[ad_1]

(Source: Pexels Images)

HOMZ Steps Up To The Plate

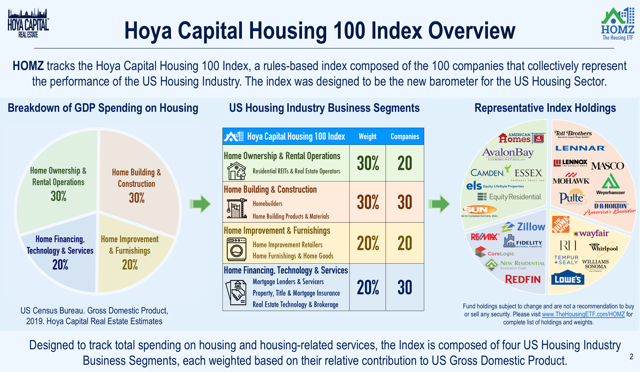

Earlier this year, Seeking Alpha contributor Hoya Capital Real Estate launched the Hoya Capital Housing ETF (HOMZ), a diversified ETF designed to be the new one-stop-shop for exposure to residential real estate. Straddling the line between a real estate ETF and homebuilder ETF, HOMZ is built for investors seeking long-term growth and capital appreciation, a unique objective in the generally yield-oriented real estate investment sector.

HOMZ unifies the previously disconnected housing-related equity sectors into a single fund designed to capture total spending on housing and housing-related services, which account for roughly a third of total consumer spending. The 100 companies span across a handful of equity sectors including residential REITs, homebuilders, home improvement, home insurance, and home technology firms.

(Source: HOMZ Investment Case)

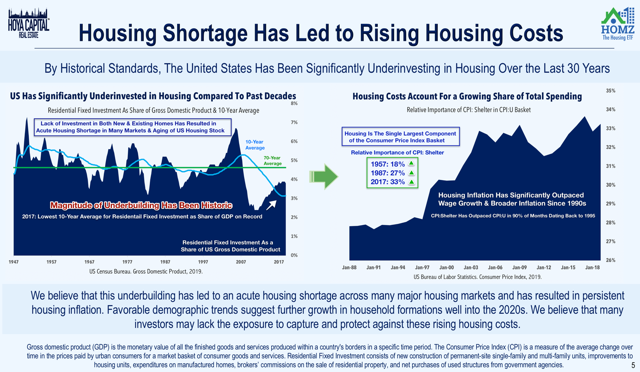

HOMZ tracks a rules-based index designed to capture the “thematic growth” trends of rising housing costs and the economic effects of the mounting housing shortage, which has led to upward pressure on rents and home values over the last decade.

As Hoya Capital often points out in their research, the US has significantly underinvested in both new and existing homes over the last decade as measured by residential fixed investment as a share of GDP and as measured by housing starts as a percent of total population.

The ETF invests in the companies expected to capture the necessary growth in new home construction, the realization of the deferred maintenance on existing homes, as well as the upward pressure on rents and home values.

(Source: HOMZ Investment Case)

Why HOMZ is A Home Run

HOMZ brings long-awaited innovation to the housing ETF category as the first fund to be fully unbound by the traditional single-sector classifications that limit other ETFs in the space. Hoya Capital told ETF Trends, “Before HOMZ, there were REIT ETFs and then there were Homebuilder ETFs. No ETF viewed the US housing market – arguably the most important asset class in the world – as a distinct investible sector at the ETF-level. HOMZ provides a modernized and highly intuitive evolution in the homebuilding and real estate categories.”

Competitors in this housing ETF category include the iShares Residential REIT ETF (REZ), the SPDR S&P Homebuilders ETF (XHB), and the iShares Home Construction ETF (ITB), and the Invesco Building & Construction ETF (PKB), each of which invest in a relatively smaller slice of the total housing industry compared with HOMZ. Charging a competitive expense ratio with its iShares peers – and lower than REZ – HOMZ invest in a significantly more diversified basket of roughly 100 companies and pays a monthly dividend yield of around 2.1%, about four times that of its homebuilder ETF peers.

|

HOMZ |

REZ |

ITB |

|

|

Name |

Hoya Capital Housing |

iShares Residential REIT |

iShares Home Construction |

|

Expense Ratio |

0.45% |

0.48% |

0.43% |

|

Yield |

2.10% |

2.91% |

0.49% |

|

Frequency |

Monthly |

Quarterly |

Quarterly |

(Source: ETF Database, 30-Day SEC Yield as of 6/30/19)

While REIT investors accustomed to 4%-6% dividend yields may scoff at the sub-3% yield on HOMZ, the fund is targeted toward growth-oriented investors willing to sacrifice some current income for long-term price appreciation. Hoya told ETF Trends, “Ironically, the need for real estate in an investor’s portfolio peaks during their renting years, but that’s typically the time that advisors have the lowest amount of real estate allocated to that investor’s portfolio.”

