[ad_1]

Main Thesis

The purpose of this article is to evaluate the iShares Cohen & Steers REIT ETF (ICF) as an investment option at its current market price. As a whole, I still find the Real Estate sector an attractive place to park capital. Interest rates remain low, and the Federal Reserve has convinced investors (for the time being) that rates will stay at current levels for the rest of 2019. This is good news for higher-yielding sectors, as income-seeking investors will continue to flock to them. Furthermore, property values nationwide continue to rise, both in the residential and commercial markets.

However, despite these positive attributes, ICF in particular could run in to some challenges going forward. The fund is near its long-term peak in terms of share price, suggesting there is limited upside left from here. As support for this point, ICF has seen its dividend yield dip below 3%, which is noticeably lower than what many individual holdings in the sector offer, as well as other Real Estate focused funds. Finally, the retail REIT sub-sector is ICF’s third largest weighting, and many headwinds exist within that space, suggesting it is an area investors may want to limit exposure to going forward.

Background

First, a little about ICF. The fund’s stated investment objective is “to track the investment results of an index composed of U.S. real estate investment trusts.” The fund attempts to hold the same proportions of its stocks as its benchmark index, Cohen & Steers Realty Majors Index, and is managed by BlackRock (BLK). ICF is currently trading at $109.22/share and yields 2.77% annually, based on its four most recent dividend payments.

This is my first review of ICF, but I believe it is timely because it focuses on a sector I have been bullish on for all of 2019, but has come under selling pressure very recently. With that in mind, I wanted to evaluate ICF to see if buying on the latest dip would be a smart move, or if investors would be wiser to remain cautious at these levels. I view the recent drop as a warning of more pain to come for ICF in particular, and I will explain why in detail below.

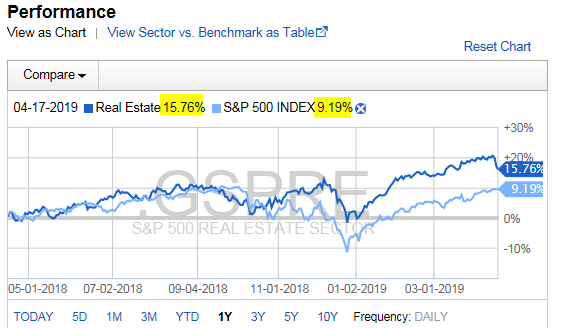

2019 Performance Has Been Stellar

To start the review, I do want to point out that the Real Estate sector as a whole has a lot of bullish momentum. While I was cautious on the sector for most of last year, when it became evident in late Q4 that the Fed was going to shift to a more dovish policy stance on interest rates in 2019, the sector once again became more attractive to me. I advocated buying in to broad funds, such as the Schwab U.S. REIT ETF (SCHH), as well as other dividend funds like the SPDR Portfolio S&P 500 High Dividend ETF (SPYD), which has a large amount of exposure to Real Estate. These have been rewarding investments in the short-term, and should not come as a surprise that the Real Estate sector as a whole has been out-performing the broader market. Aside from the Fed’s low rate policy, the sector has been helped by strong employment numbers and rising home prices, which helps fuel consumer confidence. In fact, Real Estate has handily beat the S&P 500 over the past year, even with the recent drop, as illustrated in the graph below:

Source: Fidelity

Source: Fidelity

As you can see, Real Estate has been outperforming for some time, although the sector has seen a sharp reversal of that trend this week. That said, it is worth noting that ICF has not been left out of the party, as it has beaten the S&P 500 by a even wider margin over the past year, as illustrated below:

Source: CNBC

Source: CNBC

As you can see, this performance has been quite impressive. However, it has come at a cost. While profitable for current investors, the rapid share price gain has made buying in to the fund quite expensive for new investors. And it’s for this reason that the headwinds facing the fund give me pause, as expectations appear to be very high at the moment, meaning it won’t take much to disappoint investors.

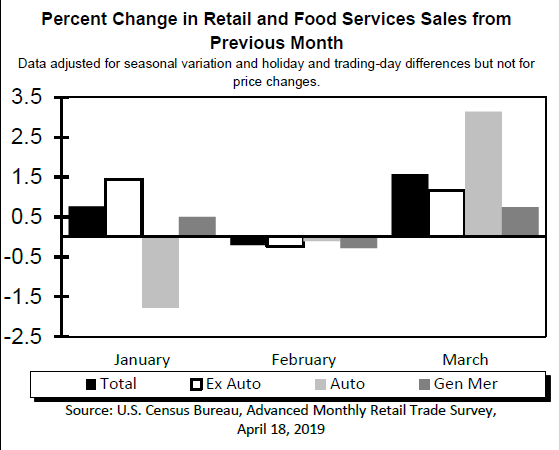

Retail Figures Give Concern

Now that I have illustrated the recent positive performance, I want to discuss why I am not optimistic it will continue for ICF in the immediate future. My first point here is that while I have been advocating for Real Estate exposure recently, this exposure can mean many things. For instance, I have been extremely bullish on self-storage units, apartment properties, and, for fixed-income investments, mortgage debt. An obvious omission from this line-up is retail shopping centers – such as malls and other retail locations. This is a part of the sector that has seen some volatility over the past few years, and one that I have trouble getting behind as an investment thesis for a few reasons. Namely, the trend towards online shopping is only getting more profound, and this will undoubtedly continue to pressure traditional retail centers for the foreseeable future. While I do not expect a retail apocalypse, I do not see a lot of growth potential either.

