[ad_1]

The Mack Truck Is Behind You. Not Heading Right For You. You Passed It Already.

grandriver/E+ via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Free Your Mind

When everyone everywhere is saying the same thing about stocks, it’s usually not correct. Or, to be clearer, it is usually old news. If talking heads are telling you that, say, Bitcoin is gonna be big? It probably already is big. TV pundits saying, oh, man, nuclear energy is gonna be the bomb, because, Russia and all? Probably the spot price of uranium ran up already. All your buddies, everyone on YouTube, and the Wall Street Journal telling you it’s going to get tough for growth stocks? Well, you work it out.

In a recent blog post we walked through why we think that stock prices lead – not lag – the news. You can read the post in full here, but in essence, our firm view is that what we all call the “news” is only new to the population at large. It isn’t new to big money decisionmakers. Bill Ackman does not make investment decisions based on what he just read in the WSJ that morning. Good chance Warren Buffett doesn’t watch Jim Cramer’s Mad Money – and even if he does, his trigger finger probably isn’t waiting to act on Jimbo’s proclamations. And most likely the unimaginably large sums of money collectively sloshing around the retirement systems of America don’t get deployed based on a CNBC market update.

You see, by the time the news reaches the retail investor, it’s not actually new, and, worse, big money already acted on it. So the idea that you can gain an edge by investing based on the news and, consequently, prevailing market sentiment, seems structurally and irrefutably incorrect to us. You need to be ahead of the news, ahead of sentiment. You can do this to the nth degree in the manner of the now-famous Renaissance Technologies fund model, you can spend your time watching stock charts, or, you can keep it simple and just zig when other folks are zagging.

The Master, of course, summed this up a hundred years ago in suitably pithy form. “Be greedy when others are fearful, and fearful when others are greedy,” is the refrain echoing out of Omaha still.

Well, there’s plenty of fear in the market right now, and that alone should have your antennae up and looking for opportunities to be greedy.

We cover a whole host of growth stocks and the overwhelming majority of them have stock charts that to our eyes are pointing up at the stars, not down into the gutter. This is completely at odds with everything you see and hear in the real world right now. So, either our chart method is completely wrong – very possible of course, though the same method has succeeded in helping us call recent tops and bottoms in the market (you can read more about that here).

Or, there’s a typical disconnect between the charts and the real world. We believe this persistent disconnect is simply the x-axis position. Specifically, while all around you folks are worrying about what is going to happen to growth stocks, i.e. what lies in store on the hard right edge of the x-axis, most of the selling has already been done in our opinion, and is now in the rear-view.

Buy The Stomped-On Poster Child

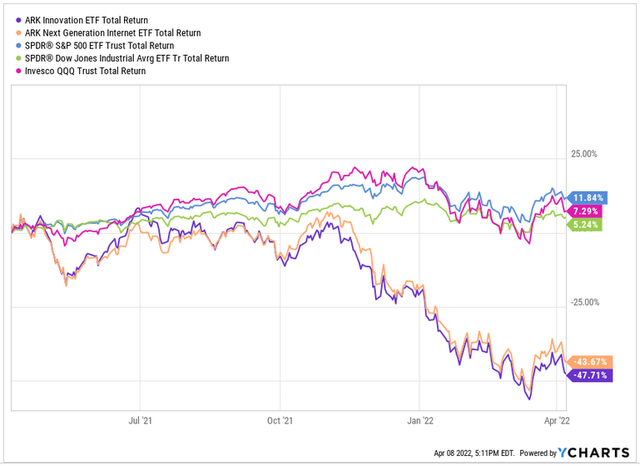

In this context we believe that the two core Ark technology funds, Ark Innovation ETF (NYSEARCA:ARKK) and Ark Next Generation Internet ETF (NYSEARCA:ARKW) offer compelling buying opportunities at present. Much of the Internet and most all your friends and family will likely laugh at you for repeating this idea in polite society. The absolute epitome of Robinhood exuberance during peak COVID crisis, the classically-trained fund manager that runs Ark Invest, Cathie Wood, has taken brickbats aplenty of late. As well she might, since the fund performance has been atrocious in recent months. Here’s how it has performed vs. the big three index ETF picks in the last twelve months.

Ark Funds vs. Indices (YCharts.com)

Oh dear. So far, the kid at the carwash is right. You should have bought the Dow!