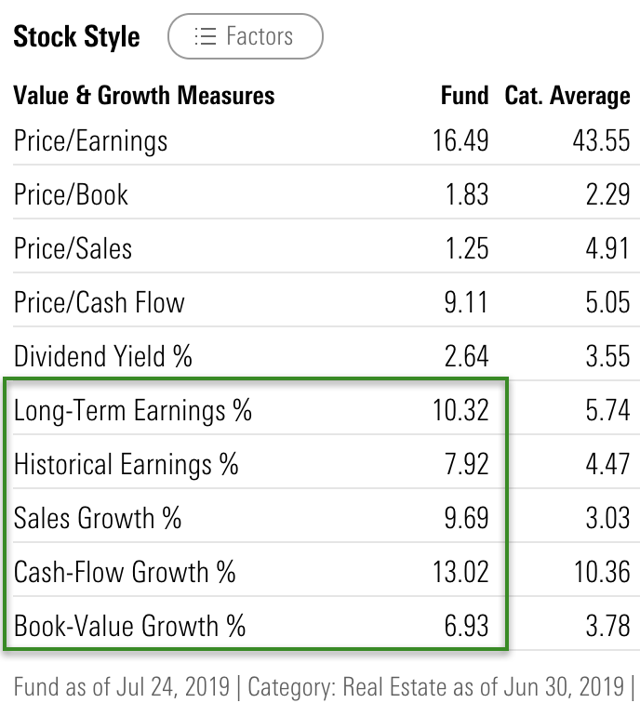

“We think that HOMZ allows asset allocators to put real estate into a growth-oriented portfolio.” To that point, according to data from Morningstar, the components in the HOMZ index are growing revenues at a rate more than three times that of the real estate benchmark.

(Source: Morningstar)

Despite it’s still-small AUM compared to the $1.5 billion in assets between REZ and ITB, one can make the case that HOMZ is actually the most liquid of the group. ETF liquidity is commonly misunderstood by even professional investors who default to looking at fund-level characteristics like AUM and average daily volume. While secondary market liquidity can be important to high-frequency traders, due to the creation/redemption process, as it relates to ETFs, the characteristics of the underlying basket are the far more important determinate of the fund’s liquidity for the typical end investor.

Using Bloomberg’s ETF Implied Liquidity measure, defined as “how many shares (or dollar volume) can potentially be traded daily in an ETF,” HOMZ is actually the most liquid ETF of the group with the ability to trade $272 million per day, again due to the deep liquidity of the underlying basket and low concentration among the roughly 100 holdings. High concentration is a commonly-cited drawback of the other ETFs in the category and of sector-specific ETFs in general.

|

HOMZ |

REZ |

ITB |

|

|

Name |

Hoya Capital Housing |

iShares Residential REIT |

iShares Home Construction |

|

Holdings |

101 |

43 |

46 |

|

Top 10 Weight |

19% |

61% |

64% |

|

Top 15 Weight |

26% |

77% |

75% |

|

Implied Liquidity |

$272 million |

$219 million |

$148 million |

(Source: Bloomberg)

A function of the market-cap weighted index structure, REZ and ITB have more than 75% of weight in just fifteen names, which has a clear negative impact on total ETF implied liquidity. Because of its tier-weighted structure, HOMZ has just 26% in the top 15 names with no single holding having more than 3% weight at each semi-annual rebalance.

On that point, Hoya told ETF Trends, “we think that HOMZ will eventually be viewed by the large institutional investors like hedge funds and insurance funds as the most direct and efficient way to express a directional view on the US housing markets in the ETF wrapper, while also serving as a possible hedge against existing exposures. The efficiency and liquidity of the underlying basket were significant considerations during the index design process.”

