The Hong Kong Government has now made clear its policy stance and approach towards developing a vibrant sector and ecosystem for virtual assets (VAs) in Hong Kong.

In this alert, we summarise the state of play in Hong Kong across the following key areas:

- VA exchanges – including the critical areas currently under consultation such as accessibility by retail customers, proprietary trading, derivatives and custody.

- VA futures ETFs – a hallmark of the next wave of retail product offerings.

- Regulated entities – the requirements imposed on existing regulated entities to be involved in VAs and VA-related products such as derivatives, funds and other products.

- Security token offerings – how will the rules change?

We are working closely with several clients on their applications, SFC engagement and structuring. Please contact us if you would like to discuss.

1. VA exchanges – “go-live” imminent, retail access on the cards and key implementing rules under consultation

Hong Kong has a draft bill in play which implements a licensing regime for VA exchanges (VASP Bill). The key details are set out in our KWM VASP Bill alert.

In brief, the VASP Bill will expand the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) (AMLO) to introduce licensing regime for VA exchanges that will be administered by the Securities and Futures Commission (SFC). Exchanges operating in Hong Kong immediately before the new regime takes effect are deemed licensed as long as they apply before 1 December 2023 and agree to comply with other requirements during the deeming period.

The current timeline is as follows. Many exchanges are now in full flight structuring their go-forward Hong Kong business plans, corporate structures, product priorities and applications.

What has happened since the VASP Bill was gazetted?

There has been a hive of activity in relation to the VASP Bill. There are two aspects to this:

- SFC soft consultation[1]– the SFC’s Fintech Unit is now consulting the industry and stakeholders on a number of issues, including:

- how to give retail investors a suitable degree of access to VA under the new regime;

- if so, what should be the governance procedures and listing criteria for the VA exchange to admit tokens for trading by retail investors; and

- how other requirements currently in the Terms and Conditions for Virtual Asset Trading Platform Operators (summarised in this KWM alert) such as restrictions on proprietary trading, margin and derivatives and custody requirements will apply to the new field of licensed exchanges.

- Bills Committee deliberations – the Legislative Council (LegCo) Bills Committee has had three meetings discussing the draft bill. Several industry stakeholders have provided their submissions in respect of the draft bill, including traditional sector participants such as the Hong Kong Association of Banks. The Financial Services and the Treasury Bureau (FSTB) has responded and set out the next steps.[2] In particular, market participants would be pleased to see the legislature and government support on:

- allowing retail investors to have access VAs;

- clarifying the narrow scope of the new regime – specifically, that the VA exchange licensing regime is not intended to cover order routing platforms, bulletin boards or over-the-counter (OTC) desks which do not offer centralised trading services, or peer-to-peer VA transactions.

These two developments are highly dynamic – they are currently in progress with strong levels of industry engagement and dialogue with the SFC. If you are considering licensing, please reach out anytime – much will turn on the precise implementation requirements.

2. VA Futures ETFs – SFC’s guidance on product authorisation

The SFC has also announced that the door is now open for exchange-traded funds that offer investors exposure to VAs – a first for Hong Kong. Specifically, the SFC has issued a detailed circular on VA futures exchange traded funds[3] (VA Futures ETFs Circular), which:

- announced that the SFC is prepared to accept applications to authorise exchange traded funds that obtain exposure to VAs through futures contracts (VA Futures ETFs) for public offering in Hong Kong under sections 104 and 105 of the Securities and Futures Ordinance (Cap. 571) (SFO); and

- set out the requirements that the SFC would consider in authorising VA Futures ETFs.

VA Futures ETFs are publicly issued securities which enable investors to gain exposure to mainstream VAs through futures contracts, whilst circumventing the potential risks associated with the trading and storage of VAs.

The following paragraphs summarise the product authorisation requirements described in the VA Futures ETFs Circular. Distribution is also a key part of the equation – see paragraph C below.

Key requirements

VA Futures ETFs seeking the SFC’s authorisation should meet the applicable requirements in the Overarching Principles Section and the Code on Unit Trusts and Mutual Funds in the SFC Handbook for Unit Trusts and Mutual Funds, Investment-Linked Assurance Schemes and Unlisted Structured Investment Products,[4] which sets out the basic requirements applicable to investment funds offered to retail investors in Hong Kong. This may include the possibility of cross-listing VA Futures ETFs from certain other markets.

In addition, VA Futures ETFs seeking authorisation should also meet the following additional requirements:

This clarity is a welcome first step for Hong Kong into the world of VA ETFs. It is a strong signal from the Hong Kong Government in further developing the Hong Kong ETF market, whilst tapping into the opportunities arising from the evolving VA landscape.

