[ad_1]

MF3d/E+ via Getty Images

Cybersecurity has become one of the most critical components when it comes to protecting the interests of individuals, corporations, and national governments. Over the past few years, we have seen numerous ransomware and cyber-attacks on corporations, U.S. government agencies, and critical infrastructure assets like the Colonial Pipeline – the largest U.S. gasoline pipeline connecting refineries in Texas to the East Coast. In my opinion, cybersecurity has become so important it should be seriously considered for placement under the umbrella of the U.S. Department of Defense. There are a couple of additional positive catalysts for cybersecurity companies: the fast growing crypto market and the potential for consolidation across the cybersecurity industry. Meantime, profits are growing and the sector continues to outperform the broad S&P500. Today, I will take a closer look at the ETFMG Prime Cyber Security ETF (NYSEARCA:HACK) as a possible holding for a well-diversified portfolio.

Investment Thesis

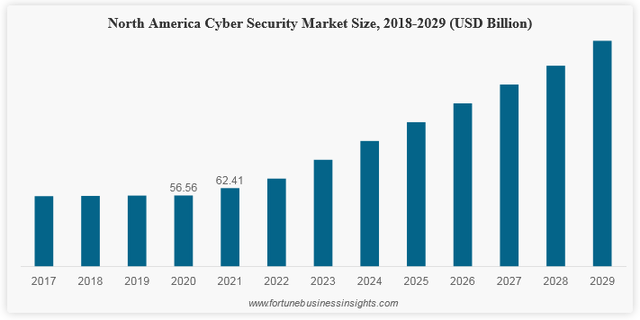

According to Fortune Business Insights, the global cybersecurity market is poised for significant growth acceleration in the coming years – from a $139.8 billion market in 2021 to $376.3 billion in 2029 (a 13.4% CAGR):

Global CyberSecurity Market (Fortune Business Insights)

Research indicates that the expected growth of the cybersecurity market is due to same reasons that I am so bullish on the semiconductor segment going forward: high growth in 5G infrastructure, 5G mobile, proliferation of the internet-of-thing (“IoT”), cloud computing, e-commerce, crypto, high-speed networking, and AI – among other growth trends. All related assets to these tech sub-sectors will require protection against cybersecurity threats.

The fast growth of cryptocurrencies is another positive catalyst. Cryptos, being a digital block-chain based technology, are particularly exposed to hacking and must be highly secured from hacking in order to gain investor acceptance and for the industry to continue to grow.

Meantime, note that this week’s Barron’s magazine suggested that the cybersecurity industry is poised for consolidation (see Cybersecurity Threats – and Profits – Are Ramping Up).

So, let’s take a look at the HACK ETF to see how it has positioned investors to benefit from these trends.

Top-10 Holdings

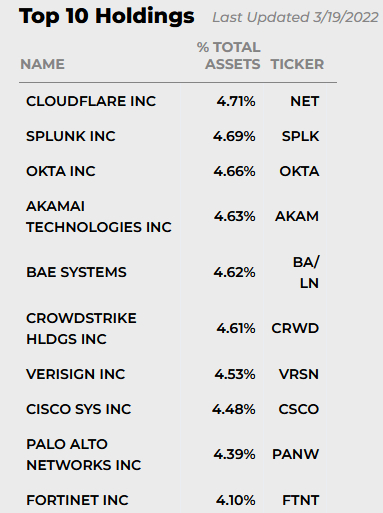

The top-10 holdings in the HACK ETF are shown below and equate to what I consider to be a relatively well diversified 45.4% of the entire portfolio:

HACK ETF Top-10 Holdings (ETFMG.com)

Note the top-10 holdings all have the same relative weighting. Typically, in a fast growing sector like cybersecurity, I would prefer to see a higher concentration in some of the more dominant companies (Palo Alto (PANW), CrowdStrike (CRWD), Zscaler (ZS), etc.). However, if Barron’s is correct in its assertion that the sector is ripe for continued M&A activity, the smaller players may outperform over the coming year.

The #1 holding in the HACK ETF with a 4.7% weight is Cloudflare (NET). Cloudflare currently has a market-cap of $34.5 billion yet is barely profitable. With a forward P/E over 3,400x, it is a curious choice to be the anchor of the portfolio in my opinion. Last month, NET announced it would acquire Area 1 Security for $162 million, with 40-50% of the purchase price in NET shares and the remainder in cash.

More to my liking is #3 holding Akamai Technologies (AKAM). Akamai has evolved its legacy and leading global content delivery network (“CDN”) into one of the leading global cybersecurity providers. See my Seeking Alpha article: Akamai Quickly Becoming A Leading Cybersecurity Power. Unlike many companies in the cybersecurity space, AKAM is extremely profitable, is poised to deliver EPS of ~$6/share this year, and with a forward P/E of only 19.9x is trading at a discount to the S&P 500. Continuing on the M&A theme, note that AKAM recently announced it would acquire Linode for $900 million.

Leading cybersecurity provider CrowdStrike is the #6 holding with a 4.6% allocation. In my opinion, this portfolio weight is too low for one of the fastest growing well-respected companies in the sector. On March 9th, CRWD announced Q4 results that beat on both the top- and bottom-lines. Quarterly revenue of $431 million (+62.7% yoy) beat consensus estimates by $18.62 million while non-GAAP EPS of $0.31 was an $0.11 beat. Better yet, net new annual recurring revenue (“ARR”) was a record $217 million – the second consecutive quarter of accelerating growth in new ARR.

