[ad_1]

Nate Geraci recently interviewed Direxion’s Dave Mazza about their suite of “Relative Weight ETFs” launched earlier this year. I have long believed in the merits of tilting an equity portfolio towards value, small cap, and emerging market stocks, and so was intrigued by the promise of these ETFs to capture these premiums by going long value / short growth, etc. These ETFs cover five pairs of long/short trades: US vs developed international, cyclicals vs defensives, international developed markets (NYSE:DM) vs emerging markets (EM), US large growth vs value, and US large vs US small. Below is a table of these ETFs, with their symbols, recent asset sizes, and expense ratios:

| ETP Name | Net Assets | Net Expense Ratio |

| Direxion FTSE Russell International Over US ETF (RWIU) | $14.6M | 0.46 |

| Direxion FTSE Russell US Over International ETF (RWUI) | $14.5M | 0.55 |

| Direxion MSCI Cyclicals Over Defensives ETF (RWCD) | $16.6M | 0.45 |

| Direxion MSCI Defensives Over Cyclicals ETF (RWDC) | $14.2M | 0.45 |

| Direxion MSCI Developed Over Emerging Markets ETF (RWDE) | $15M | 0.52 |

| Direxion MSCI Emerging Over Developed Markets ETF (RWED) | $14.4M | 0.58 |

| Direxion Russell 1000 Growth Over Value ETF (RWGV) | $26.7M | 0.46 |

| Direxion Russell 1000® Value Over Growth ETF (RWVG) | $24.5M | 0.46 |

| Direxion Russell Large Over Small Cap ETF (RWLS) | $16M | 0.46 |

| Direxion Russell Small Over Large Cap ETF (RWSL) | $15.9M | 0.47 |

Source: Direxion, Fidelity

Investing $100 in these ETFs gives me $150 long exposure to the “over” side and a $50 short position on the other side – for example, $100 of RWVG holds $150 of Russell 1000 Value, and is short $50 of Russell 1000 Growth, and these weights are rebalanced monthly. While I see the appeal of buying one ETF to gain both a “core” equity allocation with a 50% spread premium on top, I find these too inflexible for my purposes.

The “Portable Alpha” Alternative for Value vs Growth, Small vs Large and EM vs DM trades with futures

Instead of buying one of these ETFs, I would more likely construct a similar long bias portfolio by investing $100 into a “core” ETF of my choice, and then adding a long/short pair trade on the pairs of quarterly rolling futures contracts whose spread I wish to capture. The advantages of this approach include:

- The spread (say, long small caps / short large caps) is “portable” with futures contracts, requiring minimal capital, and not requiring me to hold a fixed $100 “core” long position if I don’t want to. That is, I have flexibility to choose a beta of 1, 0 or almost any alternative.

- I can customize the amount of the overlay, whether I want it to be 10%, 50%, 100%, or 500% the size of my “core” position.

- I have more flexibility over my choice of pairs, for example, I can chose US vs EM directly rather than having to choose US vs DM or DM vs EM.

- I can combine these pairs on the same $100 “core” without having to split and choose between them.

- The net effective financing / borrow rate on the pair of futures contracts is likely to be even more cost effective than the 0.45 – 0.58% expense ratios of these Direxion ETFs.

I have long argued that leveraged and inverse (L&I) ETFs, which Direxion is perhaps best known for, are largely unnecessary because they generally track benchmarks on which futures contracts tend to be both available and a more efficient way to get leveraged or inverse exposure. Although I believe these relative weight ETFs are far more suitable as a long-term holding for an investor than almost any L&I product, I believe futures are still a better and more flexible tool than these ETFs to captures these targeted spreads.

The underlying benchmarks and their ETFs

Here, I will look at some metrics and merits of the spreads between value vs growth, US small vs large, US vs International, and Developed vs Emerging, and suggest how I might implement each strategy differently than with these ETFs. I will ignore the cyclicals vs defensive pair, though will say I wish there were a global financials vs non-financials and pairs on credit spreads (e.g. investment grade vs high yield).

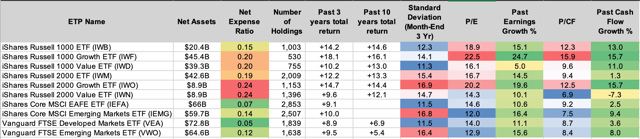

For reference, here is a list of some of the largest “core” ETFs tracking the indexes paired in the Direxion ETFs:

| iShares Russell 1000 ETF (IWB) |

| iShares Russell 1000 Growth ETF (IWF) |

| iShares Russell 1000 Value ETF (IWD) |

| iShares Russell 2000 ETF (IWM) |

| iShares Russell 2000 Growth ETF (IWO) |

| iShares Russell 2000 Value ETF (IWN) |

| iShares Core MSCI EAFE ETF (IEFA) |

| iShares Core MSCI Emerging Markets ETF (IEMG) |

| Vanguard FTSE Developed Markets ETF (VEA) |

| Vanguard FTSE Emerging Markets ETF (VWO) |

And below is a screenshot comparing the relative sizes, expense ratios, past performance, volatility, valuation, and historical earnings growth rates of these 10 benchmarks:

Source: Fidelity

Some observations from the above table:

- Russell 1000 growth has significantly outperformed value over the past 10, and especially past 3 years, partly on the back of higher earnings and cash flow growth.