Globally, this is now a rapidly maturing market – we have been in dialogue with the Investment Products Division over on VA ETFs for some time and working with other clients on their VA futures product offerings.

The key step for anyone seeking this route is to arrange a time to discuss the proposal with the Investment Products Division – we would be delighted to help.

3. Rules for SFC and HKMA regulated entities – requirements now live for VAs and VA-related products

Despite a gloomy market, the crypto sector is rapidly institutionalising, with several banks, asset managers, custodians and distributors launching products involving VAs.

Against this backdrop, the SFC has also issued a Joint Circular together with the Hong Kong Monetary Authority (HKMA) covering their expectations for regulated entities in relation to two key areas of VA sector engagement:

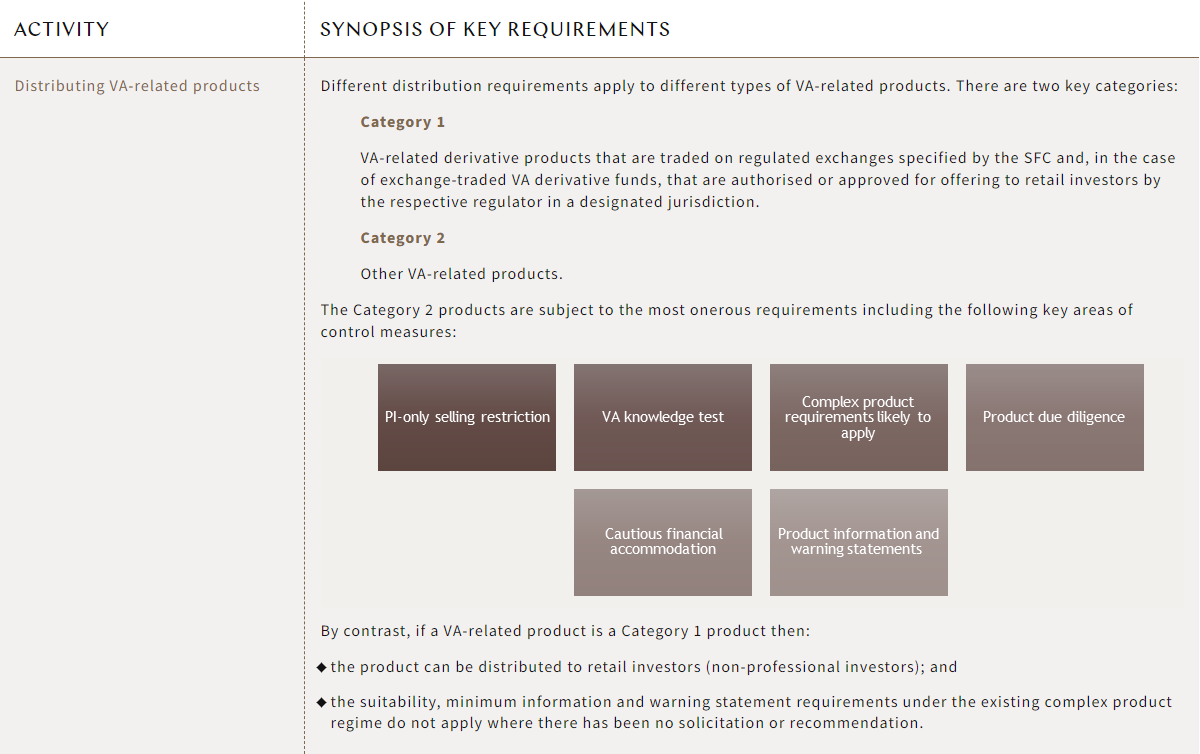

- First, distributing “VA-related products” – these are broadly described as investment products which:

- have a principal investment objective or strategy to invest in virtual assets;

- derive their value principally from the value and characteristics of virtual assets; or

- track or replicate the investment results or returns which closely match or correspond to virtual assets.

These categories include VA Futures ETFs.

