[ad_1]

Homebuilders are a key part of my trading ‘toolkit’ as most of my readers know by now. I use a few leading indicators to get a good mid-term outlook. These indicators are also perfectly capable of telling us where homebuilding stocks are headed as I will show you in this article. Furthermore, we will get some more evidence of the current housing downturn.

Extra: This article discusses the iShares U.S. Home Construction ETF (ITB). This ETF covers all major homebuilders and is, therefore, the best tool to track building sentiment/activity.

Source: BONE Structure

Single-Family Housing Is Leading The Way

The conclusion from my previous article can be seen below:

I will remain on the sidelines to start buying once we see a reversal of homebuilding indicators. I doubt that this is going to happen over the next few months. The main message of this article therefore is to stay on the sidelines if you are a mid-term trader. The time to buy will come, but it’s not now.

One of the reasons why we are still not close to a buying opportunity is the fact that building permits growth continued to disappoint in February. Building permits declined by 1.5% after a mild gain of 0.5% in January. This trend is being confirmed by housing starts. Housing starts posted their fifth consecutive month of contraction with growth being down 7.8% in February. January growth was at -14.3% with December growth being down -7.4%.

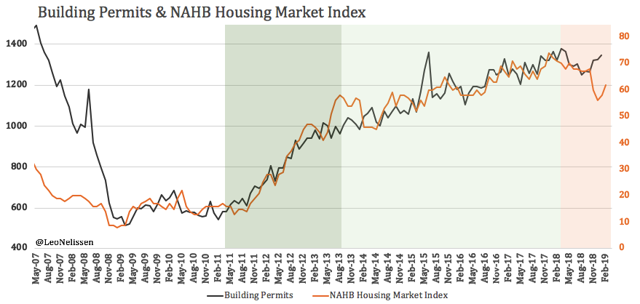

The bigger picture shows that building permits do seem to recover. This seems the way when looking at total permits. However, the growth rate is still negative as I just showed you while the leading NAHB housing market index is indicating further losses. Note that the NAHB housing market index tracks sentiment of single-family homes. This key market should expect difficulties going forward which makes an overall housing slowdown very likely.

Source: Author’s Spreadsheets (Raw Data: Census Bureau, NAHB)

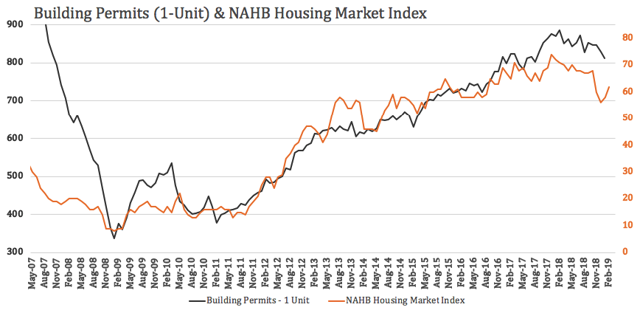

And speaking of single-family building permits, the graph below compares single-family home permits to the NAHB housing market index. We see that single-family permits are rolling over. The correlation between NAHB and 1 unit building permits could not be more perfect. 1 unit permits were down 6.7% in February after 5.5% contraction in January. 1 unit permits have been down for 5 consecutive months showing that we are indeed beyond peak growth and currently in a growth slowing trend.

Source: Author’s Spreadsheets (Raw Data: Census Bureau, NAHB)

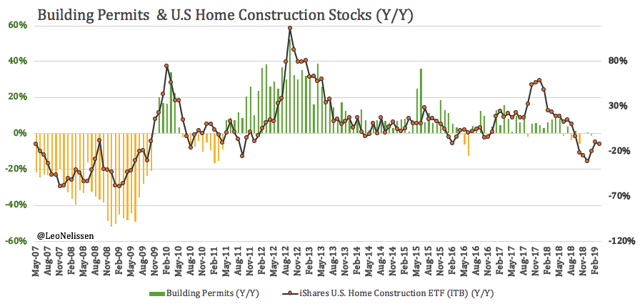

So, what does this mean for homebuilding stocks? First of all, we see that the year-on-year performance of the ITB ETF has gone almost back to neutral after being down more than 30% from the 2018 peak. Investors were eager to buy the January dip with a risk/reward that benefited from building permits that were ‘not that bad’ – despite being in a downtrend.

At this point, we see that both building permits growth and the year-on-year performance of homebuilding stocks are more or less close to 0%. In other words, the direction of building permits is pretty much going to decide whether homebuilders are going to deliver capital gains or not. With NAHB sentiment and permits being in a downtrend, I have to say that we are once again at a point where we are dealing with a terrible risk/reward ratio for a homebuilding long. Unless you are willing to bet on a housing recovery, I think it is a good idea to stay away from ITB or its many holdings.

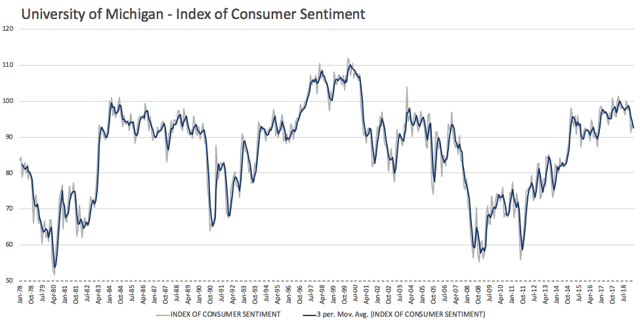

Another indication is slowing consumer sentiment which happens more or less in lockstep with the current housing slowdown. This does make sense given that lower consumer expectations do slow the housing market significantly.

Source: University of Michigan

The outright stock price of ITB also shows that the stock has to deal with a major technical resistance level. This resistance in addition to an increasingly difficult business environment are enough reasons for me to stay on the sidelines.

I think homebuilders are a great buy once we see signs that housing market sentiment is bottoming. At that point, you will get a ton of alpha from undervalued homebuilders. However, right now, I would not want to be long homebuilders in the current slowdown as lower homebuilding stock prices are quite likely. In other words, stick to cash to buy homebuilders once the growth story turns in our favor.

I’ll keep you updated!

Thank you for reading my article. Please let me know what you think of my thesis. Your input is highly appreciated!

Disclaimer: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News