HOMZ Has Hit It Out of the Park

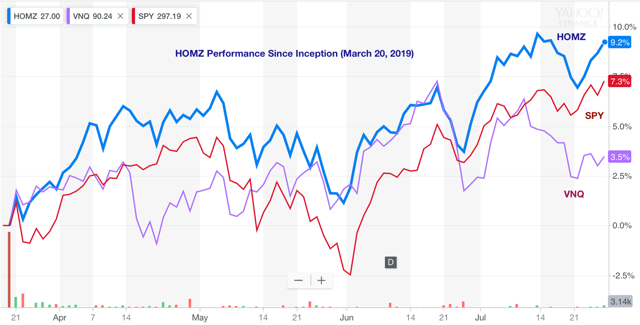

For new ETFs looking to get their foot in the door, it all comes down to performance, and HOMZ has stepped up to the plate and delivered so far. HOMZ has been one of the best-performing real estate ETF since its launch on March 20, nearly tripling the performance of the Vanguard Real Estate ETF (VNQ) and outpacing the S&P 500 (SPY) by nearly 2% during this time. HOMZ has benefited from signs of strength in the single family housing industry after a slowdown in 2018 as well as strengthening fundamentals in the residential REIT sector over the past several quarters.

(Source: Yahoo Finance)

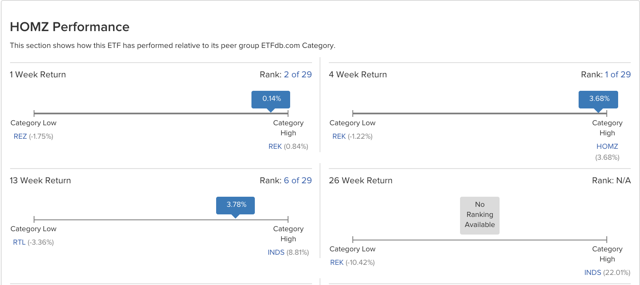

According to ETF Database performance data, HOMZ has been among the best-performing real estate ETFs over every recent measurement period. It’s the best-performing ETF in the category over the past month and trails only the Pacer Benchmark Industrial SCTR ETF (INDS) over the past quarter among US non-levered real estate ETFs.

The best performing names in the index this year include Zillow (Z), Meritage Homes (MTH), Armstrong Industries (AWI), American Woodmark (AMWD), and Sleep Number (SNBR), all of which are higher by more than 50% year-to-date.

(Source: ETF Database)

Bottom Line

The real estate and homebuilding ETF category, long dominated by giants like Vanguard and Blackrock, is beginning to be disrupted by new entrants with innovative indexes that cater more precisely to an investor’s needs and objectives. The one-size-fits-all approach of the broad-based market-cap weighted indexes doesn’t make sense in these sectors where there are vast differences in quality and investment characteristics of the underlying companies.

HOMZ is one example of this investor-driven innovation, built for investors seeking long-term growth and capital appreciation, which may open the real estate sector to a new group of growth-oriented investors. In an all-encompassing package that’s arguably more liquid that its far-larger competitors, HOMZ effectively captures the “thematic growth” trends of rising housing costs and the effects of a mounting housing shortage, and as a result, the fund has been among the top-performers since its launch.

While HOMZ targets the growth-oriented real estate investor, other investors are in search of higher yields and the current crop of high-yield real estate ETFs leave much to be desired. High-yield real estate ETFs like the Invesco Premium Yield REIT ETF (KBWY) and the Global X SuperDividend REIT ETF (SRET) are notorious for investing in many of the most questionable REITs that should keep any investor awake at night.

Thankfully, for investors seeking a high-quality SWAN portfolio that pays a premium dividend yield compared to the broad-based real estate ETFs, innovation is on the way. The much-needed evolution of the real estate ETF category is just beginning, so stay tuned.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while also providing a forum for second-level thinking.

We have over 110 REIT Preferreds in the iREIT Lab

Our product mix includes single stock (in depth) Equity REITs (small, mid and large cap), thematic (market themes), commercial mortgage REITs, preferreds, and bonds. We have assembled highly-skilled analysts to assist investors manage risk while generating superior risk-adjusted returns.

Sign-up for our 2-week free trial and get unrivaled REIT research with 4 real-time portfolios and iREIT Tracker.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Hoya Capital Real Estate is now contributing to iREIT on Alpha, which is owned by Brad Thomas.

[ad_2]

Source link Google News