[ad_1]

Takako Hatayama-Phillips/iStock Editorial via Getty Images

Main Thesis/Background

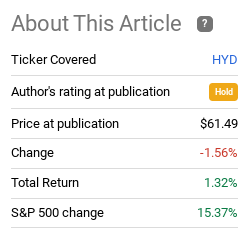

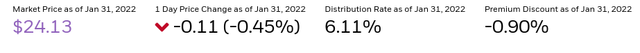

The purpose of this article is to evaluate the VanEck Vectors High Yield Municipal Index ETF (HYD) as an investment option at its current market price. The fund’s objective is to “track the overall performance of the U.S.-dollar-denominated, high-yield, long-term, tax-exempt bond market”. Over the past year, HYD has been performing moderately. Since my last review, the fund is down a few percentage points, but for longer term holders, they are probably still seeing slight gains. For example, since my March 2021 review, HYD has offer a return just over 1%. Considering the broader risk-on mode since then, that is not very impressive:

Fund Performance (Seeking Alpha)

Given this mediocre performance in the past 11 months, I wanted to examine HYD critically for 2022. After review, I feel a neutral / hold approach makes sense here. Perhaps the recent sell-off could be a buying opportunity, but I would actually favor more investment grade bonds that are offered through CEFs that have begun to trade at attractive discounts. HYD is good for passive exposure, and removes the risks associated with leverage. Further, the fund’s duration is lower than many IG CEFs, which can be a positive in a rising rate environment. Yet, the fund’s duration is not “low”, so there remains risk here as well. Finally, there are some cracks materializing in corners of the muni market. This will be amplified if we don’t see continued fiscal support from Congress, and suggests investors want to be selective on their credit exposure for the time being.

Why The Weakness? Yields

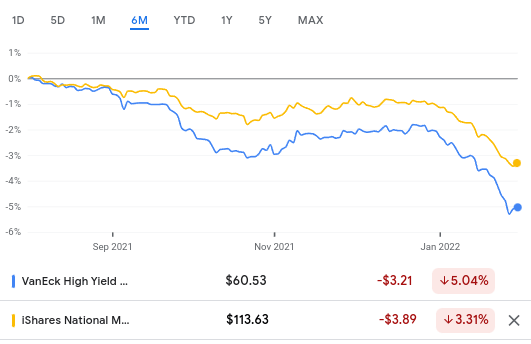

To start, I want to examine some of the reasons behind HYD’s sluggish performance. Again, this is not unique to HYD, as the entire muni sector has been caught up in some selling. Unfortunately, I had predicted the fund would hold up better in the second half of the year, as high yield sectors typically perform better than IG in rising rate environments. Yet, this did not materialize as planned. For example, over the past six months, HYD has offered a similar negative return as the iShares National Muni Bond ETF (MUB), which tracks IG credit. When we factor in the higher yield from HYD, the returns would be similar:

6-Month Performance (Google Finance)

So, what gives?

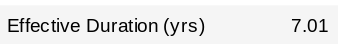

One point in particular is to note that both IG and high yield munis are pretty susceptible to rising yields. The negative here is that while many high yield sectors have lower durations than their IG counter-parts, in munis the opposite is true for the moment. To illustrate, consider that HYD has an effective duration of 7 years, while MUB is sitting with an effective duration just over 5 years:

Duration (VanEck)

Duration (iShares)

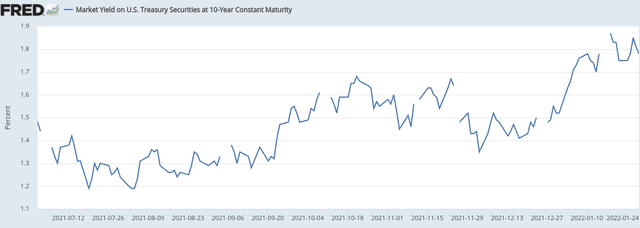

This matters because yields have been pushing higher, which is pressuring bonds/funds that are sensitive to interest rates. Over the past six months, which is the time-frame I referenced showing the drop in both HYD and MUB, the 10-year yield has moved consistently higher, justifying those drops:

10-Year Yield (St. Louis Fed)

This should be fairly self-explanatory as to why munis in general, and HYD by extension, have come under some pressure. Yields have been rising, and that is pressuring fixed-income across the board. This is probably going to be the reality for most of 2022, at least for the first half of the year, so readers need to manage their expectations regarding returns from this sector accordingly.

Why The Weakness? No Changes To Tax Code

A second point in understanding the lack of bullishness around munis has been a lack of legislative action from Congress re-tax rates. In 2021, I expected changes to the tax code to include higher rates on both corporations and high-income individuals. These are the two primary buyers on munis, so higher tax rates on these groups was likely to spur demand. This was a potential tailwind going in to 2022, when I expected those higher rates to go in to effect.

