[ad_1]

Are you looking for How Did Carl Icahn Get Rich but you are confused that where to find best answer then you are here at the right place.

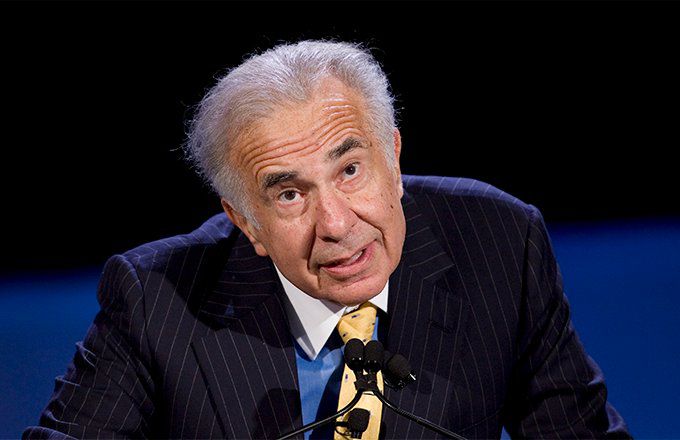

Carl Icahn made his fortune as a corporate raider by buying large stakes and manipulating the targeted company’s decisions to increase its shareholder value.

Most recently, on July 24, 2019, Icahn sent a letter critiquing Occidental Petroleum’s management and board for issuing $10 billion of preferred stock to Berkshire Hathaway in late April. The stock carries an 8% dividend yield, and estimates suggest that Occidental could have issued preferred stock on the open market at a lower rate. Icahn, who holds a 4% stake in the company, is seeking to replace several directors.

As of August 27, 2019, the activist investor’s net worth was estimated by Forbes at close to $17.5 billion. This is his story.

Key Takeaways

- Carl Icahn made his fortune through gaining controlling positions in companies and either forcing them to buy back their stocks at premium prices or manipulating company decisions to increase shareholder value.

- Icahn has actively impacted the leadership and management of many of his acquisitions, compelled them to change rules, forced some to break up, drove some into debt, and helped rebuild others.

- His main means of investing is publicly-traded Icahn Enterprises, although he also runs an investment fund comprised of his personal money and money that belongs to Icahn Enterprises.

The 1960s

Charles Icahn spun through a degree in philosophy at Princeton and three years of medical school before he turned to Wall Street and became a broker and options manager for two different companies. In 1968, Icahn established his own brokerage firm, named Icahn & Co, a holding company that dabbled in options trading and risk, or merger, arbitrage.

The 1980s

Corporate raiding, huge in the 1980s, tagged a certain notoriety. Raiders bought companies by acquiring large stakes in their corporations, achieved out-sized control, and used their shareholder rights to drastically manipulate the company’s executive and leadership decisions. Raiders became hugely rich by increasing the value share of these companies through their interference. Icahn rationalized his raiding by saying it profited ordinary stockholders. Sometimes, he merged raiding with greenmailing, where he threatened to take over companies such as Marshall Field and Phillips Petroleum. These firms repurchased their shares at a premium to remove the threat. In 1985, Icahn bought Transworld Airlines (TWA) at a profit of $469 million and, as chairman, turned the firm around from bankruptcy.

11

Carl Icahn was listed at #11 on the Forbes list of “Highest-Earning Hedge Fund Managers 2019.”

The 1990s

By the mid-1980s and through the 1990s, Icahn had amassed controlling positions in various companies that included Nabisco, Texaco, Blockbuster, USX, Marvel Comics, Revlon, Fairmont Hotels, Time Warner, Herbalife, Netflix and Motorola. Each time, the billionaire sought to acquire, break up and/or sell off parts of the company. In 1991, Icahn sold TWA’s prized London routes to American Airlines for $445 million and forged an agreement with TWA, where Icahn could purchase any ticket through St. Louis for 55 cents on the dollar and resell at a discount. He plunged TWA into debt.

The 2000s

In 2004, Icahn successfully engaged in a hostile battle with Mylan Laboratories to acquire a large portion of its stock. By 2007, the corporate raider owned swathes of companies that included American Railcar Industries, XO Communications, Philip Services, ACF Industries, and Icahn Enterprises, formerly known as American Real Estate Partners. The latter is a diversified holding company that invests in various industries. As a major shareholder of these companies and one who, therefore, has a dominant say, Icahn has often attempted to controversially influence their decisions to increase shareholder value.

In 2008, Icahn sold his casino shares in Nevada for a profit of $1 billion. In that same year, he launched The Icahn Report, which promotes his views on markets, stocks, and politics. He also acquired 61 million shares in Talisman Energy and renovated the faltering company.

In 2014, the billionaire held a 9.4% stake in Family Dollar, which he sold off later that year for a $200 million profit.

In May of 2018, Icahn significantly cut his stake in multi-level marketing firm Herbalife Ltd., after having “won” a years-long battle against hedge fund manager William Ackman and his Pershing Square Capital, who bet $1 billion against the company in 2012, claiming it was an illegal pyramid scheme. (See: Ackman and Icahn Battle Over Herbalife (HLF))

I think now your all confusion is clear about How Did Carl Icahn Get Rich if you still any questions you can ask in the comments box below.

[ad_2]