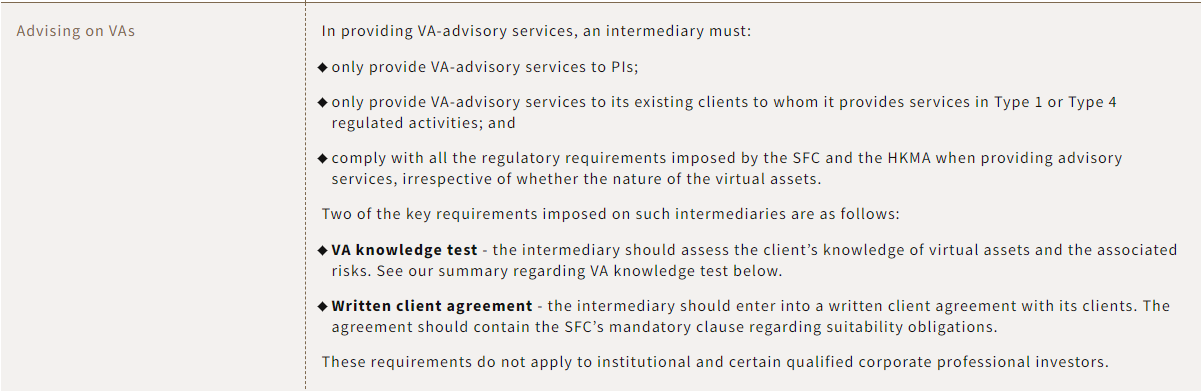

- Second, VA dealing and advisory services – even if the VAs involved are not securities.

The transitional period has now expired. All requirements are live. That said, the Joint Circular applies to regulated intermediaries only. Market participants that are not licensed or registered in Hong Kong are not directly subject to the Joint Circular. However, there are requirements – and opportunities – within it that are worth being aware of.

Key things to know

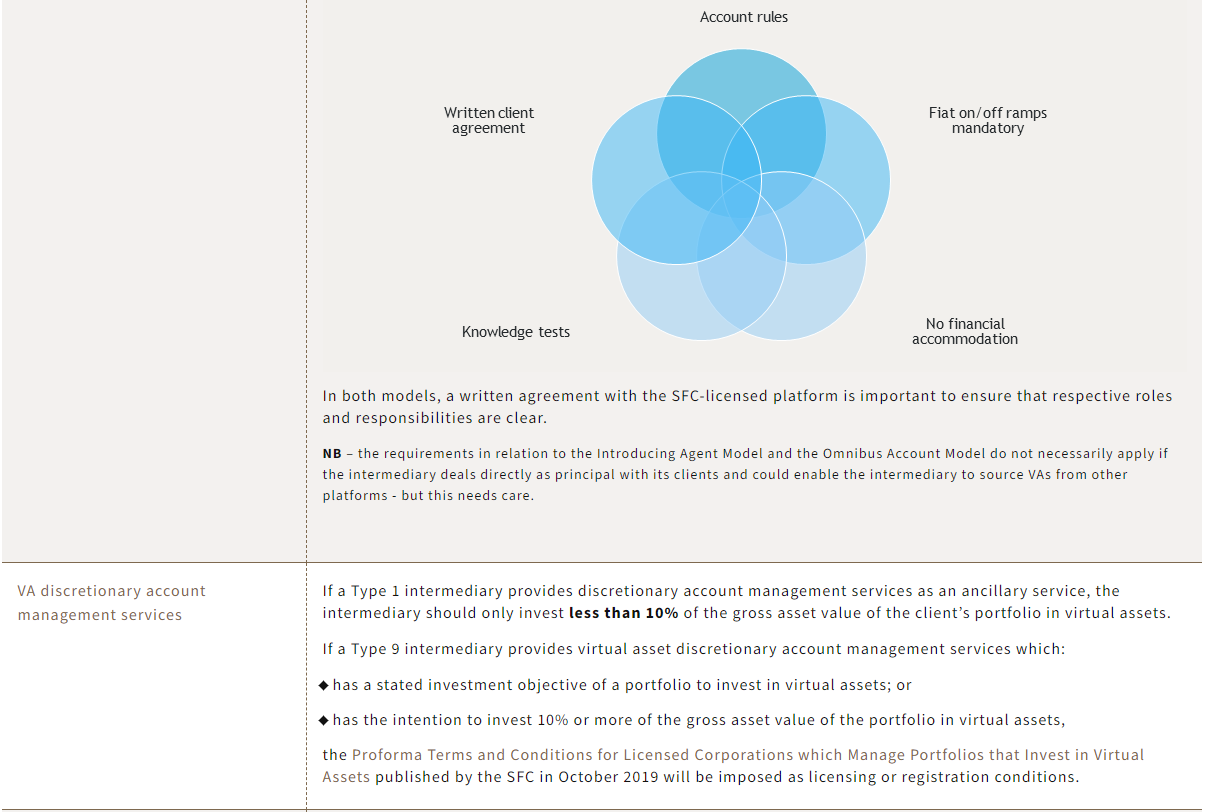

The following table describes some of the most salient features of the Joint Circular. Many of these requirements may involve VAs that do not fall under the definition of “securities” under the SFO so the scope is broad.

