in recent years- will likely be led, orchestrated and primarily funded by the U.S, that remains the technological leader and the world’s largest economy.

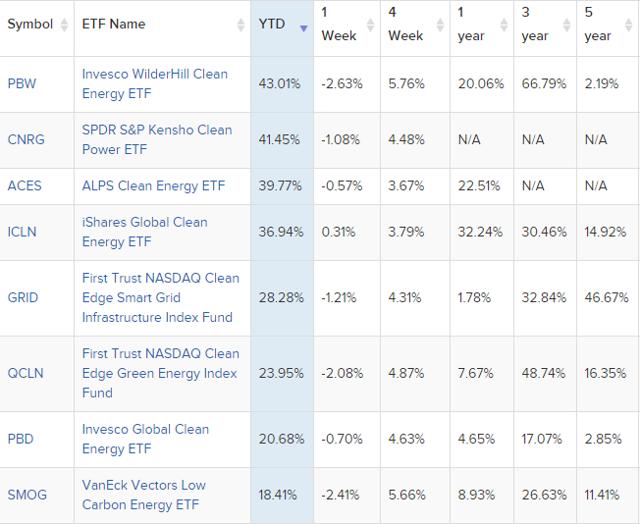

There is no denying that this fund’s defensive, well-rounded approach comes at a cost, albeit a not deal-breaking one. Namely, ICLN has displayed a positive but not excellent price performance. There are a few popular ETFs in the sector that have substantially outpaced it in recent months. Yet, they appear to offer less value, they are more expensive and more vulnerable to bouts of market volatility. This is a key difference, especially if we take into account the fragile state of today’s financial markets, the increasing probability of economic downturn and the political challenges that are bound to cast a pall over investor sentiment in the months ahead.

Source: ETFdb.com

In recent decades, the pace of global policy change when it comes to a globally coordinated approach to climate issues has been glacial. In light of the rapidly deteriorating environment and the immediacy of the threat, this is about to change. Expect a torrent of changes that will more than likely find the majority of market participants unprepared. ICLN provides a credible path toward capitalizing on that massive change.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News