[ad_1]

Nuthawut Somsuk

Thesis

With recessionary signs and warnings all around us, investors have been plowing cash into money market funds at an accelerated pace while exiting bonds and equities. There are several alternatives in the space now outside traditional funds: an investor can choose between rolling treasuries (which are finally yielding something), a short duration corporate bond fund or a short duration treasuries fund. A new alternative that offers de-minimis exposure to interest rates (in fact none of the holding periods is 6 months or more) is constituted by term funds.

The iShares iBonds Dec 2022 Corporate ETF (NYSEARCA:IBDN) is a fund which contains corporate bonds that have a maturity date up to December 2022. In essence, the fund contains very short-dated bonds and is set up to return the principal to investors once bonds mature. This ETF is different than the likes of PIMCO Enhanced Short Maturity Active ETF (MINT) because it has a term structure – i.e., it is supposed to mature at a set date. The fund was launched in 2015 and, from inception, it purchased bonds with a pre-determined maturity schedule. This type of fund addresses interest rate risk through its defined maturity schedule. A typical bond fund maintains a constant duration profile, replacing maturing bonds with new ones that have a set duration profile. Term bond funds just let the collateral mature and then return the principal to shareholders.

IBDN is set to fully unwind and return the principal to shareholders by the end of December 2022. The fund currently has a 30-day SEC yield of 1.94% and virtually quasi-zero interest rate risk due to its very short maturity profile. Given that the portfolio is all investment grade, there is little to no default risk here in the next 6 months, and this investment is best served for an investor looking to park cash for 6 months. IBDN can also serve as an arbitrage vehicle upon a market dislocation. As we have seen in June, steep market corrections are accompanied by wide bid/ask spreads on bonds and the propensity to panic for certain market participants. This can translate into a dislocation lower in price for the fund.

Holdings

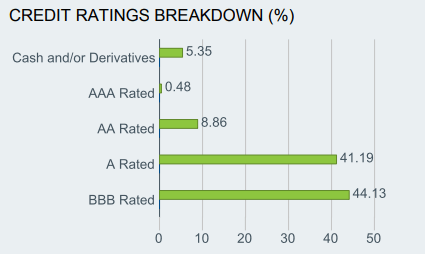

The fund is entirely composed of investment grade bonds:

Ratings (Fund Fact Sheet)

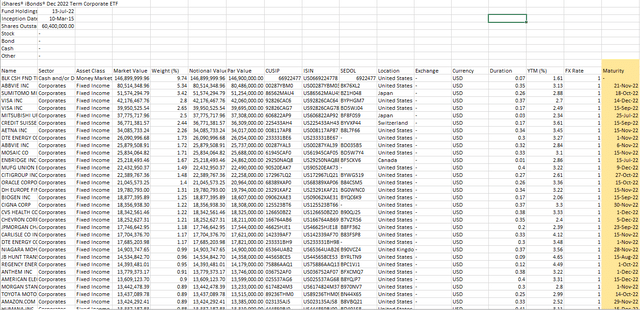

If we look at the collateral composition, we will notice that indeed all bonds mature before the end of the year:

Collateral (Fund Website)

We can notice that the collateral has a staggered maturity profile, with each bond maturing on distinct dates, as per their original offering documents.

There are 169 bonds now remaining in the collateral pool, and the number will continue to decrease as securities mature and principal is returned.

Performance

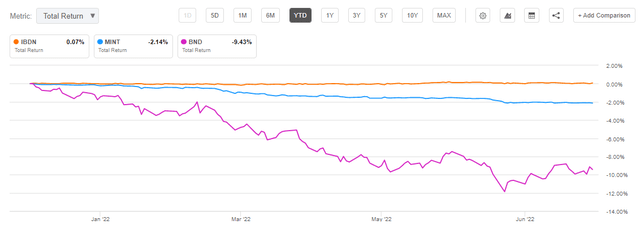

Unlike short-maturity bond funds or the aggregate market, IBDN has a flat performance year to date due to its duration profile:

YTD Performance (Seeking Alpha)

The advantage of term funds is the shortening of the duration profile as the bonds’ maturities approach. Basically, you are going to get your principal back, irrespective of the interest rate curve performance, and maturing principal is held as cash rather than reinvested in bonds with a high duration. In essence, buying into a term fund is akin to buying a bullet maturity bond, only with the benefits of diversification.

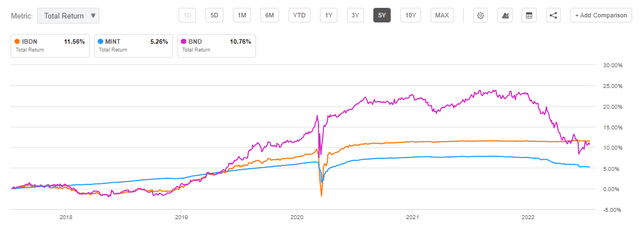

We can see a similar steady performance in the past five years:

5-Year TR (Seeking Alpha)

The Covid crisis represented a massive drawdown due to concerns around actual defaults in the collateral pool. An actual default would translate into a permanently lower NAV, hence the price dislocation lower.

Conclusion

With recessionary flags all around us and an equity market which has entered bear territory, many investors are looking to be overweight cash. Parked cash can take a multitude of forms from short-duration bond funds to outright rolling of treasuries. We bring to the fore another vehicle which can be used for this purpose, namely term bond funds. With a very short maturity profile and a collateral pool that is set to mature by December 2022, the iShares iBonds Dec 2022 Corporate ETF serves this purpose. The fund has a 1.94% 30-day SEC yield and a pure investment grade collateral composition. There is virtually no credit or interest rate risk here given the time to maturity (less than 5 months). An investor looking for alternatives would be well suited to be aware of this fund and generally corporate bonds term funds.

[ad_2]

Source links Google News