Fast forward to today, and that prediction was flat-out wrong. The current administration has struggled to get legislation passed, and has spent much of the past year trying to solidify support within their own party. Rising tax rates did not generate the needed level of support, and have therefore been tabled for now. While this may be “good”, especially for the groups that I mentioned who would have been disproportionately impacted, it was not a net positive for holders of munis as it removed a serious tailwind I was anticipating.

The fortunate part is that changes to the SALT limits did not materialize either. As part of recent legislation, House Democrats included provisions to raise the SALT deduction cap from its current $10,000 threshold to $80,000. If that had (or does) pass, it will remove some of the demand impact from the higher absolute rates. Some filers may actually see their effective tax rate go down, once the higher deduction is accounted for. To date, this has not been put in to law.

The point here is that there are push-pull discussions going on in Congress right now that will impact taxes and muni demand. A worst case scenario for muni investors would be a passing of the buck on raising tax rates, but an increase in the SALT deduction. A best case scenario would be an increase to absolute tax rates, and a leaving of the SALT deduction alone, or at least just a modest increase. Again, this outlook is not geared towards the good or bad from a political standpoint or from an individual tax planning standpoint, but rather from someone who owns muni bonds and wants to see an environment where those bonds remain in demand.

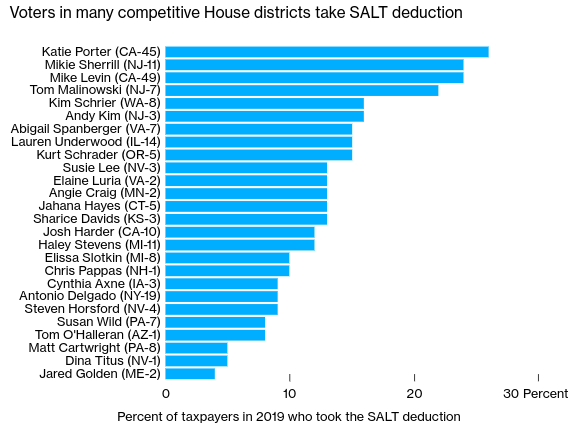

In closing on this issue, I would caution readers to stay up-to-date on any progress going forward. Both of these issues will have impacts on muni bond demand, and therefore will impact prices in the funds I cover. Importantly, while no changes were made in 2021, these issues remain front and center on many legislator’s minds. With the SALT deduction disproportionately impacting higher-tax jurisdictions run by Democrats, those legislators are using this as leverage to solicit concessions from the Biden administration before agreeing to pass any social spending bills. For illustrate purposes, consider the graphic below, which shows the percentage of voters in Democrat-run districts who utilized the SALT deduction:

SALT Deduction Demand (Bloomberg)

As you can see, this topic is going to be front and center in many mid-term elections that are coming up this year, and muni investors would be wise to monitor any developments closely.

Other Problems? At-Risk States Dominate HY

To balance out some of the pessimism I have delivered so far in this review, I want to touch on one positive development. As has been the theme for 2021, we enter 2022 with a stronger credit environment in terms of quality. As the economy continues to grow and we get closer to putting the pandemic behind us, most factions of the credit world – treasuries, corporate bonds, and municipals – are all enjoying a fairly optimistic outlook when it comes to getting paid back. Defaults have been minimal, and credit ratings agencies do not expect this to change this year.

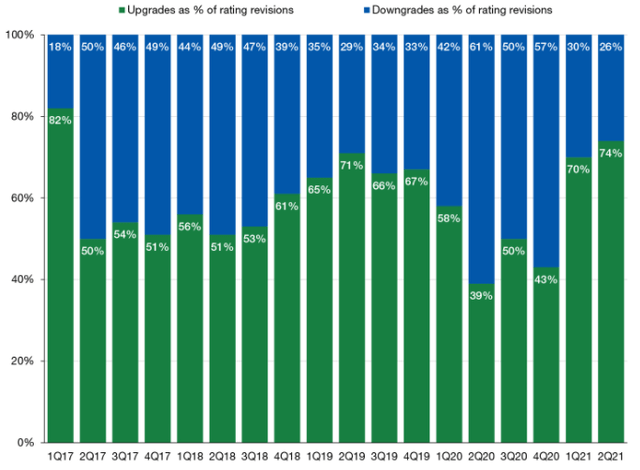

Isolating the muni sector, I will point out that munis continue to benefit from this reality as well. After 2020 saw a rash of downgrades, the opposite was true in 2021. In fact, a rising majority of rating revisions have been upgrades, with almost three-quarters of revisions being of a positive nature:

Upgrades/Downgrades Ratio (Lord Abbett)

This speaks somewhat to the resiliency of muni bonds, and helps support holding on to these positions for the longer term. Ultimately, this is good news.