- US large caps (Russell 1000) have outperformed US small caps (Russell 2000), again more in the past 3 years than over the past 10, but less on the back of earnings growth and more on earnings quality (cash flow growth).

- The US has significantly outperformed both DM and EM, though EM has shown similar earnings growth and now trades at a far lower multiple to those earnings

Pair #1: Value vs Growth

Value has underperformed growth so significantly this economic cycle (since 2009) that many investors have asked whether the value premium is dead, in ways that sound very similar to the now infamous “Death of Equities” business week cover from almost 40 years ago. As mentioned above, value seems to have recently underperformed growth because growth stocks have actually succeeded at growing their earnings significantly faster than value stocks, just as ever the trade is a bet on whether or not this growth spread will continue. While I spend a good amount of my time working to separate simply “cheap” or “value trap” stocks from “quality value”, I do overall believe it makes sense to go long value and short growth at this stage in the cycle. My critique of using RWVG to do this is that the tilts towards growth and value in the Russell 1000 benchmarks are so shallow that the two indexes actually overlap. My preference would be to replace the “core” IWD equivalent with a deeper value factor ETF like the iShares Edge MSCI USA Value Factor ETF (VLUE), or the iShares Edge MSCI Multifactor USA ETF (LRGF). The latter even has a slightly lower P/E ratio than IWD, but also incorporates quality, size, and momentum factors in addition to value.

To capture the value vs growth spread with futures, there are CME-listed e-mini futures contracts on the Russell 1000 Value and Russell 1000 Growth benchmarks, but these contracts have almost no trading volume. More likely, I would either lever up my core ETF (if I could finance at a low margin rate), or use the S&P 500, Dow, or Russell 2000 futures to lever the long position, and sell Nasdaq 100 futures for the short exposure.

Pair #2: Small vs Large

Using Russell 2000 futures for my core long position against an S&P 500 or Nasdaq 100 short position would give me very liquid exposure to the small cap vs large cap spread I am looking for, more specifically to small core vs large core and small core vs large growth respectively.

Historically, the classic two-factor smart beta premium was to go long small cap value and short large cap growth, I would prefer to tilt to small value in my core rather than simply choosing small core vs large, as RWSL and the futures would limit me to doing. Again, I would probably do this by using a smart small cap ETF in the core of my portfolio.

Pair #3: US vs DM vs EM

Of all the factors mentioned in this article, the one pair I have the highest conviction will outperform over the next 10 years is emerging markets over US stocks. This is partly backed by the metric that emerging markets are cheaper than they have been in years relative to US markets, despite strong past and future growth prospects. Unfortunately, the Direxion ETFs make me choose between trading DM over the US in RWIU, or EM vs DM in RWED. One of the largest shorts in RWED is Swiss drug company Roche, which is one of my favorite value long positions, and not a name I would want to short against EM.

Fortunately, US vs DM vs EM has the most abundant and most liquid choices of these pairs to implement with futures contracts. For the US short, I could choose the Nasdaq 100, S&P 500 or Dow futures as mentioned above. On the long side, the MSCI Emerging Markets Index has the 2nd most traded futures contract of any MSCI index on the ICE, followed by the futures on the MSCI EAFE index (a benchmark for international developed markets). I could also select individual developed and emerging markets, with liquid futures contracts available on benchmarks like the Nikkei 225, the EuroSTOXX 50, the FTSE 100, the Hang Seng, or SGX India benchmarks, just to name a few.

Conclusion

At this stage in the cycle, I am especially keen to increase exposure to the spread between value over growth, small caps over large caps, and emerging markets over the US by adding long positions to the former and short positions to the latter of each pair. However, I do not believe the Direxion ETFs offer a flexible and effective enough way of combining a core position and capturing the right combination and proportion of these spreads. Instead, I will choose other smart beta ETFs as my core, and use pairs of the above mentioned futures contracts to add the “portable alpha” of these spreads.

Tariq Dennison is a Hong Kong based wealth manager at GFM Asset Management, a US Registered Investment Advisor.

Disclosure: I am/we are long VWO, VEA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News