The detail is incredibly important – many of the key principles below have complex accompanying (or underlying) requirements so if you wish to proceed down any of these routes, we encourage you to come and speak to us.

Activities involving VAs

Activities involving VA-related products

Knowledge test

A key theme across these requirements is knowledge.

Generally, an assessment is required for all clients other than institutional professional investors or certain Code of Conduct- qualified corporate professional investors. The aim is to assess knowledge of investing in virtual assets or VA-related products. The test can be conducted on a one-off basis prior to entering into a transaction with or on behalf of the client.

Who has knowledge of virtual assets?

- Clients with trading experience – A client will be considered as having knowledge of virtual assets if the client has executed 5 or more transactions in any virtual asset or VA-related product within the past 3 years.

- Clients with no trading experience – If the client does not have the above trading experience, the intermediary should take into account any relevant training/courses, prior work experience or prior trading experience of relevant products.

- Sufficient net worth – The intermediary should also ensure that the client has sufficient net worth to assume the risks and bear the potential losses of trading VA-related products.

What if the client does not have knowledge of virtual assets?

If the client does not possess such knowledge, the intermediary may only proceed with the transaction if it would be acting in the client’s best interests by doing so and it has provided appropriate training to the client.

Derivative rules apply cumulatively

If a VA-related product is a derivative product, the intermediary must comply with the existing derivative product requirements. The Joint Circular provides additional guidance on how an intermediary should comply with these requirements including mandatory disclosure requirements.

4. Security tokens – a fresh look by the SFC

The SFC has also announced that it will issue new guidance on security token offering and revisit the requirements for listing security tokens on VA exchanges.

The SFC’s preliminary view is that tokenised securities, as digital representations of traditional securities on a blockchain, should be treated in a similar way as existing financial instruments. They have similar terms, features and risks as traditional securities, so it does not seem appropriate to classify them as “complex products” merely because they are issued or traded on a blockchain.

Consistent with the “same business, same risk, same rules” approach, a tokenised plain-vanilla bond would be classified as a “non-complex product”, and therefore the firms distributing it would be subject only to the existing requirements for the distribution of conventional securities.

This guidance is not yet in force – as such, the current requirements still apply.

What else is next? Digital bonds, e-HKD and stablecoins

In addition to the above, the Hong Kong Government and regulators have recently launched the following initiatives:

- Government green bond tokenisation – the HKMA and market participants are working on a pilot project tokenising Government green bond issuance[7] for subscription by institutional investors. This pilot project is a result of the successful completion of Project Genesis by the HKMA and the Bank for International Settlements (BIS) Innovation Hub Hong Kong Centre.

KWM is proud to have contributed to Project Genesis 1.0 report on digital bond offering and secondary market trading and to the legal term sheet for Project Genesis 2.0.

- e-HKD and stablecoins – the HKMA is paving the way for a possible launch of e-HKD, the Hong Kong retail central bank digital currency (CBDC). See our earlier alert on “Innovation at speed: the evolution of money and payments in Hong Kong” our insights on e-HKD and other CBDC projects.

What you should do – key tips

- Keep an eye out for any further developments

The Hong Kong Government expressed that it would calibrate the legal and regulatory regime for VAs as part of its effort to provide the VA sector facilitating environment, including considering the appropriateness of the authorisation of ETFs which invest directly in spot VAs. We anticipate a lot of exciting developments in the near future in promoting Hong Kong as an international crypto hub.

Intermediaries intending to commence any new VA-related activities are generally required to notify the relevant regulators, and discuss with their case officers if in doubt on any specific issues. We encourage existing VA market players to actively participate in the regulatory and legislative consultation process. It is important to provide the regulators with objective information on market realities.

Our team maintains strong and long-standing working relationships with regulatory bodies such as the SFC, the HKEX and the HKMA. We are currently supporting industry on consultation responses, as well as individual clients on their feedback. It is also possible to provide responses on a no-names basis if preferred.

We are uniquely placed as one of the largest fintech-focussed teams globally, with particular strength in financial services regulation and blockchain. With our market-leading experiences in the Hong Kong retail funds and ETF market, we act for the leading players ranging from ETF issuers, market makers, participating dealers, service providers and investors, and we are involved in the establishment of a diverse range of investment funds including the listing of numerous ETFs and the setting up of authorised funds in Hong Kong.

We expect the new initiatives and the VA-friendly approach adopted by the Hong Kong Government to open new opportunities and markets for the global fintech and VA community.