However, we have to keep in mind that this graphic does suggest downgrades are still occurring. This is not meant to cause readers to be blind to the risks out there in the credit world. Quality issuers are holding up nicely, but that does not mean all is well in every corner. This is part of the reason why I have renewed my focus on IG debt, rather than pushing down the quality ladder and in to funds like HYD.

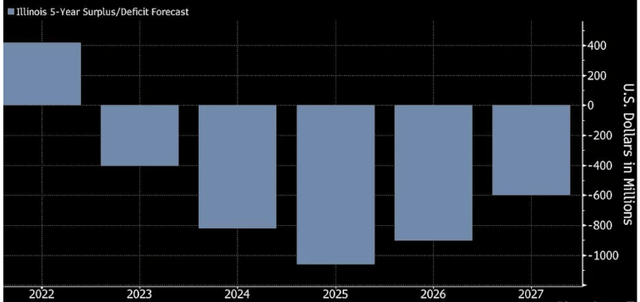

For specifics, let us consider the state of Illinois. This is a state with a history of debt problems, and it has the lowest credit rating in the U.S. (although it did have a recent upgrade in 2021). While the state has made progress and is still expected to report a surplus in 2022, that is expected to change dramatically in the years ahead, as shown below:

Illinois Budget Forecasts (Yahoo Finance)

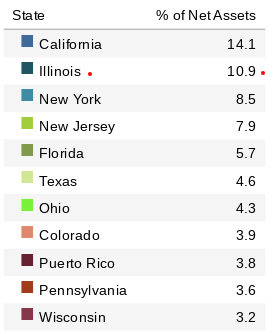

Why does this matter to HYD? While it is relevant to most muni funds, followers of this one should note that Illinois represents the second largest state exposure to HYD, coming in only behind California:

State Breakdown (VanEck)

My takeaway here is not to say investors need to flee Illinois debt, nor to avoid funds that hold bonds from this state. It is, however, a message to illustrate that there are signs of pressure in the muni market. Not all bonds or funds are created equal, and investors probably want to be more selective on what credit exposure they take on now. While in the short-term Illinois looks good, the longer term appears mixed. The high amount of exposure HYD appears to have to the state helps to justify a more modest outlook in my opinion.

Munis Actually Do Offer Some Value

My final point takes a look at the broader muni market. This is relevant to the whole sector, HYD and beyond. As readers know, this is a part of the market that has sold-off recently, worse than some other sectors. While painful, the good news for investors looking for new positions is that they are starting to get some value at these levels. For comparison, look at how the valuation gauge against treasuries has moved in just a one month time-frame:

Muni Yield To Treasuries (Bloomberg)

Now, this does not meant that munis cannot fall further, or that they are going to shoot up higher. There are legitimate reasons for the recent weakness, which I touched on in this review. Yet, finding value often means buying during periods of what is hoped to be temporary weakness. So this could be one such time.

Further, this valuation gap extends beyond just the muni index. While prices of the underlying securities have fallen, investors have also been rotating out of the CEFs that hold this debt. The result from that has been an expansion of discounts for these funds, compared to their net asset value. In fact, all three funds that I own – the Nuveen AMT-Free Quality Municipal Income Fund (NEA), the Nuveen Quality Municipal Income Fund (NAD), and the BlackRock Taxable Municipal Bond Trust (BBN) all currently have discounts to their NAV, as shown below, respectively:

Fund Valuation (Nuveen)

Fund Valuation (Nuveen)

Fund Valuation (BlackRock)

The conclusion here is that with IG CEFs, in both the tax-exempt and taxable sectors, offering this type of value, it seems wise to just go ahead and invest there. I like the idea of high yield when the IG spread is too tight and premiums abound that make it hard to justify adding to IG positions. But that isn’t the case right now, so I will focus on quality.

Bottom line

I saw more value in HYD months ago, and it has been a disappointment. Rather than “doubling down” on that position, I cut my losses and added to my investment grade holdings that are trading at much wider discounts than where they were just a few months ago. Of course, there is still plenty of risk on the horizon – stemming mostly from the potential for higher yields/rates and a lack of progress on changes to the tax code out of Washington. However, munis remain part of my long-term plan, and after fading some exposure over the last few quarters, it is time for me to build back on those positions, just not with HYD. Therefore, I will place a hold rating on HYD, and suggest readers approach this fund selectively at this time.

[ad_2]

Source links Google News