Job growth in March made a comeback following a less-than-stellar February as 196,000 jobs were created as opposed to 175,000 expected by economists with a good portion coming from the health care sector, which gave health care exchange-traded funds (ETFs) a boost Friday.

Health care ETFs rose like the Health Care Select Sector SPDR ETF (NYSEArca: XLV)–up 0.69 percent, Vanguard Health Care ETF (NYSEArca: VHT) –up 0.77 percent and the iShares US Medical Devices ETF (IHI)–up 0.21 percent. For traders, the Direxion Daily Healthcare Bull 3X ETF (NYSEArca: CURE) with triple leverage rose 1.75 percent.

The better-than-expected payrolls brings the three-month average to a strong 180,000 jobs created per month. That number is lower than the 223,000 jobs created in 2018, but falls in line with a robust labor market.

Meanwhile, the unemployment rate held steady at 3.8 percent, but lower-than-expected wage gain came in at just 0.1 percent after February’s better-than-expected 0.4 percent. Nonetheless, all signs still point to a strong labor market overall.

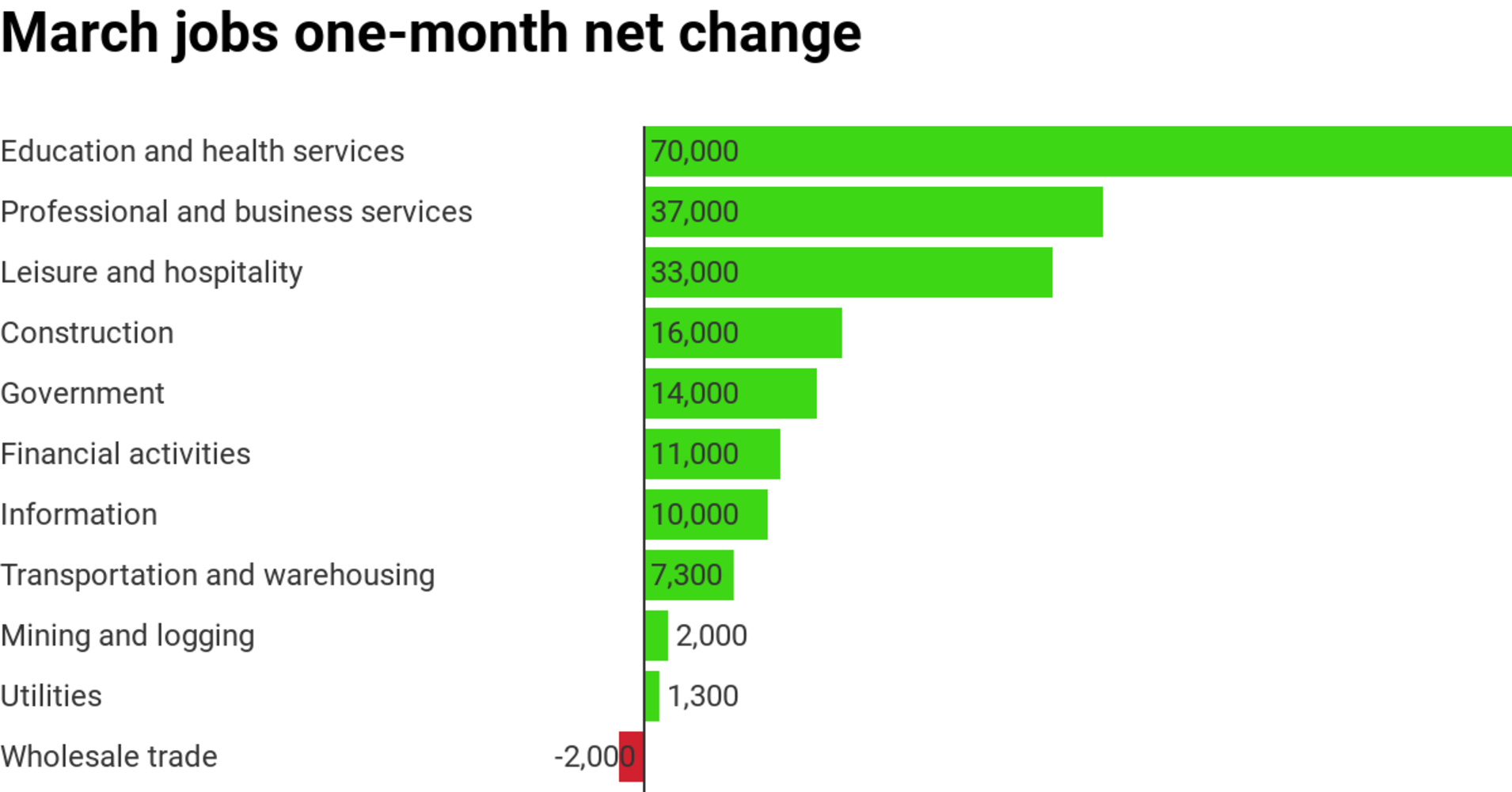

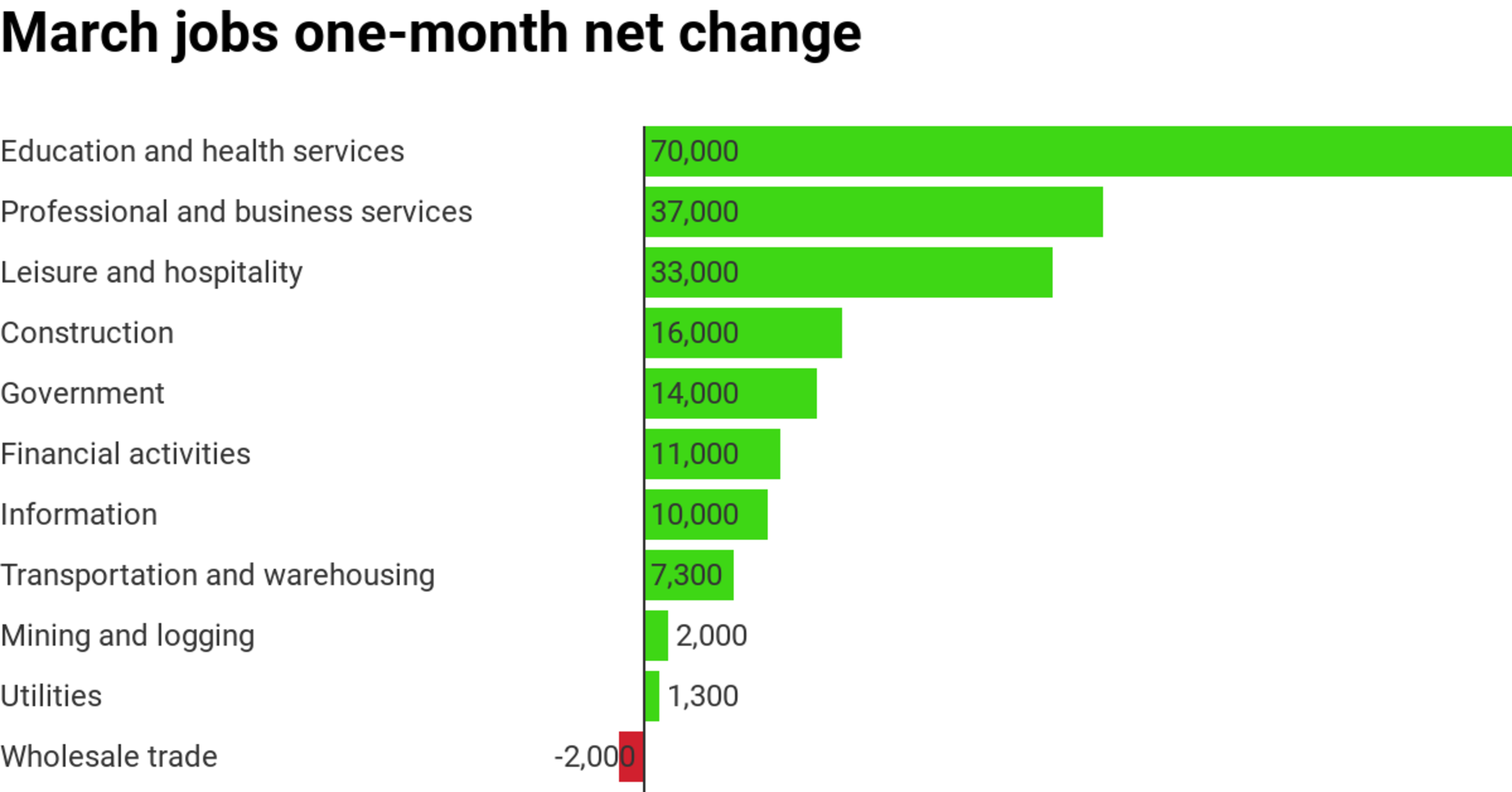

Of the 196,000 jobs created, over 35 percent came from the education and health services sector. Specifically, strong hiring came from ambulatory care, hospitals, and nursing and residential care facilities.

“Total nonfarm payroll employment increased by 196,000 in March, with notable gains in health care and in professional and technical services,” the Labor Department said in a release. “Employment growth averaged 180,000 per month in the first quarter of 2019, compared with 223,000 per month in 2018.”

Related: Healthcare ETFs Could be Healthy Summer Bets

Data released by the Labor Department on Thursday revealed that jobless claims in the U.S. hit a 49-year low, suggesting that the labor market is still strong despite fears of a global economic slowdown.

This latest jobs data comes after U.S.-based companies had less layoffs during the month of March, but job cuts during the first quarter were at their highest since 2015–a possible sign of a fading $1.5 trillion tax cut package. Initial claims for state unemployment benefits fell by 10,000 to a seasonally-adjusted 202,000 for the week ended March 30–the lowest level since early December 1969.

Economists polled by Reuters were expecting claims to rise to 216,000. Analysts view these latest numbers as continued signs of a labor market that is still operating at full steam.

Nonetheless, these latest numbers come after employment data released by ADP and Moody’s Analytics showed that job growth hit an 18-month low in the month of March. Private payrolls went up by 129,000 for the month, which fell below the 173,000 that economists surveyed by Dow Jones were expecting to see.

Furthermore, a February employment data revision did show an increase of 197,000 as opposed to the initial number of 183,000. It was the lowest figure since March 2017 when private payrolls increased by 111,000.

For more market trends, visit ETFTrends.com