Network infrastructure company Cisco Systems (CSCO) is the #8 holding with a 4.5% weighting. With a P/E of 16.3x and a yield of 2.7%, Cisco is considered to be a value play within the sector and adds a measure of balance to a portfolio holding some “high flyers”.

Leading cybersecurity provider Palo Alto Networks is the #9 holding with a 4.4% allocation. Again, similar to CrowdStrike, I’d rather see a significantly higher weight given to a high-quality company like Palo Alto. After a strong Q2 report, JPMorgan upgraded its price target on PANW to $620 while Morgan Stanley named the company its top-pick in the sector. PANW closed Friday at $577 and has a forward P/E = 79.1x.

Performance

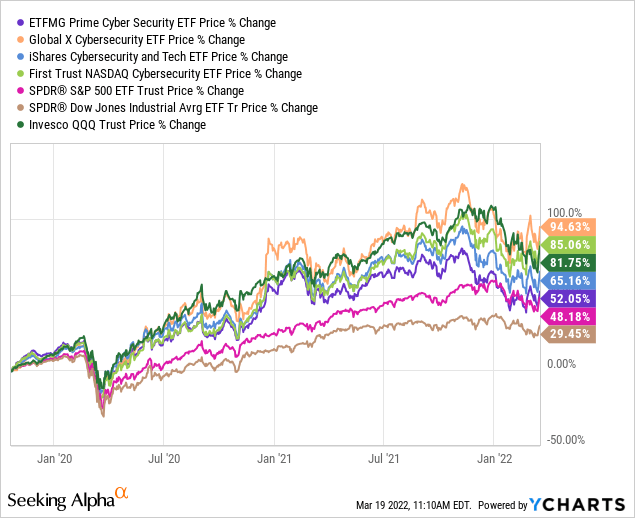

Over the past 5-years, the HACK ETF has delivered an average annual return of 15.2%. The graphic below compares the three-year returns of the HACK ETF to several competing cybersecurity funds (BUG, IHAK, and CIBR) along with the broad market averages as represented by the SPY, DIA, and QQQ ETFs:

The leader of the pack by a significant margin is BUG – the Global X Cybersecurity ETF. I cover the BUG ETF on Seeking Alpha and it continues to be my favorite fund in the space (see Recent CyberSecurity Earnings Reports Are Why You Should Own The BUG ETF NOW). BUG has outperformed the HACK ETF by 40%+ over the past three years.

Risks

All the typical investment risks of the current market environment apply to the HACK ETF as well: rising inflation and interest rates, covid-19 impacted supply chains and factory closings, geopolitical risks as they pertain to Putin’s invasion of Ukraine, and China’s increasing belligerence as it is impacting US/China trade relations. That said, one could argue – and I am arguing – that the increasing conflicts with Russia and China are actually a positive tailwind for the cybersecurity sector.

In addition, the HACK ETF holds several companies that currently sport sky-high valuation levels which make the fund particularly susceptible to a significant market correction.

Meantime, HACK’s expense ratio is 0.60%, which in my opinion is quite high given its relative performance. The BUG ETF is outperforming HACK and has a lower expense fee (0.50%).

Summary & Conclusions

The global cybersecurity market is expected to grow at a 13.4% CAGR, meaning it should double in ~5.5 years. That being the case, investors should consider allocating some of their portfolio to the sector – either through individual stocks or a diversified fund like the HACK ETF. However, I have reviewed several stocks and funds in the sector and I have decided that the BUG ETF is the best cybersecurity choice for a well-diversified portfolio that doesn’t want to take on the risks of single stock ownership within a sector that typically trades at a rather high valuation level. In the single stock case, I would suggest either Palo Alto or Akamai. AKAM may well be the best risk/reward opportunity in the sector for the more conservative investor.

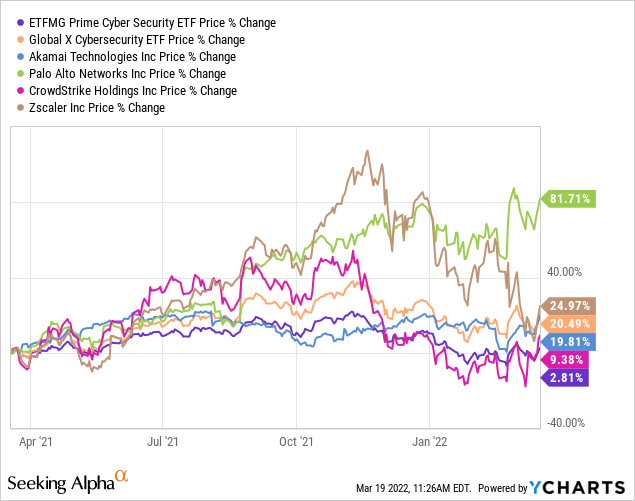

I’ll end with a graphic comparing the 1-year returns of some of the leading stocks in the cybersecurity sector along with the HACK and BUG ETFs. Note the second best performer out of the equities selected is Zscaler, a company that is not even in the top-10 holdings of the HACK ETF (ZS is the #11 holding in BUG with a 4.6% weight):

[ad_2]

Source links Google News