[ad_1]

BBuilder/iStock via Getty Images

I would recommend investors avoid the iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA:HYG) as the U.S. will likely enter a recession in the next 12 months in which case there is scope for HY spreads to widen further and cause more pain for the investors.

Fund Overview

The iShares iBoxx $ High Yield Corporate Bond ETF provides investors with exposure to high-yield (“HY”) corporate bonds. HYG is the largest high-yield corporate bond ETF, with $12.1 billion in assets (Figure 1). Peer funds include the SPDR Bloomberg Barclays High Yield Bond ETF (JNK), and the VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL). Some of the ideas discussed in this article are applicable to these peer funds as well.

Figure 1 – HYG and peers (Seeking Alpha)

Strategy

The HYG ETF achieves its objective by tracking the investment results of an index of U.S. dollar-denominated, HY corporate bonds.

HY corporate bonds, defined as those securities with ratings below BBB- (S&P and Fitch) or Baa3 (Moody’s), typically offer higher coupons than government treasuries and investment grade (“IG”) corporate bonds. They also typically have shorter maturities than IG bonds, which makes HY bonds less sensitive to interest rate movements (i.e., HY bonds have lower duration). Instead, returns on HY bonds are generally more correlated to equity markets; i.e., when the economy is improving, HY bond spreads tighten and HY bonds appreciate in value. According to PIMCO,

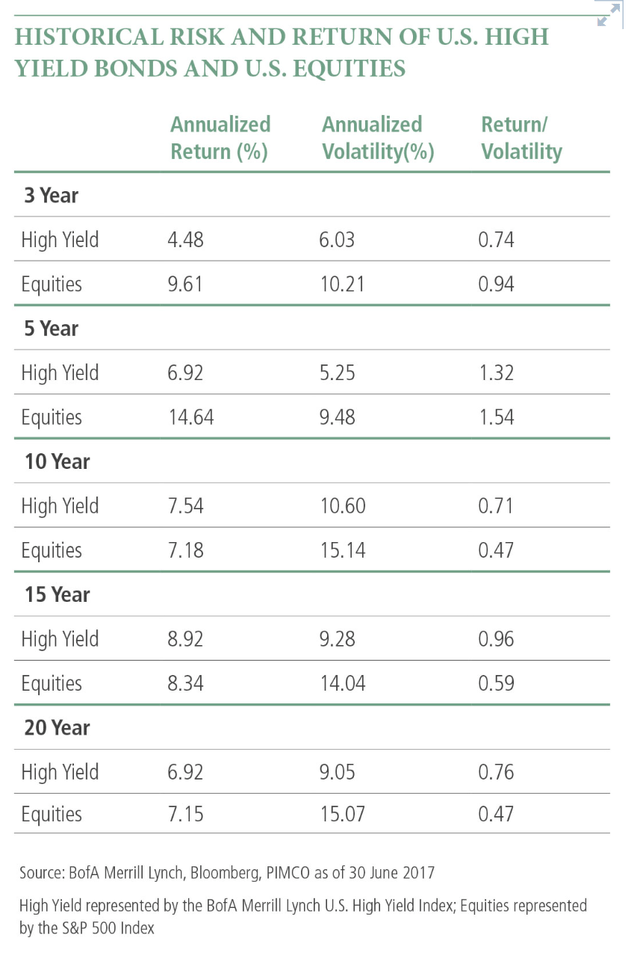

high yield bond investments have historically offered similar returns to equity markets, but with lower volatility.

PIMCO has an excellent overview of HY bonds that investors are encouraged to read. According to PIMCO’s research, high-yield bonds outperform equities on longer-term horizons (Figure 2).