That said, it is worth noting that March retail figures, released on April 18th, showed strong monthly gains in most major categories, helping to calm some fears over slowing consumer spending. However, a look at the entire Q1 sales figures shows a bit of a mixed picture, illustrated below:

Source: U.S. Commerce Department

Source: U.S. Commerce Department

As you can see, the March numbers were robust, but the gains come off a weak February, so they need to be taken with a grain of salt. Furthermore, the broader outlook within the retail space is not nearly as optimistic as those numbers could suggest. Specifically, U.S. retail companies have been announcing record numbers of store closings, which is pushing up the occupancy rates at malls nationwide. According to data compiled by CoreSight Research, year-to-date announced store closures have already exceeded the total that were actually closed in all of last year. The data showed that U.S. retailers have announced 5,994 store closures and 2,641 store openings, which compares unfavorably to 5,864 closures and 3,239 openings in all of 2018. This has impacted mall vacancy rates, which rose to 9.3% in Q1 vs. 9% in Q4 2018, according to data reported by Seeking Alpha. Worryingly, this figure marks the highest vacancy rate since Q3 2011, when it hit 9.4%.

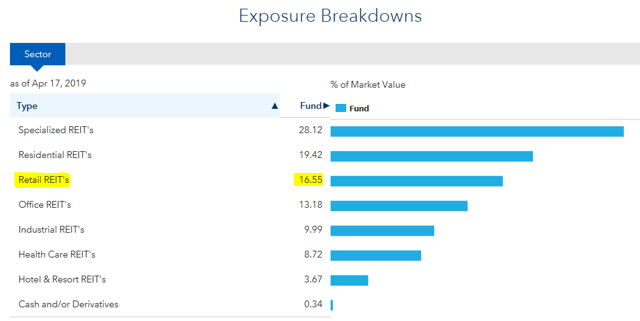

Clearly, this is a mixed picture, but the real question is: what does this mean for ICF? In my view, it presents a significant headwind for a meaningful part of the fund’s portfolio. While ICF is certainly diversified, retail REITs make up almost 17% of total holdings, as illustrated below:

Source: iShares

My takeaway here is this is a reason to avoid the fund. While some investors may view the retail space as a value opportunity, I simply see too many headwinds and a negative long-term story, to the point where I am not willing to gamble on a retail turnaround any time soon. While ICF could still perform well if its other sectors out-perform, I would simply avoid that risk by focusing on ETFs or individual holdings without the retail shopping exposure.

Lack of Dividend Growth

While I just discussed my broader concerns for a key position in ICF’s portfolio, there are likely many investors who see opportunity in the retail space and are willing to buy-in at a time when the outlook seems bleak. After all, buying when pessimism is high can often be a winning strategy.

Even with that in mind, I would hesitate to recommend ICF right now for another reason – dividend growth or, more specifically, lack thereof. One of my biggest concerns with the fund is its current yield, at only 2.77%. This yield is quite low, well under what many high yield dividend ETFs are offering, as well as plenty of other options within the Real Estate sector. While this is partly due to the fund’s rising share price, there is another reason that is less rosy. Specifically, it has to do with a lack of dividend growth for the past two quarters. To illustrate, consider the previous distributions made in Q4 2018 and Q1 2019, compared to what was paid during the same time period in the prior year, illustrated in the chart below:

| Time Period | Q4 2017 | Q4 2018 | YOY Growth |

| Distribution | $.826/share | $.680/share | (18%) |

| Time Period | Q1 2018 | Q1 2019 | |

| Distribution | $.773/share | $.726/share | (6%) |

Source: iShares

As you can see, this is a declining trend, although the decline did moderate in Q1 this year.

In fairness, distributions in the ETF space can often be volatile, and a fund could see annual growth even if one quarter shows a decline. However, I take little comfort in seeing annual declines two quarters in a row. Furthermore, my primary objective when considering the Real Estate sector is to obtain an above-average yield. If a yield were below average, as ICF’s is, I could justify a position if the growth was stellar and I expected the yield to climb throughout the year. With declines over the past two quarters, I do not have the expectation of meaningful dividend growth going forward. Therefore, the only way I would expect to see the yield move above the 3% mark would be to see the share price decline, which is not a very attractive scenario.

Bottom line

I continue to find the value in the Real Estate sector, even with the volatility we saw this week. The Fed has offered dovish guidance for the remainder of 2019, which is a tailwind for high yielding sectors. Additionally, strong employment numbers, wage gains, and a growing population are all pushing up the demand for housing. This has positively impacted both single-family and rental apartment investment plays, and has helped the Real Estate sector as a whole beat the market consistently for the past year. Looking ahead, I expect all of these market conditions to remain in place, and therefore expect Real Estate to finish the year higher than where it sits today.

That said, ICF does not strike me as the way to play this investment thesis. The fund’s lack of dividend growth (and rising share price) has pushed the yield down to a price where it no longer attracts this “dividend seeker”. Furthermore, the exposure to retail REITs gives me pause, as this is an area I want to limit my exposure to for the long-term. Therefore, I would suggest buying in to the areas of the Real Estate sector that I find more attractive, such as self-storage companies or apartment REITs, or the funds that hold these companies in a higher percentage weighting than ICF does. In summary, I would recommend investors avoid ICF at this time, and look elsewhere for Real Estate exposure.

Disclosure: I am/we are long SPY, SPYD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News