This is rather missing the point, however. Of course, during periods when the market declares that risk is most certainly off, as has been the case in the last twelve months, then oddly enough, high-risk ETFs are likely to underperform the stalwarts.

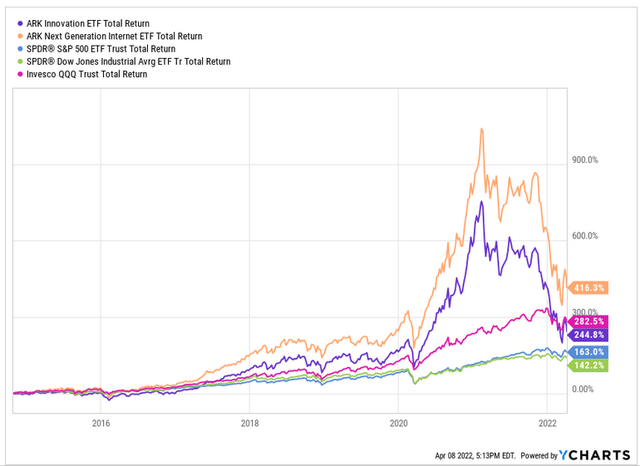

So, let’s zoom out some and see what happened over a longer period of time.

Longer Term Ark Funds vs. Indices (Ycharts.com)

Easy. When risk is on, Ark funds outperform, they come crashing back to earth when the market gets spooked, then race away again when calm descends upon market participants. You can see from this larger degree chart above why our own preference is for the less popular fund, ARKW. The outperformance vs. ARKK is mostly down to the Bitcoin holdings within ARKW – specifically the holding in Grayscale Bitcoin Trust (OTC:GBTC). In staff personal accounts we believe GBTC is a low risk way to gain access to bitcoin and so, hefty discount to NAV and management fees notwithstanding, we’re happy to own some, be it directly or through ARKW.

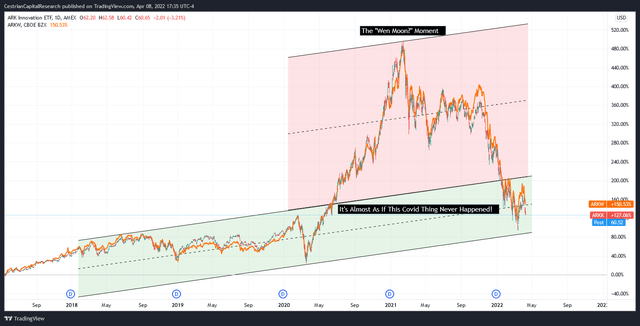

We believe the most rational way to assess ARKK and ARKW is as follows. First, just treat the disproportionate COVID stimulus spending on the funds as an anomaly. Here are the two tickers since late 2018. (You can open a full page version, here).

ARKK & ARKW x Covid-19 (TradingView, Cestrian Analysis)

If you just close your eyes and assume that Joe P. Retail and his basement-dwelling buddies never did blow their stimulus checks on these things – you can then ignore that blow-off top peaking around February 2021 and just say, well, here are a couple of growth-oriented ETFs that trade in an upward-sloping channel so I can either buy and hold for a long time, or, I can try to trade my way through that channel, or both. We see no reason why that green channel should not continue and indeed as our base expectation for the funds we think they can continue to deliver long term value appreciation at approximately the rate indicated by the angle of that channel. On that logic alone one could simply buy ARKK or ARKW and forget about them for some years whilst they accrue value.

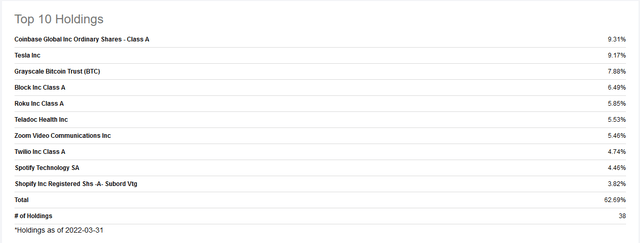

But what about a more bullish case? Well, let’s look at ARKW specifically. Here are the top ten holdings (source – Seeking Alpha).

ARKW Top Ten Holdings (Seeking Alpha)

This looks good to us. We don’t cover TSLA but we do own the stock in staff personal accounts and we’re very bullish on the name. GBTC, bullish too. Block (SQ) is showing a chart common to many such names at present.