Figure 2 – HY Bonds Outperform Equities Over Long Horizons (PIMCO)

Portfolio Holdings

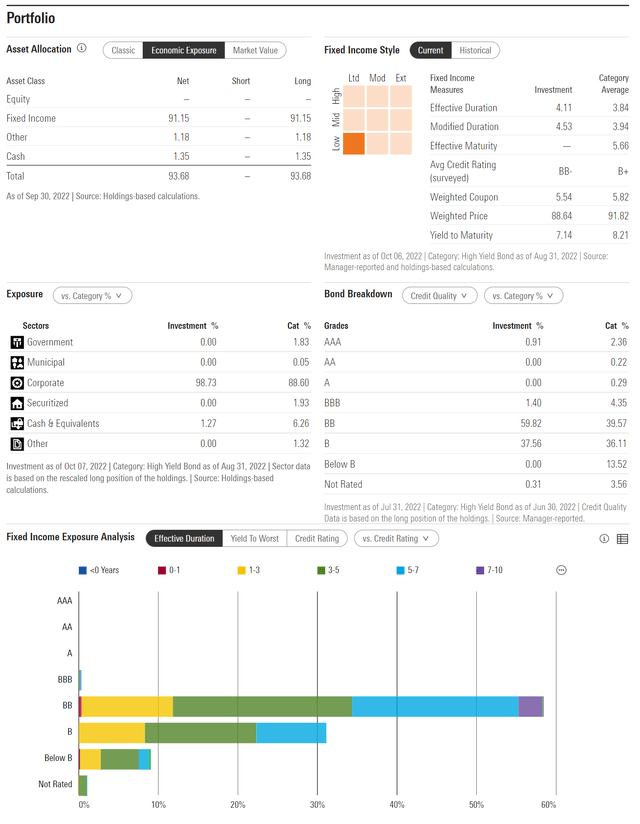

The HYG ETF has over 1,200 holdings and is broadly diversified. As of October 6, the fund has an effective duration of 4.1 years, and the credit rating breakdown of the portfolio is 1% BBB, 60% BB and 38% B (Figure 3).

Figure 3 – HYG Portfolio Characteristics (morningstar.com)

Returns

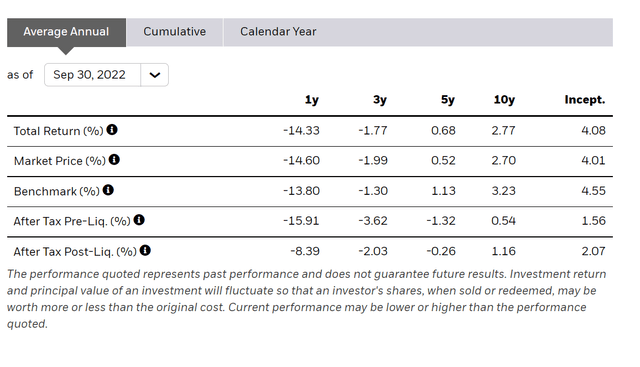

As of September 30, 2022, the HYG has delivered 3/5/10 Yr average annual returns of -1.8%/0.7%/2.8% respectively. YTD, the HYG ETF has had especially poor total returns of -14.9%.

Figure 4 – HYG Average Annual Returns (ishares.com)

HYG Produced Equity-Correlated Returns That Lagged The Market

While the major selling point of high-yield bonds (from Figure 2 above) is that they provide equity-like returns with less volatility, actual results, as shown in Figure 4 above, have been disappointing.

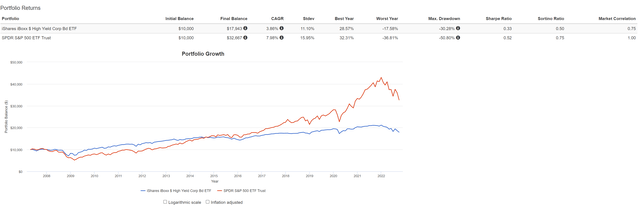

Comparing the HYG to the SPDR S&P 500 Trust ETF (SPY) using Portfolio Visualizer, we see that in the time period analyzed (March 2007 to September 2022), HYG has compounded at a 3.9% CAGR while the SPY ETF has compounded at 8.0% CAGR. HYG’s volatility is 11.1% vs. SPY’s 16.0% volatility. HYG’s sharpe ratio is 0.35 vs. SPY’s 0.50 (Figure 5).

Figure 5 – HYG vs. SPY (Author created with Portfolio Visualizer)

Per unit of volatility, the HYG ETF has only generated 0.35% of return. In contrast, the SPY ETF has generated 0.50% return per unit of volatility. Although HYG returns are highly correlated to equity returns, with a 0.75 market correlation, HYG’s returns lag that of the SPY ETF, per unit of volatility.

Understanding The Drivers Of Returns

Why are my results so dramatically different compared to PIMCO’s from Figure 2? The major difference between my analysis and PIMCO’s is the start and end dates. Investors need to understand the assets they are investing in and the key macro drivers affecting these assets.

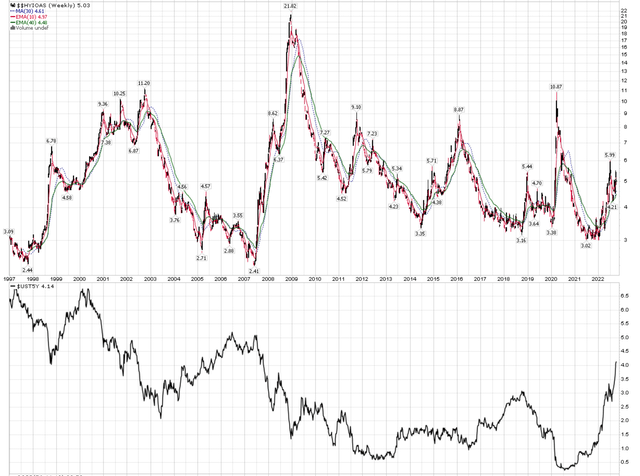

We know that HY bond returns are primarily derived by three sources: Yield (which is related to the level of HY spreads), Credit (from the tightening or widening of HY spreads), and Rates (from the rise and fall of interest rates). HY spreads generally rise and fall in sync with the economic cycle, and can provide 4.0-6.0% of return per year through a cycle; tighter spreads decrease yields but increase price, and vice versa. HY spreads are shown in the top panel of Figure 6 below.

Figure 6 – HY spreads and 5-Yr Treasury Yields (stockcharts.com)

In my opinion, the key outperformance driver of HY bond returns was the secular tailwind from ever decreasing interest rates. Notice PIMCO’s analysis from Figure 2 was trailing 10, 15, and 20 year returns from June 2017. This means the starting years were 1997, 2002, and 2007. From the second panel of Figure 6 above, we can see that 5-year treasury yields were over 6% in 1997, and ~4% in both 2002 and 2007. By 2017, 5-year treasury yields had fallen to rock bottom 1% (only to be surpassed briefly after the COVID-pandemic). This means even with a low effective duration of ~4 years, the Rates component of HY bond returns added 1.0-2.0% per year to HYG returns.

However, with interest rates effectively at the lower bound post 2017, investors could no longer depend on further rate driven returns. Is it any wonder that PIMCO has not updated their HY bond intro/marketing materials after 2017?

In fact, interest rates have now become a headwind, as 5-year treasury yields have risen rapidly to over 4%, which has been a big driver of the YTD drawdown in HYG.

Distribution & Yield

The HYG ETF pays a modestly high distribution yield, with LTM distribution of $3.76 / share equating to a trailing yield of 5.3%. HYG’s distribution is variable and is dependent on income from portfolio holdings. The most recent distribution of $0.351 / share was paid on October 7, 2022.

Fees

The HYG ETF charges a relatively high management fee of 0.48%. This is the second highest fee among the peer funds listed in Figure 1.

Will Credit Take The Baton From Rates And Cause More Pain?