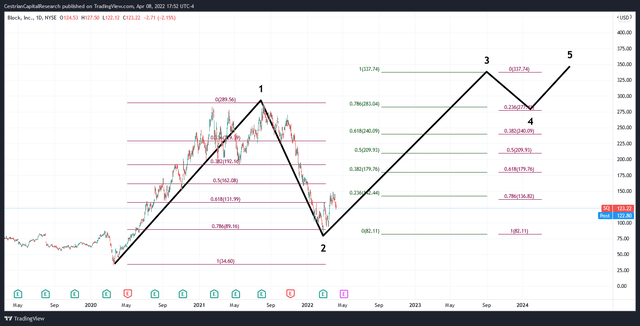

SQ Stock Chart Outlook (TradingView, Cestrian Analysis)

Textbook brutal Wave 2 down following the Q1 March 2020 Wave 1 run up. And the stock is in our view moving up the ladder toward a new high in Wave 3. We could go on.

Ark Invest could in our view use an upgrade in its marketing. Having 25-year-olds make YouTube videos about disruptive innovation might have been a good way to attract inflows from other 25 year olds who make YouTube videos, but the messaging sits ill with us and probably other grownups. But if you look at the top holdings in these funds, they aren’t banzai startups run by kids with weird hair. They’re pukka companies run by old people like ourselves. Musk, Dorsey et al – hardly spring chickens, and they don’t need to be marketed as such. We never watch an Ark video or read their research, because in our view it isn’t very good.

But what we do take notice of is what Cathie Wood says. Because she’s a classically trained fund manager and a good one at that. And she has been saying the same thing over and over about inflation. Which is to say that she has been saying that the current bout of inflation is just as transitory as Jerome Powell once insisted it was. And you know what? We agree. Each of the companies that ARKK or ARKW champion are cost-curve leaders, deflationary forces in their industry.

At Cestrian our professional investing careers have been spent investing in deflationary technology companies. The S&P 500 is spearheaded by deflationary technology companies. The “deflation” theme isn’t wacky doublespeak, it’s most certainly a thing and it’s a persistent thing. That gas prices are a little out of whack right now, that food is crazy expensive this week, that’s not the deflation of which Ark speaks. Disrupting banks, telcos, auto manufacturers, that’s the deflation they mean.

All taken together we believe that each of ARKK and ARKW are compelling stocks to buy right now and to hold for some years. Our chart take on each is similar – again, we lean toward ARKW ourselves due to the Bitcoin exposure, but against that, ARKK is much more liquid and for investors wanting larger positions, it is probably at least as good a pick.

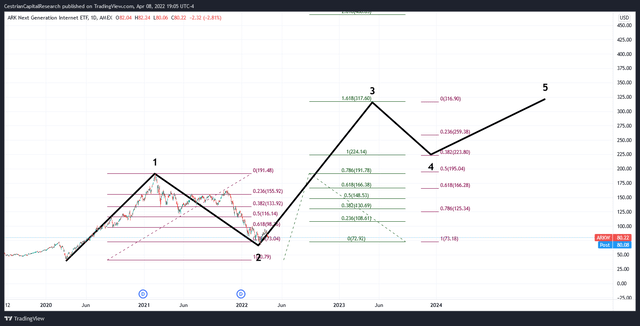

ARKW Outlook (TradingView, Cestrian Analysis)

We believe ARKW has bottomed out at the 0.786 retracement of that Wave 1 up; we think it can hit highs of between $224-317 in the next 12-18 months, those being the 100% and 1.618 extensions of Wave 1; and we think after a modest Wave 4 correction it can continue to push up thereafter. (Full page chart, here).

Want a more cautious take? Then how about this. (Full page chart, here.)

ARKK Outlook (TradingView, Cestrian Analysis)

You can say ARKK is in the early stages of a final Wave 5 up to complete a 5 wave cycle that began in 2017; Wave 5 can terminate just above the prior W3 high, meaning somewhere between $160 (a new high, just) and $172 (if W5 = the amplitude of W3). Oh and if you think these funds don’t trade to technical norms, just check that perfect ARKK Wave 3 up peaking at the 3.618 extension of Wave 1. Textbook!

So if you care to be bold, consider buying ARKK or ARKW. We own ARKW in staff personal accounts and rate both funds at Buy.

Cestrian Capital Research, Inc – 8 April 2022.

[ad_2]

Source links Google News