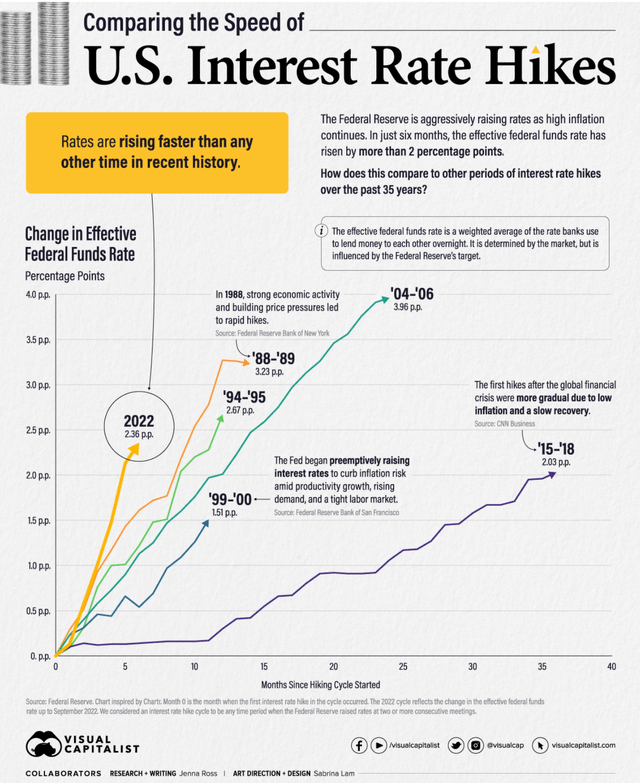

While the first 9 months of 2022 has been characterized by the Federal Reserve raising overnight rates at the fastest pace ever and dragging interest rates higher along the whole curve (Figure 7), we are now starting to see cracks in the economy which could spell trouble for HY bonds.

Figure 7 – 2022 Was Fastest Interest Rate Increase Ever (Visual Capitalist)

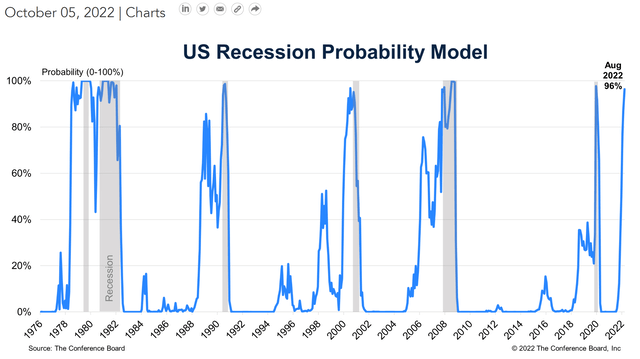

The Conference Board currently estimates a 96% probability that the U.S. will enter a recession in the next 12 months (Figure 8). When the probability gets this high, it is almost a near certainty that a recession is imminent (6 out of 6 hit rate above 90% probability). Even President Biden conceded recently of a possible recession, when he was adamant there wouldn’t be one a few months ago.

Figure 8 – Recession Probability at 96% (Conference Board)

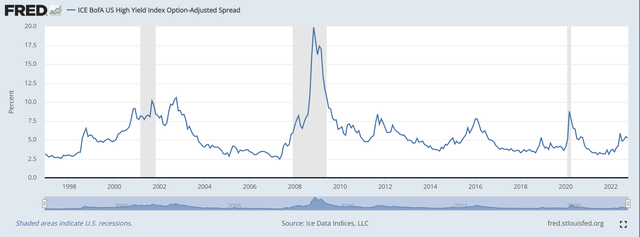

During recessions, HY spreads typically blow out to over 8%, as many companies struggle financially and some even go under (Figure 9). As we are currently only sitting at 5.0% in HY spreads, I believe there is still a lot of price downside for the HYG ETF.

Figure 9 – HY spreads vs. Recessions (St. Louis Fed)

Risk To My Call

The risk to my call is if the Federal Reserve can thread the needle and stop inflation without causing a recession, then obviously, the price drawdown can be avoided.

Conclusion

I would recommend investors avoid the HYG ETF as the U.S. will likely enter a recession in the next 12 months in which case there is scope for HY spreads to widen further and cause more pain for HYG investors.

[ad_2]

Source links Google News